Does Unum offer disability claims settlements?

However, the company frequently offers disability claims settlements (sometimes called buyouts) to insureds. What gives? At Bryant Legal Group, we’ve made a career out of standing up to UNUM, and we’re very familiar with their tactics.

Why work with Unum?

Protect what's important with benefits from Unum. Offer better benefits for the people who keep your business growing. Connect your clients to powerful benefit solutions. We help people when they need it the most.

How do I evaluate Unum’s lump-sum settlement offer?

The easiest way to evaluate UNUM’s lump-sum settlement offer is to consult an experienced LTD attorney. Most law firms, including Bryant Legal Group, offer free consultations. A free consultation will confirm the information found here.

What happens to your unpaid long-term disability benefits in a settlement?

A settlement ends your long-term disability claim. In exchange for a lump-sum payment, you’ll give up your right to any unpaid LTD benefits that UNUM might owe you, both now and in the future. You exchange the hassle of UNUM’s phone calls, requests for field interviews, and IMEs for a check. But, you could potentially be giving up a lot.

Is there a lawsuit against Unum?

A federal judge Tuesday granted class-action status to a lawsuit that contends Unum Group, the nation's largest disability insurer, schemed to deny or terminate claims of thousands of disabled Americans.

How do you get paid through Unum?

Payments will be mailed to you as a check. However, you can choose to have the benefit payments electronically deposited in your bank account by filling out an electronic transfer form in your Unum account.

Is Unum hard to deal with?

If you're applying for short-term or long-term disability benefits, you've probably heard that UNUM is notoriously difficult to deal with. The company has a reputation for denying valid claims, delaying benefit payments, and violating state and federal insurance laws. However, you can fight back.

How long does Unum take to pay?

Unum will make the initial decision on an individual short term disability claim within 5 business days after receipt of a complete claim which includes: • a completed Employee Statement form • a completed Attending Physician Statement form, and • a signed Medical Authorization form.

How long does Unum long term disability pay?

How long can I collect LTD benefits? For disabilities occurring prior to age 60, benefits will be paid to age 65; if 60 or older, benefits will be payable for 12 to 60 months depending on age when disability occurs.

Is Unum a good company?

Is Unum a good company to work for? Unum has an overall rating of 3.7 out of 5, based on over 1,481 reviews left anonymously by employees. 72% of employees would recommend working at Unum to a friend and 68% have a positive outlook for the business. This rating has decreased by -1% over the last 12 months.

What does Unum consider a disability?

Definition of disability You are considered disabled when Unum determines that, due to sickness or injury: • You are unable to perform any of the material and substantial duties of your regular occupation; and • You are not working in any occupation.

How do I sue Unum?

So you can only sue Unum following a claim denial. But first, you have to go through an administrative appeal process. So whether short term or long term, if your claim's denied, Unum requires, under the law, under ERISA, one mandatory level of appeal.

Can you work while on Unum disability?

Many policies will allow employees to work part time while on claim. Typically, an employee will need to have a certain percentage of their earnings lost due to disability for a claim to remain active.

What does Unum cover?

Unum Accident Insurance can help your employees get back on their feet after an accidental injury. Our plans provide a lump sum benefit to help them with expenses not covered by their medical insurance, such as co-pays, transportation costs and out-of-pocket fees.

Does Unum do direct deposit?

As a convenience, we also offer a secure website at www. unum. com/claimant where you can sign up for direct deposit. Choose Type of Account – Note: We are only able to deposit benefit payments into one account.

Does Unum pay weekly or biweekly?

6. When will I receive my benefit payments? Short term disability benefit payments are generally made on a weekly basis. 7.

What is Unum and how does it work?

Unum Disability Insurance can provide a benefit to replace a portion of an employee's lost income. A single disability can leave employees vulnerable to financial problems, and dealing with that stress can affect their ability to focus on work once they recover.

Do you get paid for the waiting period of short term disability?

►Is there a waiting period? Yes, the first seven (7) calendar days of absence from work are known as the waiting period. No Short Term Disability benefits are paid during this time If you don't have any accruals to use, the seven-day waiting period will be completed without pay.

Why Settle for a Lump Sum Payout?

Gregory Dell explains that it all depends on your interests, needs and what you want to do with the money. Every case and every situation is personal and unique to the circumstances, both present and future.

What happens if you are denied Unum?

A future Unum denied claim could cause a great deal of upheaval in your personal life and finances, and the ordeal of ending up in an Unum disability claim denial or eventual lawsuit can be intimidating. This is especially for those who are already dealing with the disruptive effects of a long-term disability.

How long does a disability policy last after death?

The policies also do not typically pay a death benefit beyond two or three months of payments.

What to do if playback doesn't begin?

If playback doesn't begin shortly, try restarting your device.

Can Dell and Schaefer help with disability?

