How do I reject a settlement offer from an insurance company?

To reject the initial offer, you will create a counteroffer and send it via mail to the insurance company claims adjuster. This letter should state: That you will not accept the initial settlement offer;

How long does it take to get a personal injury settlement?

The initial settlement offer that comes from the insurance company can come at any time after you've filed your claim. Some personal injury claimants have to wait weeks to receive the offer, and some receive it rather quickly.

Should I accept a medical malpractice settlement?

If you accept a settlement offer, it is guaranteed money. In most medical malpractice and accident cases a settlement is not taxable since it is not considered income. To learn more about settlement offers, I invite you to watch the quick video below... A Settlement Offer Is Made; I Recommend It, You Reject It. What Now?

When do you get a settlement offer from the defense?

A settlement offer can come at any time. It can come at the beginning of the case, the middle of a case or even during trial. The defense may make an offer that is insulting to you. They may make an offer that sounds reasonable. They may also make an offer that is way above what you perceive your case is worth. All of these are possibilities.

How do you counter a settlement offer?

Countering a Low Insurance Settlement OfferState that the offer you received is unacceptable.Refute any statements in the adjustor's letter that are inaccurate and damaging to your claim.Re-state an acceptable figure.Explain why your counteroffer is appropriate, including the reasons behind your general damages demands.More items...•

How do you respond to a low settlement offer?

Steps to Respond to a Low Settlement OfferRemain Calm and Analyze Your Offer. Just like anything in life, it's never a good idea to respond emotionally after receiving a low offer. ... Ask Questions. ... Present the Facts. ... Develop a Counteroffer. ... Respond in Writing.

What happens if you ignore a settlement offer?

When someone rejects a settlement offer, it is automatically terminated and can not be accepted at a later time. From here, you can negotiate or make a counteroffer, but will be up to the other party if they want to accept or reject the offer.

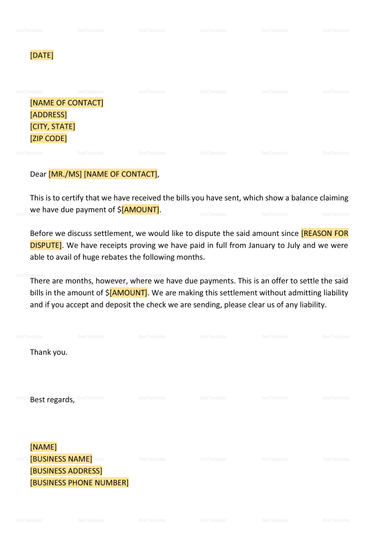

How do you write a letter to reject a settlement offer?

This letter should state:That you will not accept the initial settlement offer;The reasons why you feel you deserve a higher settlement amount;Each of their low-offer reasons, and your responses;The higher settlement amount that you will accept.

What is a reasonable settlement agreement?

By Ben Power 8 April 2022. A settlement agreement is a contract between two parties, usually (but not always) an employer and an employee, which settles the employee's claims against their employer.

Should you accept the first offer of compensation?

Unless you have taken independent legal advice on the whole value of your claim, you should not accept a first offer from an insurance company.

Do I have to accept a settlement agreement?

Do I have to accept a settlement agreement offered? The short answer is no, you do not have to sign a settlement agreement.

Should I accept the settlement?

Never accept a settlement offer until your doctor understands the full impact of your injuries. Maximum medical improvement is the milestone in your recovery where the doctor acknowledges that there is nothing more they can do for you.

Can settlement negotiations be used as evidence?

The Senate amendment provides that evidence of conduct or statements made in compromise negotiations is not admissible. The Senate amendment also provides that the rule does not require the exclusion of any evidence otherwise discoverable merely because it is presented in the course of compromise negotiations.

How do insurance companies negotiate cash settlements?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

How long does an insurance company have to respond to a counter offer?

In the best-case scenario, the insurance company will respond to your demand letter within 30 days. However, you generally have to wait anywhere from a few weeks to a couple of months because no law sets a deadline.

How do I write a counter offer for a car accident?

From the standpoint of procedure, you will need to make a counter-offer in writing. Be sure you send your letter to the appropriate person, whether that be an insurance adjuster or an attorney. Make it clear that you are rejecting their initial offer and include your reasons for doing so.

How do you negotiate a settlement with an insurance claims adjuster?

Begin the Settlement Negotiation Process (5 Steps)Step 1: File An Insurance Claim. ... Step 2: Consolidate Your Records. ... Step 3: Calculate Your Minimum Settlement Amount. ... Step 4: Reject the Claims Adjuster's First Settlement Offer. ... Step 5: Emphasize The Strongest Points in Your Favor.

