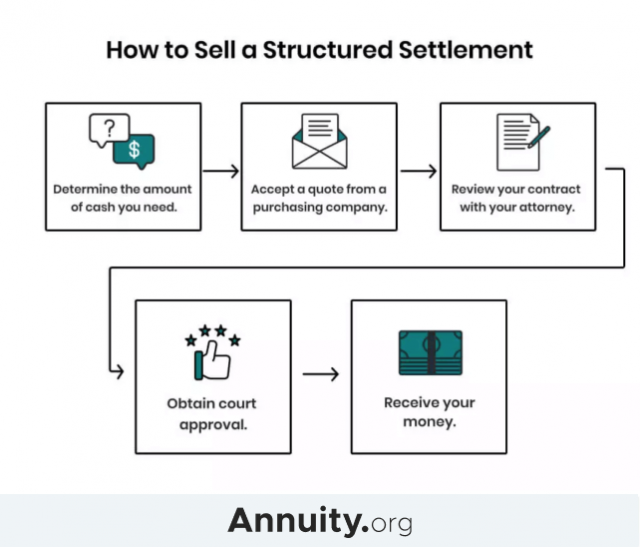

How do I Sell my structured settlement?

Step 1: Decide how much money you need and how much of your structured settlement you want to sell. Keep in mind that the total dollar amount of the payments you would receive over time will be higher than the amount you will get from a company that purchases the rights to the payments.

Can I Sell my structured settlement annuity?

Yes, a judge must approve the sale of your structured settlement. Unlike commercially available annuities, structured settlement annuities are always subject to court approval. This does not mean that it is illegal to sell them. Selling your structured settlement is perfectly legal when a judge approves the sale.

Why do I need a judge’s approval for a structured settlement?

State laws that fall under the Structured Settlement Protection Acts are intended to protect settlement recipients from unethical structured settlement buyers. Your protection is also the reason you must have your sale approved by a judge. All structured settlement sales require a judge’s approval.

Can I get a lump sum of cash for structured settlement?

Getting a lump sum of cash for structured settlement is not like visiting an ATM. You can't just get all the cash today or ever. In accordance with Federal law and state structured settlement protection acts, it is necessary to apply for and obtain court approval of the sale of structured settlement payment rights.

Can you sell structured settlements?

You can sell your structured settlement to a factoring company for immediate cash. Although you must first obtain court approval, you have the legal right to cash out your payments, either in part or in full, to a structured settlement buyer.

How does selling a structured settlement work?

Cashing in a structured settlement typically requires working with settlement buyers or factoring companies that specialize in buying settlements and providing a lump sum cash payout. When selling, you can liquidate the entire settlement or just a portion of your upcoming payments.

Is selling a structured settlement a good idea?

Selling all or a portion of your future structured settlement payments may be the best way for you to obtain a lump sum of money for an unexpected expense, such as a large medical bill or urgent home renovations. Sometimes people refer to this transaction as a structured settlement loan.

How long does it take to sell a structured settlement?

How long does it take to sell my structured settlement? After you've signed the contract, on average it takes about 45 days to receive your money. However, keep in mind that every structured settlement purchase transaction is different due to each state's laws regulating such purchase transactions.

How do you cash out a structured settlement?

To cash out your settlement annuity, you sell your right to receive certain payments that are due under your settlement agreement. The companies that buy the rights to these payments, and give you cash, are called "factoring companies."

What is a disadvantage of a structured settlement?

A major drawback of a structured settlement is that it may jeopardize the beneficiary's eligibility for public benefits, which may be particularly problematic when the person's medical needs are covered by Medicaid rather than private health insurance.

Should I take a lump sum or structured settlement?

You should take a lump sum settlement for all small settlements and most medium-sized settlements (less than $150,000 or so). But if you are settling a larger case, there are two good reasons for doing a structured settlement. First, the structure guarantees that you won't spend the money too fast.

Who owns the annuity in a structured settlement?

