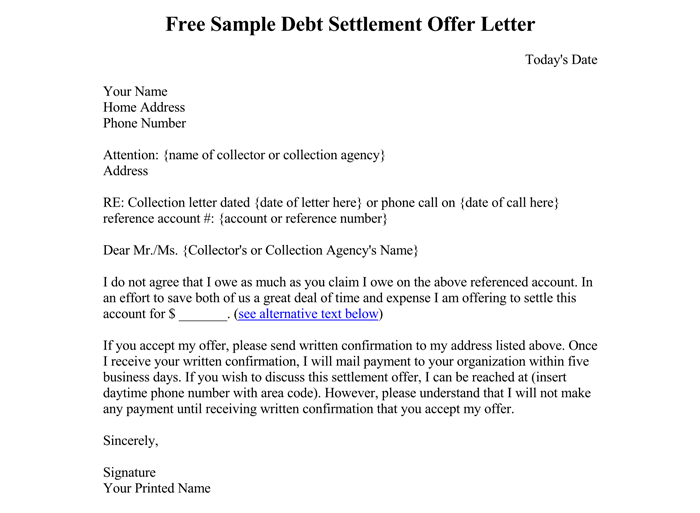

- Write your address information as the header of the letter. Provide your personal information and account number on the header of the debt settlement offer letter for easy identification.

- Outline the amount you wish to pay as settlement. The total amount of money that you offer to pay as settlement should be recorded so that your intentions are clear ...

- Give a reason why you are unable to settle. To have your debt settlement offer proposal approved, your creditor must be convinced that you genuinely can’t afford to pay off ...

- Write the account you wish to pay on and the date. ...

- Conclude the letter. End the debt settlement offer letter by adding a call-to-action plan followed by an appropriate closing tag and your signature, respectively.

How to write a successful debt settlement agreement?

Prepare Your Debt Settlement Offer

- Assess your budget – how much are expenses and income? Put what is left in an account to pay off the settlement.

- Consider taxes – The IRS considers the difference between what you owe and settle for income

- Consider credit reporting – You don’t want your creditor to report settled or paid settled

What to include in a debt settlement letter?

There are some key details that all debt settlement offer letters should have:

- The full name used for the credit account

- Your full address

- Your account numbers or a reference number from the creditor

How to write a debt recovery letter?

- A debt collection letter reminds a debtor that they owe you money.

- You can use a debt collection letter to set up a repayment plan or warn of impending legal proceedings.

- A debt collection letter should include the total debt owed, the initial due date, and any necessary warnings of impending legal action.

Is a debt settlement worth it?

The short answer: Yes, debt settlement is worth it if all of your debt is with a single creditor, and you’re able to offer a lump sum of money to settle your debt. If you’re carrying a high credit card balance or a lot of debt, a settlement offer may be the right option for you. There are numerous debt settlement and credit card companies that promise to help you settle your debt for half or even a small fraction of the total balance you owe, but is debt settlement really a good idea?

How do I propose a debt settlement?

A 6-step DIY debt settlement planAssess your situation. ... Research your creditors. ... Start a settlement fund. ... Make the creditor an offer. ... Review a written settlement agreement. ... Pay the agreed-upon settlement amount.

What percentage should I offer to settle a debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

How do you write a full and final settlement letter?

The language can be as simple as: In order to settle this matter amicably, I offer you the sum of [amount] (inclusive of interests and costs) as the full and final settlement of the above [claim/debt].

What is a letter of settlement?

Put simply, a settlement note is a formal letter that asks your creditors if they would be willing to accept a debt settlement on your account. It specifies the amount of money that you can offer them as a settlement and explains why you cannot pay your debt in full.

What is the 11 word phrase to stop debt collectors?

If you need to take a break, you can use this 11 word phrase to stop debt collectors: “Please cease and desist all calls and contact with me, immediately.” Here is what you should do if you are being contacted by a debt collector.

Is it better to settle a debt or pay in full?

It is always better to pay off your debt in full if possible. While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative.

What is a reasonable full and final settlement offer?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

Can I do my own debt settlement?

You may be able to get faster results with DIY debt settlement. While completing a plan through a company can take two and a half years or more, you may be able to settle your debts on your own within six months of going delinquent, according to debt settlement coach Michael Bovee.

What is a release of debt letter?

A Debt Release Letter is a letter written by a creditor to a debtor when their debt has been recouped in full. It establishes that a financial obligation no longer exists between the creditor and debtor.

Will Debt collectors settle for 30%?

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

What percentage should I offer a full and final settlement?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

How much less will debt collectors settle for?

Start by offering cents on every dollar you owe, say around 20 to 25 cents, then 50 cents on every dollar, then 75. The debt collector may still demand to collect the full amount that you owe, but in some cases they may also be willing to take a slightly lower amount that you propose.

What percentage should I ask a creditor to settle for after a Judgement?

