How long does it take to get a claim settlement check?

It can commonly take up to 30 days to get your check because the claim settlement process can involve many steps. When the case is settled, the insurance adjuster will send you some paperwork, including a release. The release will state that you can never again seek money from the insurance company after the matter has been settled.

Why is my insurance company taking so long to process claims?

The internal process of the defendant’s insurance company may also cause a delay, such as if the claim is processed in one state office and the check comes out of another state’s office. Usually, a settlement check is sent to the attorney of record.

What to do if an insurance company delays a settlement check?

If it’s been more than a month, and you’ve contacted the insurance company to follow up on your settlement check delay, you can file a complaint with your state’s insurance commissioner or insurance board. Every state has an insurance regulatory body that can intervene when the relationship between a claimant and an insurance company breaks down.

How long does it take to settle a personal injury case?

Generally though, you should factor between two and six weeks for the parties to sign the settlement documents, figure out the exact proceeds, and transfer the money. Often the funds from the defendant are produced in check form as a condition of the execution of the settlement.

How long does it take for a check to clear from a settlement?

A settlement check is an amount you receive after other expenses have been paid in your lawsuit. The amount will vary and can take up to six weeks to be paid out once your personal injury case has been awarded.

How long does it take for an insurance company to mail a check?

Upon successfully settling car accident claims, most insurance companies will mail out checks within 30 days. The typical wait for a settlement check after the resolution of a claim is one to two weeks. In some situations, however, it could take months for the insurance company to send your check.

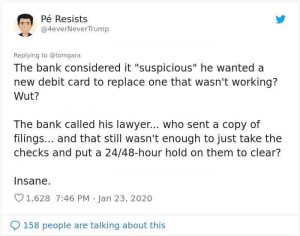

How long do banks hold settlement checks?

Generally, banks hold deposits for 1-7 business days, but large amounts of money could lead to a longer delay. All banks have a funds availability disclosure that they must make accessible to customers.

How long does it take to receive compensation after accepting offer?

In some cases, insurers will process the compensation payout within a few days. In most cases, though, you will have to wait between two and four weeks to receive your compensation.

Can I keep extra money from insurance claim?

Homeowners can keep the leftover money if there is nothing in writing saying that they must return the unused claim money. Make sure to be truthful when explaining your situation to the insurance company for the claim payout, as lying is considered insurance fraud for which the consequences are harsh.

Can I keep the money from an insurance claim?

As long as you own your car outright, you can do whatever you want with the claim money you receive from your insurer. This means that you can keep any leftover money from your claim.

How long does it take for a $30000 check to clear?

Most checks take two business days to clear. Checks may take longer to clear based on the amount of the check, your relationship with the bank, or if it's not a regular deposit. A receipt from the teller or ATM tells you when the funds become available.

What to do with a $100000 settlement?

What to Do with a $100,000 Settlement?Sort Out Tax Implications.Find a Financial Advisor.Pay Off the Debts.Invest in a Retirement Home.Start a Business or Help Friends and Family.Donate the Money to the Needy.Final Words.

What happens when you deposit over $10000 check?

Depositing a big amount of cash that is $10,000 or more means your bank or credit union will report it to the federal government. The $10,000 threshold was created as part of the Bank Secrecy Act, passed by Congress in 1970, and adjusted with the Patriot Act in 2002.

Should I accept my first compensation offer?

Unless you have taken independent legal advice on the whole value of your claim, you should not accept a first offer from an insurance company.

Can my lawyer cash my settlement check?

While your lawyer cannot release your settlement check until they resolve liens and bills associated with your case, it's usually best to be patient so you don't end up paying more than necessary.

What happens after a claim is settled?

After a case is settled, meaning that the case did not go to trial, the attorneys receive the settlement funds, prepare a final closing statement, and give the money to their clients. Once the attorney gets the settlement check, the clients will also receive their balance check.

How can I track my paycheck in the mail?

