How long does it take to settle a car accident claim?

How long a settlement takes after you’ve sent your demand letter varies from case to case. In some instances, the insurance company may accept your initial demand amount and pay it immediately—although that is relatively rare. More often, securing a settlement you and the insurance company agree upon will require a few months of negotiations.

What is a demand letter for a settlement offer?

The demand letter serves as a push to the insurance company or negligent party to make you a settlement offer. This gets the negotiations process started and represents the first steps toward an agreement. To expedite the settlement process, you and your attorney need to present the strongest case possible.

How long do insurance companies take to respond to demand letters?

Insurance companies can take weeks to respond to demand letters and in some cases may ignore them altogether. A delay in an insurance company getting back to you about a demand letter could be due to a backup in the insurance adjuster’s workload or, could be due to the insurance company ignoring the demand all together.

How long does it take to settle a civil case?

The discovery process can take anywhere from six months to a year, and the if the parties cannot reach a settlement, they may go before a mediator to arrange a settlement. Only in the most acrimonious cases does a trial occur, and these will only happen once all parties have concluded that they cannot reach a settlement.

What's the next step after the demand letter?

After you send a demand letter, one of several things can happen: The insurance company accepts your demand, and the settlement goes forward. You'll receive the compensation you asked for and sign a release of liability in exchange.

How long does it take for an insurance company to reply to a demand?

In the best-case scenario, the insurance company will respond to your demand letter within 30 days. However, you generally have to wait anywhere from a few weeks to a couple of months because no law sets a deadline.

How long does it take to respond to a demand letter?

Once you've written your demand letter and sent it on to the insurance company, the response time may vary. Typically, you can expect an answer within a few weeks. However, sometimes this process can take as long as a few months.

How long does it take to do a settlement?

The average settlement negotiation takes one to three months once all relevant variables are presented. However, some settlements can take much longer to resolve. By partnering with skilled legal counsel, you can speed up the negotiation process and secure compensation faster.

Do insurance companies want to settle quickly?

Insurance companies want to settle cases right away, because they don't want you to have an opportunity to speak to a personal injury lawyer. If an insurance company is offering you any money, it is always advisable that you at least have a consultation with an attorney.

Are demand letters effective?

Bottom line: you should generally not expect a demand letter to yield a quick and effective resolution, except in the rarest of cases where the stars align (enormous damages, clear liability, and reasonable defendant and opposing counsel on the other side).

What happens if insurance company doesn't respond to demand letter?

If an insurance company has still not responded to your demand letter, the next step may be to contact a legal representative and file a lawsuit. Be sure to understand the statute of limitations for your case. Once those run out, you could lose the right to sue.

Do insurance companies respond to demand letters?

Waiting for an insurance company to respond to your demand letter is challenging. In most cases, you'll get a response within a few weeks or months. Insurance companies have a financial motive to settle cases as efficiently as possible. But there is no guarantee that you'll receive a response to your demand letter.

Why is my car accident settlement taking so long?

High Value Claims In cases of serious injury or extensive property damage, the time it takes to settle your claim could be longer. The higher the value of your claim, the more complex the negotiation becomes and the longer an insurance company may draw out the process.

How much should I expect in a settlement agreement?

The rough 'rule of thumb' that is generally used to determine the value of a settlement agreement (in respect of compensation for termination of employment) is two to three months' gross salary.

What is the usual result of a settlement?

After a case is settled, meaning that the case did not go to trial, the attorneys receive the settlement funds, prepare a final closing statement, and give the money to their clients. Once the attorney gets the settlement check, the clients will also receive their balance check.

How does the settlement process work?

A settlement agreement works by the parties coming to terms on a resolution of the case. The parties agree on exactly what the outcome is going to be. They put the agreement in writing, and both parties sign it. Then, the settlement agreement has the same effect as though the jury decided the case with that outcome.

Do insurance companies respond to demand letters?

