How long does it take for insurance to pay a claim?

North Carolina - Insurers have 30 days to acknowledge a claim and then 10 days after settlement to pay the claim. Texas - Insurers have 30 days to accept or reject a claim and then five days to issue payment once a settlement is agreed upon. However, the amount of time for the claims process usually depends on the specific claim.

How long after a car accident can you make a claim?

In some states, you can wait up to one year or longer to file a claim after a collision. How long does an insurance claim take? A car insurance claims process can be resolved in as little as a few weeks, or as long as a few months.

How long does it take to settle a personal injury claim?

After a settlement demand is sent with the relevant medical bills and records and other information necessary to resolve the claim, it takes the insurance company time to evaluate the claim. Most injury claims should not take more than three weeks.

How long does it take to get paid after a settlement?

How Long Does It Take to Get Paid After a Settlement? Depending on your case, it can take from 1 – 6 weeks to receive your money after your case has been settled. This is due to many factors but below outlines the basic process.

How long does it take settlements to pay out?

While rough estimates usually put the amount of time to receive settlement money around four to six weeks after a case it settled, the amount of time leading up to settlement will also vary. There are multiple factors to consider when asking how long it takes to get a settlement check.

How long does it take for insurance to pay you back?

Within 30 DaysMost Insurance Companies Pay Claims Within 30 Days Most insurance companies set goals to pay out accepted claims within 30 days of receiving the initial claim. Within those 30 days, the company should assign a claims adjuster to the case, review the facts, accept or deny the claim and issue prompt payment.

How long does an insurance company have to settle with you?

within 85 daysA: California state law requires insurance carriers to settle claims within 85 days after the date of filing. Other deadlines come into play when contacting claimants and completing other steps in the auto insurance claim process.

Why is my car accident settlement taking so long?

High Value Claims In cases of serious injury or extensive property damage, the time it takes to settle your claim could be longer. The higher the value of your claim, the more complex the negotiation becomes and the longer an insurance company may draw out the process.

How long does it take to get insurance check for totaled car?

The time it takes to pay out a claim depends on the severity of the accident and the policies of the involved car insurance companies. On average, it takes one week to one month for an insurance company to pay out a claim.

How long does a car accident claim take to settle?

If you and the insurance company are able to agree on a fair settlement, the process to receive your check typically takes around four to six weeks. The insurance company will have you sign a release form.

Why do insurance claims take so long?

There are several factors that can affect exactly how long it takes for an insurance company to settle a claim. For example, claims involving serious or multiple injuries take longer to settle. Additionally, poor communication between the driver, insurance company, and insurance adjuster can slow down the process.

Why do insurance adjusters take so long?

The most common reason for an insurer's delay is the adjuster's case load. An adjuster likely has dozens of claims to handle at a time. Many decisions made by insurers require the approval of one or more superiors, who also will have many other claims to review.

How long does it take for an accident claim to be settled?

Most injury claims should not take more than three weeks. But it often does. Your accident lawyer needs to be following up with the insurance company to keep your case at the front of the line.

Why is my car accident settlement taking so long?

When victims ask why their call accident settlement is taking so long, they are often implicitly asking if their car accident lawyer's neglect is the reason for the delay. The answer? Maybe. There are bottlenecks in the settlement process that no amount of hustle can speed up. So it may be there is nothing your accident lawyer can do because the attorneys is waiting on medical records or waiting for the insurance company to respond. But there is no question that the delay is often the result of a plaintiff's lawyer who is not staying on top of the case.

What do car accident lawyers need to collect?

If a case is going to be settled fast without a lawsuit for top value, a car accident lawyer will need to obtain all of the medical records and bills for the client. At our law firm and many personal injury firms, it is the lawyer’s job to collect the medical bills and records.

How long does it take to get a response from insurance?

Getting a response to the demand package. This takes between 15 and 90 days. (We look at all the major insurance companies and take a look at the average time of how long they take to respond.)

When is the best time to settle a lawsuit?

The best time to settle is often right after the lawsuit has been filed. The insurance company now knows you are serious. With many insurers, this can often lead to an immediate and meaningful increase in the offer (GEICO, Nationwide. Liberty Mutual, and Progressive come to mind more than State Farm and Allstate).

How long does it take for a patient to complete a treatment?

