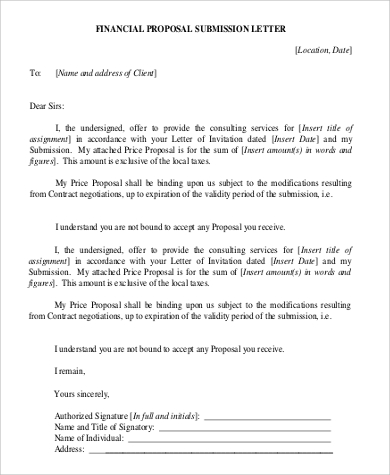

- First Paragraph. Your opening paragraph should quickly state the purpose of your letter, which is a proposal to settle the account for less than the full amount.

- Second Paragraph. You’ll use this paragraph to present the details of your settlement offer. This will include the dollar amount you’re proposing to pay.

- Final Paragraph. In this paragraph, you’re making the assumption that the creditor is accepting your settlement proposal.

- Your Signature. Your letter will require your signature because you’ll be offering the creditor a contract, which is settlement of the debt.

How to write a debt settlement proposal letter?

Sample Debt Settlement Proposal Letter Your debt settlement proposal letter should be formatted as a formal business letter, with your name and complete mailing address in the top left corner of the page, followed by a blank line, your account number, another blank line, and the date listed beneath it.

What is a settlement proposal?

Edit Article. A settlement proposal most commonly refers to an attempt by a person in debt to reduce or eliminate their debt by proposing an alternative to paying the full debt to the creditor.

How do you ask a creditor to accept a settlement proposal?

Close the letter by reiterating that you are not able to pay off the debt, and that this settlement proposal represents your best effort to give the creditor something. Request that the creditor respond in writing to your proposal, indicating their acceptance, refusal, or request for new terms.

What should I consider when writing a settlement offer letter?

[1] Figure out a realistic offer before beginning your letter. As with any negotiation, you don’t want your settlement offer to be so low that the creditor refuses to even consider it, but also no higher than it needs to be in order for them to accept it.

How do you write a proposal for a settlement?

Write a debt settlement letter to your creditor. Explain your current situation and how much you can pay. Also, provide them with a clear description of what you expect in return, such as removal of missed payments or the account shown as paid in full on your report.

How do you write a full and final settlement letter?

The language can be as simple as: In order to settle this matter amicably, I offer you the sum of [amount] (inclusive of interests and costs) as the full and final settlement of the above [claim/debt].

What is a letter of settlement?

Put simply, a settlement note is a formal letter that asks your creditors if they would be willing to accept a debt settlement on your account. It specifies the amount of money that you can offer them as a settlement and explains why you cannot pay your debt in full.

How do you negotiate a full and final settlement?

What percentage should I offer a full and final settlement? It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

What is a settlement proposal?

Settlement proposal means a proposal for effecting settlement of a contract terminated in whole or in part, submitted by a contractor or subcontractor in the form, and supported by the data, required by this part.

What is the time period for full and final settlement?

A company must pay the full and final settlement of wages within two days of an employee's last working day following their resignation, dismissal or removal from employment and services, according to the new wage code.

What is a good settlement percentage?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

How do I ask for a final settlement?

Dear Sir, I had resigned from my position of (Designation) in the company on (Date). Before the last date of service and notice period, I had completed all the handing over formalities duly. I was told that I would get a full and final settlement amount of ___________ towards the pending salary and other dues.

Are settlement offers good?

While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative. Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account.

How do you write a letter to close a loan settlement?

I am willing to opt for one time settlement in order to close the loan account. I can make the all dues in one payment by ......... (Date). Even though it will be very hard in arranging this money, I am still willing to do it.

How do I write a paid full letter?

How to Write a Paid-in-Full LetterWrite the date on the top of the page.Next, include your personal contact details: your name, address, and phone number. ... Write the creditor or debt collection agency's contact details next. ... Write the heading of the letter. ... Write an introduction. ... Write the body of the letter.More items...•

What should be included in a debt settlement letter?

You should also include all the key information your creditor will need to locate your account on their system, which includes: Your full name used on the account. Your full address.

When proposing a full and final debt settlement to creditors, it’s important you go about this in the right?

When proposing a full and final debt settlement to creditors, it’s important you go about this in the right way. This means sending a written letter explaining how you wish to settle your debt, how much you are offering to pay and when this can be paid by.

