You can then respond to the written offer with your own email when you're ready. If you'd like to take some time to consider the offer, write back something like this: Dear [Recipient Name],

Full Answer

What is a settlement offer letter?

A Settlement Offer Letter is a communication between two parties in a dispute. The dispute does not have to be in a court of law, although most of the time, it is. One party sends the other party this Settlement Offer Letter, with the proposed terms for a complete settlement between the parties.

How do I respond to a debt settlement offer?

If you receive a settlement offer and decided you’re interested, there are a couple of ways you can respond. You can accept the settlement offer and pay the settlement account in full. This is the easiest and fastest way to deal with the debt, assuming you’ve received a legitimate settlement offer.

How do you accept a settlement offer from a company?

Accepting the Settlement Offer Draft the agreement. Carefully read terms. Sign the agreement. Make the exchange bargained for in the settlement agreement. Inform the court or administrative agency where the cause of action was filed of the parties’ decision to settle.

Why would a debt collector Send Me a settlement letter?

Debt collectors have been known to send settlement letters as a trick to get debtors to make one or more partial payments on a time-barred debt, that is one whose statute of limitations has expired. The payment would restart the statute of limitations giving the collector more time to sue you for the debt.

How do you respond to a settlement offer?

Steps to Respond to a Low Settlement OfferRemain Calm and Analyze Your Offer. Just like anything in life, it's never a good idea to respond emotionally after receiving a low offer. ... Ask Questions. ... Present the Facts. ... Develop a Counteroffer. ... Respond in Writing.

How do you reject and respond to a low insurance settlement offer?

Countering a Low Insurance Settlement OfferState that the offer you received is unacceptable.Refute any statements in the adjustor's letter that are inaccurate and damaging to your claim.Re-state an acceptable figure.Explain why your counteroffer is appropriate, including the reasons behind your general damages demands.More items...•

How do you write a good settlement offer?

Writing the Settlement Offer Letter Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

How do you decline a low settlement offer?

Always reject a settlement offer in writing. Type a letter to your contact at the insurance company listing the reasons you think that their offer is too low. Back up these reasons with concrete evidence attached to the letter. Finally, provide a counteroffer of a sum you think is more reasonable.

How do you counter offer an insurance settlement?

From the standpoint of procedure, you will need to make a counter-offer in writing. Be sure you send your letter to the appropriate person, whether that be an insurance adjuster or an attorney. Make it clear that you are rejecting their initial offer and include your reasons for doing so.

Should you accept the first offer of compensation?

Unless you have taken independent legal advice on the whole value of your claim, you should not accept a first offer from an insurance company.

How do you negotiate a full and final settlement?

What percentage should I offer a full and final settlement? It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

How do you write a full and final settlement in an email?

Dear Sir, I had resigned from my position of (Designation) in the company on (Date). Before the last date of service and notice period, I had completed all the handing over formalities duly. I was told that I would get a full and final settlement amount of ___________ towards the pending salary and other dues.

How do you negotiate a settlement?

Identify, gather and produce the most important information early. Settlement negotiations are most effective at the proverbial sweet spot, when each side has the information it believes it needs to make a judgment about settlement but before discovery expenses allow the sunk costs mentality to take hold.

What is a reasonable settlement agreement?

By Ben Power 8 April 2022. A settlement agreement is a contract between two parties, usually (but not always) an employer and an employee, which settles the employee's claims against their employer.

What do I do if my insurance offer is too low?

Here are five steps to take if the insurance company is lowballing you:Get Help from an Attorney. ... Make Sure It Is Actually a Lowball Offer. ... Figure Out Why the Insurance Company Is Lowballing You. ... Collect the Evidence You Need to Prove Your Claim. ... Keep Negotiating and/or File a Lawsuit in Court.

How do insurance companies negotiate settlements?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

What do I do if my insurance offer is too low?

Here are five steps to take if the insurance company is lowballing you:Get Help from an Attorney. ... Make Sure It Is Actually a Lowball Offer. ... Figure Out Why the Insurance Company Is Lowballing You. ... Collect the Evidence You Need to Prove Your Claim. ... Keep Negotiating and/or File a Lawsuit in Court.

What happens if you decline an insurance offer?

When you reject a settlement offer from the insurance company, that offer is “dead,” meaning you can't later change your mind and accept it. Instead, you'll submit a counteroffer, which means that you are now the party submitting an offer, and it's up to the insurance company to accept or reject it.

How do you negotiate a total loss payout?

Summary: How to negotiate the best settlement for your totaled carKnow what you are selling to your car insurance company.Prepare your counter offer.Determine the comparables (comps) in the area.Obtain a written settlement offer from the auto insurance company.Make your counteroffer for your totaled car.

How do you negotiate a settlement with an insurance claims adjuster?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

What does it mean to make a settlement offer?

A settlement offer during trial might mean that the other side thinks it’s going to lose and wants a more predictable way out of the situation.

What is a settlement offer?

Since a settlement offer is essentially a contract between the parties , you can feel free to suggest -- and agree to -- terms that might not have been available if you tried your case in court. For example, some settlement agreements require one party to make a formal apology to the other for the wrongs committed.

How to guarantee a settlement doesn't include any terms that violate the law?

