...

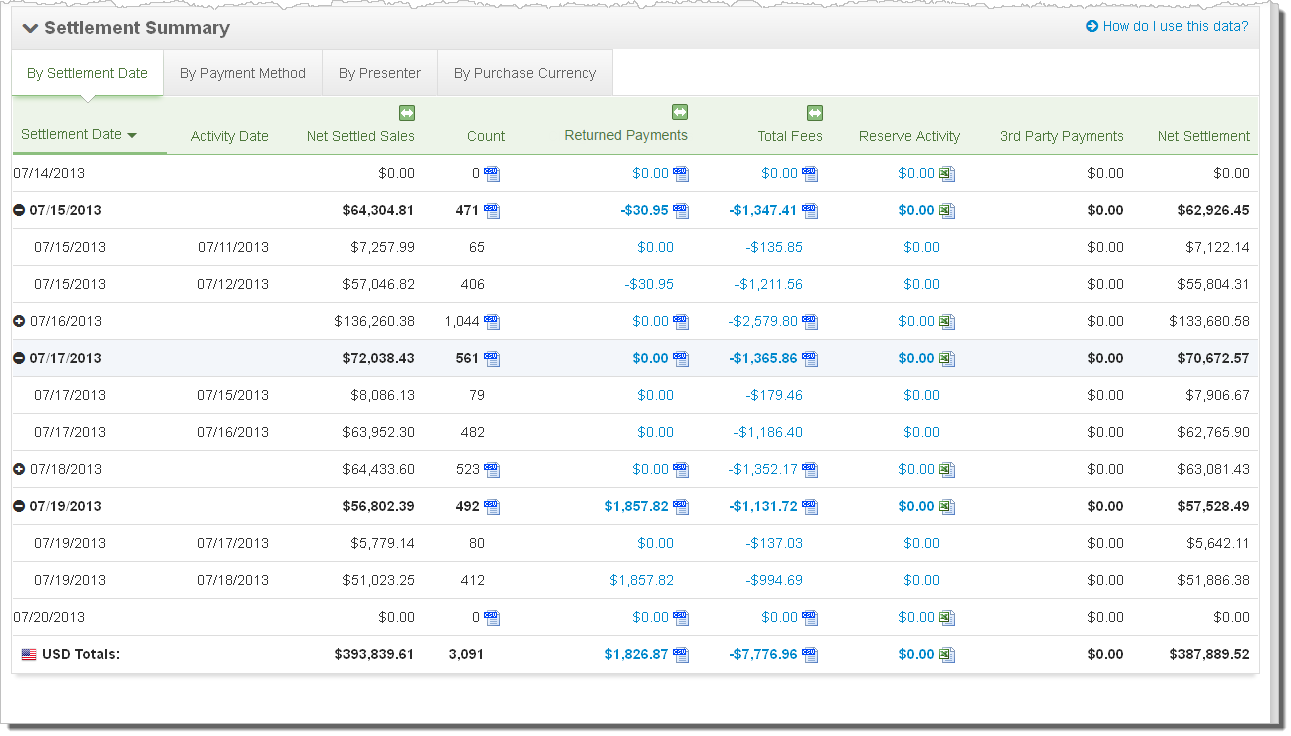

CME Group E-mini S&P 500.

| E-mini S&P 500 Futures | |

|---|---|

| Listed Contracts | Quarterly contracts (Mar, Jun, Sep, Dec) listed for 5 consecutive quarters |

| Settlement Method | Financially Settled |

How are options settled?

Regular options on stocks and ETFs will involve settlement by purchasing or receiving the specified number of shares if the contract ends in-the-money. For equity futures options settlement is normally to the underlying futures contract or simply to cash.

What do options exercise settlements tell you?

Like the hours of the day, these exercise settlements reflect the opening numbers and closing values of the day's trading. To avoid surprises on the Friday of stock options expiration, the issues associated with the individual settlement styles require careful handling.

How is the settlement price determined for the Feb 20th option?

