What are the Steps in the Settlement Check Process?

- Signing the Forms. Prior to the release of your settlement funds, the defense attorney of the at-fault party will...

- Insurance Processes and Releases Check. Once the insurance company receives the signed release forms, they will...

- Your Attorney Deposits Check into Trust Account. After your attorney receives...

How does it take to receive a settlement check?

What factors determine how long it takes to get a settlement check after a car accident?

- Security of the injury. ...

- Medical treatment duration. ...

- Time is taken by the other party’s insurance company to settle. ...

- Time is taken by your lawyer to review the amount of compensation owed. ...

- State Laws. ...

- Time is taken by your judge to review the settlement amount. ...

- Time required by the attorney to fill all the necessary paperwork. ...

Is my settlement check taxable?

You must report the full settlement of $100,000 to the IRS, on which you are taxed, even if your attorney is entitled to a share. So, yes, you read that right. The settlement total amount is fully taxable even if you split it into separate checks.

How to cash an insurance settlement check?

Where to Cash Insurance Checks – 5 Places

- Walmart Insurance Check Cashing. Walmart stores provide one of the best places one can cash their insurance claim checks. ...

- Local grocery stores. In most cases, grocery stores are unreliable check cashing spots. ...

- 7-Eleven. The only trick involved here is that one must download the app called Transact by 7-Eleven. ...

- Using Apps. ...

- NetSpend. ...

Will an insurance company offer a settlement?

Unless the insurance representative has a solid reason not to pay the claim, you can almost always expect a settlement offer after filing a claim with an insurance company. Of course, the insurance adjuster will start by looking for reasons not to pay.

How do I deposit a large settlement check?

The bank may ask you to bring two forms of ID when you are cashing a large check. The teller may also call the issuing bank to verify the check's legitimacy and ask you some questions about the source of the check. This is a normal bank procedure and nothing to worry about. You should then receive your cash.

How long do banks hold settlement checks?

In most cases, banks will not hold settlement checks for more than five to seven working days.

How does the settlement process work?

A settlement agreement works by the parties coming to terms on a resolution of the case. The parties agree on exactly what the outcome is going to be. They put the agreement in writing, and both parties sign it. Then, the settlement agreement has the same effect as though the jury decided the case with that outcome.

What happens after you agree to a settlement?

After a case is settled, meaning that the case did not go to trial, the attorneys receive the settlement funds, prepare a final closing statement, and give the money to their clients. Once the attorney gets the settlement check, the clients will also receive their balance check.

How long does it take for a $30000 check to clear?

Most checks take two business days to clear. Checks may take longer to clear based on the amount of the check, your relationship with the bank, or if it's not a regular deposit. A receipt from the teller or ATM tells you when the funds become available.

What to do with a $100000 settlement?

What to Do with a $100,000 Settlement?Sort Out Tax Implications.Find a Financial Advisor.Pay Off the Debts.Invest in a Retirement Home.Start a Business or Help Friends and Family.Donate the Money to the Needy.Final Words.

How long after settlement Do you receive the money?

If your matter settles electronically, the funds should appear in your nominated account within a couple of hours after settlement. However, PEXA does recommend allowing a maximum of 24 hours just in case banking delays occur.

How long does it take to cash a settlement check?

You can deposit the settlement check into your bank account and use it any way you wish. It can take about six weeks for you to have the money in your hands. Most law firms issue paper checks to their clients.

How long does it take to get paid after a settlement?

While rough estimates usually put the amount of time to receive settlement money around four to six weeks after a case it settled, the amount of time leading up to settlement will also vary. There are multiple factors to consider when asking how long it takes to get a settlement check.

Can my lawyer cash my settlement check?

While your lawyer cannot release your settlement check until they resolve liens and bills associated with your case, it's usually best to be patient so you don't end up paying more than necessary.

How much should I expect in a settlement agreement?

The rough 'rule of thumb' that is generally used to determine the value of a settlement agreement (in respect of compensation for termination of employment) is two to three months' gross salary.

How do you handle settlement money?