The best way to guarantee your settlement doesn’t include any terms that violate the law is to hire an attorney. Attorneys are bound by professional ethics rules and bar regulations to alert you to illegal terms and have them removed.

Why do you need a settlement?

2. Use a settlement to avoid risk. Whether you’re a plaintiff suing someone else or a defendant who’s been sued, a settlement provides the same opportunity to avoid the financial and emotional costs of litigation and create certainty in the outcome.

Why do plaintiffs prefer an open settlement agreement?

Aggrieved plaintiffs may prefer an open settlement agreement because they want the public to know about a particular injustice. Allowing a settlement’s terms to be made public also allows attorneys to adequately ascertain the value of similar cases that may arise in the future.

How many times should you read a settlement agreement?

Carefully read terms. Whether your side or the other side drafts the settlement agreement, read it several times and make sure you understand everything in it.

What to do if you don't like your chances of winning at trial?

If you don’t like your chances of winning at trial, though, a settlement may begin to look more attractive. Take the opportunity to get creative. A settlement offer allows you to craft terms that actually fit the nature of the issue and come closer to satisfying the needs of all involved.

How do you respond to a settlement offer?

Remain Polite. Stay polite and professional when negotiating with an insurance claims adjuster, even if you believe he or she is trying to take advantage of you or is using bad faith tactics. Ask Questions. Present the Facts. Respond in Writing. Do Not Fall for Common Insurance Tactics.

How do you respond to a low insurance settlement offer?

State that the offer you received is unacceptable. Refute any statements in the adjustor's letter that are inaccurate and damaging to your claim. Re-state an acceptable figure. Explain why your counteroffer is appropriate, including the reasons behind your general damages demands.

What is a settlement demand letter?

A settlement demand letter is used to ask for a settlement. The demand letter indicates that you are willing and ready to settle your claim related to your slip and fall accident, car crash, construction accident, or other injury.

How do you politely decline a settlement offer?

Always reject a settlement offer in writing. Type a letter to your contact at the insurance company listing the reasons you think that their offer is too low. Back up these reasons with concrete evidence attached to the letter. Finally, provide a counteroffer of a sum you think is more reasonable.

What happens if I reject a settlement offer?

Scenario 3: Protect Your Legal Rights by Filing a Lawsuit The most dramatic result of a rejected settlement offer is a lawsuit against the party who injured you, the insurance company, or both.

How do I write a demand letter for a settlement?

Outline The Incident. You will need to start by outlining the details of the accident. Detail Your Injuries. Explain All Of Your Damages. Calculate Your Settlement Demand. Attach Relevant Documents. Get Help From An Attorney.

How to counter an offer to an adjuster?

State that the offer you received is unacceptable. Refute any statements in the adjustor's letter that are inaccurate and damaging to your claim. Re-state an acceptable figure. Explain why your counteroffer is appropriate, including the reasons behind your general damages demands.

1. How to Ask for More Time to Consider a Job Offer

You’ll typically get the initial job offer over the phone—this is referred to as a “verbal”. But you’re not expected to give an answer at that point—so don’t feel pressured to. Thank the employer for the offer, and let them know that you'll send in your response soon.

2. How to Negotiate a Job Offer

If the terms of the offer are not satisfactory for you, don't hesitate to negotiate. Accepting an underpaying job will take a toll on your mental health and career growth in the long run, so do yourself a solid and demand what you deserve.

3. How to Accept a Job Offer

If you decide to accept a job offer, keep your email short and straightforward. You want to thank the employer for the offer, then include a clear acceptance of the job offer. Also, mention the confirmation of the agreed job title and start date, and finish off with a question about the next steps.

4. How to Decline a Job Offer

After careful consideration, if you decide that a job offer isn't right for you, you should inform the employer. This may not be the easiest thing to articulate—rejection is painful no matter which side you're on. Even if you believe an employer went to great lengths to sell you the job, “no” is a part of the job search process for both parties.

One Email Closer to Your Dream Job

It's super important to be professional with your responses to employers. Whatever your response is, with the help of this article, rest assured that it'll be well-articulated.

What is a settlement offer letter?

A Settlement Offer Letter is a communication between two parties in a dispute. The dispute does not have to be in a court of law, although most of the time, it is. One party sends the other party this Settlement Offer Letter, with the proposed terms for a complete settlement between the parties. Rather than a formal legal document, this letter can ...

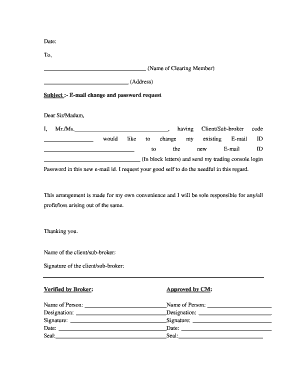

What information is entered in a settlement agreement?

The parties' identifying details and contact information will be entered, as well as the proposed settlement terms.

What happens if a dispute is not litigated?

If the dispute is not being litigated, details of the incident at the heart of the parties' dispute will be entered.

Is a settlement agreement a legal document?

Although the terms listed in this letter will generally become the terms of the Settlement Agreement, this letter does not create a legally binding contract.

Is a settlement offer letter legal?

Although settlement agreements can be governed by both state and federal law, this Settlement Offer Letter is not a legal document, so it is simply a best practice to give the recipient of the letter as much information as possible about the terms of the proposed settlement.