How long do settled accounts stay on your credit report?

Settled accounts are potentially negative and remain for seven years. Settled accounts stay on your credit report for seven years. Settling an account for less than the full balance owed is considered potentially negative because you did not repay the entire debt as agreed under the original contract.

How long does debt settlement affect your credit score?

In some cases, debt settlement is your best option for debt relief. Unfortunately, it can leave an ugly mark on your credit report. Settled debt in good standing will remain on your credit report for seven years. But it can remain on your report for years more if you are not careful.

How long does a late payment stay on your credit report?

If there is a history of late payments, the account will be updated to show that is settled and will remain in your credit report for seven years from the date the account first became delinquent and was never again current. That date is called the original delinquency date.

How long do delinquencies stay on your credit report?

Delinquencies are reported to the credit bureaus after 30, 60, 90, and 120 days of being late. A settled debt with no delinquent payments will stay on your credit report for seven years from the date it was settled accordingly to regulations outlined in the Fair Credit Reporting Act (FCRA).

Can I get a settlement removed from credit report?

That's a common question. Yes, you can remove a settled account from your credit report. A settled account means you paid your outstanding balance in full or less than the amount owed. Otherwise, a settled account will appear on your credit report for up to 7.5 years from the date it was fully paid or closed.

How long does it take for your credit score to improve after debt settlement?

between 6 and 24 monthsHowever, a debt settlement does not mean that your life needs to stop. You can begin rebuilding your credit score little by little. Your credit score will usually take between 6 and 24 months to improve.

How many points does a settlement affect credit score?

Debt settlement practices can knock down your credit score by 100 points or more, according to the National Foundation for Credit Counseling. And that black mark can linger for up to seven years.

How do I remove paid accounts from my credit report?

A goodwill deletion is the only way to remove a legitimate paid collection from a credit report. This strategy involves you writing a letter to your lender. In the letter, you need to explain your circumstances and why you would like the record of the paid collection to be removed from your credit report.

Is it better to settle a debt or pay in full?

It is always better to pay off your debt in full if possible. While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative.

How do I raise my credit score after a settlement?

How to Improve CIBIL Score After Loan Settlement?Build a Good Credit Repayment History. ... Clear off Pending Dues. ... Manage Credit Cards Better. ... Apply for a Secured Card. ... Credit Utilisation. ... Do Not Raise Frequent Loan Queries. ... Apply for a Secured Credit.

Can I get loan after settlement?

The bank or lender takes a look at the borrower's CIBIL score before offering him a loan and if the past record shows any settlement or non-payment, his loan is likely to get rejected.

Is settled in full good on credit report?

Having a "settled in full" account on your credit report shows lenders that you have a history of not paying your entire loan or credit card back. While it is better than completely defaulting/not paying on your account, it still does not look great.

Is it worth it to settle debt?

The short answer: Yes, debt settlement is worth it if all of your debt is with a single creditor, and you're able to offer a lump sum of money to settle your debt. If you're carrying a high credit card balance or a lot of debt, a settlement offer may be the right option for you.

Is it true that after 7 years your credit is clear?

Highlights: Most negative information generally stays on credit reports for 7 years. Bankruptcy stays on your Equifax credit report for 7 to 10 years, depending on the bankruptcy type. Closed accounts paid as agreed stay on your Equifax credit report for up to 10 years.

How long does it take to get a 800 credit score?

Depending on where you're starting from, It can take several years or more to build an 800 credit score. You need to have a few years of only positive payment history and a good mix of credit accounts showing you have experience managing different types of credit cards and loans.

How many points will my credit score go up when a derogatory is removed?

How much your credit score will increase after a collection is deleted from your credit report varies depending on how old the collection is, the scoring model used, and the overall state of your credit. Depending on these factors, your score could increase by 100+ points or much less.

Why did my credit score drop 40 points after paying off debt?

Credit utilization — the portion of your credit limits that you are currently using — is a significant factor in credit scores. It is one reason your credit score could drop a little after you pay off debt, particularly if you close the account.

Is settled in full good on credit report?

Having a "settled in full" account on your credit report shows lenders that you have a history of not paying your entire loan or credit card back. While it is better than completely defaulting/not paying on your account, it still does not look great.

Does paying off all debt increase credit score?

There's no guarantee that paying off debt will help your scores, and doing so can actually cause scores to dip temporarily at first. In general, however, you could see an improvement in your credit as soon as one or two months after you pay off the debt.