– What do I do with a large settlement check?Pay off any debt: If you have any debt, this can be a great way to pay off all or as much of your debt as you want.Create an emergency fund: If you don't have an emergency fund, using some of your settlement money to create one is a great idea.More items...•

How long does a bank hold a check over $10000?

Essentially, any transaction you make exceeding $10,000 requires your bank or credit union to report it to the government within 15 days of receiving it -- not because they're necessarily wary of you, but because large amounts of money changing hands could indicate possible illegal activity.

How do you get a bank to release a hold on a check?

Contact Your Bank You can ask your bank to provide an explanation for the hold or sometimes even to release the hold. In most cases, you won't be able to do anything about the hold though, and because all banks have them, you can't switch banks to avoid them either.

What happens when you deposit over $10000 check?

Depositing a big amount of cash that is $10,000 or more means your bank or credit union will report it to the federal government. The $10,000 threshold was created as part of the Bank Secrecy Act, passed by Congress in 1970, and adjusted with the Patriot Act in 2002.

How long does it take for a large check to clear?

Large deposits (those greater than $5,000) can be held for a “reasonable period of time,” between two and seven business days, depending on the type of check.

What are the Steps in the Settlement Check Process?

While the time it takes to receive your check will vary, settlement checks undergo a specific process before your funds are ready to deposit. This process proceeds as follows”

How to Deposit Your Personal Injury Settlement Check

You can deposit your settlement check like any other check you receive. Most personal injury firms, including ours, still issue paper checks to clients. The bank teller may bring over a manager to authorize the transaction, but other than that you should be good to go.

Speak with a Personal Injury Attorney Near You!

If you or a loved one would like to know more about filing personal injury claims and recovering compensation for your injuries, you can contact The Advocates by phone at 1-888-565-5277 or use our online form fill here. Don’t wait. You deserve an Advocate.

How long does it take to get a settlement check?

Once you have signed the completed release, it generally takes about six weeks to receive a settlement check; however, it can also take much longer. The timing depends on the defendant’s policy, the type of personal injury case involved, and other circumstances.

Who pays for a settlement?

Typically, as part of the settlement, the defendant must pay the plaintiff compensation for resulting losses. However, the parties may have very different perspectives on the case. They may disagree about issues of fault or the amount of compensation warranted.

What Is a Legal Settlement?

According to the Bureau of Justice, only 4 percent of personal injury cases go to trial. The majority settle out of court, by mutual agreement between the parties. This resolution is called a settlement.

What are the advantages and disadvantages of settling a case?

For both parties, there are potential advantages and disadvantages to settling the case. By settling, both parties know the terms of the agreement and avoid the unpredictability of a trial. Settlement allows both parties to resolve the matter more quickly. The settlement is not final until the plaintiff or the plaintiff’s attorney receives the check, and it clears.

What is the most important settlement document?

The most important settlement document is the release . This document absolves the other party of any further liability. The attorney for the defendant prepares a release form, which should clearly and accurately outline the terms and conditions of the settlement.

What is settlement in litigation?

A settlement is an agreement that ends a dispute and results in the voluntary dismissal of any related litigation. It may happen during the early stages of litigation, or in some cases, even before the injured person files a lawsuit. Settlements usually happen when the defendant and the plaintiff agree to the plaintiff’s claims rather than going to trial.

What happens before a trial?

Before a trial begins, there are investigations, pre-trial motions, insurance claims, medical evaluations, and more. Many accidents result in significant injuries, expenses, and lost wages, so victims often feel anxious about when they can expect to receive a settlement check for financial losses.

What happens to third party settlements after settlement is agreed?

Once you agree to all aspects of the settlement, and all third-party claims have been fully negotiated, we disburse to you the net proceeds shown in the settlement statement.

What is release of claims?

A written settlement agreement and “release of claims” is negotiated between the two sides and signed by the plaintiff, i.e., you. This typically includes the amount of money, the identities of everyone who is included by the “release,” and what happens with side claims by insurers and government entities who may claim a piece of the settlement.

Does a settlement agreement require a plaintiff to keep secret?