A settlement agreement establishing the structured settlement will typically expressly state that the assignment company has all rights of ownership of the annuity. The structured settlement payee only owns the right to receive payments. The payee does not own the structured settlement annuity.

What percentage does JG Wentworth take?

9% to 15%Typically, JG Wentworth's fees range from 9% to 15% of the asset's total value. Its representatives provide free quotes over the phone to help you evaluate the cost of cashing in your structured settlement, winnings or annuity.

Are structured settlements considered income?

Structured settlement payments do not count as income for tax purposes, even when the structured settlement earns interest over time.

Can you borrow against a structured settlement?

Considering that you can't borrow against your structured settlement, selling your future payments for a lump sum can protect you in the long run. It means an influx of money that you would have had to wait months or even years for otherwise.

What is a tax free structured settlement annuity?

A structured settlement annuity (“structured settlement”) allows a claimant to receive all or a portion of a personal injury, wrongful death, or workers' compensation settlement in a series of income tax-free periodic payments.

Should I take a lump sum or structured settlement?

You should take a lump sum settlement for all small settlements and most medium-sized settlements (less than $150,000 or so). But if you are settling a larger case, there are two good reasons for doing a structured settlement. First, the structure guarantees that you won't spend the money too fast.

Is a structured settlement considered income?

Structured settlement payments do not count as income for tax purposes, even when the structured settlement earns interest over time.

Who owns the annuity in a structured settlement?

A settlement agreement establishing the structured settlement will typically expressly state that the assignment company has all rights of ownership of the annuity. The structured settlement payee only owns the right to receive payments. The payee does not own the structured settlement annuity.

What percentage does JG Wentworth take?

9% to 15%Typically, JG Wentworth's fees range from 9% to 15% of the asset's total value. Its representatives provide free quotes over the phone to help you evaluate the cost of cashing in your structured settlement, winnings or annuity.

Does a judge have to approve the sale of my structured settlement?

Yes, a judge must approve the sale of your structured settlement. Unlike commercially available annuities, structured settlement annuities are alwa...

What are my selling options?

Your selling options include the sale of your entire structured settlement — meaning you will no longer retain the rights to any future payments —...

Will I be taxed on the sale of my structured settlement?

In most cases, no, the amount you receive from the purchasing company will not be taxed. However, some exceptions apply. According to the IRS, comp...

Will I be charged an interest rate if I sell my payments?

Factoring companies charge a discount rate on the sale of structured settlement payments. Average discount rates range from 9 to 20 percent and are...

How long does it take to sell my payments?

The length of time it will take to sell your payments depends on a number of factors. Your state statutes and the availability of the courts to rev...

What Are the Benefits of Selling My Structured Settlement?

In a word, the benefit of selling your structured settlement is liquidity.

What does it mean to sell a portion of a settlement?

Your selling options include the sale of your entire structured settlement — meaning you will no longer retain the rights to any future payments — or the sale of only a specific number of payments or a predetermined dollar amount. Selling only a portion of your payments means you will still receive periodic payments, either resuming after the date of the last payment you sold or continuing at a reduced amount without interruption.

How does factoring company calculate present value?

The factoring company calculates the present value using a formula that takes the future value of your payments — because the company will not receive the money until some date in the future — and subtracts the growth potential the company will lose by not having the money in hand to invest immediately.

What is the discount rate for a settlement?

The discount rate typically falls between 9 and 20 percent. In addition to the present value of your settlement, the company takes into account the number of payments you’re selling, the dates of your payments, current market rates and economic conditions, and any service fees associated with the transaction to arrive at your discount rate. ...

How long does it take to get a court approval?

Your future financial obligations, such as college tuition. The court-approval process takes roughly 45 to 60 days. Although state and federal regulations are in place to protect you from entering into an agreement that may cause you undue financial hardship, you must take responsibility for your financial future.

What happens if you sell your Social Security?

The sale could potentially affect your retirement plans, your eligibility for Social Security or other government assistance programs, and your tax obligations.

Is selling a structured settlement good for you?

