- In a cash surrender, the policyholder surrenders the policy to the insurance company in exchange for a cash payout. ...

- In a policy loan, the policyholder borrows money against the policy’s cash value. The loan is typically repaid with interest.

- In a life settlement transaction, the policyholder sells the policy to a third party for a lump sum of cash. ...

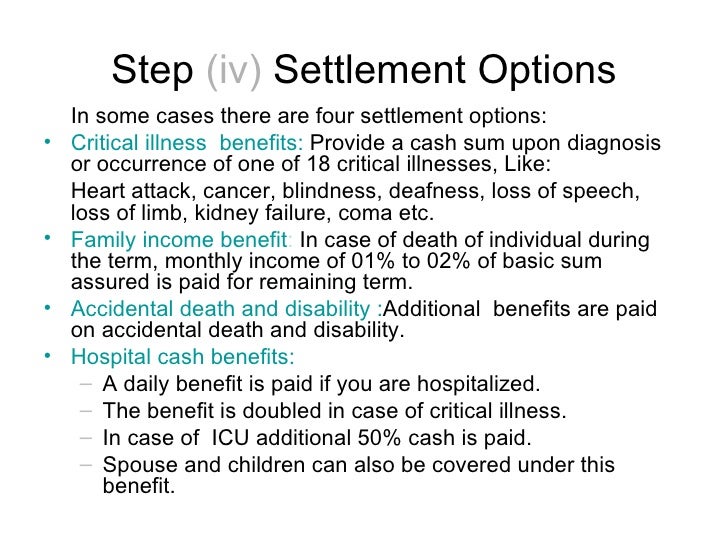

Do You Know Your Life insurance settlement options?

To put it in basic terms, your Life Insurance Settlement Options are the various choices that are available to distribute the death benefit to the beneficiary. Your life insurance policy has 2 main parts to it. The first part is the “insured” or the person who purchased the policy.

Which life insurance payout option should you choose?

- Claim Payout Option is a feature that allows you to choose how your nominee or family will receive the claim amount.

- It is important to choose a claim payout option based on your nominee or family’s financial aptitude.

- Some of the common types of Claim Payout Option are- Lump Sum Payout, Monthly Income, and Lump Sum with Monthly Income option.

Are life settlements bad for insurance companies?

This is bad for you, the customer because it jeopardises the chances of your claims being honoured. So, when comparing life insurance companies, you should check the claim settlement ratio of each company. Companies which have a high ratio should be favoured because those companies are more likely to settle your life insurance claims than ...

Is life insurance a good investment option?

Essentially, for a well-planned financial life, planning insurance and investments in a distinct and unconnected way is essential. Coupling the two leads to bad planning, without fail. In order to make correct decisions, life insurance must come first, but it must be term insurance.

What is a settlement option in life insurance?

Settlement Options — in life insurance, how proceeds are paid to the designated beneficiaries. Most life insurance policies provide for payment in a lump sum.

What is the purpose of settlement option?

The primary objective of settlement option is to generate regular streams of income for the insured. Description: Under settlement option, the insured receives a regular flow of income from the insurer post the maturity of the policy.

What are the beneficiary payout options?

In most cases, beneficiaries choose the type of life insurance payout after the insured dies. Payout options include lump-sum payments, installments and annuities and a retained asset account.

Who may choose the settlement option for a life insurance policy?

Life Insurance Settlement Options If there is no designated settlement option at the time of the insured's death, the beneficiaries of the life insurance policy may choose how they would like to receive the death benefit. Lump Sum: The beneficiary will receive the full amount of the death benefit at one time.

How long will the beneficiary receive payments under the single life settlement option?

Under a single life annuity with a 10 or 15 year certain period, guaranteed monthly payments will be made to you for at least a specified number of years. (You can choose either a 10-year period or a 15-year period.) Under this form of annuity, you will receive monthly payments for as long as you live.

How are payments determined on life income settlement option?

Life Income A life income settlement is also known as a life annuity. It lets you convert the death benefit to fixed, regular annuity payments for the rest of your beneficiary's life. The insurer guarantees an annual annuity amount based on the beneficiary's expected lifespan and the death benefit amount.

How are life insurance beneficiaries paid out?

Life insurance payouts are sent to the beneficiaries listed on your policy when you pass away. But your loved ones don't have to receive the money all at once. They can choose to get the proceeds through a series of payments or put the funds in an interest-earning account.

Which settlement option ensures highest payout amount?