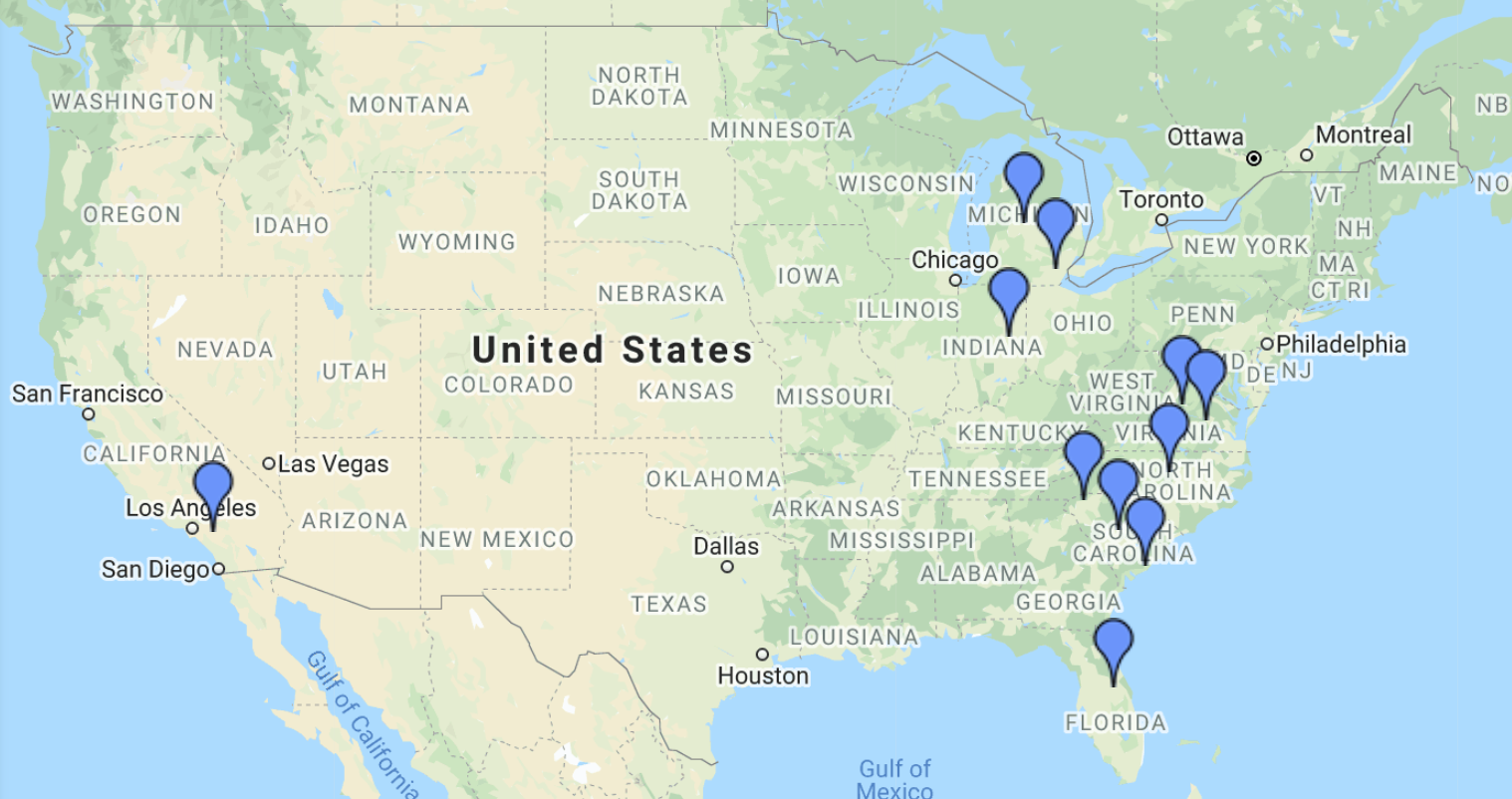

The disability insurance lawyers at Dell & Schaefer always offer a free consultation to see if they can help with your claim. They’ll need to see a copy of your disability policy in order to talk about the pros and cons and to determine whether it’s in your best interest to pursue a lump sum buyout. They work with clients all across America and can handle claims with Unum or many other disability insurance providers. Just contact them by phone or via the contact form on the company website.

Does Dell and Schaefer pay lump sum?

When retaining a disability insurance law firm such as Dell & Schaefer, they do whatever it takes to get the most amount of money possible in a lump sum payout, if that’s the path you choose to take. Sometimes, it’s the best way forward, rather than risking an eventual disability insurance claim denial.

Is a lump sum buyout good?

Lump sum buyouts can be a very good option for many people, but they can be less than ideal for others. Gregory Dell explains that it all depends on your interests, needs and what you want to do with the money. Every case and every situation is personal and unique to the circumstances, both present and future.

Software engineer unable to continue working following auto accident

Mr. Z attempted to return to work, but soon found that sitting at a desk and working on a computer only made the pain worse. In fact, maintaining any static position for too long caused pain. He requested that his employer provide him the accommodation of working from home, which his employer granted. However, Mr.

