A payment gateway communicates to the merchant whether the charge has been approved by the cardholder’s bank and submits the charges for settlement. One way of putting it would be to say that a payment gateway is the “virtual” equivalent of a physical card terminal that helps merchants accept payments online.

Full Answer

What is a payment settlement?

The payment settlement is the process through which the merchant finally gets paid for the goods and services sold online. It is one of the critical stages in a payment gateway system . Once a customer has purchased a product/service and made the payment, the amount is charged to the customer’s bank account.

How long does a payment gateway settlement take (and why)?

Once PayG gets the sum, it is settled to the dealer's financial balance after the derivation of a particular charge This will take upto T+2 or T+3 days. However, this period can shift dependent on the payment settlement instrument and settlement cycle. How Does a Payment Gateway Settlement Work?

What is a payment gateway and how it works?

A payment gateway is what keeps the payments climate moving effectively, as it engages online payments for purchasers and associations. In the event that you're an online broker, you ought not to be a payment gateway ace, anyway it justifies understanding the essentials of how an online payments streams from your customer to your record.

How much time does it take for PAYG to settle a charge?

Once PayG gets the sum, it is settled to the dealer's financial balance after the derivation of a particular charge This will take upto T+2 or T+3 days. However, this period can shift dependent on the payment settlement instrument and settlement cycle.

What is settlement in payment gateway?

What is “Settlement” in the Payment Processing World? Simply put, payment gateway settlement is when the bank transfers funds immediately with no waiting. It is the process where the money is transferred or routed from the customer's bank to the merchant's bank.

What is the settlement step of the payment process?

Once a transaction has been approved, settlement is the second and final step. This is when the issuing bank transfers the funds from the cardholder's account to the payment processor, who then transfers the money to the acquiring bank. The business will then receive the authorized funds in its merchant account.

How does settlement process work?

Payment settlement involves collecting the funds for the amount recorded for an order. For example, when using credit cards, the settlement process specifically involves contacting the payment system and collecting the required amount of funds against the credit card.

Which payment gateway gives instant settlement?

Razorpay gives you the flexibility to pick and choose how you want your Instant Settlements, based on your business needs. Choose when you want your customer payment to transfer into your bank account. Settle with 10 seconds the needed amount from the settlement balance.

How long does a merchant have to settle a transaction?

One of the common requirements to gain access to the lowest possible interchange fee is that you must settle any given sale within 24 hours of authorization. This makes sense when you think about it.

What is the difference between payment and settlement?

Settlement in "real time" means payment transaction is not subjected to any waiting period. "Gross settlement" means the transaction is settled on one to one basis without bunching or netting with any other transaction. Once processed, payments are final and irrevocable.

Why does payment settlement take so long?

Every bank has or offers a different settlement cycle. Hence, the time-frame for the acquirers can vary. For example, Bank A may usually settle within a day, whereas Bank B may take two days to pay. Keeping track of these timelines and consolidating it all in a single sheet does take time.

What is the difference between clearing and settlement?

Clearing involves network operators routing messages and other information among financial institutions to facilitate payments between payers and payees. Interbank settlement is the discharge of obligations that arise in connection with faster payments either in real-time or on a deferred schedule.

What is transaction settlement?

trans - ac - tion set - tle - ment. The process through which a merchant receives funds for a transaction with a customer.

How can I settle my Paytm payment immediately?

With Paytm, accept payment directly in your bank account. The amount accepted through QR code will automatically settle down in your linked bank account with us on the end of the next day.

What is same day settlement?

Same Day Settlement (also known as 'Faster Payments') is processing service provided by RMS which allows customers to receive their GBP funds from card transactions in a matter of hours, rather than waiting the normal 3-5 days for funds to clear.

How do you do a Cashfree settlement?

Access customer payments made via Cashfree Payment Gateway directly into your payouts account! Define the settlement cycle for your payments – as fast as 15 minutes from payment capture. Choose which account your funds need to be credited – virtual account number or your bank account.

What is settlement process in banking?