What is debt settlement?

Debt settlement is something many people consider if they are able to offer a lump sum of money up front – usually less than the total amount owed – in the hope the creditor will agree to this and accept the debt as settled.

What to do if creditor accepts offer?

If the creditor accepts your offer, ensure this is in writing before you send any money to them. Keep this written confirmation safe too in case there is any dispute in the future, so you can offer this as proof of the agreement.

What happens if you settle early on a debt?

It’s important to remember that if you settle early on your debt, this means you are not paying it in full and so it will show as partially settled on your credit report instead of settled. This can affect your ability to obtain credit in the future, as it suggests to future creditors that you may not be able to pay back the full amount borrowed.

How to contact PayPlan?

If you are looking for guidance when dealing with creditors and proposing a debt settlement, our team here at PayPlan can help. Speak to our experts on 0800 280 2816 or use our contact form to get in touch.

What is a settlement proposal?

A settlement proposal most commonly refers to an attempt by a person in debt to reduce or eliminate their debt by proposing an alternative to paying the full debt to the creditor. Proposing a settlement is a good idea for someone who is considering bankruptcy or who feels like they can pay some, but not all, of a debt.

How to close a settlement letter?

Close the letter by reiterating that you are not able to pay off the debt, and that this settlement proposal represents your best effort to give the creditor something.

What does it mean to request a debt settlement?

Request, in exchange for a debt settlement, that the creditor remove mention of the debt in your credit report and make a good effort to improve your credit rating.

What is a proposal payment?

Propose payment terms, including whether you are seeking a cancellation of the debt or simply a debt reduction and offer a payment schedule. Request, in exchange for a debt settlement, that the creditor remove mention of the debt in your credit report and make a good effort to improve your credit rating.

Why are creditors open to settlement?

Creditors are often open to settlement proposals as they offer an alternative to settling a debt that might otherwise go unpaid. The steps below will guide you on how to write a settlement proposal and seek good terms for a partial or full debt reduction.

What is a request for a creditor to respond to a proposal?

Request that the creditor respond in writing to your proposal, indicating their acceptance, refusal, or request for new terms.

How much should a debt settlement be?

In general, a debt settlement should be about half of the total amount owed. ...

How long does a debt settlement stay on your credit report?

Debt settlement will stay on your credit report for seven years, and there is no public record of debt settlement, so once a debt settlement is agreed upon by the debtor and creditor, the debtor can request that the debt be removed from his or her credit report. Creditors are Happy to Reach an Agreement.

Why are creditors happy to settle a debt?

This is because it is worth getting part of a debt repaid than getting nothing.

Why do people settle debt?

The main reason many people choose debt settlement is so that they can avoid declaring bankruptcy. Filing for bankruptcy is a debt solution that stays on your credit record for 10 years, but even after 10 years, many creditors and employers will ask applicants for loans or jobs if they have ever filed for bankruptcy.

How Debt Relief and Debt Settlement Work?

Debt Relief and Debt Settlement is a negotiated agreement by which a creditor accepts less than the total amount owed to legally satisfy a debt.

Who can help with debt letters?

It’s important to have the proper help either by an attorney or a debt expert to make sure that your letter is proper and you can get the results that you’re expecting.

What is the first adjustment you need?

The first adjustment that you’re gonna need is to make sure you have your creditors’ address and address it to them in the header.

Does debt settlement exist?

Debt settlement services have existed in some form since the advent of debt itself.

When do you use proposal letters?

Proposal letters can be used for a variety of endeavors, including small business projects, like requesting a loan or suggesting a new marketing plan to your manager. Proposal letters can also be sent as a brief precursor to a larger, more-detailed business proposal, like a government grant for a research project.

Why is a proposal letter important?

Proposal letters are important because they are normally the first impression your recipient has of you and your business. A clear and influential letter will increase the likelihood of your audience favoring your proposal and moving forward with it.

What should be included in a proposal introduction?

This paragraph should include basic information about your company and an overview of the topic to make it clear what the recipient will be reading. If you are following up on a meeting, briefly mention the meeting in the opening statements for context. If your business already has a relationship with your letter's recipient, mention this as well.

How to stand out in a proposal?