1. Lump-sum payment. Lump-sum payment is the simplest and most common insurance type of life insurance settlement. Once the insurance company receives and validates the life insurance claim, your beneficiary will be paid the death benefit in a single, tax-free payment.

How much is the average life insurance payout?

However, some industry experts estimate that the average payout for a life insurance policy is between $10,000 and $50,000.

What are the basic settlement options for life insurance policies except?

All of the following are life insurance settlement options, EXCEPT: There are four settlement options: interest only, fixed-period installments (period certain), fixed-amount installments and life income. An automatic premium loan is a policy loan provision.

Are settlement options taxable?

The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code.

Which of the following is the most common settlement option?

The most common settlement option is a lump sum payment. However, this is not the only settlement option that is available to policyholders or beneficiaries.

What is the purpose of settlement options quizlet?

What is the purpose of a fixed-period settlement option? To provide a guaranteed income for a certain amount of time.

What is an annuity settlement option?

Annuity Settlement Options - One of the unique features of an annuity is the opportunity to elect a settlement option and set up a dependable stream of income. If a settlement option is elected, Gleaner will make periodic payments to the annuitant.

What are settlement options which option should you choose quizlet?

There are four settlement options: interest only, fixed-period installments (period certain), fixed-amount installments and life income. An automatic premium loan is a policy loan provision. The interest only option leaves the proceeds with the insurer and pays the interest to the beneficiary on an installment basis.

What is the interest only settlement option?

Definition. What does Interest Only Settlement Option mean? This is a life insurance settlement option in which the insurance company keeps the proceeds from the life insurance policy and invests it, promising the beneficiary a guaranteed minimum rate of interest.

How Does a Life Insurance Death Benefit Work?

A death benefit can be a valuable asset, and insurers provide various options for disbursing payments after death. In rare cases, the policy owner might specify which life insurance settlement options they want to provide for beneficiaries, and they may even restrict when beneficiaries can receive funds. But in most cases, beneficiaries have options, and you can select the option that works most appropriately for your needs.

What happens to life insurance when a person dies?

When an insured person dies, their beneficiary is then eligible to receive the policy's death benefit. Some people may think of a life insurance death benefit as a lump-sum payment, but insurers typically offer a variety of life insurance settlement options.

What is interest income option?

With an interest income option, the insurance company holds the principal of the death benefit and pays you the interest earned. Any interest earnings would be paid out to you, and you can typically take full or partial withdrawals at almost any time if you need more money. This option may make sense if you only need a small amount of income from the death benefit.

How long can you receive death benefit?

Instead of taking everything at once, you are able to receive the death benefit over a specified length of time, such as 20 years. That option may make sense if you have predictable expenses, such as mortgage payments, that end at a known date. Those regular payments can also simulate an income, helping to fill the gap that might arise when the deceased stops receiving income. Any funds that remain with the insurance company earn interest, and those earnings get paid out as part of the regular payments.

What is lump sum payment?

A lump-sum payment is perhaps the easiest to understand. With this option, you receive the entire death benefit as a one-time payment. This gives you full access to the death benefit, and you can spend the money as you choose. This may enable you to pay off debts such as a mortgage. You can also save or invest this money after receiving the lump-sum payment.

What is lifetime income with period certain?

Lifetime Income With Period Certain. Life only payments end after the death of the insured, so the balance of the settlement amount is left with the insurer. When choosing the lifetime income with period certain option, the insurance company pays out income for your whole life or the period certain — whichever is longer.

Can you change your life only death benefit?

Lifetime income is commonly referred to as life only payments. You can receive payments that are designed to last for the rest of your life (based primarily on your age). This approach may help to prevent you from spending the entire death benefit prematurely, and it could help ensure that you have regular income. Once this is set up, you typically cannot change the payment or take additional withdrawals.

What is life settlement?

The beauty of a life settlement is that you receive a lump sum cash payment GREATER than the surrender value your insurance company can give you. The amount you receive depends on three factors: your age, health and the terms/conditions of your policy.

How Do I Qualify for a Life Settlement?

Speak to a professional life settlement broker and receive a free quote on the value of your life insurance policy. Once we evaluate the cash surrender value of your insurance policy, we can let you know if you how/when you can liquidate your life insurance policy.

What happens when you surrender a life insurance policy?

Similarly, when you allow your life insurance policy to lapse you are telling your life insurance company that you cannot pay your monthly dues anymore.

Who was the doctor who paid the death benefit?

Trusted Life Settlement Company. The doctor, named Grigsby , agreed. Grigsby would pay the premiums on his patient’s life insurance and receive the death benefit after his passing. In exchange, the patient was able to get immediate financial help and turn this unused asset into cash.

