How long does it take for mutual funds to settle?

With most mutual fund trades, the fund is able to settle the transaction on the next business day. By contrast, stock trades typically take three business days to settle. Occasionally, a fund might have provisions in its shareholder agreement that give it more time to settle transactions.

When are mutual fund orders executed?

Whether you are buying or selling shares in a fund, mutual fund trades are executed once per day, after market close, at 4 p.m. Eastern Time; they are typically posted by 6 p.m. Trade orders can be entered through a broker, a brokerage, an advisor, or directly through the mutual fund.

Can mutual fund be withdrawn at any time?

The majority of mutual funds are liquid investments, which means they can be withdrawn at any time. Some funds, on the other hand, have a lock-in term. The Equity Linked Savings Scheme (ELSS), which has a 3-year maturity period, is one such scheme. ... You can withdraw money from a mutual fund scheme through a broker or distributor if you ...

Are mutual funds better than stocks for long term investment?

Whether stocks or mutual funds are better for your portfolio depends on your goals and risk tolerance. For many investors, it can make sense to use mutual funds for a long-term retirement portfolio, where diversification and reduced risk might be more important.

How many days does it take for mutual funds to settle?

Participants have to provide funds in their settlement accounts by 8.30 a.m. on the T+1 day.

Do mutual funds settle T 2?

The two-day settlement date applies to most security transactions, including stocks, bonds, municipal securities, mutual funds traded through a brokerage firm, and limited partnerships that trade on an exchange. Government securities and stock options settle on the next business day following the trade.

How long does it take for mutual funds to settle in India?

T+1 means that market trade-related settlements will need to be cleared within one day of the actual transactions taking place. Currently, trades on the Indian stock exchanges are settled in two working days after the transaction is done (T+2).

Why does settlement take 2 days?

The rationale for the delayed settlement is to give time for the seller to get documents to the settlement and for the purchaser to clear the funds required for settlement. T+2 is the standard settlement period for normal trades on a stock exchange, and any other conditions need to be handled on an "off-market" basis.

What is a settlement period?

Property settlement is the final stage of a property sale wherein the buyer completes payment of the contract price to the vendor and takes legal possession of the property. The 'settlement period' is the amount of time between the exchange of contracts and the property settlement.

What is the settlement cycle?

A Settlement Cycle refers to a calendar according to which all purchase and sale transactions done on T Day are settled on a T+2 basis. T = Trading Day and +2 means 2 consecutive working days after T (excluding all holidays).

What is settlement cycle in mutual funds?

Settlement Cycle in Debt Funds Settlement cycle in case of debt funds for both purchase as well as sale transaction is T+1 days. For example, if you purchase or sell a Debt fund scheme on Tuesday then the settlement date for this transaction will be Wednesday.

Why is my mutual fund order still pending?

If your status shows as Verification under Progress, then your order will be processed after the verification is successful. This process may take a couple of days more than usual. If it's your first ever order, then it may take additional day or two to complete the verification process.

Can I buy MF on Saturday?

Saturdays and Sundays are usually non-business days for MFs. There is no net asset value (NAV) allotment on non-business days, and the allotments to funds are resumed the following business day.

What is the 3 day rule in stocks?

In short, the 3-day rule dictates that following a substantial drop in a stock's share price — typically high single digits or more in terms of percent change — investors should wait 3 days to buy.

What is the current settlement date?

The settlement date is the date when a trade is final, and the buyer must make payment to the seller while the seller delivers the assets to the buyer. The settlement date for stocks and bonds is usually two business days after the execution date (T+2).

Why does it take 3 days to settle a trade?

This date is three days after the date of the trade for stocks and the next business day for government securities and bonds. It represents the day that the buyer must pay for the securities delivered by the seller. It also affects shareholder voting rights, payouts of dividends and margin calls.

Are mutual funds T 1 or T 2?

Stocks are usually T+2 and bonds, mutual funds, and money market funds vary among T+1, T+2, and T+3.

How are mutual funds settled?

Some equity and bond funds settle on the next business day, while other funds may take up to 3 business days to settle. If you exchange shares of one fund for another fund within the same fund family, the trade will usually settle on the next business day.

Do all ETFs settle T 2?

Stocks, bonds, mutual funds and ETFs all currently use a T+3 settlement period. But several other investments are on a T+1 cycle, with settlement the next business day.

Can I sell share on t2 day?

The moment you sell the stock from your DEMAT account, the stock gets blocked. Before the T+2 day, the blocked shares are given to the exchange. On T+2 day you would receive the funds from the sale which will be credited to your trading account after deduction of all applicable charges.