If your proposal is the answer to a company's problem, showcasing your valuable assets can help you stand out. State some of your special skills related to the project and reasons you are the best fit for the job. This might include experience with a similar issue or outlining a unique process that gets great results. If your proposal is for a business venture, highlight a few factors that differentiate your ideas from others. When highlighting your key differentiators, you could use bullet points to list your features so they're easier to read.

What is the purpose of a proposal?

Your purpose for the proposal is what you intend to accomplish, or what problem exists that you intend to fix. A proposal for a business arrangement would provide clear details and basic terms of the arrangement, while a proposal to redesign a company website would discuss your understanding of their current website issues.

What is a settlement offer letter?

A Settlement Offer Letter is a communication between two parties in a dispute. The dispute does not have to be in a court of law, although most of the time, it is. One party sends the other party this Settlement Offer Letter, with the proposed terms for a complete settlement between the parties. Rather than a formal legal document, this letter can ...

What information is entered in a settlement agreement?

The parties' identifying details and contact information will be entered, as well as the proposed settlement terms.

What happens if a dispute is not litigated?

If the dispute is not being litigated, details of the incident at the heart of the parties' dispute will be entered.

Is a settlement agreement a legal document?

Although the terms listed in this letter will generally become the terms of the Settlement Agreement, this letter does not create a legally binding contract.

Is a settlement offer letter legal?

Although settlement agreements can be governed by both state and federal law, this Settlement Offer Letter is not a legal document, so it is simply a best practice to give the recipient of the letter as much information as possible about the terms of the proposed settlement.

What is the purpose of the settlement paragraph?

You’ll use this paragraph to present the details of your settlement offer. This will include the dollar amount you’re proposing to pay.

What is the most important part of a debt settlement letter?

One of the most important components of your debt settlement letter is a single number: the amount you decide to offer. You’ll base that number on your assessment of two considerations. Affordability. Never offer more than you can afford to pay.

Why do you need to sign a letter?

Your Signature. Your letter will require your signature because you’ll be offering the creditor a contract, which is settlement of the debt. If you fail to sign your letter, the creditor may interpret that as an indication you’re not completely serious.

What should be the opening paragraph of a letter?

First Paragraph. Your opening paragraph should quickly state the purpose of your letter, which is a proposal to settle the account for less than the full amount. In the next sentence, you’ll explain why you can’t pay the full amount.

What happens if you fail to sign a letter?

If you fail to sign your letter, the creditor may interpret that as an indication you’re not completely serious.

What should I say in the last sentence?

In the last sentence, you should provide a reason why you won’t be able to pay the full amount. It should be a circumstance beyond your control. I’ve listed several within the parentheses, but feel free to include whatever situation may be preventing you from making full payment. You don’t need to be long-winded here.

What to do if your proposal is not read?

If that happens, your proposal will never be read, let alone acted upon. You should send a letter to the person you’ve been dealing with at the company. If there’s no specific individual, make a phone call and get the name of a person likely to be in a capacity to work with your proposal.

What happens when you submit a claim letter to an insurance company?

When a person submits a claim letter to an insurance company, whether it’s for a car accident, medical malpractice, personal injury or other reason, the insurance company will respond with a first offer. At this point, the claimant has the right to make a counter offer, and in most cases, this is the best thing to do.

Who does a letter go to when a claimant is at fault?

In most cases, the letter goes to the at-fault party’s insurance company to make it clear that the claimant suffered injuries because of the fault of the company’s insured person.

What should an insurance adjuster do if the first offer is very close to the claimant's minimum amount?

If the insurance adjuster’s first offer is very close to the claimant’s minimum amount, the claimant should adjust their expectations upward.

What to do if a claimant wants to lower the amount?

If the claimant wants, they can enter into negotiations and send several letters that gradually lower the amount they will accept. It is also important for the claimant to mention any emotional suffering. This will not have a dollar value, but it is strong support of a higher settlement.

Should the claimant decide on the lowest amount they have calculated is fair for their claim?

The claimant should decide on the lowest amount they have calculated is fair for their claim and keep it in mind during negotiations, but not reveal it to the insurance company. If the insurance adjuster’s first offer is very close to the claimant’s minimum amount, the claimant should adjust their expectations upward.

Is an insurance company required to give a fair settlement?

The insurance company is not required by law to give a claimant a fair settlement. There are some adjusters who want to treat claimants fairly and some who take advantage of the claimant’s naiveté to offer a less than fair amount.