Waiting for an insurance company to respond to your demand letter is challenging. In most cases, you'll get a response within a few weeks or months. Insurance companies have a financial motive to settle cases as efficiently as possible. But there is no guarantee that you'll receive a response to your demand letter.

What happens if insurance company doesn't respond to demand letter?

If an insurance company has still not responded to your demand letter, the next step may be to contact a legal representative and file a lawsuit. Be sure to understand the statute of limitations for your case. Once those run out, you could lose the right to sue.

How long does an insurance company have to investigate a claim?

In general, the insurer must complete an investigation within 30 days of receiving your claim. If they cannot complete their investigation within 30 days, they will need to explain in writing why they need more time. The insurance company will need to send you a case update every 45 days after this initial letter.

What is a letter of demand for insurance?

A letter of demand is a letter sent to a person who has caused damage to your car and has failed to pay money to cover the costs to repair or replace your car. You will generally send a letter of demand when: your vehicle was damaged or written off in an accident; you were not at fault for the accident; and.

Settlement Timeline

Knowing the timeline after a demand letter is sent can be hard to gauge because this is when the claim is in the hands of the opposing party. Depending on the defendant’s reception of the demand letter, it can take anywhere from a few weeks to a few months to receive your settlement.

Contact a San Diego Personal Injury Attorney

Making sure you hire a competent San Diego personal injury lawyer will be key to speeding up your settlement process. At The Kindley Firm, APC, our attorneys have years of experience with claims and will ensure yours gets filed properly and on time. Reach out today for a free consultation to discuss your case.

How long does it take for a settlement to be paid?

In some instances, the insurance company may accept your initial demand amount and pay it immediately —although that is relatively rare.

What happens after a demand letter is sent?

The most common route is that, after your demand letter has been sent, the insurance company will reject your settlement amount and come back with a different value. Once that has been sent, you and your attorney will either accept or refuse the amount. This back-and-forth process can go on until a dollar amount is agreed upon.

How to write a settlement letter for a car accident?

To expedite the settlement process, you and your attorney need to present the strongest case possible. The following are some details your attorney may include in your letter: 1 How your injuries were sustained 2 How your injuries have impacted your life 3 The extent of your medical treatment and associated expenses 4 Reasoning as to why the other party is liable for your injuries 5 The amount of income you lost over the accident

What to include in a settlement letter?

The following are some details your attorney may include in your letter: How your injuries were sustained. How your injuries have impacted your life. The extent of your medical treatment and associated expenses.

What is the purpose of a demand letter?

The ultimate goal of a demand letter is to provide you, the victim, with a settlement you are satisfied with. But if you’re facing a personal injury lawsuit, you’re likely wondering how long your settlement will take after your demand letter has been sent. Each case is different.

Why does it take so long for insurance to settle?

Insurance companies often have valid reasons for taking several weeks to reach a decision. However, the insurance provider in your case may be guilty of bad faith instead. Insurance bad faith means the company is treating your claim unfairly or dishonestly. A common bad faith tactic is to deny a client’s payout. If you suspect bad faith is what is making your settlement take so long, contact an attorney for a free consultation.

How long does it take for insurance to pay a claim?

Additional time often means a total of 60 days from the date of receiving your claim. Most clients receive settlement checks from insurance companies within two weeks of claim acceptance, making the total average timeline about one to three months long.

How long does it take to get compensation from an insurance company?

If you and the insurance provider cannot agree on a fair and reasonable settlement, you may have to take your case to trial to obtain compensation. You might also have to take your claim to court if the insurance company responds to your initial demand letter with a claim denial. Rather than taking a few months, a personal injury trial takes a year or longer on average. At the end of the trial, you might not receive any compensation at all. If you win your trial, however, the verdict awarded could be more than what you would have received through an insurance settlement.

What happens if you submit a claim without an attorney?

If you submitted your demand letter without first running it by an attorney, it may contain errors that could make a settlement take longer to achieve. An issue could rest with your insurance company. The company might be dealing with a lot of claims or need additional time reviewing your case.

