Full Answer

How long does it take for money to move to Zelle?

The money will move directly into your bank account associated with your profile, typically within minutes 1. If you have not yet enrolled your Zelle® profile, follow these simple steps: Click on the link provided in the payment notification.

What is Zelle and how does it work?

Zelle is a method of making payments that lets you send money easily, quickly and securely from your own bank account to anyone you choose. To use Zelle, if your bank offers it, all you need to send money is the other person’s email address or phone number.

How do I send money with Zelle®?

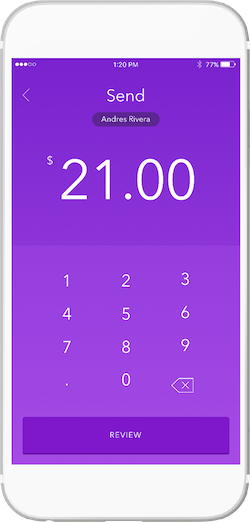

Pick a person to pay. Once you enroll, all you need to send money with Zelle® is the preferred email address or mobile number of the trusted recipient. Choose the amount to send. Enter the amount you want to send. If your recipient is already enrolled with Zelle®, the money will go directly into their bank account, typically in minutes 1.

What should I do if I have already enrolled with Zelle®?

If you have already enrolled with Zelle®, you do not need to take any further action. The money will move directly into your bank account associated with your profile, typically within minutes 1. If you have not yet enrolled your Zelle® profile, follow these simple steps:

Why is my Zelle payment pending?

A Zelle payment may be “pending” if the payment recipient hasn’t yet enrolled in Zelle. The recipient will need to use their mobile phone number or...

Is there a way to increase my Zelle limit for sending money?

To increase your Zelle limit, reach out to your financial institution. Limits may be determined by the type of account you hold, or they may be uni...

Can I use Zelle for my small business, or to pay a small business?

Yes. Zelle can be a great way to get paid as a small business owner because it’s fast and there are no fees. If your customers’ payment amounts are...

Can I use Zelle if I don’t have a smartphone?

If your bank or credit union offers Zelle, you can use its online banking website to send or receive Zelle payments, even if you do not have a smar...

What are TCH and EWS seeking to do?

At a high level, he said, what TCH and EWS are seeking to do is “hit the sweet spot in terms of giving the biller, and the bill payer, the control that they want.”

What did Ledford want to do with the pilot?

As Ledford related, “What we wanted to do with the pilot was to make sure the process would work. We were able to test a few things at once.”

Which banks send Zelle payments?

Bank of America (BofA) and PNC Bank are the first FIs to send Zelle payments over the RTP network, with additional FIs coming on board later in the year. For corporate customers of the FIs (both sending and receiving), the benefits of sending payments and Request for Payments (RfP) through electronic means quickly accrue in the form of simplified back-office processes and lower costs tied to printing, stamping and mailing checks and invoices.

Can BofA make P2P payments?

In terms of the mechanics, he said a hypothetical BofA customer will, as has long been the case, be able to make P2P payments.

Do bill payers have to be part of Zelle?

Both the biller’s FI and the bill payers must be part of the Zelle network if they are using Zelle account names.

Does Zelle have real time settlement?

Prior to real-time settlement availability, Zelle transactions have been (and still are being) transmitted from sender to receiver in real time, but interbank settlement has occurred through automated clearing house (ACH). That translates into a lag time before funds settle, even though the customer gets immediate access to funds.

Do billers have to have payment credentials?

The biller does not have to have payment credentials on file (which reduces risk).

Which banks have taken advantage of the new payment option?

Bank of America and PNC Bank were the first to take advantage of the new payment option. Bank of America said the new capability will help consumers better manage their money and reduce the potential for late payments by giving customers more control over the timing of payments.

Does PNC use Zelle?

Not having to remember bank account information is seen as a boon to customers as well. PNC sees an eventual possible use of Zelle as simplifying the new-hire process for businesses. “Your first day of work, most people don’t show up with their [International Bank Account Number] account memorized, but they know their mobile number and email address,” says Ward. “If you can set up an employee to be paid electronically just using their mobile number or email address, that reduces a huge barrier to onboarding that employee.”

Does RTP work with Zelle?

With the integration of Zelle and RTP, payments are sent to the RTP network based on information from Zelle and from Early Warning Services, and that information is used to send a payment to the receiving bank and they can immediately apply and immediately have settlement for, says TCH SVP Steve Ledford adding: “It makes it into a single stream process as opposed to a couple streams and it all happens at once so there is nothing to reconcile, nothing to tie back across two different processes.”

Does Zelle pay bills?

The ability to pay bills through Zelle is seen as another advantage to the integration, with real-time bill payment allowing business to reduce the cost of collections with fewer paper bills and postage.

Does Zelle store bank information?

Corporate customers using Zelle to request a payment will not need to store and transmit a customer’s bank account information, increasing security during a transaction. “Instead, they can focus on transacting through the U.S. banking system with a customer’s email address or U.S. mobile number they use to enroll with Zelle,” says Chris Ward, EVP for treasury management at PNC.

Which banks use Zelle?

Bank of America and PNC Bank are the first to send Zelle payments over the RTP network, providing consumers and businesses a fully-digital payment experience with improved efficiency by leveraging the emerging global ISO 20022 message standard. By sending Zelle payments over the RTP network, financial institutions can enable instant settlement and simpler back-office processing which improves efficiency and reduces costs.

Is Zelle a real time payment?

Early Warning System’s Zelle money movement app is now a true real-time payments solution. Zelle has always provided near instant transactions to consumers and businesses using the app, but now they have completed the integration of their settlement process to The Clearing House RTP network.

Why use RTP for bill payments?

There are several advantages for billers to use RTP for bill payments, according to Ledford. By using the secure RTP network a biller would know that any bill on the network was vetted going in by a financial institution and received by the customer’s financial institution. Essentially, this would counter common email bill pay scams.

Does TCH provide bill payment?

An article in today’s PaymentsSource suggests that TCH will play not just a role in settlement but will also provide bill payment product through its Request for Pay solution which can be imbedded in the Zelle app:

Does Zelle guarantee funds?

Funds are guaranteed by the sender bank so the risk is managed, but as Zelle is used for larger and larger transactions–some in the millions of dollars –banks and credit unions can get a little uneasy. This is where TCH steps in to provide instant settlement between banks for Zelle transactions for those FIs who can receive RTP transactions.

Does Zelle have ACH?

Today, Zelle transactions are messaged in real time and the recipient has access to funds immediately, but the settlement of funds between the sender’s and recipient’ s banks is managed through ACH . This means that the recipient banks may incur some settlement risk as they wait for the next ACH batch.

Who owns early warning and TCH?

The owners of Early Warning and TCH are banks who have a business model around receiving interchange through the card networks. They aren’t going to bite the hand the feed them.