Can seniors sell life insurance?

Many people do not know the benefits that a life settlement organization like Life Insurance Settlements can offer. In fact, most seniors don’t know that they have this option but there and there are many reasons for selling your life insurance policy. Viatical settlements can be a valuable source of liquidity for people who would otherwise surrender their policies or allow them to lapse.

Can you take advantage of a life insurance policy?

Similar to selling a home, a person with a life insurance policy can take advantage of their asset and be financially rewarded before the maturity date. Viatical settlements and whole life insurance settlements that provide cash settlements for life insurance policyholders are considered the same as transactions for private property.

How is the payout of a life insurance policy determined?

The amount of the payout will be determined and offered by the insurance carrier. It will be based on the face value of the policy and the age of the beneficiary at the time payments start.

What happens to life insurance when the insured dies?

With life insurance, when the insured dies, the beneficiary receives one large payout check equal to the death benefit of the policy.

What happens to guaranteed income if the insured dies?

If the person receiving the guaranteed income dies earlier than expected, the insurance company will cease payments. These do not pass on to a secondary beneficiary.

What is a guarantee for life?

The guarantee means that unlike a typical “for life” option where payments stop at death, in this case, the secondary beneficiary would receive those payments until that period of time has been reached.

How long does interest accrue on death benefit last?

Example: On a $500,000 death benefit, the beneficiary may choose to receive $50,000 per year. They will receive the same $50,000 for at least 10 years. The interest accrued will allow the payment to continue beyond 10 years.

What happens to a loan against a built up cash value?

In the case of permanent and universal life policies where loans against any built up cash value are permitted, if there is an outstanding loan, the payout amount will be reduced to pay that off first.

What happens if you choose specific income?

Specific Income. If you choose the Specific Income Option, you will get a fixed amount of income each year until the funds are exhausted. With this option, you do collect interest as well on whatever money is not yet paid out. The eventual amount you receive will, therefore, be greater than the death benefit.

How does a life insurance settlement work?

How Life Settlements Work. When an insured party can no longer afford their insurance policy, they can sell it for a certain amount of cash to an investor— usually an institutional investor. The cash payment is primarily tax-free for most policy owners. The insured person essentially transfers ownership of the policy to the investor.

What Is a Life Settlement?

A life settlement refers to the sale of an existing insurance policy to a third party for a one-time cash payment. Payment is more than the surrender value but less than the actual death benefit. After the sale, the purchaser becomes the policy's beneficiary and assumes payment of its premiums. By doing so, they receive the death benefit when the insured dies.

What happens if you fail to pay insurance premiums?

Failure to pay the premiums may net the insured a smaller cash surrender value —or none at all, depending on the terms. A life settlement on a current policy, though, usually results in a higher cash payment from the investor. The policy is no longer needed. There may come a time when the reasons for having the policy don't exist anymore.

What happens to a viatic settlement after the insured dies?

After the insured party dies, the new owner receives the death benefit. Viatical settlements are generally riskier because the investor basically speculates on the death of the insured. Even though the original policy owner may be ill, there's no way of knowing when they will actually die.

What happens when you sell a life insurance policy?

By selling it, the insured person transfers every aspect of the policy to the new owner. This means the investor who takes over the policy inherits and becomes responsible for everything related to the policy including premium payments along with the death benefit. So, once the insured party dies, the new owner—who becomes the beneficiary after the transfer—receives the payout.

What happens to the death benefit after a policy is sold?

After the sale, the purchaser becomes the policy's beneficiary and assumes payment of its premiums. By doing so, they receive the death benefit when the insured dies.

Why do people sell life insurance?

There are many reasons why people choose to sell their life insurance policies and are usually only done when the insured person doesn't have a known life-threatening illness. The majority of people who sell their policies for a life settlement tend to be older people—those who need money for retirement but haven't been able to save up enough. That's why life settlements are often called senior settlements. By receiving a cash payout, the insured party can supplement their retirement income with a largely tax-free payout.

What Is a Life Settlement and How Does It Work?

Many people don’t know that this option exists. But how does the process work? Do your loved ones qualify for it? And is selling the policy the right move?

Century-Old Ruling

A 1911 U.S. Supreme Court ruling established the precedent that life insurance is private property, but it was the AIDS epidemic in the 1980s that opened up the market for ownership transfers. It was a morbid business; a viatical settlement was a bet on another’s demise. The sooner the death, the sooner the payoff.