How long does a debt settlement stay on your credit report?

How long does debt settlement stay on your credit report? A settled debt with no late payments will stay on your credit report for seven years from the date it was settled accordingly to regulations outlined in the Fair Credit Reporting Act (FCRA). A late payment on an account is called a delinquency.

How will debt settlement affect my credit score?

When you settle debt, it means your lender has agreed to take less than you actually owe. This is a bad sign for future lenders. To them, it looks like you’re risky to lend to because they may not get all of their money back. This is why it’s a negative item on your credit report, even though it seems positive because you got out of debt.

How to get rid of a delinquent account on credit report?

Gather all the evidence you have to prove that the account isn’t yours and get ready to dispute. You need to send the credit bureaus reporting the error a dispute letter explaining your situation.

How long does it take for a delinquent payment to be reported?

Delinquencies are reported to the credit bureaus after 30, 60, 90, and 120 days of being late. If you do make a late payment, it will stay on your report starting on the date it became a delinquent account and was never current again. If the account that you settle is a collections account, then the negative item in your credit report would remain ...

What is re-aging on credit report?

Re-Aging. The process of Re-aging changes the status of your accounts – at least, how they’re shown on your credit report. If you work out a repayment plan with a creditor, they can re-age your account by no longer reporting it as delinquent. You get a kind of clean slate for your debt.

How many points does a debt settlement take?

When you settle your debt, your credit score can drop between 60 and 100 points, depending on your credit history and where you started. This is one of the major reasons why you should use a professional debt settlement company instead of trying to do it yourself. If you mess up, your score could fall even further and take even longer to repair.

What happens if you pay as agreed?

This is what debt settlement companies will negotiate with your creditors if you go through a debt settlement program. Once the settlement is paid and the account is closed, the creditor will list the account as paid as agreed.

How Long Does Debt Settlement Stay on Your Credit Report?

These delinquencies are reported to credit bureaus after 30, 60, 90 and 180 days of non-payment. If you do not bring the debt payments up to date, each delinquency will stay on your credit report for up to seven years from the date the debt became delinquent, regardless of if it was settled later.

What credit bureaus report your debt?