But it’s not only financial hardship that leads people to selling their structured settlements.

What is structured settlement?

A structured settlement is a stream of regular payments granted to a plaintiff in a civil lawsuit. These settlements can be based on an individual lawsuit or a class action suit involving a number of claimants.

What is the job of a judge in a settlement?

It’s the judge’s job to determine whether or not it is in the settlement holder’s best interest to sell the rights to future payments in exchange for a discounted lump sum.

Why do we need a judge's approval?

The need for a judge’s approval is based on a desire to protect the structured settlement holders from both themselves and bad actors who seek to take advantage of vulnerable individuals.

Why is it important to have proper documentation when going to court?

It’s important to have the proper documentation when you go to court. Being prepared prevents delays and is one way to demonstrate your seriousness about the sale and show that you are competent.

Do you have to get court approval to sell a structured settlement?

Federal law mandates that in order to sell some or all of your structured settlement, you must get court approval. In addition, 49 states and the District of Columbia have their own laws in place for this type of transaction. The laws, called Structured Settlement Protection Acts, aim to protect your interests as the structured settlement seller and encourage you to seek advice before making this decision.

How to sell a structured settlement?

Tips on deciding how to sell structured settlement payments 1 Carefully weight the benefit of getting cash now against the loss of receiving less, perhaps tens of thousands of dollars less than your settlement value. 2 Make sure there's valid reason to justify selling your payments and the needs of raising funds at the moment outweigh the advantage of keeping your steady future payments. 3 Consider possible implications and consequences of receiving a cash lump sum from selling your settlement payments (tax implications, eligibility to benefits, financial security at retirement, risk of reinvesting, taxes on gains of reinvested funds). 4 Research and ask around if there may be other ways to finance your current needs in a less costly way, such as getting a loan at low or no interest, before giving up your structured settlement at a very high price. 5 Consult an attorney, a financial adviser, or money management expert for advice about selling your structured settlement versus other possible options to obtain the money you need momentarily. 6 Determine that you will be able indeed to manage well your cash lumpsum after selling your settlement payments without ending up losing both your future payments and your cash payout. 7 Finally decide HOW to sell your structured settlement payments that to raise the amount that will satisfy your current needs without going over board to sell more of your payments and raise more cash than you really need now.

How to sell a settlement?

Before you do any move, stop ahead and think. Remember, when you are selling future payments of a settlement that you have earned as a result of a personal injury, or money you won in a lottery, you are simply giving up your very valuable asset. You are giving up a source of financial stability that you may never regain.

When was the Washington Post story about structured settlement?

6 years ago. The Washington Post has published a shocking (or not so shocking) story on Dec. 27 about a Virginia resident who was preyed on by structured settlement.

Why structured settlements?

The biggest reason for structured settlements is to give financial security to the wronged party so that they will have enough money over time to lead their expenses and medical bills.

Are there any charges involved in the process?

Factoring companies charge a discount rate on the sale of structured settlement payments . This rate usually ranges from 9 to 20 percent, depending on the perceived risk associated with your payment.

Is it legal to sell a structured settlement?

It is absolutely legal to sell a structured settlement for instant cash, although you’ll need to get court approval before proceeding.

What happens when you transfer a structured settlement?

Once a structured settlement transfer petition is submitted to the court, say goodbye to your privacy. If you like your privacy, then don't start the process to sell your structured settlement. Once a petition to transfer your structured settlement payments is submitted to Court for approval, as is required by law, ...

How does an unethical factoring company attempt to mask their pennies on the dollar value proposition?

This is where an unethical factoring company attempts to mask their pennies on the dollar value proposition by working with a financial adviser who shows you "pretty looking" investment projections to to take your eye off the ball. the investment projections are probably not achievable without risk, a risk that you may not fully appreciate or be willing to tolerate. Instead of using a Monte Carlo analysis, the returns on examples we've seen projected were linear and fail to take into account taxes. The structured settlement these predators are trying to raid are income tax free, if the payments represent damages on account of physical injury, physical sickness, wrongful death, wrongful imprisonment, or claims of workers compensation (per the relevant sections of the Internal Revenue Code)

Can you use structured settlement money to pay for life insurance?