Enter the USPS tracking number (to find it, simply look at the bottom of a shipping label) in the search bar; do not include any dashes or spaces. Click on “Check Status”. View the scan history and status information of your package.

How long does it take to receive mail?

The U.S. Postal Service advertises that first-class mail — your average letter with a 55 cent stamp — arrives within “1-3 business days.” That is an official standard set by the Postal Service.

How long does mail take to deliver?

Generally speaking, standard mail takes around 3 to 4 days for it to be delivered, priority mail takes 1 to 3 days, and priority express mail takes 1 to 2 days.

How long does it take to mail a check in the same state?

If you've come to this article to learn how long it normally may take a letter to be delivered, the short answer is this: Local first-class mail will typically be delivered in 2 or 3 days. (“Local” generally means in the same city or state.)

Settlement Checks usually Come from Plaintiff's Attorney

Often the funds from the defendant are produced in check form as a condition of the execution of the settlement. The plaintiff's attorney will coll...

Attorney's Contingency Fee Is Taken from The Settlement Check

In the case of, for example, a personal injury lawsuit, where the attorney's fees are paid on a contingency basis, those fees will also be subtract...

If You Do Not Get Your Check

If you do not receive your settlement check within six weeks, there may be a problem. Contact your attorney, if you have one, and ask what is going...

How long does it take for insurance to pay settlement checks?

The question is how long can the insurance company take to pay you this check? The answer is that a private insurance company has three weeks to send you your settlement check, provided your attorney has sent them all the appropriate copies of the closing documents.

How long does it take to get a settlement check in New York?

However, if the defense is a municipal agency or the City of New York, then this three-week provision does not apply, and it can take quite a long time before you receive your settlement check. Secondly, the three-week provision will also not apply to wrongful death matters.

Is the defense responsible for payment of claims?

The document says that if you receive money or claims from any other places, we the defense are not responsible for payment of any of these issues.

Do insurance companies pay victims?

In most personal injury cases such as accident cases or medical malpractice cases, an insurance company of the defendant will actually be making the payment to the victim. With this information, the insurance company will be actively involved in the settlement discussions, and once you have agreed to a settlement, you can expect a check from the insurance company.

How long does it take to receive insurance settlements?

Although there is no fixed timeline in which insurance settlements are disbursed, it generally takes up to 30 days to receive the funds.

When will insurance companies issue settlement checks?

The insurance company will not issue the settlement check until you sign the release. Therefore, you should arrange to meet with your attorney as soon as possible when the release is available for review. Every day you wait to review the release with your attorney means another day without a check in your hand.

What happens if you settle a case without an attorney?

If you settle the case without an attorney, the insurer will send the release and later the settlement check directly to you. This will shorten the process of getting your check.

What happens when you settle a case with an insurance company?

When the case is settled, the insurance adjuster will send you some paperwork, including a release. The release will state that you can never again seek money from the insurance company after the matter has been settled. After you sign the release, the insurance company still needs to receive the release and issue a settlement check.

What to do if you have unpaid medical bills?

If you have unpaid medical bills related to your claim, you or your attorney may need to speak with the medical providers and resolve those unpaid balances before your attorney can issue you a check. Medical providers may be ultimately willing to accept a reduced amount, but negotiations can be time consuming.

Can you get a penalty if your insurance company takes too long to send you a check?

If your case is in litigation, you might be entitled to interest or penalties if the insurance company takes too long to send you the check, depending on the particular laws of your state. Follow up and send emails whenever possible to create a paper trial.

Do you get your check when you settle an insurance claim?

Learn More →. When you settle an insurance claim, you are usually very eager to get your money. Because of the complicated nature of insurance claims and the number of people involved, you may not get your check as quickly as you would like. The exact time frame will depend on the specifics of your claim, but generally you should have your check ...

What happens if you don't get your settlement check?

