How Settlement Negotiation Works in an Injury Case

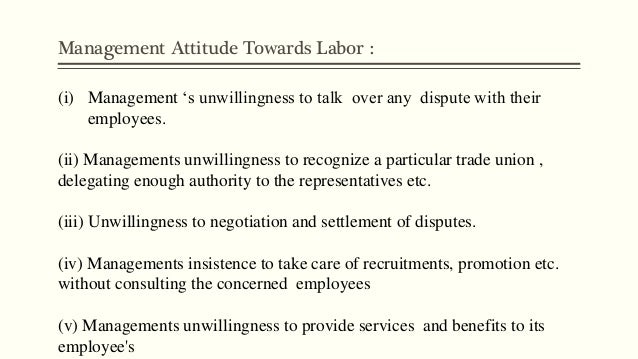

- Subjects of Negotiation with an Adjuster. During negotiations, an insurance adjuster has a right to ask questions and dispute facts in an attempt to limit your right to compensation.

- Keys to Successful Injury Claim Negotiation. ...

- More Information on Negotiating Your Injury Claim. ...

What is the best way to negotiate a settlement?

What is the best way to negotiate a divorce settlement?

- Focus On Interests Not Positions. ...

- Be Careful Of “Hard Bargaining” ...

- Be Careful Not To Destroy The Relationship With The Other Side. ...

- Recognize The Other Side's Perceptions & Emotions. ...

- Take Control Of Your Own Emotions.

How to negotiate the best possible settlement agreement?

Your solicitor will be able to advise you on factors such as:

- The amount of compensation you should be entitled to in the settlement agreement

- The most cost-effective way of drafting the document to avoid having to pay tax unnecessarily

- Whether you have any prospect of an Employment Tribunal claim against your employer and what the value of that claim would be

How long does a settlement negotiation take?

Negotiating a settlement might take a few weeks to several months. If the case goes to court, it can take longer to agree to a fair offer. Learn more here.

How to win at debt settlement negotiations?

What can you do if you need help to get the best debt settlement agreement possible?

- Debt settlement companies employ professional negotiators who have experience in negotiating even in challenging circumstances.

- They do not be intimidated by your creditors.

- Debt professionals will not respond emotionally to the situation.

- They will focus on saving you the most amount of money and will bring all their expertise to bear on your behalf.

How long does it take to negotiate a settlement?

The average settlement negotiation takes one to three months once all relevant variables are presented. However, some settlements can take much longer to resolve. By partnering with skilled legal counsel, you can speed up the negotiation process and secure compensation faster.

How do you negotiate a settlement?

Identify, gather and produce the most important information early. Settlement negotiations are most effective at the proverbial sweet spot, when each side has the information it believes it needs to make a judgment about settlement but before discovery expenses allow the sunk costs mentality to take hold.

How do you respond to a low ball settlement offer?

Here's a quick summary of the steps you and your attorney will follow when responding to a low settlement offer: Remain calm and analyze the offer even if you feel like the adjuster is trying to take advantage of you. Ask questions to find out how the adjuster came to the conclusion that they did.

Can you lie during a settlement negotiation?

In California, the Rules of Professional Conduct govern a lawyer's ethical duties. The law prohibits lawyers from engaging in dishonesty. Cal.

Is it better to settle or go to court?

Settlements are usually faster and more cost-efficient than trials. They are also less stressful for the accident victim who would not need to testify in front of a judge or hear the defence attempt to minimize their injuries and symptoms.

What are the disadvantages of negotiation?

Disadvantages of Negotiation: The parties to the dispute may not come to a settlement. Lack of legal protection of the parties to the conflict. Imbalance of power between the parties is possible in negotiation.

Should you accept the first offer of compensation?

Unless you have taken independent legal advice on the whole value of your claim, you should not accept a first offer from an insurance company.

How do you ask for more money in a settlement?

Send a Detailed Demand Letter to the Insurance Company Because the insurance company will likely reply with an offer for an amount lower than what you've asked for in the demand letter, you should ask for between 25 and 100 percent more than what you would be willing to settle for.

What do I do if my insurance offer is too low?

Here are five steps to take if the insurance company is lowballing you:Get Help from an Attorney. ... Make Sure It Is Actually a Lowball Offer. ... Figure Out Why the Insurance Company Is Lowballing You. ... Collect the Evidence You Need to Prove Your Claim. ... Keep Negotiating and/or File a Lawsuit in Court.

What are attorneys afraid of?

Being judged unfairly by potential or actual jurors. Being intimidated by judges. Suffering reprisals from judicial disqualification motions or reporting judicial misconduct. Suffering “the pain, humiliation and shame of defeat.”

Do lawyers know their clients are guilty?

Although popular culture may detest the work that criminal lawyers do, the function of a lawyer is crucial in order to maintain justice and ensure fair outcomes for anyone that is facing legal charges. Truthfully, a defense lawyer almost never really knows whether the defendant is guilty or not of the charged crime.

What if a lawyer knows his client is lying?

