What is a batch and settlement?

That’s where batches and settlements come in. What is a Batch? A batch is a group of transactions that have been processed but have yet to be settled. When a transaction is approved, it is added to your batch. When a batch hasn’t been settled yet, it is called an open batch, and transactions in the batch can still be voided and reversed if needed.

How often do merchants settle their batches?

For most merchants, settlement is typically done automatically at a set time each day. However, some merchants, like retailers and restaurants, prefer to manually settle their batches during their end-of-day cash out.

How much did class action lawsuits settle for in 2019?

Class settlements in employee benefit disputes hit $449 million in 2019, up significantly from 2018 and nearly reaching 2017 levels, a Bloomberg Law analysis found.

How long does it take to receive a settlement payment?

Without holds, funds should appear in your bank account within 1-2 business days. Some processors have longer wait times and might make you wait 7-10 business days to receive your funds, while others might offer same-day deposits, but for a higher fee. How Does the Settlement Process Work?

What is a batch settlement fee?

Typically, batches must be settled every 24 hours or else all the transactions of the batch will be charged the maximum transaction fees no matter which pricing tier each transaction fell into originally. Batch fees usually cost around 15 – 25 cents per batch and vary by processor.

What is a daily batch fee?

With other firms, batch fees are assessed on every day that transactions are sent in for processing, regardless of how many transactions are processed. Batch fees are paid if you process one transaction or one hundred. So, if your business is open every day, you'd be subject to 30 batch fees in a month.

What is a good rate for merchant services?

Effective rates for most merchants should average between 1.70% and 2.1%; depending upon your average ticket, card mix, and monthly volume. If your effective rate exceeds 2% ( or . 02 based on the calculation above) you are likely paying too much!

What is a batch header fee?

A batch fee (also known as a batch-header fee) can be charged to a merchant whenever the merchant "settles" their terminal. Settling a terminal, also known as "batching", is when a merchant sends their completed transactions for the day to their acquiring bank for payment.

How long does a batch payment take?

48-72 hoursOnce the transactions are cleared (or settled), the funds are usually delivered to the specified merchant account within 48-72 hours.

What is the batch settlement process?

During batch processing, the merchant sends the authorization codes for every credit card transaction to its payment processor, and the processor categorizes the transactions by the bank that issued each customer's credit card. Each of those banks then remits the payments to the merchant in a step called settlement.

How much is a processing fee?

Credit card processing fees will typically cost a business 1.5% to 3.5% of each transaction's total. For a sale of $100, that means you could pay anywhere from $1.50 to $3.50 in credit card processing fees. For a small business, these fees can be a significant expense. Here's how they work and how to lower your rates.

How is processing fee calculated?

The formula for calculating processing fees is: (order amount * percentage fee) + (transaction fee * number of transactions).

Can I pass on credit card fees to customers?

Yes. Merchants can apply varying surcharges by card brand or card product, but not both. For example, a retailer may impose surcharges only on American Express cards or only on certain products, such as Visa Signature cards.

What is a batch payment?

A batch payment is when you send multiple payments to different recipients at once, but through a single payment as opposed to many individual transactions.

What percentage does Square take?

The Square standard processing fee is 2.6% + 10¢ for contactless payments, swiped or inserted chip cards, and swiped magstripe cards. Payments that are manually keyed-in, processed using Card on File, or manually entered using Virtual Terminal have a 3.5% + 15¢ fee.

What is an example of batch processing?

Examples of batch processing are transactions of credit cards, generation of bills, processing of input and output in the operating system etc. Examples of real-time processing are bank ATM transactions, customer services, radar system, weather forecasts, temperature measurement etc.

What does batch payment mean?

A batch payment is when you send multiple payments to different recipients at once, but through a single payment as opposed to many individual transactions.

What is a batch in medical billing?

A batch payment refers to a group of insurance or patient payments deposited by a clinic or practice. In the system, it is a tool for grouping multiple payments into a single batch so you can then allocate the payments to patient or insurance charges.

What is an example of batch processing?

Examples of batch processing are transactions of credit cards, generation of bills, processing of input and output in the operating system etc. