Cashing in Your Settlement Check With Your Bank For up to two business days for checks against an account at the same institution. For up to five additional days for other banks (totaling seven days)

Full Answer

How long does it take for a settlement check to clear?

In most cases, the defendant sends the check to your lawyer. Once your lawyer receives the check, they usually hold it in a trust or escrow account until it clears. This process takes around 5-7 days for larger settlement checks.

Can I cash a settlement check from an insurance company?

If you typically have in excess of $30,000 in your account, the bank might let you cash the item, because it could recoup the money from your account if the drawee bank returns the item unpaid. Very often settlement checks issued by insurance companies are returned unpaid because the issuers require endorsements to match the payee line.

When do you receive your settlement money?

Once your attorney pays off any remaining liens and subtracts legal costs (e.g. hours devoted to your case, court reporting costs, expert witness fees, private investigator fees, etc.), you will receive your settlement money. How Long Does it Take to Get a Personal Injury Settlement Check?

How long does it take for a bank to cash a check?

If the representative agrees to cash the item, she will probably require you to wait two or three days for the bank to make a special cash shipment order. Agree to a time to cash the check. If the check is large, you must contact the bank ahead of time to schedule your visit.

What is the best way to cash a settlement check?

Check-cashing and payday loan stores can be a good option for those who do not possess a bank account or where the check is too large to be cashed in at a retailer. Photo ID will be required. Check-cashing stores can charge considerable fees, often based on a percentage of the amount cashed in.

How can I cash a large settlement check without a bank account?

Cash a Check without a Bank AccountCash it at the issuing bank (this is the bank name that is pre-printed on the check)Cash a check at a retailer that cashes checks (discount department store, grocery stores, etc.)Cash the check at a check-cashing store.More items...

Can I cash an expired settlement check?

After June 8, 2020, any uncashed settlement checks will be voided and cancelled. Do not attempt to cash any settlement checks after the void or expiration date listed on the check, or you may be subject to bank fees. If you still have an uncashed settlement check issued in 2019, you should not attempt to cash it.

How long does it take to cash a settlement check?

You can deposit the settlement check into your bank account and use it any way you wish. It can take about six weeks for you to have the money in your hands. Most law firms issue paper checks to their clients.

What to do with a $100000 settlement?

What to Do with a $100,000 Settlement?Sort Out Tax Implications.Find a Financial Advisor.Pay Off the Debts.Invest in a Retirement Home.Start a Business or Help Friends and Family.Donate the Money to the Needy.Final Words.

How long does it take for a $30000 check to clear?

Most checks take two business days to clear. Checks may take longer to clear based on the amount of the check, your relationship with the bank, or if it's not a regular deposit. A receipt from the teller or ATM tells you when the funds become available.

Can I cash a 2 year old check?

Banks don't have to accept checks that are more than 6 months (180 days) old. That's according to the Uniform Commercial Code (UCC), a set of laws governing commercial exchanges, including checks.

What do you do with expired settlement checks?

How to Replace Expired Cashier's Checks. If the expired check was a cashier's check, also known as a bank or certified check, visit the issuing financial institution to have a new one issued. The California State Controller recommends using cashier's checks within three years and money orders within seven years.

What happens if I forgot to cash a check?

If somebody worries that a check got lost, they may decide to stop payment—an order not to pay a check that has been issued, but not cashed—on that check. The bank will then reject your deposit, and it'll bounce back to your bank unpaid.

Can I deposit a large settlement check?

You will be free to deposit that settlement check anywhere that you choose. If the check is a large sum of money, you can speak to a personal financial planner to decide how you want to disburse the check to yourself.

What is the largest check a bank will cash?

Banks don't place restrictions on how large of a check you can cash. However, it's helpful to call ahead to ensure the bank will have enough cash on hand to endorse it. In addition, banks are required to report transactions over $10,000 to the Internal Revenue Service.

What happens when you deposit over $10000 check?

Depositing a big amount of cash that is $10,000 or more means your bank or credit union will report it to the federal government. The $10,000 threshold was created as part of the Bank Secrecy Act, passed by Congress in 1970, and adjusted with the Patriot Act in 2002.

What is the maximum amount you can cash a check for?

According to the Consumer Financial Protection Bureau, a check can be cashed for any amount if it is written on an account from the institution where it is being cashed, there is enough money in the account to cover the check, the check is dated within the last six months and the person cashing the check presents a ...

Can my lawyer cash my settlement check?