How is the settlement price determined in terms of whether the weekly Feb 20th option is ITM, ATM or OTM? For cash settlement of the futures contract itself at the end of the contract month, there is an algorithm that calculates prices at the expiration date during the market opening.

What happens when an option contract is exercised or assigned?

When an options contract is exercised or assigned, the clearing organization facilitates the options contract’s settlement. Settlement can be physical delivery of the underlying security or commodity or cash-settled through an exchange of money. Options expiration is the last trading day for exercise and assignment.

How are ES options settled?

Futures options will expire into cash when the options and futures expire in the same month. If the options and the future expire in different months, the options settle to the future. For example if we have FEB /ES Call that expires ITM, we end up with a MAR /ES Future.

Are E-mini options cash settled?

The contract allows investors to hedge or speculate on the movement of the index. Contracts are priced at $50 times the value of the S&P 500 and are available quarterly. E-mini index futures are cash-settled, which means you receive a credit or debit rather than delivery of the underlying asset.

What time do weekly ES options expire?

Weekly options are designed to expire on each Friday of the month, with the exception of the third Friday if a quarterly option is already listed for that Friday, while Monday and Wednesday options expire on the Monday and Wednesday of each week, respectively.

Are ES futures cash settled?

If you're trading the E-mini S&P 500 future (/ES), the underlying contract represents $50 multiplied by the price of the index. E-mini S&P 500 futures are financially settled, so when delivery takes place you'll receive a cash credit or debit that's based on the settlement price.

What time of day do es options expire?

According to NASDAQ, options technically expire at 11:59 AM Eastern Standard time on the date of expiration, which is a Saturday, oddly enough. Public holders of options contracts, however, must indicate their desire to trade no later than 5:30 PM on the business day preceding the option expiration date.

How are ES futures settled?

Normal Daily Settlement Procedure Daily settlement of the E-Mini S&P 500 futures (ES) is equal to the daily settlement price of the S&P 500 futures (SP), rounded to the nearest tradable tick.

Are Emini futures options cash settled?

Option exercise results in a position in the underlying cash-settled futures contract....CME Group E-mini S&P 500.E-mini S&P 500 FuturesListed ContractsQuarterly contracts (Mar, Jun, Sep, Dec) listed for 5 consecutive quartersSettlement MethodFinancially Settled10 more rows•Feb 19, 2021

What time do futures options close?

What time does the futures market open and close? The futures market is open nearly 24 hours per day, from 6 p.m. EST Sunday through 5 p.m. Friday. There is a break between 5 p.m. and 6 p.m., and some markets have other breaks, but traders can generally find a market to trade at any point during the week.

Do options expire at 4pm?

Keep in mind that most stock options stop trading at 4:00 pm ET when the regular stock market session closes, but many stocks continue to trade after hours until 8:00 pm ET, even on expiration Friday, which may affect the intrinsic value and possibly the decision of a call or put option buyer to exercise an option, as ...

How long does it take for futures to settle?

The settlement date for stocks and bonds is usually two business days after the execution date (T+2). For government securities and options, it's the next business day (T+1). In spot foreign exchange (FX), the date is two business days after the transaction date.

Are futures options traded 24 hours?

What if you could trade 24 hours per day? You can—in the futures options market. Yup, 24 hours a day, 5.5 days a week, you can trade E-mini S&P and E-mini Nasdaq, as well as crude oil, gold, corn, the euro currency, and many more.

What is the difference between ES and SPX?

SPX is the S&P 500 Index. The index cannot be traded directly but options based on the SPX trade an average of more than 800,000 contracts per day. /ES represents the E-mini S&P 500 futures contract.

Are all futures physically settled?

Although physical delivery is an important mechanism for certain energy, metals and agriculture products, only a small percent of all commodities futures contracts are physically delivered. In most cases, delivery will take place in the form of cash settlement.

Are futures and options physically settled or cash settled?

In an F&O contract, when there is an open position that has not been squared off by its expiry date, physical settlement takes place. This implies they have to physically give/take delivery of stocks to settle the open transactions instead of settling them with cash.

