The 8 Steps to a Life Settlement: How to Life Settlements Work?

- Determine your eligibility for a life settlement. ...

- Decide if you want to involve an advocate. ...

- Submit an in-force illustration. ...

- Submit additional paperwork and schedule medical interview. ...

- Wait for Magna review and informal offer. ...

- Magna obtains medical records and life expectancy report. ...

- Magna extends a formal offer. ...

- Buyer takes over the policy. ...

How can a life settlement help me?

HOW CAN A LIFE SETTLEMENT HELP ME? Selling your policy can supplement your retirement income, free up cash that was being used to pay premiums, fund a long-term care policy, cover unexpected medical expenses or pay off debt. If you still need insurance, you can retain a portion of your coverage while eliminating your ongoing premium payments. ...

Do I qualify for a life settlement?

Qualifying for a Life Settlement If you are at least 70 years old and own more than $100,000 of life insurance, you may qualify for a life settlement. Determining whether you qualify for a life settlement is based on a few basic factors, namely, your age, health history, policy type and future premium costs.

What to expect from a settlement?

- For minor injuries, they often settle for 1 to 2 times the medical bills.

- For more serious injuries, your case could settle for 10 times or more of the medical bills.

- But in most cases, it is likely that your case will settle for somewhere between 1 1/2 to 4 times your medical bills.

How are life settlement payments taxed?

Under this doctrine, if a settlement or award payment represents damages for lost profits, it is generally taxable as ordinary income. Similarly, a settlement or award payment received from an employer for lost wages and damages would likewise generally be ordinary income.

Are life settlements a good idea?

Life settlements can be a valuable source of liquidity for people who would otherwise surrender their policies or allow them to lapse—or for people whose life insurance needs have changed. But they are not for everyone. Life settlements can have high transaction costs and unintended consequences.

How much can you get from a life settlement?

It's typical for a life settlement to pay anywhere from 10% to 25% of the policy benefit amount. So if you were to sell a $200,000 policy you may get anywhere from $20,000 to $50,000 in cash. But there's a catch. Any money you receive from a life settlement would be subject to taxation at your ordinary income tax rate.

How do you qualify for a life settlement?

People who qualify for life settlements are usually 65 or older, and have a policy with a face value of $100,000 or more.

Are life settlements Legal?

A life settlement is the legal sale of an existing life insurance policy (typically of seniors) for more than its cash surrender value, but less than its net death benefit, to a third party investor.

Is a life settlement tax Free?

Is A Viatical Settlement Taxable? Most of the time, viatical settlements are not taxable. Settlement proceeds for terminally ill insureds are considered an advance of the life insurance benefit. Life insurance benefits are tax-free, and so it follows that the viatical settlement wouldn't be taxed, either.

Are Life Settlements taxable?

To recap: Sale proceeds up to the amount of the cost basis are not taxable. Sale proceeds above the cost basis and up to the policy's cash surrender value are taxed as ordinary income. Any remaining sale proceeds are taxed as long-term capital gains.

What are life settlement funds?

A life settlement is a financial transaction in which a life insurance policy is sold on the open market for a value greater than the policy surrender value (the cash value of the policy which the insurance company will pay to “repurchase” the policy) but less than the full policy benefit value.

What is a life settlement transaction?

A life settlement is the sale of a life insurance policy to a third party called a life settlement provider. The owner of the life insurance policy sells the policy to the life settlement provider and receives an immediate payment in return.

Which policies Cannot be sold as part of a life settlement?

Standard term policies and premium financed policies generally do not qualify for life settlements, because of the additional risk to the investor. Group life insurance policies can also qualify, if they are permanent or convertible term policies (and are actually transferable in the first place).

Who regulates life settlements?

the Department of Insurance (DOI)Life settlements are regulated by the Department of Insurance (DOI) on a state by state basis. All documentation used in a life settlement must be approved and on file at the states DOI.

How are settlement options paid?

The four most common alternative settlement approaches are: the interest option, under which the insurer holds the proceeds and pays interest to the beneficiary until such time as the beneficiary withdraws the principal; the fixed period option, under which the future value of the proceeds is calculated and paid in ...

What are life settlement funds?

A life settlement is a financial transaction in which a life insurance policy is sold on the open market for a value greater than the policy surrender value (the cash value of the policy which the insurance company will pay to “repurchase” the policy) but less than the full policy benefit value.

What is a life settlement transaction?

A life settlement is the sale of a life insurance policy to a third party called a life settlement provider. The owner of the life insurance policy sells the policy to the life settlement provider and receives an immediate payment in return.