If You Do Not Get Your Check. If you do not receive your settlement check within six weeks, there may be a problem. Contact your attorney, if you have one, and ask what is going on. Your attorney may be able to expedite the shipping of documents or secure a partial payment of your settlement while your attorney holds the balance in order ...

How long does it take for a settlement to arrive in California?

Settlement & Release Agreement. What Is a Breach of Settlement? After you’ve reached a settlement agreement with the defendant or their insurance company, it usually takes between two and six weeks for your settlement check to arrive.

What happens to attorney fees in a personal injury lawsuit?

In the case of, for example, a personal injury lawsuit, where the attorney's fees are paid on a contingency basis, those fees will also be subtracted from the sum received from the defendant, prior to the remaining funds being distributed to the plaintiff. Additionally, any liens placed on the settlement funds, such as a Medicare lien, will be subtracted prior to distribution of the residuary to the plaintiff. There can be delays in healthcare insurers sending a “final balance due” statement which may slow down the cutting of your settlement check.

How long does it take to settle a medical lien?

Generally though, you should factor between two and six weeks for the parties to sign the settlement documents, figure out the exact proceeds, and transfer the money.

Can a plaintiff receive a settlement?

Settlement Options. While a plaintiff in a settled suit can generally expect to receive the residuary of the settlement funds relatively quickly after settlement, parties to a lawsuit have latitude to structure a settlement in a way that is mutually agreeable to all parties. For example, the parties may agree that the plaintiff will receive ...

How Long Does it Take to Get a Personal Injury Settlement Check?

A personal injury settlement process refers to the monetary compensation that a victim/plaintiff receives from a defendant in order to prevent the case from going to a jury trial. If you have completed the process of filing a personal injury claim with a health insurance company, you may be wondering, how long does it take to get a settlement check?

How long does it take to get a settlement offer?

So how long does it take to get your settlement offer after the release is submitted? It typically takes about six weeks, depending on the complexity of the case.

What is an itemized statement in insurance?

By signing the itemized statement, you effectively protect the liable party from being sued in the future for the same injury or accident.

How does a personal injury attorney distribute settlement money?

Once the check is received, your attorney will deposit it into a special trust or escrow account. As soon as the check clears, your personal injury case attorney will distribute the settlement money. However, it should be noted that in some cases your personal injury attorney might need to put a portion of the settlement money towards various unpaid debts or medical lien.

Why do people get settlement checks?

It’s true that most injured victims in personal injury cases are anxious to receive a settlement check to pay for mounting medical expenses and gathering medical records received as a result of the accident.

How is a personal injury settlement determined?

Most personal injury settlements are determined after both parties have examined the evidence and found a rough estimate of how much the case is worth. Both parties will then sign a settlement agreement after the insurance company processes the claim. The plaintiff also signs legal documentation giving up the right to pursue a future lawsuit.

What is financial compensation in an accident?

When a victim is injured in an accident and suffers expenses for maximum medical improvement, lost wages or earning capacity, reduced quality of life, pain and suffering, loss of consortium, and more, financial compensation via a lawsuit settlement is a means of helping the injured party recovery from a jury verdict and live a productive life following an accident.

How long does it take for insurance to investigate a claim?

Generally, the insurance company has about 30 days to investigate your claim.

How long does it take to settle a car accident claim?

The amount of time it takes to settle an insurance claim for a car accident varies, anywhere from a few weeks to several months. The timing ultimately depends on the circumstances of the accident and factors like state laws, severity of injury and property damage, whether lawyers are involved, and how quickly you filed the claim. You may also receive separate claim payouts at different times for each type of coverage that applies to your claim. For example, you may receive payment from your rental car reimbursement coverage before you receive the settlement check from a bodily injury liability claim.

What can I do to avoid delays in receiving my claim settlement?

Be ready to provide copies of the police report, photos of the damage, and insurance information for all parties involved, as well as any other information requested by your adjuster. If you're at fault, an insurance adjuster will investigate the claim to determine the amount to be paid for injuries and property damage to the other driver, as well as any injuries or vehicle damage you suffered (if you file a medical payments / personal injury protection or collision insurance claim).

What happens if a settlement claim takes longer than anticipated?

Some states require the insurer to provide a written explanation in response to why the claim is taking longer than 30 days. Occasionally, claims are delayed, but most state laws require insurance companies to inform you of the claim's status. Check your state's laws for specific guidelines.

How do I file an auto insurance claim?

You have several options to submit your claim by using our mobile app, going online, logging into your account, or by calling 1-800-776-4737.

How does an investigation affect settlement?

Investigations can have the most significant impact on the time it takes for you to receive your settlement check. For instance, a car accident with multiple serious injuries and a question about which driver was at fault can take longer to investigate than a small fender-bender with a clear at-fault driver.

How long does an auto accident investigation last?

You can expect to communicate with your adjuster frequently, and the investigation can last a few weeks or months, depending on the severity of the car accident.

How long does it take to get a settlement check?

Although the time required for a settlement negotiation process to be finalized can vary considerably from case-to-case, once a settlement is reached a victim can generally expect to receive a settlement check in approximately six weeks. There are, of course, exceptions to that rule, and delays can occur. Let’s take a look at the standard process for receiving a personal injury settlement check, the steps involved from start to finish, and also look at average settlements for personal injury cases.

What are the steps involved in receiving a personal injury settlement check?

Personal injury settlement checks can be issued for various types of cases, including car accidents, wrongful death claims, slip and falls, product liability or defect claims, premises liability claims, medical malpractice, TBI (traumatic brain injury) or spinal cord injuries, and more . When a victim is injured in an accident and suffers expenses from medical care, lost wages or earning capacity, reduced quality of life, pain and suffering, loss of consortium, and more, financial compensation via a civil lawsuit settlement is a means of helping the injured party recovery and live a productive life following an unfortunate accident.

What is a medical lien in a personal injury settlement?

Medical liens refer to a third party’s legal right to appropriate a portion or the entirety of the settlement or proceeds from your personal injury case. Said third party may file a request for a lien during the lawsuit, and a judge will ultimately decide whether to approve or deny the request. If a judge were to approve a lien, the person or entity who owns that lien would be paid from your total settlement amount before you receive any financial compensation. Again, this is just another example of why having an experienced and dedicated DLG lawyer fighting on your behalf can give you the advantage necessary to prevail, and help ensure another party does not wrongly take a portion of your settlement. Once a lien is approved by a judge, there is virtually nothing you or your attorney can do to reverse the decision, and the debt must be legally paid in full.

What is a legal settlement?

In civil lawsuits, a settlement is an alternative to pursuing trial litigation. Generally, a settlement occurs when the defendant agrees to some or all of the plaintiff’s claims rather than proceeding to fight the matter in a court of law. In almost all cases, a settlement requires the defendant to pay the plaintiff monetary compensation – whether for medical bills, pain and suffering, lost wages, psychological trauma, etc. Agreeing to a settlement is commonly referred to as settling out of court, and said settlement effectively ends the matter of litigation. Agreeing to a settlement is an advantageous option for both parties in many cases. By settling out of court, defendants can avoid exorbitant costs of litigation, which can drag on for an extended period of time depending on the nature of the case. A settlement may be reached before a trial, or during its early stages. In some cases, settlements are reached before a lawsuit is ever filed.

What happens if my attorney won’t turn over my settlement award check?

Most attorney-client relationships are built on respect and an understanding that both individuals are working together to achieve the same goal – a successful case outcome leading to a maximum financial damages award.

Can a delay in a personal injury settlement happen?

Delays, while not a common occurrence, can happen occasionally in personal injury settlements. In such cases, it’s helpful to know what to expect. If a defendant is not represented by an insurance company, it’s possible that he or she may have their own release form that needs to be agreed upon by all parties. In such cases, your attorneys, as well as the legal representation for the defendant, will have to review the release and agree unanimously on the terms. This may add additional time to your settlement check being received, but in most cases the situation can be resolved without issue and in a relatively short period of time. Wrongful death cases and other cases involving estates are two types of claims that tend to take a bit longer and require additional preparation.