Which options are cash settled?

Cash-settled options include digital options, binary options, cash-or-nothing options, as well as plain-vanilla index options that settle to the cash value of an index.

How are futures settled daily?

Finally, what exactly is the daily settlement price and how is it calculated. It is simply the closing price of the specific futures contract on that day. The closing price for a futures contract is calculated as the weighted average price of the contract in the F&O Segment of NSE in the last half hour.

What Is the E-Mini S&P 500?

E-Mini S&P 500, which usually carries the commodity ticker symbol ES, is a stock market index futures contract predominantly traded on the Chicago Mercantile Exchange (CME). Like the other E-Minis available on a wide range of indexes, the S&P 500 is also a fraction of the total contract price for a corresponding standard futures contract.

Why Trade S&P 500-Based Futures?

S&P 500 futures is a preferred destination for many investors and traders. And it is mainly because of the following reasons:

How Do You Get Started?

Trading in futures offers a swift and cost-effective way of accessing financials and stock markets 24/7. If you are confident enough to commence trading futures contracts, then it comes highly recommended that you begin with simulated trading to familiarize yourself with the broad market terminology, the price quotations, and the general personality of a specific market.

What is micro e mini?

Micro E-Mini S&P futures contracts are one-tenth the size of the E-Mini S&P futures contract. This means that trading in these futures gives you the chance of trading the same S&P 500 index in small amounts of money and lower margin requirements.

Why do traders prefer E-mini futures?

Since flexibility and leverage are some of the main advantages of futures trades, traders prefer investing in such assets with relatively small capital because it gives them access to various opportunities that are lacking in other markets, and E-mini futures trading was a game changer in that regard .

What is ES futures?

One of the popular futures that is trading is the ES futures (E-Mini S&P 500 futures options). Most traders choose this option because it provides deep liquidity and 24-hour market access for S&P 500 index speculation.

What are E-minis in day trading?

Many people have dropped their traditional day trading strategies in regular stocks to focus on E-minis such as the ES , YM, NQ, and TF. These forms of electronic index futures allow traders to gradually leverage on price fluctuations in the broad indices.

What is a physically settled option?

Physically settled options are those that involve the actual delivery of the underlying security they are based on. The holder of physically settled call options would therefore buy the underlying security if they were exercised, whereas the holder of physically settled put options would sell the underlying security.

What happens when a contract expires?

Basically, if there's any intrinsic value in contracts at the time of expiration, then that profit is paid to the holder of the contracts at that point. If the contracts are at the money or out of the money, meaning there is no intrinsic value, then they expire worthless and no money exchanges hands.

What is an option settlement?

Options Contract Settlements. Settlement is the process for the terms of an options contract to be resolved between the relevant parties when it's exercised. Exercising can take place voluntarily if the holder chooses to exercise at some point prior to expiration, or automatically, if the contract is in the money at the point of expiration.

Who handles the settlement of options contracts?

Although settlement is technically between the holder of options contracts and the writer of those contracts, the process is actually handled by a clearing organization. When the holder exercises, or an option is automatically exercised, it's the clearing organization that effectively resolves the contracts with the holder.

Is a stock option cash settled?

Physically settled options tend to be American style, and most stock options are physically settled. It isn't always immediately obviously when looking at options as they are listed whether they are physically settled or cash settled, so if this aspect is important to you it's well worth checking to be absolutely sure.

Who handles options exercise?

Whether you are exercising options you own or receiving an assignment on contracts you have written, that part of the process goes relatively unseen and is all handled by your broker.

What are Futures Options?

A futures option is an option on a futures contract that gives the holder the right to buy or sell a given asset at a specific price for a certain period of time.

What are the Benefits of Future Options?

The biggest benefit to trading futures options is access to greater leverage though SPAN Margin.

What is the most confusing thing about futures options?

One of the most confusing things about futures options is settlement.

What happens if you settle an option on the underlying future?

