How Does The Settlement Process Work In Payment Gateway

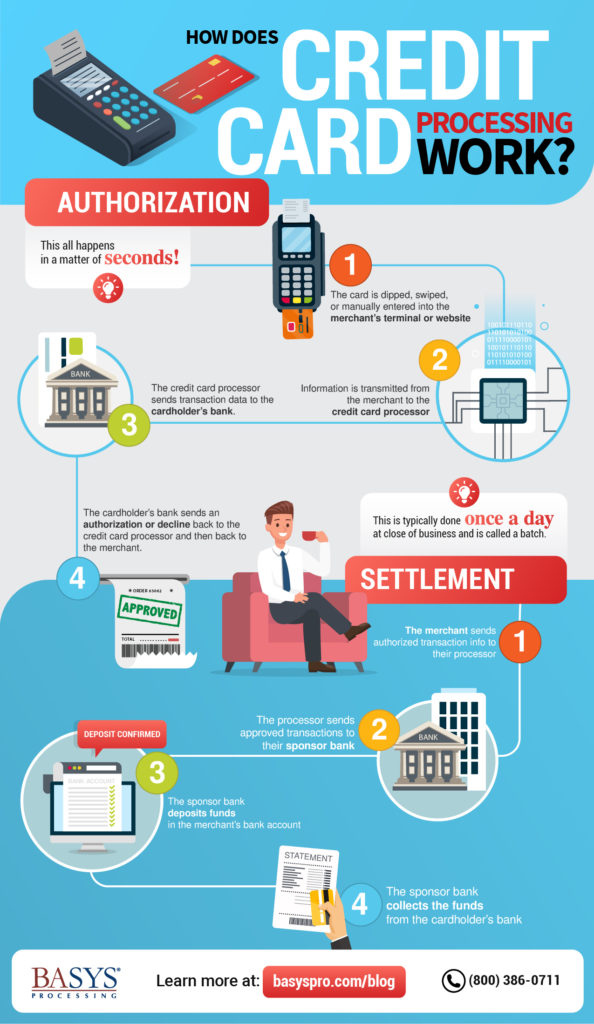

- The Settlement Process Has Several Steps. The client starts the payments interaction by entering the record subtleties or swiping the card to pay for stock.

- Settlement is for the most part done: On request when day's end settlement message is gotten.

- About Nodal Bank – where your payment rests. ...

- Conclusion. ...

What is a good settlement amount?

What is a good settlement amount? Very roughly, if you think that you have a 50% chance of winning at trial, and that a jury is likely to award you something in the vicinity of $100,000, you might want to try to settle the case for about $50,000.

How to cash out structured settlement payments?

- Withdraw any payment or amount of money earlier than the pre-set date

- Change the amount of the periodic payments (how much to get in a payment)

- Change the future payment structure (when to get the payments)

How to sell structured settlement payments?

Your Quick Guide to Selling Structured Settlement Payments

- Decide How Much You Want to Sell. When selling structured settlement payments, you have the option of selling the entire annuity or part of it.

- Ask for Quotes. Next, you’ll need to consult with a company to get a quote. ...

- Sign the Contract. ...

- Get a Judge’s Approval. ...

- Get Cash Now by Selling Structured Settlements. ...

What is average settlement period?

The Average Settlement Period for Trade payables depicts with an average of 250 days an even higher period for goods to be paid by the business to suppliers. Considerable reasons for this result might be a special trade payment agreement with some suppliers.

How is money distributed when resolving a claim with a structured settlement?

Depending on the terms of your contract, your payments may be distributed on a monthly, yearly or quarterly schedule. Payouts may be in fixed amoun...

How much will I pay in taxes on my settlement money?

Section 104(a)(2) of the federal Internal Revenue Code excludes damages paid for physical injuries or wrongful death. Punitive damages, however, ar...

How do I sell my structured settlement?

The process for selling your structured settlement involves researching structured settlement purchasing companies, shopping around for the best qu...

What is settlement in trading?

Settlement is the interaction through which a trader gets cash paid by their end clients for a specific item. There are various substances associated with the settlement interaction.

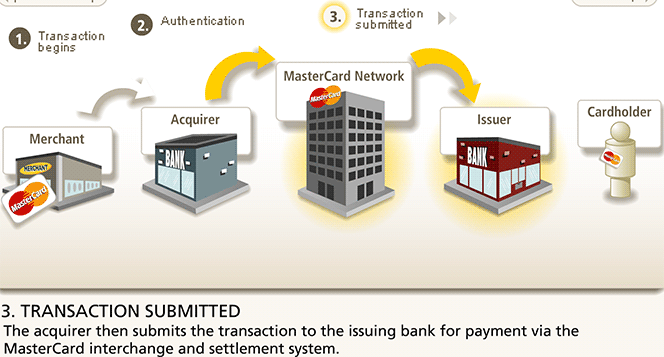

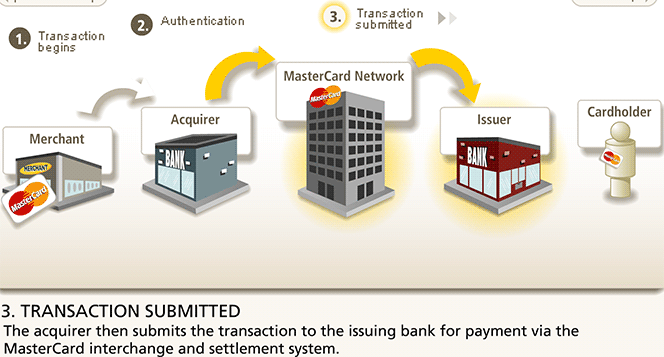

How does a client start a payment?