How Long Does It Take To Get A Settlement Check: What is a Personal Injury Settlement?

Before we talk about a personal injury settlement check timeline, let’s talk about what accepting a personal injury settlement means.

How long does it take to get a personal injury settlement check?

The time frame for a settlement can range from a few months to years. For instance, the average time for a car accident settlement may be different than other types of personal injury settlements.

What is a personal injury settlement?

A personal injury settlement is some amount of money a defendant pays to a plaintiff in a personal injury case. If the plaintiff accepts this settlement, the case does not proceed to trial. This is how most personal injury cases end, rather than in a jury verdict. To arrive at a settlement, both the defendant and the plaintiff will come up ...

What happens if your doctor can't determine if the defendant's negligence caused your injury?

If your doctor can’t determine whether the defendant’s negligence caused your injury, the defendant’s insurance will lowball you again. You need a doctor to testify that the defendant’s negligence caused your injuries to get a reasonable settlement offer.

What happens if a plaintiff wins a trial?

If the plaintiff is likely to win at trial, the defendant may choose to accept a higher settlement offer. If the plaintiff’s chances at trial are neutral, they may, in turn, be willing to accept a somewhat lower settlement.

What happens if you don't hire a personal injury attorney?

If you don’t hire the services of a personal injury attorney, an insurance company may persuade you to accept a small settlement.

What happens when you sign a release with insurance?

The insurance company will have you sign a release that officially settles your claim. The release will state that you are giving up your right to sue the plaintiff. Once the insurance company receives this release, you will receive the agreed-upon sum of money. Your attorney will receive your personal injury settlement check first.

How long does it take for a settlement check to clear?

The attorney may hold the check in a trust or escrow account until it clears. This may take several days, especially if it is a large check.

What is the first step in receiving a settlement check?

Release Form. The first step in receiving your settlement check is to sign a release form that states that you will not pursue any further monies from the defendant for the specific incident in question. The defendant or the defendant’s insurance company will not send a check for your damages without such a form.

What happens if you owe child support?

If you owe child support, a lien may be issued against your settlement. Liens must be paid off before you receive your remaining portion of the settlement. In some instances, your attorney may try to negotiate to have the value of these liens reduced so that you will wind up with more money in your own pocket. However, this negotiation can take up additional time and slow down the receipt of your settlement funds. The internal process of the defendant’s insurance company may also cause a delay, such as if the claim is processed in one state office and the check comes out of another state’s office.

How to speed up a settlement?

The release may indicate the amount of time that actual payment is expected. You can ensure that you submit all documents to your attorney that the defendant requires before cutting a check. Your attorney can also use expedited shipping and return receipt request mailings to avoid excuses that documents were not received by the defendant. If you anticipate that you will owe medical providers or other creditors' funds, you may ask your attorney if you can receive a partial distribution while your attorney holds the rest and settles your outstanding claims.

What are some examples of delay in a settlement?

There are several instances when a delay may occur. For example, the defendant may have its own release form. Your attorney and the defendant’s attorney may have to revise this form until it is acceptable to both parties. Certain cases may require more preparation, such as cases involving estates or minors. You may have a medical lien or other lien against the proceeds of your settlement. For example, a medical provider may have a lien against you if it has not received payment for the services you incurred during an accident.

Can an attorney give you an estimate of when you can expect your check?

While you can ask your attorney to give you an estimate of when you can expect your check, the answer to this question depends on a number of factors, such as the defendant’s policy, the type of case that it is and whether there are any extraneous circumstances affecting payout.

Do insurance companies have loopholes?

However, there are usually loopholes that experienced defendants and insurance companies know about to avoid these negative ramifications, such as the statute not saying how long an insurance company has to process the actual release form.