If you're healthy, you can keep your stable tax free structured settlement payments and use part of them to pay for life insurance you buy to cover the contingency of your death. This will probably be more advantageous than getting hustled by structured settlement cash now pushers.

Is selling a structured settlement a money loser?

Selling a structured settlement is a money loser 100% of the time. You always lose money. Despite the best laid plans, life situations might change and what made sense when a structured settlement was created may become "derailed" by an unanticipated occurrence or living beyond your means. While selling a structured settlement may not make sense ...

Do you need to get court approval for a structured settlement?

In accordance with Federal law and state structured settlement protection acts, it is necessary to apply for and obtain court approval of the sale of structured settlement payment rights. The transaction must be in your best interest and the best interest of any applicable dependents in the Court's discretion.

Does the lawyer on a structured settlement represent you?

The lawyer provided by the buyer of your structured settlement payments doesn't represent you . It's a lie.

Do settlement planners pay referral fees?

It is believed some structured settlement brokers and settlement planners conceal that they are paid referral fees, the amount of such fees and the impact of such fees on the amount of cash the seller receives or the amount of future payments that need to be sold to pay such fees.

Who is involved in a structured settlement?

The process of settling a civil case through a structured settlement involves the person who has been wronged (the plaintiff), the person or company who caused the harm (the defendant), a consultant experienced in such cases (a qualified assignee) and a life insurance company.

Who will help calculate the settlement amount?

Calculating the structured settlement amount can be a complex financial task. A financial advisor or lawyer will typically hire an economist to help calculate the value of the contract.

Why is a structured settlement annuity more than a lump sum payout?

A structured settlement annuity contract often yields, in total, more than a lump-sum payout would because of the interest the annuity may earn over time. Cons. Once the terms of a settlement are finalized, there’s little you can do to alter them if they do not meet your needs.

What are the pros and cons of structured settlements?

Structured Settlements Pros and Cons 1 Structured settlement payments do not count as income for tax purposes, even when the structured settlement earns interest over time. 2 Income from structured settlement payments also does not affect your eligibility for Medicaid, Social Security Disability benefits or other forms of aid. 3 In the event of the recipient’s premature death, the contract’s designated beneficiary can continue to receive any future guaranteed payments, tax-free. 4 Payments can be scheduled for almost any length of time and can begin immediately or be deferred for as many years as requested. They can include scheduled lump-sum payouts or benefit increases in anticipation of future expenses. 5 Spreading out payments over time can reduce the temptation to make large, extravagant purchases, and it guarantees future income. This is especially helpful if you have a medical condition that will require long-term care. 6 Unlike stocks, bonds and mutual funds, fluctuations in financial markets do not affect structured settlements. 7 The insurance company that issued the annuity guarantees payments. Even in the unlikely event that the insurance company becomes insolvent, your state’s insurance guaranty association still protects you from loss. 8 A structured settlement annuity contract often yields, in total, more than a lump-sum payout would because of the interest the annuity may earn over time.

What happens if a case goes to trial?

If the case does go to trial and the judge rules in the plaintiff’s favor, the defendant may then be forced to set up a settlement. The defendant and the plaintiff work with a qualified assignee to determine the terms of the structured settlement agreement — that is, how much the regular payments should be, how long they should continue for, ...

Why do plaintiffs sue?

The plaintiff sues the defendant to seek compensation for an injury, illness or death the defendant caused. Often the defendant agrees to give money to the plaintiff through a structured settlement in order to keep the lawsuit from going to trial. If the case does go to trial and the judge rules in the plaintiff’s favor, the defendant may then be forced to set up a settlement.

Which settlement option has the most freedom?

Lawsuit Payout Options: Lump sum settlements come with the most freedom and the most risk. Structured settlements, on the other hand, are flexible to set up but rigid once established.