Does debt settlement hurt your credit?

Yes, undoubtedly. Debt settlement can have a significant negative impact on your credit score in two potential ways. The main reason is that the amount you owe won’t be settled in full.

How does debt settlement agreements affect your credit?

What Happens to Your Credit Score During Debt Settlement?

- Offer in Compromise. One of the best solutions is an offer in compromise. ...

- Currently Not Collectible. Some people struggling with tax debt have no income and no assets that could be sold to pay it. ...

- Installment Agreement. ...

- Using Credit to Pay Taxes. ...

Do settle accounts effect your credit score?

Your credit utilization could go up. Often, when you settle a credit card debt, the issuer will close the account. This could have a negative impact on your credit utilization ratio – the amount of debt you owe compared with the total amount of credit you have available. This number accounts for 30% of your credit score.

How does a lawsuit affect your credit?

How Does A Lawsuit Affect My Credit?

- The lawsuit will not appear on your credit report unless it results in a judgment. ...

- If the lawsuit results in a judgment, the judgment can remain on your credit report for at least 7 years and possibly much longer. ...

- Defeating the lawsuit will not get the underlying debt off your credit report. ...

- Your goal, credit-wise, is to avoid a judgment. ...

How does debt settlement affect credit score?

Because you aren’t paying your full balance as agreed, debt settlements impact your credit score negatively. 3 Your credit is based on several different factors, so the exact impact on your score can vary depending on the other information on your credit report.

How long will it take for credit scores to improve after debt settlement?

After debt settlement, it's important to remember that it will remain on your credit report for seven years. However, you can begin improving your credit score right away. You can do that by adding positive history to your credit report. That includes paying your bills on time, paying off other past debts, and keeping your credit utilization low. 8

How many points does a credit score lose?

In one scenario, a person with a 680 credit score and one late payment on the credit card would lose between 45 and 65 points after debt settlement for one credit card, while a person with a 780 credit score and no other late payments would lose between 140 and 160 points.

What does it mean when your credit card company closes your account?

Most of your credit and loan obligations are reported to the credit bureaus each month. 2 Your account status is listed on your credit report indicating whether your payments are on time, late, or the account is closed. For instance, your credit card company will likely close your credit card after settling your debt.

Why do debt settlement companies advise you to fall behind on your payments?

Many debt settlement companies will advise you to purposely fall behind on your payments so creditors will be more willing to accept a settlement payment on the debt. The theory behind this strategy is the belief that lenders will only be motivated to settle debts that are at risk of not being paid.

What does debt settlement mean?

Debt settlement means you’ve made an agreement with your creditors to pay less than the balance due to satisfy your debt. 1.

What is a credit score?

A credit score is a measurement of the likelihood that you'll pay back the money you borrowed in the form of a loan, mortgage, or credit card. Credit scores also factor in how well borrowers pay their bills on time. A FICO credit score is a type of scoring model used to calculate your credit score and is used by banks, lenders, ...

How does a debt settlement affect your credit score?

A debt settlemen t can decrease your credit score by 100 points or more. The amount it drops will depend on your credit history, types of debt, current credit score, and current credit activity. It will also depend on whether the lender reported the settled debt as partially paid or paid in full. When you’re negotiating a debt settlement, ask the lender if they will report the account as “paid in full” as part of the settlement terms. Having an account reported as paid in full, won’t harm your credit score. But if it’s reported as “partially paid,” it will lower your score.

How does debt settlement work?

Debt settlement is a repayment method where you negotiate with a creditor to pay less than you owe to close your account and stop collection activity. You or a debt settlement company can negotiate payment options to close your account. You can use the money you have to settle the debt in one lump sum or work out a plan to make monthly payments. Debt settlement is often used with credit card debt. The part of the debt you don’t pay is forgiven debt. If a lender forgives $600 or more it’s considered “canceled debt” and taxable income by the IRS.

How long does a debt settlement stay on your credit report?

When you apply for new credit, lenders will see that you did not pay that previous balance in full. This will tell them that you might be a risky borrower to lend to. This information stays on your credit report for seven years.

What is debt management plan?

A debt management plan (DMP) is a method of debt consolidation to manage debt so you can improve your credit score. A debt management plan will require making monthly payments for a few years to pay down your debt. You’ll talk with a credit counselor who will help make arrangements for affordable monthly payments. In a debt management plan, debt is consolidated so you can pay one monthly payment instead of having to pay several creditors every month.

What is the difference between bankruptcy and debt settlement?