How long does it take to settle a mutual fund?

With most mutual fund trades, the fund is able to settle the transaction on the next business day. By contrast, stock trades typically take three business days to settle. Occasionally, a fund might have provisions in its shareholder agreement that give it more time to settle transactions.

Why are mutual fund settlement rules important?

Knowing those rules will help you avoid unfortunate mistakes in not having cash on hand in time for a purchase to settle.

Why do investors use mutual funds?

Millions of investors use mutual funds to invest, taking advantage of their diversified holdings of a wide array of different types of assets. Behind the scenes, mutual funds have to comply with regulations regarding settlement of purchases and sales of their shares, and the rules they follow differ from what brokerage firms have to do with stock trades. Let's take a closer look at mutual fund settlement rules.

What happens if you miss a mutual fund trade deadline?

If you miss the trading deadline for a particular day, your mutual fund trade won't get executed until the following day. This difference in how mutual fund shares get handled also helps speed the settlement process. With most mutual fund trades, the fund is able to settle the transaction on the next business day.

How often do mutual funds trade?

In nearly all cases, mutual fund trades execute once every day after the financial markets close .

Can you use money market mutual funds as sweep options?

That allows shareholders to use money market mutual funds as sweep options for brokerage accounts without having to wait an extra day to clear purchases and sales. Finally, bear in mind that other types of funds that are governed by some similar rules to mutual funds nevertheless have different settlement rules.

Do money market mutual funds settle on the same day?

Because money market mutual funds are designed to be especially liquid, fund transactions settle on the same day that the trade is effective .

How long does it take to settle a mutual fund?

The settlement period for mutual-fund transactions varies from one to three days, depending on the type of fund.

What are the fees associated with mutual funds?

In addition to the NAV, investors need to consider the various fees or sales loads associated with mutual funds, such as front loads (commissions), deferred sales charges due upon redemption, short-term transaction and redemption fees, exchange fees and account fees.

What time do trade orders go out?

They are typically posted by 6 p.m. Trade orders can be entered through a broker, a brokerage, an advisor or directly through the mutual fund. However, unlike other instruments such as stocks and exchange traded funds (ETFs), they are executed by the fund company rather than traded on the secondary market.

Who executes ETFs?

However, unlike other instruments such as stocks and exchange traded funds (ETFs), they are executed by the fund company rather than traded on the secondary market.

Can you buy or sell shares of mutual funds?

Orders can be placed to either buy or sell and can be made through a brokerage, advisor, or directly through the mutual fund. The shares of mutual funds are very liquid, easily traded, and can be bought or sold on any day the market is open.

How long does it take to settle mutual funds?

For some trades, brokers establish longer settlement periods of up to two days. Others subdivide days into trading periods.

What is settlement in mutual funds?

Settlement refers to the process of trading or selling a mutual fund, which involves regulations that investors should be aware of when navigating the process.

How do mutual funds change?

Mutual fund prices change rapidly throughout the trading day, and from one day to the next. Because the settlement period for a mutual fund purchase is typically one business day, there is uncertainty as to the exact purchase price based on when you execute an order, and when the purchase is settled. However, these changes are generally minor; mutual funds are not subject to the same volatility, or likelihood of rapid change in value, that some stocks are.

Do mutual funds have the same rules?

Although mutual funds usually contain stocks, they do not follow the same rules when it comes to settlement. When you invest in a mutual fund, you agree to settlement terms with the broker or fund manager. Even if the same party also sells stock directly, you are bound by the settlement rules of the specific mutual fund you invest in.

How Long Does it Take to Settle Funds at Fidelity?

It takes two business days to settle stock trades at Fidelity. One day is required to settle options trades.

How long does it take for a trade to settle?

Before the computer age and the current modern era, it might take days or even weeks for a particular trade to settle.

Can you use cash from a trade until settlement date?

If the trade you have done is a sale, the cash received from that trade cannot be used until the settlement date. This is something you will want to keep in mind you do not try to use these funds for another trade or withdraw them before you are able to.

Can you trade stock without a settlement period?

You cannot trade on the United States stock exchanges without a settlement period, but there are some creative methods to get around the settlement date issue so that you can get your funds faster from sales of stock or mutual funds.

How long does it take to settle a mutual fund?

The upshot of the clearing and settling process for mutual funds is that fund buyers need to have cash available to settle their purchase more quickly than the three-day period that prevails for most stock transactions.

How often do mutual funds set price?

Different processes for different funds. Most mutual funds only set a share price once per day at the close of market trading. In order to prevent mutual fund traders from gaining an unfair advantage, purchases and sales of mutual fund shares are accepted only once daily, with trade requests received before a set deadline all occurring at ...