What are the settlement options for life insurance?

Common Life Insurance Settlement OptionsLump-Sum Payment. A lump-sum payment is perhaps the easiest to understand. ... Interest Only. ... Interest Accumulation. ... Fixed Period. ... Lifetime Income. ... Lifetime Income With Period Certain.

How much do life settlement brokers make?

Life Settlement Broker Salary According to ZipRectuiter, the average salary is around $65,000 per year. For reference, that is about $31 per hour or $5300 per month, pre-tax. However, top earners can make over six figures, and even the 75th percentile are bringing home upwards of $75,000 annually, or $6000 per month.

What is a life settlement?

A life settlement is the sale of a life insurance policy to a third party for its market value. In the transaction, the seller receives a substantial payout (on average 4 or more times greater than the cash surrender value), and the buyer becomes the owner and beneficiary of the policy.

How long does it take to get a life settlement?

In most cases, after you provide personal, policy, and health information to a life settlement provider or broker, you’ll get an offer in a few weeks. Some companies require extensive medical underwriting which can result in a long wait before you receive an offer, while other companies can make offers more quickly – sometimes in under 5 business days. For healthy life settlements, the turnaround time for an offer can be under 24 hours.

How long does it take to get a medical underwriting offer?

Some companies require extensive medical underwriting which can result in a long wait before you receive an offer, while other companies can make offers more quickly – sometimes in under 5 business days. For healthy life settlements, the turnaround time for an offer can be under 24 hours.

What to do if your life insurance policy is too expensive?

If you have a life insurance policy that no longer serves its original purpose, or is too expensive to maintain, you should consider converting it to a large cash payout through a life settlement.

What happens after you accept a life insurance offer?

After you complete and submit the required paperwork, the funds for the offer you accepted are placed in escrow.

What are the steps in a life insurance settlement?

Life settlements, broadly speaking, have three steps – eligibility, offer, and settlement.

Can you get a settlement on life insurance?

While not everyone qualifies for a life settlement, many people do – even healthy policyowners. It is free to find out if you qualify and to learn how much you could get by selling your life insurance policy.

What Is a Life Settlement?

A life settlement refers to the sale of an existing insurance policy to a third party for a one-time cash payment. Payment is more than the surrender value but less than the actual death benefit. After the sale, the purchaser becomes the policy's beneficiary and assumes payment of its premiums. By doing so, they receive the death benefit when the insured dies.

How does a life insurance settlement work?

How Life Settlements Work. When an insured party can no longer afford their insurance policy, they can sell it for a certain amount of cash to an investor— usually an institutional investor. The cash payment is primarily tax-free for most policy owners. The insured person essentially transfers ownership of the policy to the investor.

What happens to a viatic settlement after the insured dies?

After the insured party dies, the new owner receives the death benefit. Viatical settlements are generally riskier because the investor basically speculates on the death of the insured. Even though the original policy owner may be ill, there's no way of knowing when they will actually die.

What happens when you sell a life insurance policy?

By selling it, the insured person transfers every aspect of the policy to the new owner. This means the investor who takes over the policy inherits and becomes responsible for everything related to the policy including premium payments along with the death benefit. So, once the insured party dies, the new owner—who becomes the beneficiary after the transfer—receives the payout.

What happens to the death benefit after a policy is sold?

After the sale, the purchaser becomes the policy's beneficiary and assumes payment of its premiums. By doing so, they receive the death benefit when the insured dies.

Why do people sell life insurance?

There are many reasons why people choose to sell their life insurance policies and are usually only done when the insured person doesn't have a known life-threatening illness. The majority of people who sell their policies for a life settlement tend to be older people—those who need money for retirement but haven't been able to save up enough. That's why life settlements are often called senior settlements. By receiving a cash payout, the insured party can supplement their retirement income with a largely tax-free payout.

Why do people choose life settlements?

Other reasons for choosing a life settlement include: The inability to afford premiums.

What Is a Life Settlement and How Does It Work?

Many people don’t know that this option exists. But how does the process work? Do your loved ones qualify for it? And is selling the policy the right move?