An alternative to debt settlement is bankruptcy. The biggest difference between the two is that debt settlement doesn’t require you to give up assets. Although you can often make agreements to keep your house and car during bankruptcy, assets can be sold to pay off debts through a court order. When you settle your debt with a creditor, you’re free to decide what to do with your assets, not the court. One advantage of bankruptcy over debt settlement is that filing bankruptcy stops debt collectors from calling. Creditors can still hound you during debt settlement negotiations.

What happens if you file Chapter 7 bankruptcy?

If you file a Chapter 7 bankruptcy, your unsecured debts and certain secured debts can be discharged. This means you would no longer owe the debt and you’ll have a $0.00 balance. If you don’t have the money to pay the unsecured debt, you don’t pay your debt. The debt still goes away.

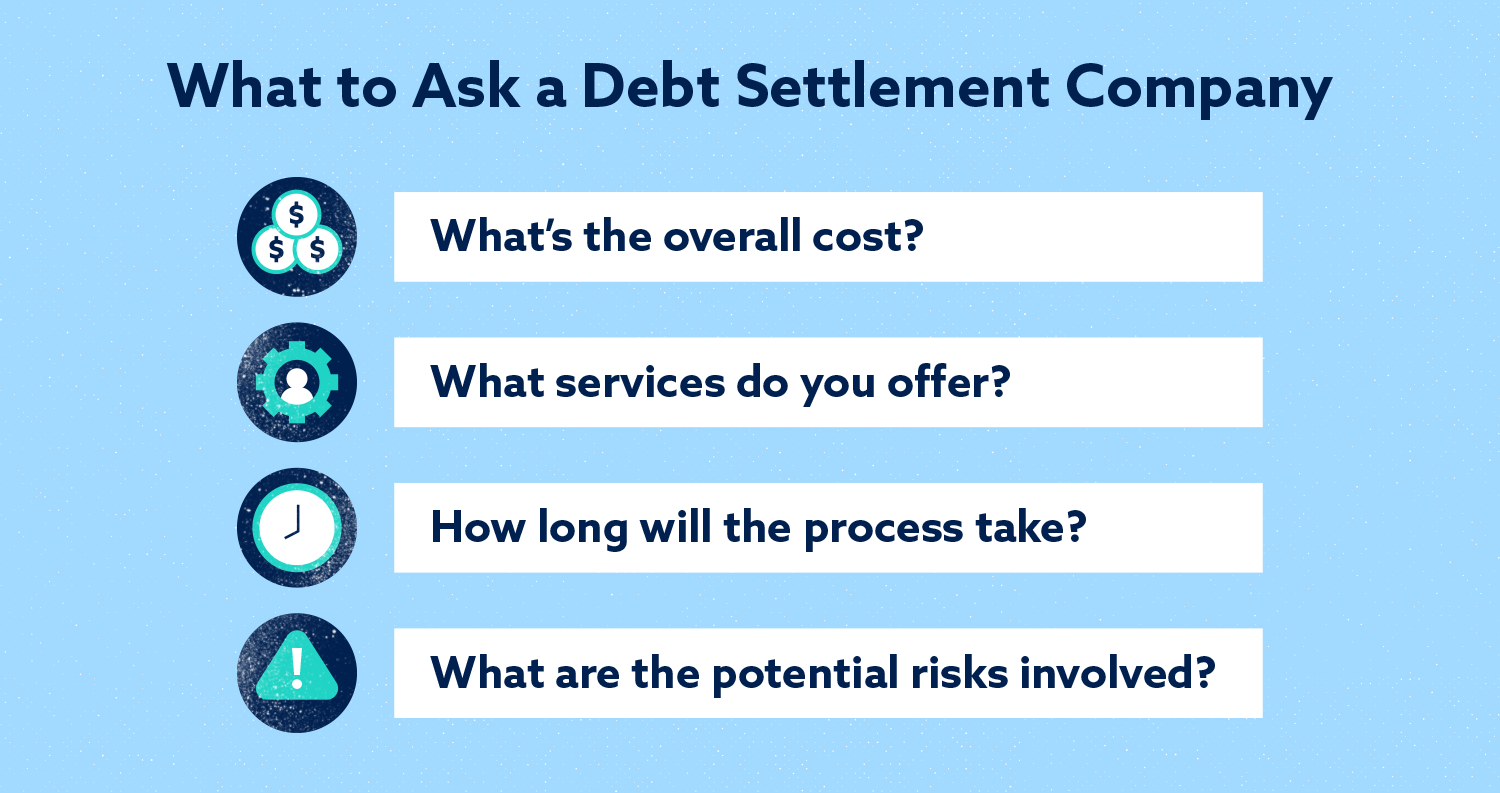

What to ask a company about a debt settlement?