Why do mutual funds have to follow rules?

But mutual funds have to follow rules from securities regulators to ensure that they handle trades properly , and the rules for clearing and settling mutual fund trades are slightly different than the corresponding rules ...

What is money market mutual fund?

Money-market mutual funds give investors a liquid investment vehicle that's similar to holding cash. In order to reflect the need for liquidity, money market mutual fund trades generally clear and settle on the same day that the investor makes a trade.

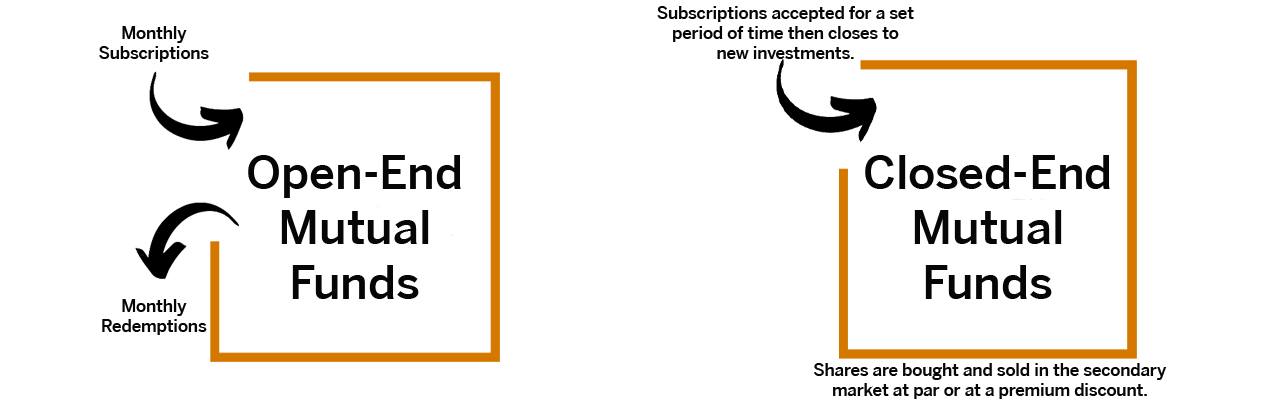

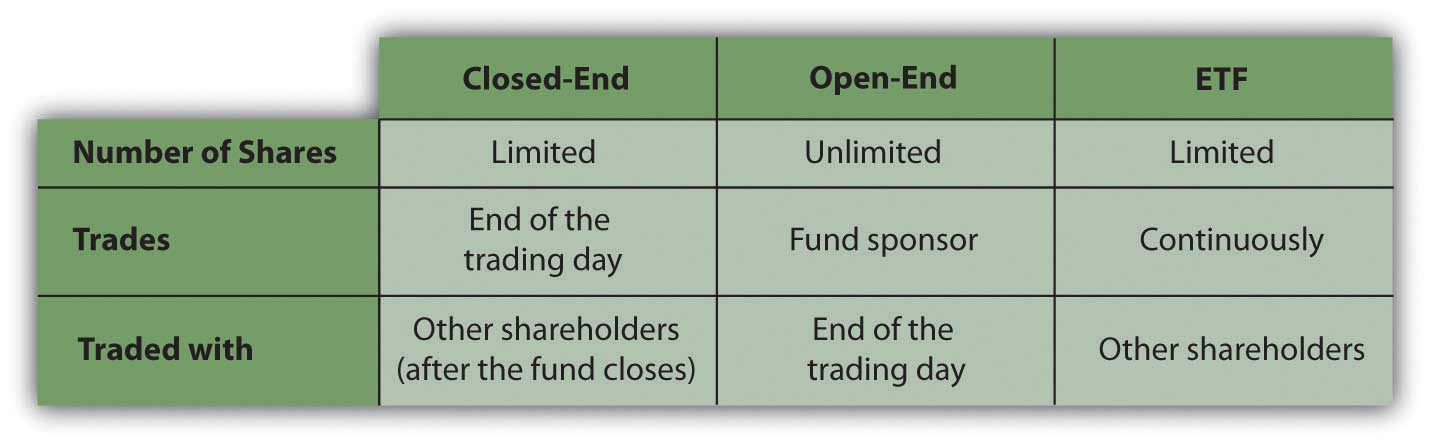

Do closed end mutual funds have the same rules as stocks?

Finally, remember that these rules apply to traditional mutual funds. Closed-end funds and exchange-traded funds that trade on exchanges throughout the day typically have different rules, and many follow the same three-day clearing and settlement process that applies to stocks.