Treatment is completed or the patient is at maximum medical improvement. The timeline on this is anywhere from 1 day to years.

Do insurance companies have to respond to a bodily injury letter?

In most states, there is no rule requiring the insurance company to respond at all.

How Long Does a Car Insurance Claim Take To Settle?

According to HG.org, the answer to the question "How long does a car insurance claim take to settle?" depends on a number of factors, but most importantly, it comes down to how clear-cut the claim is. If the damages are clear, easy to value, involve only property, and the person at fault is clear, claims can be settled quickly.

How long does it take to settle a claim?

Claims that involve medical damages and personal injury, on the other hand, can take several months or more to settle, with some of the most complex cases taking years. Some cases never settle.

How long does it take to get a physical damage claim?

Physical damage and medical claims can take a bit longer because they can be more complex. In a physical damage claim, the time frame required depends on the extent of the damage. Usually, you'll hear from an insurance adjuster within three days of making the claim to discuss matters. If they need to survey the damage, it can be a few more days.

Why do insurance companies file claims so quickly?

They will certainly do their best to get it filed as fast as they can because the insurance company is a business and they don't make money by dragging out complicated claims. Factors that can influence the general time frame of your claim include: state laws. your insurance company.

What are the different types of claims?

Aside from general liability, collision, and comprehensive claims, there are a variety of other types of claims you might make, some of which can save you money without taking the full hit to your rates. According to Overett Group Attorneys, these include such things as: 1 roadside assistance 2 glass replacement 3 physical damage 4 medical claims

How long does it take for roadside assistance to be reimbursed?

Usually, if you need to get reimbursed for these, it's just around a week, from five to eight business days, for the check to arrive.

What types of claims can you make without taking the full hit to your rates?

Aside from general liability, collision, and comprehensive claims , there are a variety of other types of claims you might make, some of which can save you money without taking the full hit to your rates. According to Overett Group Attorneys, these include such things as:

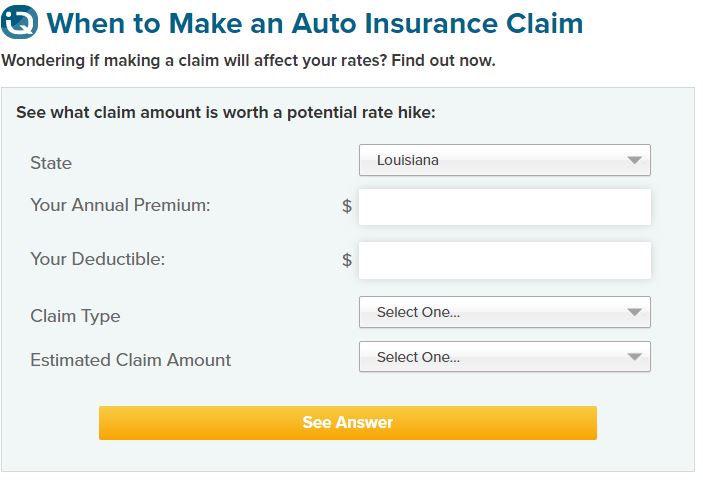

How Much are you Looking to Get?

How long insurance settlement negotiations will take depends partly on how much money you hope to get out of this situation. Whatever your situation, your insurance company will be attempting to pay as little as possible to you. It's just good business for them. But this may not be good for you.

How Strong is your Case?

You power in insurance settlement negotiations lies in the strength of your case.

How Long Will all of this Take?

The honest and often unsatisfying answer to this question is that your case will be unique. You cannot know for sure ahead of time how long insurance settlement negotiations will last. All you can do is gather all the evidence and documentation concerning your case that you have and work to understand the insurance settlement negotiation process.

Protect Yourself With Legal Help

To be certain of your ability to negotiate you should consider hiring a lawyer to assist you or to handle the matter for you. When an insurance company does not want to pay, or does not want to pay your full and rightful claim, you can be certain that they will have a strong legal team on the case, and to protect your rights, so, too, should you.

How long does it take for a car insurance company to settle a claim?

Most states protect consumers by demanding insurers handle the claims promptly. Some states even require a specific period, such as 30 days. During that time, the car insurer acknowledges the claim, investigates and makes a fair settlement.

How long after an accident can you file an insurance claim?

The length of time you have to file a claim after a crash varies based on your state and the type of claim.