Settlement can be defined as the process of transferring of funds through a central agency, from payer to payee, through participation of their respective banks or custodians of funds.

What is settlement in credit card processing?

What is a Settlement in Credit Card Processing? A settlement is essentially the process for a merchant to receive their funds of their submitted batch. After a batch is submitted, the payment processor sends the transaction to the issuing bank. The issuing bank verifies the transactions.

What does it mean to settle a transaction?

Transaction settlement is the process of moving funds from the cardholder's account to the merchant's account following a credit or debit card purchase. The issuer will route funds to the acquirer via the card network.

What is clearing and settlement process?

Settlement involves exchanging funds between the two banks, while clearing can end without any interbank money movement. In the clearing process, funds move between the recipient's or sender's bank account and their bank's reserves.

What is a payment gateway?

A payment gateway is what keeps the payments climate moving effectively, as it engages online payments for purchasers and associations. In the event that you're an online broker, you ought not to be a payment gateway ace, anyway it justifies understanding the essentials of how an online payments streams from your customer to your record.

How does a client start a payment?

The client starts the payments interaction by entering the record subtleties or swiping the card to pay for stock. After effective confirmation of client's and client's bank subtleties, the said sum is charged from the client's ledger. The charge sum gets moved to the gaining bank visa card organizations. The acquirer at that point charges this sum in the shipper's record.

What happens after the client continues with the payment?

After that when the client continues with the payment; enters the subtleties and chooses the payment alternatives and snaps on the Pay Now choice then these subtleties are shipped off the PayG worker in a got way.

What happens when a payment commencement is done?

When the payment commencement is done, the responsible bank moves the assets to the payment processor. The payment processor at that point moves these assets to the procuring bank and afterward the exchange sum gets charged in the dealer's record.

What is settlement in trading?

Settlement is the interaction through which a trader gets cash paid by their end clients for a specific item. There are various substances associated with the settlement interaction.

Do payment gateways need a nodal account?

According to the RBI rules, the payment gateways and aggregators need to keep a Nodal Account. This is controlled and overseen by the actual bank which implies that the payment gateways or aggregators can't utilize the assets in that financial balance for some other reason than to settle it to the separate dealer to whom the payments have a place.

How does an instant payment settlement gateway work?

To understand how same day services work, it’s first helpful to take a closer look at what happens during payment processing via a gateway.

How does a payment gateway work?

A same day settlement payment gateway works to eliminate this time lag by transferring funds directly into the merchant account , enabling real-time payments even on bank holidays and weekends.

What is PayPal payment gateway?

One example of a payment gateway offering instant funding credit card processing is PayPal. The company’s Payflow Gateway helps merchants accept credit card payments and integrates with most ecommerce platforms. When a transaction is approved, the funds appear nearly instantly in the merchant’s PayPal account for same day settlement.

How long does it take for a payment to settle?

Normally, this takes anywhere between 24 hours and several weeks, but three to five working days is typical for most payment processing services. Banks use this processing time to monitor transactions for fraud and avoid chargebacks as part of the clearing process.

What types of payments does the gateway accept?

What types of payments does the gateway accept? While most accept Visa and Mastercard , your customers might prefer additional card types.

How many businesses use GoCardless?

GoCardless is used by over 60,000 businesses around the world. Learn more about how you can improve payment processing at your business today.

What is merchant bank?

The merchant’s bank deposits the total amount of authorised transactions into the business bank account, deducting applicable fees.

What Is A Payment Gateway And How Does It Work?

As online transactions continue to see an upsurge worldwide, especially during the pandemic, customers are expecting their purchases to be made quickly, safely, and seamlessly.

So What Is A Payment Gateway?

A payment gateway is a software that safely authenticates a customers’ credit card information to ensure that they have sufficient funds for a merchant to get paid.

How Does It Work?

Let’s take a look at how a payment gateway works in reference to the payment journey:

Choosing The Best Payment Gateway For Your Business

Seeking the right payment gateway provider can sound just as daunting as finding the right merchant account provider for your business. However, it does not have to be this way.