How do you negotiate a higher settlement?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

How do I negotiate a home insurance settlement?

Here are some things to keep in mind as you negotiate:Understand the Policy You Bought (Or Was Bought For You) ... Understand What's In Your Claim and Settlement Offer. ... Appeal Your Offer. ... Consult a Property Damage Lawyer. ... Last Resort: Filing a Lawsuit.

How do you respond to an insurance claim?

Promptly respond to letters and requests if they are unreasonable. If they are, say so, in writing. Be proactive: Give your insurer proof of your losses and ask for the dollar amounts you are entitled to. Don't wait for them to tell you how much they owe you.

How to reject a settlement offer?

To reject the initial offer, you will create a counteroffer and send it via mail to the insurance company claims adjuster. This letter should state: 1 That you will not accept the initial settlement offer; 2 The reasons why you feel you deserve a higher settlement amount; 3 Each of their low-offer reasons, and your responses; 4 The higher settlement amount that you will accept.

How long does it take to get a settlement offer from insurance?

The initial settlement offer that comes from the insurance company can come at any time after you've filed your claim . Some personal injury claimants have to wait weeks to receive the offer, and some receive it rather quickly. Unfortunately, there is no set time in which the initial offer must be made.

How to counter an insurance settlement offer?

When you receive the initial settlement offer in writing, examine the reasons the insurance adjuster has given for the low settlement amount . Each of these points will become a part of your counteroffer letter, and you should respond to each and every one. Your counteroffer letter will reassert your original position described in your demand letter, as well as respond to each of their low-offer reasons in turn. Keep your emotions out of the letter and stick to facts, such as the extreme pain and suffering you have had to endure and the frustration and hassle of attending medical treatments. Be professional, courteous, and confident, and never attack the claims adjuster personally in your counteroffer letter.

What is a lowball offer from an insurance adjuster?

The initial offer you receive from the insurance adjuster will almost always be a "lowball" offer. They may defend their low offer by claiming that you were partially at fault for the accident that caused your injuries, or that the injuries you suffered weren't severe enough to warrant a greater amount. They may also question the amount of pain and suffering you experienced. They will aggressively defend their position of a low offer because this will often intimidate people into simply accepting the low offer. Do not ever accept the initial offer unless it is a fair offer.

How to reject an insurance offer?

To reject the initial offer, you will create a counteroffer and send it via mail to the insurance company claims adjuster. This letter should state:

What happens after an insurance adjuster investigates a personal injury claim?

After the insurance company has fully investigated your personal injury claim, they will make their first offer of settlement. Their investigation may include witness interviews, examination of the police reports and medical records pertinent to your case, and the demand letter you've forwarded to them. By the time the insurance adjuster presents an offer, they will feel confident about who was liable for the injuries you've suffered and property damage incurred, and what those are worth as a dollar amount.

Can a claims adjuster be forthwith?

Of course, the claims adjuster will usually not be forthwith to the actual dollar amount of the "authority", but they may try to use the term to try to make you believe that their offer is the highest offer they can give you. This is more often than not a bluff on their part.

What to do if you disagree with a settlement offer?

If I believe this settlement offer is a good one, I will tell you. If you disagree and choose to reject the offer I will then go back to the defense lawyer and let him know the offer is not acceptable and see if he is willing to negotiate further. If he makes another offer, I will again relay that information to you and discuss it again. However, there will reach a point where no further settlement offer will be made and you must make a decision about whether to accept or to reject an offer.

What to do if playback doesn't begin?

If playback doesn't begin shortly, try restarting your device.

Is it a big deal to go to trial?

Many injured victims think it's no big deal to go to trial since they are not paying any money out of their own pocket initially and there's no skin off their back to force the case to trial. What they do not realize is that there is a significant risk that they could lose the case or receive less than what has already been offered.

When do you get an offer after injury?

You might receive an offer right after you become injured, after you’ve filed a personal injury lawsuit or later if things end up going to trial. Whether the offer is low or high, early or late we often see client anxiety spike once it’s made because they know accepting or rejecting it is a critical decision.

What to do when you receive an offer?

When you receive an offer, don’t accept or decline right away. Even if it seems like a fantastic offer or a huge insult, wait to respond until you’ve talked with an experienced personal injury attorney. It won’t go away while you take some time, but if you reject it immediately, you can’t accept it later if the other party withdraws.

What happens when you file a personal injury claim?

If you make a personal injury claim, the person against whom you file a claim and their insurance company are both powerfully motivated to protect their own interests.