How long does it take to receive a loss and claim payment in Texas?

Loss and claim payment should be mailed within 10 business days after the claim is settled. Texas -- An insurer must acknowledge the claim within 15 days of receiving it. Within 15 days of receiving all the necessary paperwork, insurance companies must accept or deny the claim.

How long do insurance companies have to accept a claim?

They may say an insurer must handle claims in a “reasonable time.”. Here are three examples of specific time limits: California -- Insurance companies have 40 days to accept or deny a claim. If insurers need more time, they must notify you every 30 days about the claim’s status.

How long does it take for an insurance company to acknowledge a claim in North Carolina?

North Carolina – An insurance company has 30 days to acknowledge a claim. The acknowledgment can include denying the claim, making an offer of settlement, paying the claim or advising you that the investigation into the claim is ongoing.

What happens if you have full coverage collision insurance?

If you have a full coverage policy with collision coverage, your insurance company will pay an insurance settlement for your vehicle’s repairs, up to your car's actual cash value. You will also have to pay your collision deductible.

What to do if you get into an accident?

If you get into an accident, the first thing you need to do is make sure everyone is OK. Then, you’ll want to call the police if the crash involves another person. Police can investigate the collision and take statements. If you don’t call the police, you can file a police report at the station.

What happens when you get a personal injury settlement?

Once the insurance company finally agrees to a personal injury settlement, most victims are eager to wrap up their case, receive their compensation, and start using that money to address their medical bills and other costs.

How long does it take to settle a personal injury claim in Texas?

While most personal injury settlements in Texas finalize within six weeks or less, the process to get there can be a bit complex. Fortunately, if you know what to expect, you’ll find this process a lot easier to navigate. Keep reading to learn more about the various steps in the personal injury settlement process.

What happens when you deposit an insurance check in Texas?

Upon receipt, your attorney will deposit the insurance check into a special trust or escrow account. This is only temporary, and it’s not your attorney’s decision — it’s a mandatory part of the settlement process under State Bar of Texas rules. Once the settlement check clears, your lawyer will distribute your settlement money.

What happens to the settlement check after it clears?

Once the settlement check clears, your lawyer will distribute your settlement money. Usually, your lawyer will have to use some of your settlement money to settle various unpaid debts (also called liens). For example, your lawyer might have to send portions of your settlement money to: Medical providers with unpaid bills.

How often does an annuity pay out?

For example, if you received a structured settlement, your annuity might pay you a portion of your settlement every month, every year, or every few years.

Why do insurance companies delay payment?

While this process should run smoothly, insurance companies sometimes delay payment for various reasons, including flat-out clerical errors. If you experience prolonged delays while waiting for your settlement check, you should contact your lawyer for assistance.

How does a personal injury claim get paid?

On rare occasions, a personal injury claim gets paid through a structured settlement, which is an arrangement that involves the victim receiving portions of their settlement over time. Typically, these structured settlements occur when the victim is a minor or has a catastrophic injury claim that involves ongoing, expensive medical and nursing care.

What happens after a settlement is reached?

After a settlement has been reached, your attorney will pay any outstanding medical or automobile bills. This process can be sped up if your attorney has all the most current bills.

What happens after you pay court fees?

After all other fees are paid, then the remainder of the funds will go to you. Common court fees are for filing of settlements, fees to force witnesses to appear, and other court expenses.

What is structured settlement?

If you have been awarded a large sum, it may come in the form of periodic payments. These periodic payments are called a structured settlement. If you have a structured settlement but would like more of your money now, read up on sell structured settlement details to see if this is the right path for you about “ how long does it take ...

How long does a bank hold money?

If you receive a large sum of money at once, your bank may hold some of the money for 3-9 business days. This helps to ensure that the money that is deposited comes from legitimate sources. At the end of a long case, the last thing you want to hear is that it will take longer to receive your funds. Rest assured your attorney will be working ...

When will insurance companies issue checks?

After the Agreement Is Signed. While an agreement may have been made, the insurance company will not issue a check until the legal paperwork has been signed. It may take some time to ensure all the legal paperwork is signed and appropriately filed.

Can you get a check after a certain time?

Typically if checks are received after a certain time of day or day of the week, they will be processed on the next business day. Weekends and holidays can delay check processing.