Waiting Times Can Vary

You may know your lawyer can help, but how long will it take to get an answer from your insurance company for your economic and non-economic damages? Unfortunately, there’s no universal answer.

Ensuring You Get the Compensation You Deserve

But rushing your claim can hurt your future, and it can impact your claim. That’s why we’re focused on getting your compensation, not on rushing your claim to any conclusion. For example, if you have a long-term injury like brain trauma, you may need to spend more time calculating the long-term effects of your brain injury .

How long does it take to settle a lawsuit?

The discovery process can take anywhere from six months to a year, and the if the parties cannot reach a settlement, they may go before a mediator to arrange a settlement.

What is the process of reaching a settlement?

Reaching a Settlement. The majority of civil suits settle long before a trial is necessary. The negotiation process is a multifaceted procedure that involves all parties meeting with their respective lawyers and discussing the case. Settlements depend on the strength of each side’s case, and their available resources.

What Happens If the Parties Cannot Reach a Settlement?

This can be because the litigating party decides to reject the insurance company or defendant’s counteroffer. In rare cases, it can be because the defendant party does not respond to the demand letter in the first place. Regardless, the next step for most attorneys is to initiate a lawsuit.

What happens if an insurance company does not respond to a demand letter?

If a company does not respond – a rare, but not unheard-of occurrence – it is typical to follow up on the demand letter.

How long does it take for a personal injury lawyer to settle a lawsuit?

The negotiation process can take some time, up to several months. This is, however, a faster, easier, and cheaper process than going through the courts via a lawsuit.

What happens after a lawsuit is filed?

In cases that move directly to filing a lawsuit, this is normally the end of the line for these suits.

How long does a trial last?

Once a trial date is set, the actual trial can last from a day to several weeks, depending entirely on the schedule of the judge, lawyers and parties. It is common for trials to be rescheduled frequently, often for simple reasons, and this is often why they take more than one day.

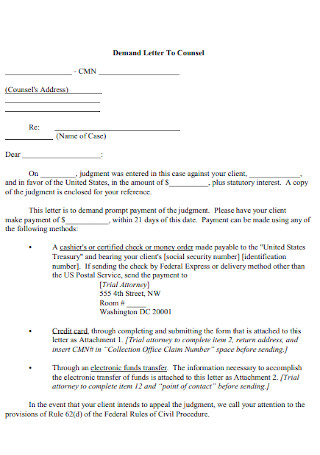

What is a settlement demand letter?

Negotiations usually begin when the party bringing the claim sends a demand letter to whom they’d like to reach a settlement. The party receiving the settlement demand letter could be the party that was negligent, or it could be the negligent parties representative, such as an insurance company (as in cases involving car accidents with personal injuries ).

How Long Does It Take To Negotiate A Legal Settlement?

If you’ve been the victim of someone else’s negligence, you have likely suffered losses mentally, physically, or financially during the fallout afterward. When it comes to securing compensation for those losses, victims often decide to reach a settlement for their claim, as opposed to going to trial.

How Do You Begin A Settlement Negotiation?

Negotiations usually begin when the party bringing the claim sends a demand letter to whom they’d like to reach a settlement. The party receiving the settlement demand letter could be the party that was negligent, or it could be the negligent parties representative, such as an insurance company (as in cases involving car accidents with personal injuries ).

How do insurance adjusters negotiate?

One way adjusters try to get that result in negotiations is by disputing facts and asking questions about your claim.

How long does it take to settle a dispute?

Negotiations can take weeks to several months to years and usually come to an end when both parties are agreeable to a number that has been offered. In the process of negotiating to settle, parties will typically refuse offers and make counteroffers in different amounts.

What is a counteroffer in a legal settlement?

A counteroffer is typically the act of offering an alternative number that they would like you to agree to, but you don’t have to agree.

What is it called when a party cannot agree to a settlement?

Usually, this ends in a settlement agreement and the matter is resolved. Other times, the parties cannot agree. This is called an “impasse” and oftentimes results in a settlement at a later date, or trial.