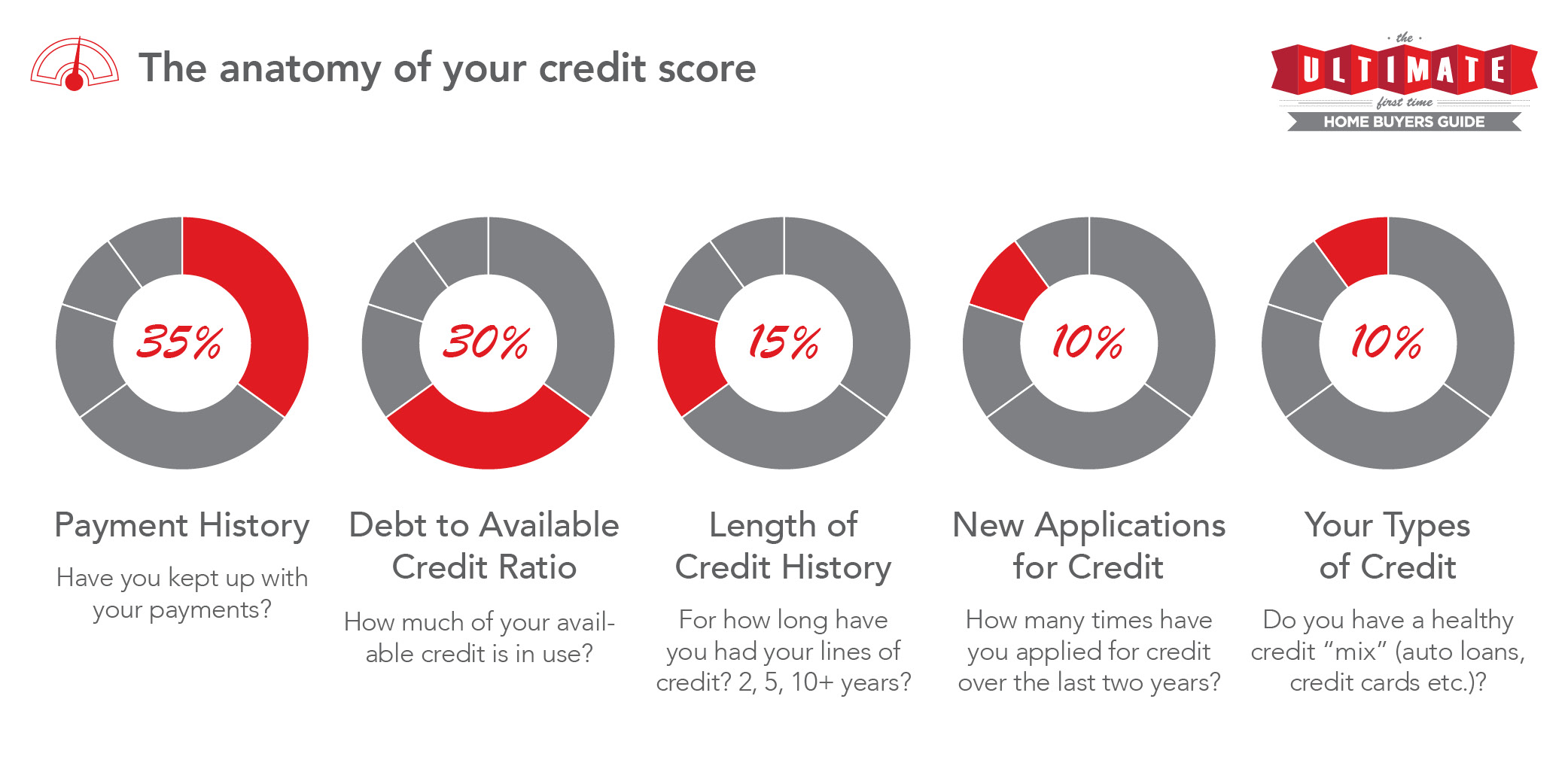

When you borrow money, your repayment history is reported to one or all three credit bureaus including TransUnion, Equifax, and Experian. They use formulas developed by either FICO or VantageScore to determine your credit score. More than half your credit score is based on paying your bills on-time and how much of your available credit you are using. The less of your available credit you use, the better. The rest of your score is based on how long you have had credit, what kinds of credit you have, and how many “hard pulls” you have authorized on your credit report.

How long does a settled account stay on your credit report?

In most cases, a settled account remains on your credit report for seven years from the time ...

What happens when you settle a debt?

After you settle your accounts, they will be closed and marked as settled on your report.

Why is a settled account considered negative?

A settled account is considered negative because you didn’t pay off the account in full or as originally agreed. If you’re considering debt settlement, you have probably already missed months of payments and your credit score has already felt the blow.

Can you remove settled debt sooner?

You might wonder if there’s a chance you can remove your settled account from your credit report in less than seven years — or have it reported differently to the credit bureaus. It is possible to negotiate for the account to be reported as paid in full instead of settled. In exchange, you might offer to pay some of your debt or increase the amount you initially offered to pay. This isn’t very likely if your debt is with credit card banks or other lenders, but it could be a possibility for medical and utility collections. Three of the largest debt buyers in the country now include this scenario in their reporting policies.

How long does a debt settlement stay on your credit report?

At this point, you probably know that debt settlement remains on your credit report and continue to affect your credit score for seven years starting from the date you first became delinquent on your account. That said, as the debt settlement ages, its impact on your credit score will lessen. If a debt settlement notation was added to your credit report in error, you should dispute it with the credit reporting bureau reporting inaccurate or incorrect information. However, removing a valid debt settlement from your credit report is extremely difficult, if not impossible to do. If you have any general questions or comments about debt settlements, please feel free to leave them in the comments section below.

How Does Debt Settlement Affect Your Credit Score?

Debt settlement will have a significant negative impact on your credit score, the higher your credit score, the bigger the drop in your score. That said, the effect on your credit score will depend on the current condition of your credit, how much of your available credit you’re utilizing, and whether you have other negative marks on your credit report. If you already have multiple negative marks on your credit report, you may not notice as significant of a drop as someone who has a flawless credit history.

How to Improve Your Credit After Debt Settlement?

If you want to improve your credit after settling your debt, you should do the following:

What to do if you haven't settled a credit card?

If you have yet to settle an account, you can try to negotiate with your lender by asking them not to add the settlement notation on your credit report in exchange for you paying off the debt. Some lenders may agree to close the account in good standing in exchange for a partial payment on the debt you owe them. However, some lenders may not be willing to negotiate this way.