Sometimes the settlement agreement includes a provision requiring the settling plaintiff to keep secret certain aspects of the case . We are very cautious about provisions like this, because we think they are often bad for our clients and bad for the justice system. In fact, we have an extensive discussion about secret settlements on another page of our website here.

Litigation settlements are a great way to avoid losing a lawsuit

A plaintiff can get money from the defendant within hours or days of receiving a settlement advance, and the insurance company will mail a check in three weeks. However, a lawsuit settlement is not a guarantee that a defendant will agree to pay the settlement amount. A court has the right to make changes to a settlement if it feels it is unfair.

While the U.S. Supreme Court has set a limit on punitive damages, most states have a lower limit

In any event, punitive damages often far exceed the actual compensation that a plaintiff will receive. Nonetheless, there is no reason to believe that the total amount of money the plaintiff will receive will be any less than the total sum they’re owed in damages. This is why many states have lower limits on punitive damages.

Litigation settlements are an option that most lawsuits resolve without a trial

The parties agree to a settlement that defines the legal obligations of both parties. The defendant will agree to pay the plaintiff a certain amount of money, while the plaintiff will waive the right to file an appeal. A lawsuit settlement is not necessarily the best solution for everyone, and it will require a lengthy and expensive court case.

Why is structured settlement important?

One of the greatest strengths of a structured settlement is its ability to earn interest, which can allow the payments to be adjusted upward over time to keep up with inflation. In addition, payments can be set to rise according to a schedule. This may be necessary if the costs of the recipient’s health care are expected to increase over time.

What is structured settlement?

A structured settlement can include a large lump-sum payment upon termination of the contract. A child recipient may receive regular payments while they are a minor and then one large lump sum to pay for their college tuition when they graduate from high school.

What is extra payment in a structured settlement?

Extra payments that occur in the form of periodic lump sums may be included in the terms of a structured settlement contract . For example, a structured settlement holder on a monthly payment schedule may receive an additional payment every five years to pay for the cost of replacing and upgrading medical devices.

Why do structured settlement contracts yield more than lump sum payouts?

In total, a structured settlement contract often yields more than a lump-sum payout would because of the interest earned over time.

How does a period-certain annuity work?

A life-only annuity will continue to pay out for the rest of your life, whereas a period-certain annuity will pay you only for the length of time specified in the contract.

How often can a structured settlement recipient receive payments?

A structured settlement recipient can receive payments at any reasonable regular interval, such as monthly, quarterly, annual ly or even some combination of schedules.

What is a reviewer in the Wall Street Journal?

These reviewers are industry leaders and professional writers who regularly contribute to reputable publications such as the Wall Street Journal and The New York Times.

How long does it take to get a settlement check?

Remember, the settlement check must get deposited into your trust account and the funds need to be available to withdraw. This may take two to three days, depending on your bank’s deposit rules and the amount of the check being deposited. Trust accounting has rules that need to be followed.

What is settlement statement?

The settlement statement is your audit trail and it should be reviewed and signed by both the client and the lawyer. It defines the proposed disposition of the settlement fund check and should include the following:

What should a contingent fee agreement explain?

In the case when a settlement is not reached and there is no settlement check for the client, the fee agreement should also explain what expenses or fees the client will be responsible for paying, if any. As an example, below is a sample of text that may be used in a contingent fee agreement.

What do you write on a trust check?

On the check, write the case number, client name and case description. (This is good risk management if you ever need to re-create your trust accounting records.)

What is the best practice for handling settlement funds?

Best practices for handling settlement funds starts with a properly written and executed contingent fee agreement. This document should clearly communicate to the client how funds from a settlement check will be disbursed. In the case when a settlement is not reached and there is no settlement check for the client, the fee agreement should also explain what expenses or fees the client will be responsible for paying, if any.

Where are settlement funds deposited?

Settlement funds are always deposited directly into your law firm’s trust account and are paid to parties of the settlement from the trust account. A settlement check is never directly deposited into your firm’s operating account.

Can you write checks to all parties on a settlement?