The client starts the payments interaction by entering the record subtleties or swiping the card to pay for stock. After effective confirmation of client's and client's bank subtleties, the said sum is charged from the client's ledger. The charge sum gets moved to the gaining bank visa card organizations. The acquirer at that point charges this sum in the shipper's record.

What happens after the client continues with the payment?

After that when the client continues with the payment; enters the subtleties and chooses the payment alternatives and snaps on the Pay Now choice then these subtleties are shipped off the PayG worker in a got way.

What is a payment gateway?

A payment gateway is what keeps the payments climate moving effectively, as it engages online payments for purchasers and associations. In the event that you're an online broker, you ought not to be a payment gateway ace, anyway it justifies understanding the essentials of how an online payments streams from your customer to your record.

What happens when a payment commencement is done?

When the payment commencement is done, the responsible bank moves the assets to the payment processor. The payment processor at that point moves these assets to the procuring bank and afterward the exchange sum gets charged in the dealer's record.

Do payment gateways need a nodal account?

According to the RBI rules, the payment gateways and aggregators need to keep a Nodal Account. This is controlled and overseen by the actual bank which implies that the payment gateways or aggregators can't utilize the assets in that financial balance for some other reason than to settle it to the separate dealer to whom the payments have a place.

How does a settlement work?

Settlement offers work only if it seems you won’t pay at all, so you stop making payments on your debts. Instead, you open a savings account and put a monthly payment there. Once the settlement company believes the account has enough for a lump-sum offer, it negotiates on your behalf with the creditor to accept a smaller amount.

What does debt settlement mean?

Debt settlement means a creditor has agreed to accept less than the amount you owe as full payment. It also means collectors can’t continue to hound you for the money and you don’t have to worry that you could get sued over the debt. It sounds like a good deal, but debt settlement can be risky:

What happens if your credit score is shredded?

Your credit scores will have been shredded, you will feel hopelessly behind and your income won’t be enough to keep up with your debt obligations. Debt settlement companies negotiate with creditors to reduce what you owe, mostly on unsecured debt such as credit cards.

What are the two largest debt settlement companies?

There’s no guarantee of success: The two largest debt settlement companies are National Debt Relief and Freedom Debt Relief. Freedom Debt, for instance, says it has settled more than $8 billion in debt for more than 450,000 clients since 2002.

What to do if you don't want to use a debt settlement company?

If you don’t want to use a debt-settlement company, consider using a lawyer or doing it yourself.

What to do if you don't want to settle debt?

If you don’t want to use a debt-settlement company, consider using a lawyer or doing it yourself. A lawyer may bill by the hour, have a flat fee per creditor, or charge a percentage of debt or debt eliminated. Once you’re significantly behind, it usually doesn’t hurt to reach out to your creditors.

How to reduce debt?

Reduce your debt in three steps: 1. Get a handle on what you owe. 2. Assess which payoff strategy will work for you. 3. Set a goal and track your progress. More

What is the process of settlement between banks?

Banks settle payment with each other based on shared ledgers. This could be a direct relationship or assisted via the central bank or correspondent banks. Most of the transaction settlement is via correspondent banking.

What is a settlement bank?

In most cases, a settlement bank is used. The settlement bank will usually settle all the net transactions at the end of the day (at a particular anointed time and will settle the net funds for all the participating member banks). In this example, let us consider three banks:

Can settlement process be applied universally?

Here is a generic settlement process example as shown below. It can be applied universally all across for payments. For some intricate payment scenario the model slightly changes, but the gist of it remains the same.

Does money move?

Remember, nothing more than a message is sent across. No money actually moves. Just an "instruction" (or message).

Who will we loan the money to?

In simple words, we will loan the money to whomsoever needs it immediately, because I have already been assured by the switch that the money is available, and you will settle with me later on.

Can a switch operator have a settlement bank?

As a switch operator or payment system operator, they too will have a Settlement Bank to use.

How Does Debt Settlement Work?

These days, nearly everyone has debt of one kind or another. Home mortgages, car loans, credit cards, and student loans are a fact of life in the current American financial landscape.

What Is Debt Settlement?

Simply put, debt settlement is when your creditors accept less than the full amount they are owed in order to avoid the total losses they would face if you declare bankruptcy. This amount is usually a relatively small (sometimes very small) percentage of the total amount.