If it is settled to the underlying future, one simply buys or sells the future position on assignment or closes the options position before assignment to the future.

Is soybean futures liquid?

In contrast Soybean futures and futures options are liquid, margin efficient and allow investors to get the exact exposures they want.

Can futures options be used for trading?

Futures Options can sometimes provide the best of both worlds for traders on certain products.

Is it difficult to branch into futures options?

Thus, if you have experience with options, branching into futures options isn’t difficult.

What are the two types of options settlement?

First of all, there are two types of Options settlement – American style and European style. And there are two baskets of securities when it comes to settlement procedures – 1) Equities and ETFs and 2) Major Indices like the SPX, NDX and the RUT. The American style applies to all equities and ETFs, and the European style applies to cash settled ...

What is the American style of investing?

The American style applies to all equities and ETFs, and the European style applies to cash settled index Options. And there are two ways to settle them – 1) Exchange of securities and 2) Exchange of cash.

When can you exercise American style options?

American style Options can be exercised at any time prior to the day of expiry of the Option. The American style applies to all equities and ETFs (Basket 1), including ETFs based on indices – like the SPY or QQQ. They trade until the close of every third Friday of the month.

What happens if you buy an option and it is ITM?

And if you’re an Option buyer and your Option is ITM, then you will be automatically exercised, unless you have informed your broker specifically that you don’t intend to exercise. This applies even if the Option is ITM by 1 cent. This type of settlement is done by “exchange of securities”.

Is the SPX a European option?

In the US markets, only Options on the major indices like the SPX, NDX and the RUT are European style. And these Options are also “cash-settled” – meaning the settlement process only involves transacting in cash between the buyers and sellers. There are no underlying securities that exchange hands. In fact, these indices are not tradable securities.

What is the American style option?

It should be noted that stock options on certain indices are classified by either the {American option} style or the {European option} style. In the case of American-style stock options, the investor maintains control over the right to exercise, or sell, the stock options at any time before or at the specified time on its expiration date. Failure to exercise an American-style stock option will result in the expiration of the option as a financial instrument, basically rendering it worthless as it ceases to exist.

What is index stock option?

Index stock options create investment opportunities for investors who wish to take advantage of market moves, as well as protect existing holdings. Offering known risk, the premium set by a long index option ensures the investor will not incur losses exceeding the purchase price of the index option. Investors can also take short positions with index stock options, but with the potential for unlimited loss in many cases. Additionally, an index credit spread stock options position, short an index option and long an index option with the same expiration month, gives investors an opportunity to pursue leveraged investments without paying interest fees for margin as with other leveraged strategies. However, the risks associated with credit spreads on indexes must be carefully considered.

What happens if you fail to exercise an American stock option?

Failure to exercise an American-style stock option will result in the expiration of the option as a financial instrument, basically rendering it worthless as it ceases to exist. European style stock options specify a strict time period for exercising the stock options prior to expiration.

What is AM exercise settlement?

AM Exercise Settlement is established by calculating the opening prices of the individual component stocks of an index and thus the index option is exercised or sold based on that value. The S&P 500 Index (SPX) covering a broad range of industries is a commonly known AM Exercise Settlement index option.

When do index options expire?

When purchased by the investor, the stock options expire at this set time and date, unless exercised, or sold prior to expiration.

What is PM settlement?

A PM Exercise Settlement establishes its value at the close of the market, when the last reported prices for the individual stock components are calculated to determine the index's value. Most ETFs are PM Settlement, including the most favored {QQQ}, {SPY}, {IWM} and {DIA}. A well-known index with PM settlement is the S&P100 Index ( {OEX}).

Can you trade credit spreads on Thursday?

Investors trading index option credit spreads should be very careful in trading index options with AM settlement as sudden moves between Thursday's close and Friday's open can turn a sure gain on Thursday into a very big loss on Friday. An example of an index AM settlement causing heartburn for index option credit spreads for the Russell 2000 Index ( {RUT}) occurred in August of 2008.