If you decide to try to settle your unsecured debts, aim to pay 50% or less. It might take some time to get to this point, but most unsecured creditors will agree to take around 30% to 50% of the debt. So, start with a lower offer—about 15%—and negotiate from there.

What Is a Debt Settlement Letter?

If you’re unable or unsure about negotiating a debt settlement over the telephone, negotiating by letter is a reasonable option. It’s not much different negotiating with your creditor by telephone, but it might take longer. There are several ways to prepare a settlement letter, including hiring an attorney to write it for you or going online to download a template to use as a starting point. There are also several sample letters you can look at to get an idea of what your completed letter should look like.

What is the first step in a debt settlement?

The first step in a debt settlement negotiation with a bank, credit card company, or collection agency is to confirm the debt belongs to you. Some debts pass through multiple collection agencies once they leave the original creditor. During that time, mix-ups can occur or debts can become so old they are past the statute of limitations and legally uncollectible .

How does debt settlement work?

Luckily, there are many debt relief options. Debt settlement is one of the most advertised and for good reason. It’s often used for credit card debts and allows borrowers with unmanageable debt to pay off one or more debts for less than the full amount. The creditor then forgives the remaining debt. This may sound too good to be true, but it’s not. How well it works for you will depend on your financial situation and whether you choose to hire a debt settlement company to help you or do the debt settlement process yourself. This article will explain how to handle debt settlement on your own and how to write the best debt settlement letter possible.

How long do you have to be behind on your debt to get a creditor to accept your debt?

To increase your chances of getting a creditor to accept your debt, you need to be at least 90 days behind on your payments with that creditor. And during the negotiation process, you’ll need to continue not making any payments. This will hurt your credit score and the extra fees and interest may increase your overall debt. But it’s easier to convince a creditor that you can’t fully pay off your debt when you haven’t made any payments for several months. Remember, a creditor is willing to settle a debt for less than what you owe because they fear your financial situation is so uncertain that they won’t recover any money from you in the near future.

What is Upsolve for bankruptcy?

Upsolve is a nonprofit tool that helps you file bankruptcy for free. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Explore our free tool

How to reach out to your creditor?

Now it’s time to reach out to your creditor. You can do this by telephone or by letter. Either way, you’ll need to have some cash saved up beforehand. Most debts get settled after the borrower makes a one-time lump-sum payment of the outstanding debt. In other cases, you’ll need to pay two or three large payments over a short period of time instead. Creditors rarely agree to let borrowers use a payment plan with monthly payments to settle their debts.

How long does it take to settle a debt?

Another major advantage is that the DIY debt settlement process tends to be faster, perhaps six months or less. In contrast, using a debt settlement company can easily take several years. Not only does this extra time mean it takes longer to get debt relief, but that’s more time for your debt to accrue interest and penalties.

Why do we need a debt settlement letter?

Making decisions when it comes to your finances is no joke, and a debt settlement letter is a great tool to help yourself get out of debt and on the road to financial freedom.

How to write a letter to a creditor?

Start your letter off by introducing yourself and indicating the reason behind writing the letter. Tell your creditor about your situation and why you’ve been unable to pay the balance on your account.

How to remove late payment from credit report?

Put in a request for your creditor to have this debt removed from your credit report after it is cleared. By doing this, you’ll remove a late account from your report and in return, increase your credit score.

What to do if a company cannot validate your debt?

However, if the company cannot validate your debt, they must cease collections and you can request to have the account removed from your credit profile. At this point, you should have a list of your verified debts and who they are owed to. 2. Check The Statute Of Limitations.

What to do after explaining your circumstances?

After you’ve explained your circumstances, reiterate the amount that you owe, and give the creditor your initial settlement offer.

Why do companies accept settlements?

You’re more likely to have a company accept a settlement offer if you are able to pay it upfront and in full. Creditors prefer this method because they’re guaranteed to get their money and it’s a done deal afterwards.

What to do if you see a duplicate trade line?

If you see a duplicate or unfamiliar trade line reporting on your credit, make sure to call and inquire about it. Once you have organized a list of your accounts, the next step is to validate each individual debt with the corresponding creditor. Remember, you only have to pay on a debt if it is validated.

What should be included in a debt settlement letter?

You should also include all the key information your creditor will need to locate your account on their system, which includes: Your full name used on the account. Your full address.

What is debt settlement?

Debt settlement is something many people consider if they are able to offer a lump sum of money up front – usually less than the total amount owed – in the hope the creditor will agree to this and accept the debt as settled.

How to contact PayPlan?

If you are looking for guidance when dealing with creditors and proposing a debt settlement, our team here at PayPlan can help. Speak to our experts on 0800 280 2816 or use our contact form to get in touch.

What to do if creditor accepts offer?

If the creditor accepts your offer, ensure this is in writing before you send any money to them. Keep this written confirmation safe too in case there is any dispute in the future, so you can offer this as proof of the agreement.

What does it mean when you get your debt removed?

Doing this means your debt can be removed earlier and that you will no longer need to worry about making repayments.