(3) offer evidence that the lawyer knows to be false. If a lawyer, the lawyer's client, or a witness called by the lawyer, has offered material evidence and the lawyer comes to know of its falsity, the lawyer shall take reasonable remedial measures, including, if necessary, disclosure to the tribunal.

What percentage should I offer to settle debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

How do you ask for more money in a settlement?

Send a Detailed Demand Letter to the Insurance Company Because the insurance company will likely reply with an offer for an amount lower than what you've asked for in the demand letter, you should ask for between 25 and 100 percent more than what you would be willing to settle for.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

What should I ask for in a settlement agreement?

8 Questions to Ask if You've Been Offered a Settlement AgreementIs the price right? ... How much will I pay for legal advice? ... Have I been offered a reference? ... How much time would legal action take? ... Are there any restrictive covenants in your agreement? ... Do I have to pay tax on my agreement?More items...

How much does a debt settlement company charge?

With a debt settlement company, you’ll likely pay a fee of 20% to 25% of the enrolled debt once you agree to a negotiated settlement and make at least one payment to the creditor from an account set up for this purpose, according to the Center for Responsible Lending.

What is the difference between debt settlement through a company and doing it yourself?

Time and cost are the main distinctions between debt settlement through a company and doing it yourself.

What is do it yourself debt settlement?

With do-it-yourself debt settlement, you negotiate directly with your creditors in an effort to settle your debt for less than you originally owed.

What company did the CFPB take legal action against?

In 2013, the CFPB took legal action against one company, American Debt Settlement Solutions, saying it failed to settle any debt for 89% of its clients. The Florida-based company agreed to effectively shut down its operations, according to a court order.

What does "settled" mean on credit report?

Settled debts are generally marked as “Settled” or “Paid Settled,” which doesn’t look great on credit reports. Instead, you'll try to get your creditor to mark the settled account “Paid as Agreed” to minimize the damage.

How long can you be behind on a debt settlement?

Debt settlement is an option if your payments are at least 90 days late, but it’s more feasible when you're five or more months behind. But because you must continue to miss payments while negotiating, damage to your credit stacks up, and there is no guarantee that you’ll end up with a deal.

How long does it take to settle a debt?

While completing a plan through a company can take two and a half years or more, you may be able to settle your debts on your own within six months of going delinquent, according to debt settlement coach Michael Bovee.

How to negotiate a settlement in a personal injury case?

Negotiating a final settlement in your personal injury case is a little like bargaining to buy something at an outdoor market where haggling is commonplace. You and the buyer (the insurance adjuster) both know roughly how much an item (your damages) is worth. You know how much you are willing to take for it, and the adjuster knows how much the insurance company is willing to pay. But neither of you knows how much the other side might be willing to accept/pay. So you go through a process of testing each other, a dance of bluff and bluster that usually only last through two or three phone calls.

What are the factors that determine the outcome of a personal injury settlement?

The main factors determining the outcome of a personal injury settlement are how well you have prepared all stages of your claim—investigation, supporting documents, and demand letter—how much you are willing to settle for, and how much of a hurry you are in to settle.

What If the Insurer Isn't Responding?

If you do not hear from an adjuster within two weeks after sending your demand letter, call the claims department and ask when you can expect a response. If an adjuster says that he or she hasn't had a chance to review your demand yet, be polite but ask for a specific date—two more weeks, perhaps—by which the adjuster will contact you with a response. Confirm the date with a brief email or written letter.

How long does it take for an insurance adjuster to respond to a demand letter?

Usually the adjuster will telephone you within a week or two after receiving your demand. The length of time between demand letter and response depends on how busy the adjuster is, and how much time the adjuster needs to go over your claim and perhaps to speak with the insured about the accident. Learn more about how long it takes to settle a personal injury case.

What does an insurance adjuster tell you?

The insurance adjuster tells you what's wrong with your claim— that there is a question about liability, or that your lengthy physical therapy was unnecessary. You respond to these arguments. The adjuster makes a low counteroffer to feel out whether you are in a hurry to take any settlement amount.

How to contact an adjuster if you haven't heard anything?

Confirm the date with a brief email or written letter. If you haven't heard anything by the date mentioned, call or send an email and firmly remind the adjuster of the promises made. If, after that, you still do not get a prompt response to your demand, you may have to go over the adjuster's head to a supervisor.

Do you have to be intimidated by a reservation of rights letter?

Do not be intimidated by a reservation of rights letter. The insurance company still must investigate your claim and negotiate with you fairly. Of course, if there is good reason to deny coverage altogether under the policy, the insurer is legally free to do so. But a reservation of rights letter does not change how the insurance company will respond to your claim. That will be determined by the facts of your accident and the nature and extent of your injuries.

How soon after an injury can you start negotiating?

In fact, as soon as an employee hires a lawyer, negotiations on a settlement can begin. That can be a day after the injury, a week, a month … it’s up to you and your lawyer when you want to start negotiating a settlement.

What is the first step in the settlement process with an injured worker?

The first step in the settlement process with an injured worker begins after the doctor treating the case declares the patient to be “as healthy as he is going to get.” That is referred to as Maximum Medical Improvement – designated as MMI – and understanding it is vital to everyone involved in workers compensation.