While your lawyer cannot release your settlement check until they resolve liens and bills associated with your case, it's usually best to be patient so you don't end up paying more than necessary.

Will Walmart cash a settlement check?

Retail or Convenience Store Several retail chains offer check cashing services. Walmart cashes a wide variety of checks that include legal settlement checks.

What do I do if I have a large settlement?

– What do I do with a large settlement check?Pay off any debt: If you have any debt, this can be a great way to pay off all or as much of your debt as you want.Create an emergency fund: If you don't have an emergency fund, using some of your settlement money to create one is a great idea.More items...•

Why do people get settlement checks?

People across the U.S. receive settlement checks from insurance companies for a variety of reasons, including payouts connected to car accidents and storm damage. Most settlement checks are payable to the insured and a third party involved in the case, such as an automobile repair shop or attorney. Banks cannot cash checks payable ...

Why are settlement checks returned unpaid?

Very often settlement checks issued by insurance companies are returned unpaid because the issuers require endorsements to match the payee line. Omitting a middle initial or suffix or abbreviating a name could cause the drawee bank to reject the item for improper endorsement.

How to cash a check with a Patriot Act check?

When you arrive at the branch, give the teller your two forms of ID. You will probably be required to provide a thumb print sample somewhere on the check. Due to the amount of the check, the teller will call the drawer or the drawee bank (if you are not at the drawee bank) and verify the legitimacy of the check before cashing it. The teller may ask you some additional questions about the source of the funds. The Patriot Act requires banks to maintain information on people conducting certain large dollar transactions. Having established your identity, the teller will cash the check. Request a bag to conceal the money in as you leave the bank. The bank may charge a check cashing fee of between $5 and $10.

Why won't my bank cash a check that exceeds my average balance?

Your bank will not cash a check that exceeds your average balance because the drawee could return the check unpaid at a later date, in which case the bank would incur a loss.

How to find drawee bank on insurance check?

On the front of the check, usually under the numeric dollar amount , you will see the name of the drawee bank. Some insurance checks feature the names of two banks: a drawee bank and a bank through which the check is payable. If negotiating your check involves just one bank, look the bank up online and locate a nearby branch. Because of the high dollar amount, you may need two forms of identification.

Why won't my bank cash my check?

The bank may refuse to cash the check, because federal laws do not require banks to negotiate checks for non-customers and banks do not keep excess cash on hand. If the representative agrees to cash the item, she will probably require you to wait two or three days for the bank to make a special cash shipment order.

What to do if a check is large?

If the check is large, you must contact the bank ahead of time to schedule your visit. Branches do not always have sufficient cash on hand to provide to customers with large checks.

How long does it take for a settlement check to be delivered?

While many settlements finalize within six weeks, some settlements may take several months to resolve.

What happens when you get a settlement check?

When you finally reach a settlement, there are a few more things you and your lawyer need to do before the defendant gives your lawyer the check. Even so, once the check reaches your lawyer, there are a few obligations they must attend to before they give you the final balance.

How long does it take to settle a liens claim?

It’s usually easy to settle liens, unless the government has a lien against your settlement. If you have any liens from a government-funded program like Medicare or Medicaid, it takes months to resolve them. Your lawyer also uses your settlement check to resolve any bills related to your lawsuit.

How long does it take for a check to clear?

Once your lawyer receives the check, they usually hold it in a trust or escrow account until it clears. This process takes around 5-7 days for larger settlement checks. Once the check clears, your lawyer deducts their share to cover the cost of their legal services.

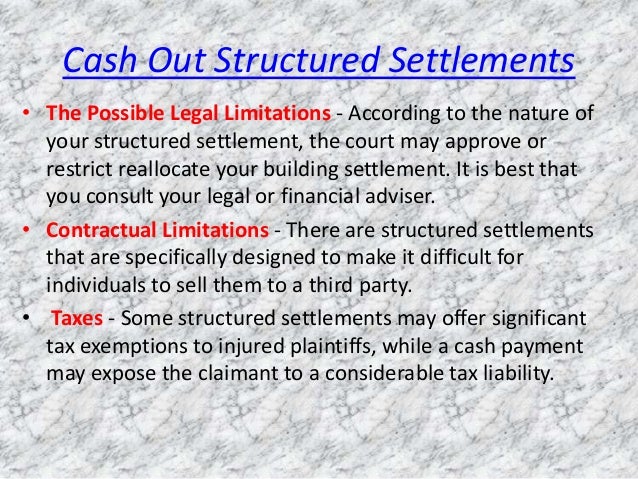

What is structured settlement?