What Is a Payment Gateway? How Does It Function?

A payment gateway is a tech that grabs and transmits payment info from the buying side to those who accept this payment and then reports about the acceptance or refusal. Simply said, it is an online service for payments that acts as a channel to make and get payments. This term serves as an interface between a trader’s site and its purchaser. The main idea is to make sure that money is available to let merchants pay with them. Payment gateways encrypt sensitive financial data to verify that info is delivered safely.

How Much Time Does It Take to Build a Payment Gateway of High Quality?

While a payment gateway development cost may vary a lot, we will try to calculate the time required to create a payment gateway technology. From a financial aspect, determining the exact amount is impossible as it only depends on your gateway’s complexity, features, workforce, and other things.

Who Can Benefit from Using a Payment Gateway?

So, does it make sense to design an app or purchase one? This question may pop up in your mind when it comes to discussing different approaches to integrating payment gateway in a website. If you belong to one of these groups , you will definitely benefit from using a payment gateway:

What Are the Benefits of Building a Custom Gateway?

It is still worth your attempts as a gateway will dramatically assist your company’s growth and prosperity of your business. For example, in 2020, the number of noncash (debit/credit card, ACH, and check payments) procedures achieved more than 167.3 billion euros only in the EU area. When choosing the preferred payment systems for your future customers, mind that 57% of all American shoppers choose Visa as their preferred way to pay.

What Exactly Is The Function of A Payment Gateway Settlement?

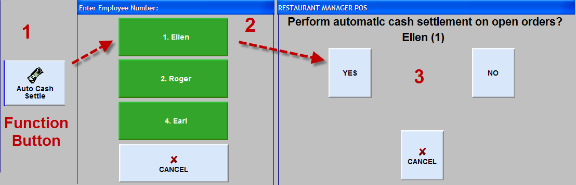

Processes That Are Involved in The Payment Gateway Settlement Process

- The client initiates the payment by entering the account information or using the card to purchase items. After the successful authentication of the customer’s and the bank’s information, the amount is deducted from the customer’s bank account. The debit balance is transferred to the bank that is acquiring its Visa card networks. The acquirer debit...

Types of Settlement Mechanisms

- There are two settlement methods. The mechanisms are based on who is handling files for the settlement.

Selecting The Gateway Settlement Approach

- When deciding on the best settlement method, any business should think about the best solution that is merchant-initiated or time-initiated, as well as terminal capture. It is also essential to think about the structure of your business and its requirements. Because both systems have particular features, it’s an organizational structure that could aid in choosing the settlement technique that’…

What Is Payment Gateway?

- A payment gateway is a simple tool that securely validates your client’s payment mode details and ensures that the funds are available for you to pay the bills. With the help of a payment gateway, one can authorize both offline and online payments through cards. It is similar to physical POS (point-of-sale). You will find most used cases of payment gateway integration with ecommerce …

Types of Payment Gateways

- Payment gateways are far more complex than it looks from the outside. These software solutions come with complications and this depends upon what type of service one uses and how someone organizes the virtual store of the business. There are three main types of payment gateways, so here we are going to have a look at the three types of it that every payment service provider in th…

How Does A Payment Gateway Work?

- An online payment gateway is an approach that follows a simple and straightforward procedure to settle the payment each time it is processed. This process starts when a client places an order for a product from a merchant who uses a gateway. The payment gateway process starts from filling in all the payment mode details to the final settlement. The...

Payment Gateway Features and Functionality

- With so many payment gateways and payment service providers available in the market, knowing which is the right for your business is quite difficult? Therefore, here we are going to have a look at some important features and functionality a top payment gateway must deliver to help optimize payments services and offer a seamless payment processing experience.

Conclusion

- As seen in this blog, online transactions are not going to stop anytime soon and neither does the software that supports these types of transactions. When clients purchase products, they trust the business to process the payment securely, quickly, and without any hassle. Therefore, having the right payment gateway can be a very beneficial and important part when it comes to deliveri…