How many workers compensation cases are settled during mediation?

There is not definitive survey to verify this, but both Judge Sojourner and Pitts agreed that 99% of workers’ compensation cases are settled during mediation.

Why do workers comp cases end up in court?

The 1% of cases that end up in front of a workers compensation judge get there for one of two reasons: The insurance company has denied the worker’s claim for benefits. There are difficult legal issues involved that fall into gray area’s of the law and the two sides want a judge to decide.

How long does it take for a workers comp hearing to end?

It can end in a matter of days (unusual) or a matter of months (usual). The timing difference in the two is usually the presence of a lawyer. People on all sides of workers compensation hearings agree that having a lawyer involved is a good thing.

Why do we need a workers compensation mediator?

The reason for workers compensation mediation is the two sides can’t agree on a settlement, so they bring another adult in the room and hope everybody is ready to get this matter resolved. The mediator’s job is to act on behalf of both sides and push the process toward a settlement.

What is the purpose of hearing questions in a workers compensation trial?

Hearing Questions. The questions in a workers compensation trial usually are meant to challenge the authority of expert witnesses provided by one side or the other. If a worker is called upon, it usually is to substantiate his claims or challenge them, depending on which side is asking the question.

What is a Negotiated Settlement?

Negotiated settlements typically occur during the mediation phase of the lawsuit. They can, however, take place at any point in the case. The plaintiff, defendants, and their attorneys try to negotiate a deal that’s fair for both sides and agree on a monetary value.

How Long Do Settlement Negotiations Take?

However, it can often last several months up to years before the claim is finally settled.

Why do settlement negotiations need to be admitted?

One particularly powerful purpose for admitting settlement communications is to show a party's intent. As described above, parties are typically their most candid during settlement communications and are likely to make statements indicative of their true intent. For example, in a recent case, the plaintiff's representative acknowledged during settlement negotiations that the plaintiff's goal was to shut down the defendant's business. Subsequently, the defendant filed an abuse of process claim essentially alleging that the plaintiff had brought its lawsuit for the improper purpose of shutting down the defendant's business. The court found that the statements by the plaintiff's representative during settlement negotiations were admissible as to the plaintiff's intent.

What is the rule for settlement communications?

In the Federal Rules of Evidence (and most state rules, including North Carolina's) Rule 408 (sometimes referred to in this article as the "Rule") is the rule that addresses the admissibility ...

What does Plaintiff 1 do?

Plaintiff 1 has sued your company claiming that your company's negligent supervision of an employee caused Plaintiff 1's injury. As part of settlement negotiations, your company sends Plaintiff 1 a communication similar to the following: "Although we could have pre-screened this employee better, we were not negligent in supervising the employee. Therefore, we can only offer 50% of your claimed damages." Plaintiff 1 ultimately agrees and accepts the offer.

Why is a confidential settlement offer affixed to documents?

It's commonly understood that this label is affixed to documents because then they may not be used against the sending party in any on-going or future litigation. As a general matter, this common understanding is correct—settlement communications are often inadmissible in court proceedings.

What is Rule 408?

Specifically, Rule 408 says only that settlement communications are "not admissible." However, just because a settlement communication may be inadmissible does not mean that the opposing party can't discover it. This creates a potential issue because your company may tend to be more open and frank in settlement communications because of the belief that they are protected communications. But, you should be cautious because, even if not admissible, your company's settlement communications might be discoverable. A simple hypothetical demonstrates this point:

Why is it important to be cautious when settling a company?

But, you should be cautious because, even if not admissible, your company's settlement communications might be discoverable.

Is settlement negotiation a confidential negotiation?

However, it's far too simplistic to suggest that anything your company considers to be a "settlement negotiation" is going to be kept out of court. It's important to understand the limits of the protections afforded to "settlement negotiations." Otherwise, your company may make a statement in what it believes to be a confidential "settlement negotiation" only to have that statement used against it in court. This article explores some of the common situations in which your company may fall into a trap if it doesn't understand the rules regarding protections for settlement negotiations or communications.

When Will Settlement Negotiations Begin?

- Negotiations with the insurance claims adjuster will begin shortly after the adjuster receives your demand letter. Usually the adjuster will telephone you within a week or two after receiving your demand. The length of time between demand letter and response depends on how busy the adjuster is, and how much time the adjuster needs to go over your c...

Don't Sweat The Reservation of Rights Letter

- The first thing you might receive from an insurance company is called a “reservation of rights letter.” This letter informs you that the company is investigating your claim but is reserving its right not to pay anything if it turns out that the accident is not covered under the policy. A reservation of rights letter is intended to protect the insurance company so that you cannot later claim that bec…

What If The Insurer Isn't responding?

- If you do not hear from an adjuster within two weeks after sending your demand letter, call the claims department and ask when you can expect a response. If an adjuster says that he or she hasn't had a chance to review your demand yet, be polite but ask for a specific date—two more weeks, perhaps—by which the adjuster will contact you with a response. Confirm the date with …