Write checks and receive payments for your portion of the settlement. Once funds are available, you can write checks to all of the parties listed on the settlement statement. All funds get disbursed directly out of your trust bank account and recorded in the client’s trust account ledger.

What is the goal of a worker's compensation claim?

Ideally, the goal is to resolve claims without a bitter court fight. The most important thing is to quickly get an injured worker back to health and back on the job whenever possible – for everyone’s benefit.

What happens if a workers compensation claim is approved?

If the workers’ compensation claim is approved, the insurance company will pay for any medical expenses related to the injury.

What is lump sum compensation?

A work injury settlement can be either a lump sum or a structured payment plan: Lump sum payment: The employee receives a one-time payment for all medical costs and benefits under the claim.

Who is responsible for filing a workers comp claim?

File a claim. You’re usually responsible for filing a workers’ comp claim with your insurance provider. Rules vary, but you may also need to submit documentation to the state workers’ comp board.

Do workers compensation judges review settlements?

In many states, a workers’ compensation judge must review the proposed settlement before it’s finalized. The judge will consider whether it’s fair to the employee, but it’s always helpful for the injured worker to have legal representation to protect their interests.

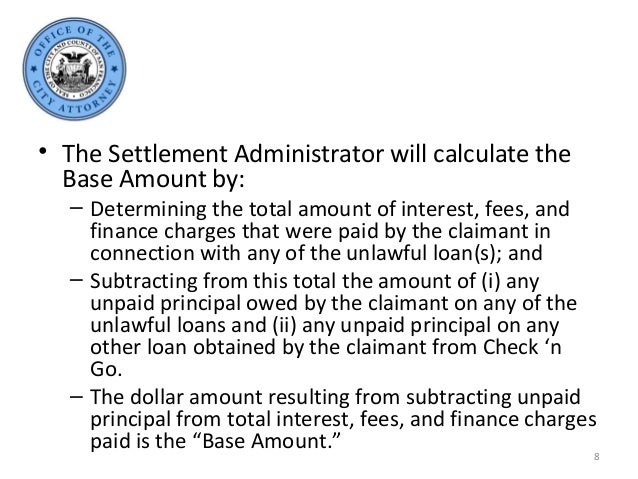

How Is a Settlement Calculated for Workers Compensation?

The formula for calculating a workers compensation settlement package involves four major factors:

What is workers compensation settlement?

Workers Compensation Settlements. Workers compensation insurance provides a safety net for medical expenses and lost wages of those who get hurt on the job. But that doesn’t mean such workers have to accept whatever the insurance company offers. A workers compensation settlement is a way you can negotiate the immediate payment ...

How long does it take to settle a workers comp case?

Short answer: It varies greatly. The Martindale-Nolo survey of readers turned up an average of 15.7 months to resolve a case, and less than 20% of cases are resolved in less than six months. Obviously, those who try to negotiate a better workers comp settlement may hire legal assistance to negotiate the best terms for a settlement or to bring a hearing if there is a disputed issued. This can be time consuming. However, a shorter time frame is not always better. Those actions that lengthen the process can also bring higher settlements.

Why do you settle a lump sum claim?

If you settle the claim, you can choose or change your physicians. However, if you have severe and complicated work-related injuries, you may not want to settle the medical portion of the claim because you can be entitled to medical benefits for your accident for the rest of your life. Some injuries are too complicated to take the risk that you will not have enough money through a settlement to meet your medical needs.

How long does it take for a settlement to be approved?

Those actions that lengthen the process can also bring higher settlements. Once an agreement is reached, it can take four-to-eight weeks for money to arrive while settlement contracts are drafted, signed and approved.

Do you have to agree to a workers comp settlement?

You don’t have to agree to a settlement offer proposed by your employer or its insurance company, nor do you have the ability to force the employer or insurer to settle your claim. Talk with an attorney for free today, and find out how much money you could receive in a workers comp settlement.

Can you settle a workers compensation claim?

There are advantages and disadvantages to settling your workers compensation claim through a lump-sum settlement or some type of structured settlement. A workers compensation judge or hearing officer will need to approve your settlement.