Ask if they have company policies governing debt settlement and if they’d be willing to settle the debt for less than the amount owed. Also, ask them if they are willing to report the account as paid in full if a debt sett lement agreement is reached.

What does it mean when your credit score is settled?

A settled account may be seen as proof that you were unable to pay your balance in full. New lenders may look into your full credit report to understand how likely you are to repay any balance they lend to you, so a "Settled" account shows that you were unable to completely repay a balance in the past.

How long does a debt settlement stay on your credit report?

This record of your debt settlement will remain on your credit report for seven years, which can also affect your ability to be approved for loans or new credit lines, and could even be seen as a negative when you apply for a rental home.

What is a debt settlement?

Credit card issuers regularly report your payment history to credit agencies each month. Along with each payment record, credit card issuers will update your account condition, which include:

What does it mean to settle credit card debt?

Settling your credit card debt typically means that you negotiate an agreement to repay a portion of your balance, because you are facing hardships that prevent you from repaying the debt in full or if you cannot pay your outstanding balance for other specific reasons.

What does it mean when a debt settlement is a settlement?

A settled account may be seen as proof that you were unable to pay your balance in full. New lenders may look into your full credit report to understand how likely you are to repay any balance they lend to you, so a "Settled" account shows that you were unable to completely repay a balance in the past. For this reason, while a debt settlement can ...

What happens when you work with your creditor?

When you work with your creditor to demonstrate hardship (such as loss of job or extended medical leave), they may be willing to develop a settlement agreement. Settlement agreements allow you to pay less than the full balance against the card, but will close the account after that agreed payment has been made.

How does debt settlement affect your credit?

When you enter a settlement program with debt or credit card settlement companies, you typically must stop paying all your creditors for several months. This puts your accounts into arrears and makes your creditors concerned they might not collect any more money from you. When your past due payments are sizable, your debt settlement company will approach your creditors and offer to settle your debt for a lump sum payment that is less than what you owe. The fact that you stopped paying your bills for a number of months, combined with the fact that you didn’t pay back your debt in full, will have a severe and lasting impact on your credit rating.

How does debt settlement affect your credit if your settlement offer is not accepted?

In this scenario, your credit will still be negatively impacted because you stopped paying your bills for a number of months.

Does debt settlement affect your credit more than bankruptcy?

When comparing bankruptcy vs settlement, conventional wisdom suggests that bankruptcy affects your credit score more severely than debt settlement, but some experts suggest that bankruptcy may be more advantageous because you can begin rebuilding your credit more quickly.

What is debt settlement?

A debt settlement is an agreement between a borrower and a lender which allows borrowers to repay a lender less than the amount they owe, and the creditor considers the debt paid off. This might sound like a good way to pay off all your debts and quickly improve your financial situation, but it can…. A debt settlement is an agreement between ...

What should a settlement agreement tell you?

The agreement should tell you how much the original debt is, how much the creditor is willing to accept to settle the account, and how it will be reported to the credit bureaus. Other options. If you decide a debt settlement isn’t your best option for getting out of debt, you have about four other choices:

How much does a debt settlement hurt your credit score?

A debt settlement can hurt your credit score. A debt settlement can reduce your credit score by as much as 125 points. This is a big hit to absorb all at once, and may be difficult to recover from quickly in the event you need a high credit score.

How long does a debt settlement last?

Credit history. On your credit report, a debt settlement will appear for 7 years from the original delinquency date of the debt. Other lenders will look at that notation negatively, and it may prevent them from lending money to you in the future. A lower credit score can make it difficult or impossible to borrow money, result in an inability to rent an apartment, higher car insurance premiums, and even cause denial for job opportunities.

Does non payment affect credit score?

Late payments or non-payment will decrease your credit score . Consumers considering a debt settlement often argue that their credit scores and credit history are already taking a beating, since they’re struggling to pay their debts on time. This is true!

Is debt settlement bad for your credit?

Dangers of debt settlements. Consumers may be able to get out of debt more quickly if they use a debt settlement, but they have very bad consequences. For example: a debt settlement is reported to the credit bureaus, appears on your credit report, results in a huge drop of your FICO credit score, and can affect your tax situation.

When did Ryan start the Military Wallet?

Ryan started The Military Wallet in 2007 after separating from active duty military service and has been writing about financial, small business, and military benefits topics since then. He also writes about personal finance and investing at Cash Money Life. Ryan uses Personal Capital to track and manage his finances.