Disability claim filed with Unum and STD benefits are approved

Unum received medical records from Mr. Z’s treating physicians which supported that his complaints of pain were very credible. Mr. Z had begun developing paresthesias (numbness) in his left hand, and was undergoing intense physical therapy and painful epidural steroid injections to control his pain. Initially, Unum approved Mr.

Unum denies LTD benefits and conducts IME and video surveillance

The trouble for Mr. Z started soon after he received his first long-term disability benefit payment. Unum requested that Mr. Z undergo an Independent Medical Evaluation (IME) with a physiatrist selected by them. The IME concluded that Mr. Z was not limited in any way due to the herniated disks in his neck and spine, but that Mr.

How long can you receive disability benefits?

The length of time you can receive benefits depends on your policy’s Maximum Benefit Period, which is determined by your employer. Once the elimination period (the number of days that must elapse before you’re eligible for benefit payments) is satisfied and you continue to meet the definition of disability, your Long Term Disability Insurance benefits can extend through the Maximum Benefit Period.

How much does Unum pay for long term disability?

If you experience a covered illness or disability that leaves you unable to work for an extended period of time, Unum Long Term Disability Insurance can pay a monthly benefit of up to 60% of your normal income. You can use this benefit however you need, whether it’s to pay out-of-pocket treatment costs or to cover personal bills and day-to-day expenses.

What happened to Bill from the gutter?

Bill was cleaning leaves out of his gutter when he fell off the ladder and hurt his back. A trip to the ER confirmed he had four herniated discs and would need intensive physical therapy before he could return to work. Bill’s Long Term Disability Insurance paid a percentage of his lost income, while he worked to regain his strength.

What happens if an employee becomes disabled after the number of days in the recurrent provision?

If an employee becomes disabled after the number of days in the recurrent provision, or due to a new medical condition, a new claim would need to be filed.

How does disability affect your financial situation?

A disability can drastically impact your financial situation if you’re not prepared. If you’re the primary income provider in your home, a disability can place a huge stress on your loved ones. Protect what you’ve worked so hard to build. Talk with your HR representative to see if Long Term Disability Insurance is available through your workplace.

What is a review on Unum?

The reviews on our website represent the individual experiences of verified Unum customers. We publish reviews we receive in their original format, after reviewing to ensure they meet our guidelines set forth in our terms & conditions.

Can disability be reduced?

The disability benefit may be reduced if you are receiving income from other insurance policies, retirement or government programs.

Jeremy Lyle Bordelon

I have helped people through several of these negotiations. First of all, what they claim is 66% of the value of your case may actually be more like 50% - they through a lot of extra factors in there, like "mortality and morbidity," that in my opinion don't matter when calculated the "full value" of a case.

John M Connell

You can settle the disability claim if you want but there is a lot that goes into the evaluation. Your health, your age, your need for medical treatment, the SSDI, etc If they are offering 66% they would probably go higher but that's unknown at this time.

James E Mitchem

Because workmen's compensation is not handled by the regular courts in Colorado, it is a field of legal specialization. You should consult with an attorney who regularly handles workmen's comp cases in Colorado. The decision to be made is a major one for your lifetime, and you should be well informed as to your rights.

What is present value in disability?

Present value is also an important concept in the disability insurance world. Insurance companies use the concept of present value to calculate your LTD lump sum buyout amount and, as you might expect, the insurance companies will do everything possible to ensure the calculation works in their favor. The calculation is based on a variety of factors including:

What companies offer lump sum buyouts?

A long-term disability (LTD) company, such as Cigna, Hartford, Lincoln, MetLife, Standard, Prudential, and Unum, may offer to give you a lump sum of money to buy you out of your disability insurance policy. In exchange for a lump sum buyout, you agree to forgo monthly benefits and cancel your disability insurance policy. You will no longer have an active disability claim with the insurance company. The lump sum may seem like a lot of money, but is the lump sum buyout really a good deal for you?

How to contact LTD disability legal team?

We would be happy to answer all of your questions related to your LTD claim and to help you make the decision that is right for you. Call us at (888) 321-8131 or contact us online.

How much of your disability is offered by LTD?

Once the present value of your claim has been calculated, the LTD insurance company will offer you some percentage of that amount—typically between 50% and 70% of the total value of your disability claim. It is important to note that these percentages can vary considerably. The initial offer may be just the starting point – some insurance companies may be willing to negotiate.

What does a calculator do for insurance?

Once you enter the necessary information, the calculator will provide you with the present value of your policy—taking fees and costs into consideration. If you choose, it will also provide you with a detailed report showing the present value of your future payments.

What is the present value of a $100?

To illustrate: if you invest $90.91 today at 10% interest compounded annually, you will have $100 in one year. In this simple example, $90.91 is the present value of $100: in other words, a payment of $100 one year from now is worth $90.91 today.

Can you go back to the insurance company for a lump sum disability?

Not only is it hard to determine if the amount offered by the insurance company is fair, but if you do accept an LTD lump-sum buyout offer, the decision is final—you can’t go back to the insurance company and ask for more money. For these reasons, you need to consider your options carefully before you give up your monthly disability insurance benefits.