What happens if you settle early on a debt?

It’s important to remember that if you settle early on your debt, this means you are not paying it in full and so it will show as partially settled on your credit report instead of settled. This can affect your ability to obtain credit in the future, as it suggests to future creditors that you may not be able to pay back the full amount borrowed.

When proposing a full and final debt settlement to creditors, it’s important you go about this in the right?

When proposing a full and final debt settlement to creditors, it’s important you go about this in the right way. This means sending a written letter explaining how you wish to settle your debt, how much you are offering to pay and when this can be paid by.

How Debt Relief and Debt Settlement Work?

Debt Relief and Debt Settlement is a negotiated agreement by which a creditor accepts less than the total amount owed to legally satisfy a debt.

Who can help with debt letters?

It’s important to have the proper help either by an attorney or a debt expert to make sure that your letter is proper and you can get the results that you’re expecting.

What is debt specialist?

The debt specialist evaluates the caller’s financial situation and suggests the optimal debt relief strategy.

How long does it take for debt to be resolved?

Your debts will be resolved in a few short years or even months so you can have a new beginning financially.

What is the first adjustment you need?

The first adjustment that you’re gonna need is to make sure you have your creditors’ address and address it to them in the header.

Does debt settlement exist?

Debt settlement services have existed in some form since the advent of debt itself.

Do today's borrowers have more debt than their parents?

In addition, today’s borrowers are taking on significantly more debt than their parents had at a similar stage in life and are subsequently paying off that debt at a slower rate.

What to include in a letter to creditor?

It’s important to include the facts of your case. These include details such as the credit card number of the card tied to the debt. Once you’ve introduced yourself and the account in question, you can name your number.

What is debt settlement?

Debt Settlement Basics. A debt settlement is an agreement between a debtor and creditor. Generally, the terms of the debt settlement allow the debtor to pay less than he or she owns. Sometimes the payment will be made in a lump sum.

What happens if a debt collector settles your case?

If a debt collector or other creditor is on your case, it’s likely that your creditor is after you for an amount equal to what you owe, plus any interest that has accrued. Your goal in the process of a debt settlement is to agree to pay less than what you owe.

Is it a good idea to send a debt settlement letter?

It’s also a good idea to approach the debt settlement process as a negotiation between you and your creditor.

Can a non profit write a debt settlement letter?

Non-profit credit counselors can also help write debt settlement letters if they deem it appropriate for an individual’s circumstances. You can also write your own debt settlement letter.

Is it a gamble to write a settlement?

Writing a debt settlement is a bit of a gamble. There's no guarantee that your creditors will accept the settlement you offer. But if the gamble pays off... Menu burger. Close thin.

Can a debt settlement letter be used as a negotiation?

You’re trying to pay a low amount and your creditor is trying to get as much out of you as possible. Ideally, a debt settlement letter would not be the start of your debt settlement negotiation. If you make the first move by sending a debt settlement letter, your creditor can easily come back and ask for more.

What is a debt settlement request letter?

Writing a debt settlement request letter is a good way to negotiate your debt and to agree on a new financial agreement to either pay down or pay off your financial obligations.

Why do we need a debt settlement letter?

Writing a well-written debt settlement letter is a great tool if you’re seeking a plausible solution to protect your credit score or avoid bankruptcy.

Is it bad to pay off a debt without a written statement?

In terms of credit reporting, debt buying, and debt collection, paying off a debt without a documented written statement could prove to be a huge mistake.

Can anything you say in a letter be held against you?

Therefore, anything you say in your letter can be held against you in the event you have to go to court and face legal action.

Can credit card debt affect your credit score?

No matter if you’re credit card debt is overwhelming you or you can’t make your mortgage payments, your credit score can be seriously harmed by financial delinquency.

How to settle a debt on your own?

When you’re working to settle a debt on your own, you want to do everything in writing. This is especially true if you’re making formal debt settlement agreements. Creditors and collectors will try to get you to agree to things over the phone. Don’t fall for it! Ask them to send you their proposal in writing. Avoid saying anything that acknowledges that you’re obligated to repay the debt. You can use these debt settlement letter templates to negotiate everything in writing.

How long does it take to settle a debt with a collection agency?

They have five days to do so under the Fair Debt Collection Practices Act (FDCPA).

Can you admit to a debt?

Never admit that you owe the debt or that you’re supposed to pay it. This can reset the statute of limitations on collecting the debt in some states!

What a Debt Settlement Agreement Must Include

After you have negotiated a debt settlement with a creditor, such as a credit card company, you will need to formalize your agreement in writing. You can write the agreement yourself and send two copies to your creditor so that they can send a signed copy back to you. Or it may be easier to have your creditor draft up a letter and send it to you.

Sample Debt Settlement Letter Template

Here is a general template that you can use to draft your debt settlement agreement. You can add to, remove, or modify the information contained in this agreement to match your circumstances. The agreement letter can be either simple or complex, depending upon your specific financial situation and the type of debt that you owe.