Unlike a regular settlement that pays the settlement amount in full, a structured settlement is when a defendant pays the settlement amount over time. These types of settlements usually occur when the case involves a minor or if there was a catastrophic injury that requires extensive ongoing medical care.

What form do you sign to get a settlement?

The first form you have to sign to get your settlement is a release form. This form is a legally binding agreement stating that you will not pursue further legal action against the defendant for your specific case. Most defendants or insurance companies won’t give you a settlement check unless you sign the release form. However, if you have concurrent lawsuits against the same defendant for a different matter, you don’t have to stop pursuing those claims.

How to speed up the delivery of a settlement check?

Once you get close to a settlement, start drafting a release form ahead of time so it’s ready once you reach an agreement.

How long does it take for insurance to pay settlement checks?

The question is how long can the insurance company take to pay you this check? The answer is that a private insurance company has three weeks to send you your settlement check, provided your attorney has sent them all the appropriate copies of the closing documents.

How long does it take to get a settlement check in New York?

However, if the defense is a municipal agency or the City of New York, then this three-week provision does not apply, and it can take quite a long time before you receive your settlement check. Secondly, the three-week provision will also not apply to wrongful death matters.

What is the closing document of a case?

One of the closing documents will be what is known as stipulation of discontinuance. This document has to be filed with the court, which enables everybody in the system know that this case has been settled.

Is the defense responsible for payment of claims?

The document says that if you receive money or claims from any other places, we the defense are not responsible for payment of any of these issues.

Do insurance companies pay victims?

In most personal injury cases such as accident cases or medical malpractice cases, an insurance company of the defendant will actually be making the payment to the victim. With this information, the insurance company will be actively involved in the settlement discussions, and once you have agreed to a settlement, you can expect a check from the insurance company.

What is a check cashing store?

Check cashing stores often specialize in cashing checks for people who don't have bank accounts, need the money immediately or have a check too large for others retailers to cash . Payday loan stores also offer check cashing services without requiring you to take out a loan or payday advance.

Do payday loan stores cash checks?

Payday loan stores also offer check cashing services without requiring you to take out a loan or payday advance. For example, Amscot cashes insurance settlement checks up to any amount. A government issued photo ID is required. Fees vary based on the location and amount of the check.

How long does it take for a settlement check to clear?

The attorney may hold the check in a trust or escrow account until it clears. This may take several days, especially if it is a large check.

What is the first step in receiving a settlement check?

Release Form. The first step in receiving your settlement check is to sign a release form that states that you will not pursue any further monies from the defendant for the specific incident in question. The defendant or the defendant’s insurance company will not send a check for your damages without such a form.

What happens if you owe child support?

If you owe child support, a lien may be issued against your settlement. Liens must be paid off before you receive your remaining portion of the settlement. In some instances, your attorney may try to negotiate to have the value of these liens reduced so that you will wind up with more money in your own pocket. However, this negotiation can take up additional time and slow down the receipt of your settlement funds. The internal process of the defendant’s insurance company may also cause a delay, such as if the claim is processed in one state office and the check comes out of another state’s office.

How to speed up a settlement?

The release may indicate the amount of time that actual payment is expected. You can ensure that you submit all documents to your attorney that the defendant requires before cutting a check. Your attorney can also use expedited shipping and return receipt request mailings to avoid excuses that documents were not received by the defendant. If you anticipate that you will owe medical providers or other creditors' funds, you may ask your attorney if you can receive a partial distribution while your attorney holds the rest and settles your outstanding claims.

What are some examples of delay in a settlement?

There are several instances when a delay may occur. For example, the defendant may have its own release form. Your attorney and the defendant’s attorney may have to revise this form until it is acceptable to both parties. Certain cases may require more preparation, such as cases involving estates or minors. You may have a medical lien or other lien against the proceeds of your settlement. For example, a medical provider may have a lien against you if it has not received payment for the services you incurred during an accident.

Can an attorney give you an estimate of when you can expect your check?

While you can ask your attorney to give you an estimate of when you can expect your check, the answer to this question depends on a number of factors, such as the defendant’s policy, the type of case that it is and whether there are any extraneous circumstances affecting payout.

Do insurance companies have loopholes?

However, there are usually loopholes that experienced defendants and insurance companies know about to avoid these negative ramifications, such as the statute not saying how long an insurance company has to process the actual release form.