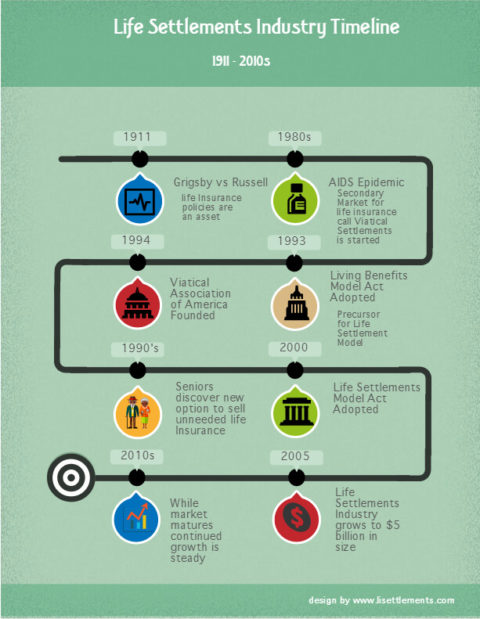

Century-Old Ruling

A 1911 U.S. Supreme Court ruling established the precedent that life insurance is private property, but it was the AIDS epidemic in the 1980s that opened up the market for ownership transfers. It was a morbid business; a viatical settlement was a bet on another’s demise. The sooner the death, the sooner the payoff.

What is life settlement?

A life settlement is the legal sale of an existing life insurance policy (typically of seniors) for more than its cash surrender value, but less than its net death benefit to a third party investor. . The investor assumes the financial responsibility for ongoing premiums and receives the death benefit when the insured passes away. The primary reason the policy owner sells is because they can no longer afford the ongoing premiums, they no longer need or want the policy, or they need money for expenses.

How to increase awareness of life settlement options?

To increase market individuals' awareness of the life settlement option, providers are utilizing marketing and advertising strategies to reach them. By eliminating the intermediate financial advisors and other professionals hired to identify potential policy owners, the policy supply has increased and transaction costs paid by policy owners have decreased. This results in a greater return on investment for buyers.

Why are life insurance settlements so rare?

Despite the Supreme Court ruling, life settlements remained extremely uncommon due to lack of awareness from policy holders and lack of interest from potential investors. That changed in the 1980s when the U.S. faced an AIDS epidemic. AIDS victims faced short life expectancies, high unanticipated expenses related to medical care, and selling a life insurance policy that they no longer needed as a way to pay these expenses made sense. However, by the mid-1990s, this investment strategy had faded away because of the rise of antiviral drugs .

What is the age limit for life insurance?

Most commonly, universal life insurance policies are sold. Policyholders are generally 65 or older and own a life insurance policy worth $100,000 or more.

Why are life settlements uncommon?

Despite the Supreme Court ruling, life settlements remained extremely uncommon due to lack of awareness from policy holders and lack of interest from potential investors. That changed in the 1980s when the U.S. faced an AIDS epidemic.

Why do insurance companies sell policies?

The primary reason the policy owner sells is because they can no longer afford the ongoing premiums, they no longer need or want the policy, or they need money for expenses. The investors consider five variables when pricing a policy for purchase: Life expectancy of the insured (health status) Cost of future premiums.

Do terminally ill people need a settlement?

Second, carriers now offer accelerated death benefit riders, which pay out if the insured is terminally ill, so there is no need for a sett lement.

What Is A Life Settlement?

Eligibility

- Life settlements are available to certain life insurance policyowners based on different eligibility criteria. While not everyone qualifies for a life settlement, many people do – even healthy policyowners. It is free to find out if you qualify and to learn how much you could get by selling your life insurance policy. It takes less than 5 minutes to get your free estimate and learn if you …

Traditional Life Settlement

- With traditional life settlements, a person needs to be at least 65 years old (although if you are 75 or older, you’re more likely to qualify), have a policy with a death benefit of at least $100,000, and have experienced a change in health since the policy was issued (for example, being diagnosed with cancer, COPD, or heart disease). Sometimes individuals under age 65 can qualify if they hav…

Healthy Life Settlement

- Recently, some healthy policyowners have been able to take advantage of the benefits of life settlements that used to only be available to people with impaired health. For a healthy person to qualify for a life settlement, there are some additional eligibility guidelines. The insured must usually be at least 75 years old and have a universal life (UL) policy, with a death benefit of at lea…

Offer

- In most cases, after you provide personal, policy, and health information to a life settlement provider or broker, you’ll get an offer in a few weeks. Some companies require extensive medical underwriting which can result in a long wait before you receive an offer, while other companies can make offers more quickly – sometimes in under 5 business days. For healthy life settlement…

Settlement

- Once you accept the offer to purchase your policy, you’ll need to complete some paperwork with the help of the life settlement provider or broker. After you complete and submit the required paperwork, the funds for the offer you accepted are placed in escrow. Once the policy ownership is transferred and the sale is finalized, the funds are released from the escrow account to you. If …