Why Should You Not Reject A Settlement Offer? What Happens?

If you are injured in an accident, the insurance company will offer a settlement. How you reply to the offer has significant legal implications. You should never react to the offer in haste without contacting your attorney.

What happens if you decline a settlement offer?

If you accept the settlement offer, you will lose your eight to file a personal injury lawsuit against the party at fault. On the other hand, if you decline the offer, the settlement offer will no longer be available if you change your mind later. You cannot accept the settlement offer once you have refused it or if the offer has expired ...

What to do if you decline a totaled car offer?

Take the advice of an attorney before you decline or accept an offer on a totaled vehicle. They will guide you and show you the true picture of your car. They will help you better understand the benefits and disadvantages of rejecting an offer.

How to know if an insurance adjuster is a low settlement?

It is very common for insurance adjusters to know how much time, headache, and money your claim will cost the company, and to avoid all the hustle, they will try to offer a low settlement to silence you. You should be aware of offers like that. You should contact an attorney to determine the strength of the offer.

Why don't people accept settlements?

One of the top reasons why most people do not accept a settlement offer is that the party’s insurance company at fault asks the victim to sign a liability waiver before handing over the settlement amount . The liability waiver is a legal document that forbids you or the victim from filing a lawsuit against the company, suing the party at fault, ...

When you buy insurance, do you pay for a certain amount of coverage?

When purchasing an insurance policy, you pay for a certain amount of coverage, the limit of which is mentioned in the insurance policy. Therefore, when you know the insurance policy limits, you can know whether the insurance adjuster will be able to meet your demand or not.

Can you get a large settlement for a personal injury?

Even the most skilled attorneys who have years of experience dealing with personal injury settlements will tell you that no matter how good your negotiating skills are, you can not get a large settlement that will get you a luxurious mansion, especially if you do not deserve it.

How much to increase settlement amount for auto accident?

Calculate the total cost of all the factors affected by the auto accident, such as medical bills, lost wages and auto repair, and increase this amount by about 20 percent to 25 percent. A claim that is too high or too low can put you at a disadvantage. Insurance companies typically offer the lowest possible settlement amount when it is obvious that the claimant is uninformed.

Why should you reject an insurance adjuster offer?

Because the claim adjuster works in the interest of the insurance company, the amount offered for settlement may be less than fair. If you are not satisfied, you should reject the offer and negotiate a mutually beneficial settlement.

How to decline an insurance offer?

Write a formal letter to decline the insurance company's initial offer. The letter should detail the facts of the accident and your injuries and include your request for a settlement in the amount you have calculated. Include copies of your supporting documents in with the letter.

Who has the upper hand in negotiating a settlement?

Insurance companies usually have the upper hand in negotiating a settlement when the self-representing claimant is inexperienced and uninformed. An experienced insurance lawyer can help evaluate the initial offer and negotiate a better settlement from the insurance company in a shorter amount of time.

How to negotiate with insurance company?

Wait for the insurance company to contact you. This begins the negotiations, which, from this point, typically happen over several phone calls. The company will make a counteroffer for a much lower amount than you proposed. You may accept the offer, if it is reasonable, or respond with a counter-proposal that is lower than your original amount but higher than the company's proposal.

The Initial Settlement Offer

Evaluating The Initial Offer

- When you receive the initial settlement offer in writing, examine the reasons the insurance adjuster has given for the low settlement amount. Each of these points will become a part of your counteroffer letter, and you should respond to each and every one. Your counteroffer letter will reassert your original position described in your demand letter, as well as respond to each of the…

Rejecting The Initial Offer and Making A Counteroffer

- To reject the initial offer, you will create a counteroffer and send it via mail to the insurance company claims adjuster. This letter should state: 1. That you will not accept the initial settlement offer; 2. The reasons why you feel you deserve a higher settlement amount; 3. Each of their low-offer reasons, and your responses; 4. The higher settl...

Fair Initial Settlement Offer

- Though it doesn’t happen often, if the insurance adjuster thinks that you have a very strong case against their insured (the at-fault party), their initial settlement offer may be fair. Don’t simply reject the initial offer because it is the first offer you’ve gotten. Measure what you’ve asked for in your demand letter against what the insurance adjuster has offered, and then you and your attor…

Let Us Help You

- The process of settlement offers and counteroffers can be complex and overwhelming. We understand, and we want you to know that you can call us anytime to schedule a free, no-obligation consultation. With one of our skilled attorneys on your side, you can rest assured you’ll receive fair compensation for the damages you’ve suffered. You can reach us by phone at (916) …