Why is it important to notate a debt on your credit report?

Additionally, the notation on your credit report serves the purpose of alerting new lenders and creditors that you did not pay an account as initially agreed upon so that they can better assess the risk of lending money to you in the future.

Why is debt settlement reported to credit bureaus?

Debt settlement is reported to the credit reporting bureaus because it serves to inform future lenders and creditors that you settled your debt and could not pay off the account as originally agreed upon between you and your lender. It allows future lenders to assess the risk you pose to them when it comes to lending you money. That said, although lenders will view a settled account negatively, having an account settled is much better than becoming delinquent on the account, which can cause significant damage to your credit score.

What happens if there is no error on my credit report?

If the investigation finds that there is no error, the account will remain on your credit report, however, if they find that there is indeed an error, the account will be removed from your credit report.

How Long Does Debt Settlement Stay on Your Credit Report?

Expect that evidence of this negotiation will appear on your credit history for up to seven years from your first delinquency instance.

How Does Debt Settlement Hurt Your Credit?

It’s true that you canhurt your credit score by deciding to negotiate a new agreement with your lending entity. However, the question you have to ask yourself is this—in which situation would you be worse off? If there is a 0-50% chance that will ever be able to follow through with payment on what you’re indebted to, then settling is likely the option you should take. However, once you do so, this decision is going to be noted on your profile.

What does it mean to settle debt?

Essentially, debt settlement means making a deal with the organization or individual you owe money to.

How much debt settlement is there in 2020?

How Debt Settlement Works. As of the end of 2020, the level of American consumer debt hit $14.56 trillion. This incredibly high number is mostly composed of financial situations relating to peoples’ homes, vehicles, and loans taken out to pursue higher education. The average American home owes around $6,270 in credit card debt.

What are the pros and cons of settling?

Some pros of settling include: Reducing the overall number of dollars owed. Negotiating a number that you will realistically be able to pay off soon.

How long does it take to get out of debt?

It could take anywhere from around a year to many years.

Does debt settlement affect credit score?

Debt settlement affects your FICO credit score. If you do not follow through with your newly made deal, your debt could actually increase. If you don’t feel as though you are economically savvy enough to analyze these factors on your own, it’s likely in your best interest to obtain well-practiced assistance.

How long does a debt settlement stay on your credit report?

A debt settlement remains on your credit report for seven years. 3 . As with all debts, larger balances have a proportionately larger impact on your credit score. If you are settling small accounts—particularly if you are current on other, bigger loans —then the impact of a debt settlement may be negligible.

What is a debt settlement plan?

A debt settlement plan—in which you agree to pay back a portion of your outstanding debt —modifies or negates the original credit agreement. 1 When the lender closes the account due to a modification to the original contract (as it often does, after the settlement's complete), your score gets dinged.

What Sort of Debt Should I Settle?

Since most creditors are unwilling to settle debts that are current and serviced with timely payments, you're better off trying to work out a deal for older, seriously past-due debt, perhaps something that's already been turned over to a collections department. It sounds counter-intuitive, but generally, your credit score drops less as you become more delinquent in your payments .

How to negotiate a debt settlement?

You can negotiate a debt settlement arrangement directly with your lender or seek the help of a debt settlement company. Through either route, you make an agreement to pay back just a portion of the outstanding debt. If the lender agrees, your debt is reported to the credit bureaus as "paid-settled.".

What is a credit report?

As you know, your credit report is a snapshot of your financial past and present. It displays the history of each of your accounts and loans, including the original terms of the loan agreement, the size of your outstanding balance compared with your credit limit, and whether payments were timely or skipped.

Is debt settlement good for credit?

Facing past due debt can be scary, and you may feel like doing anything you can to get out of it. In this situation, a debt settlement arrangement seems like an attractive option. From the lender’s perspective, arranging for payment of some, but not all, of the outstanding debt can be better than receiving none. For you, a debt settlement packs a punch against your credit report, but it can let you resolve things and rebuild.

Is it better to settle debt or receive none?

From the lender’s perspective, arranging for payment of some, but not all, of the outstanding debt can be better than receiving none. For you, a debt settlement packs a punch against your credit report, but it can let you resolve things and rebuild. Consider the opportunity cost of not settling your debt.