Why You Settle

One of the central aspects of the question “ How does debt settlement work ?” is the question “Why would I need to settle?” The simple answer is: to stave off bankruptcy. Debt settlement is not a process you undertake because you don’t want to have to make payments any more, nor is it a “get out of debt free (or cheap)” card. It’s a last resort.

Why Creditors Settle

It may seem counter intuitive for creditors to settle or accept debt consolidation. All things being equal, it would seem to be better for them to persist in attempting to collect the full amount of your debt. After awhile, though, too many bad debts in their records becomes a problem for them.

How Creditors Behave

While your creditors will be willing to settle if they have to, they do not want to. They would prefer, of course, to recoup all of their money, rather than have to settle for only getting some of it back. To that end, they will often take measures that are unsavory, even mean, in order to get you to pay in full.

What Debt Settlement Means For Your Credit

One of the questions you need to ask when you start asking “How does debt settlement work?” is “How will it impact me in the future?” The simple answer here is that debt settlement will all but ruin your credit. Much like a bankruptcy, debt settlements have a strong and long-lasting negative impact on your credit score.

Why is the Net Settlement System Important?

The net settlement system allows banks to be flexible and gain more freedom in exchanging and transferring funds between each other.

What is net settlement?

A net settlement is an inter-bank payment settlement system wherein banks collect data on transactions throughout the day and exchange the information with the clearinghouse and the central bank. Federal Reserve (The Fed) The Federal Reserve is the central bank of the United States and is the financial authority behind the world’s largest free ...

What is bilateral net settlement?

Bilateral net settlement systems are payment systems in which payments are settled for each bilateral combination of banks. Banks that send out more funds in transfers than they receive (i.e., banks with a positive net settlement balance) are credited with the difference, and banks with a negative net settlement balance pay the difference.

What is the net settlement amount of Bank A and B?

At the end of the day (i.e., the exchange period), the clearinghouse processes the transactions and confirms that Bank A’s net settlement amount is –$600,000, and Bank B’s net settlement amount is $600,000.

What does "600000" mean in the bank?

It means that at the end of the day, Bank A owes Bank B the full $600,000.

When was the Bank for International Settlements established?

Bank for International Settlements (BIS) The Bank for International Settlements (BIS) started in 1930, and is owned by the central banks of different countries. It serves as a bank for member central banks

When is a bank statement prepared?

Bank Statement A bank statement is a financial document that provides a summary of the account holder’s activity, generally prepared at the end of each month.

How to make sure your settlement process runs smoothly?

You can also make sure the settlement process runs smoothly by giving your employees the contact information for your insurance company. This will help them stay updated on your business’ work injury policies.

How Does a Workers’ Comp Settlement Work?

Instead, they can go after a monetary settlement with the help of workers’ comp lawyers.

What happens if you don't settle for workers comp?

Workers’ comp settlements can end with one lump sum amount or a structured payment plan . However, if your employee doesn’t settle or isn’t willing to negotiate, it could go to trial. This is often referred to as a workers’ comp hearing or workers’ compensation lawsuit.

Do all workers comp cases end in a settlement?

Not all workers’ comp cases will end in a settlement offer. They are most common for permanent disability claims.

What is workers compensation settlement?

Workers Compensation Settlements. Workers compensation insurance provides a safety net for medical expenses and lost wages of those who get hurt on the job. But that doesn’t mean such workers have to accept whatever the insurance company offers. A workers compensation settlement is a way you can negotiate the immediate payment ...

How Is a Settlement Calculated for Workers Compensation?

The formula for calculating a workers compensation settlement package involves four major factors:

What happens if you dispute a workers comp claim?

If your claim is disputed, a trial or workers comp hearing is time-consuming and risky. The judge or hearing officer may award you less money than the insurance company offered to settle your workers comp claim. Note: Workers comp settlements are entirely voluntary. You don’t have to agree to a settlement offer proposed by your employer ...

How long does it take to settle a workers comp case?

Short answer: It varies greatly. The Martindale-Nolo survey of readers turned up an average of 15.7 months to resolve a case, and less than 20% of cases are resolved in less than six months. Obviously, those who try to negotiate a better workers comp settlement may hire legal assistance to negotiate the best terms for a settlement or to bring a hearing if there is a disputed issued. This can be time consuming. However, a shorter time frame is not always better. Those actions that lengthen the process can also bring higher settlements.

Why do you settle a lump sum claim?

If you settle the claim, you can choose or change your physicians. However, if you have severe and complicated work-related injuries, you may not want to settle the medical portion of the claim because you can be entitled to medical benefits for your accident for the rest of your life. Some injuries are too complicated to take the risk that you will not have enough money through a settlement to meet your medical needs.

How long does it take for a settlement to be approved?

Those actions that lengthen the process can also bring higher settlements. Once an agreement is reached, it can take four-to-eight weeks for money to arrive while settlement contracts are drafted, signed and approved.

Do you have to agree to a workers comp settlement?

You don’t have to agree to a settlement offer proposed by your employer or its insurance company, nor do you have the ability to force the employer or insurer to settle your claim. Talk with an attorney for free today, and find out how much money you could receive in a workers comp settlement.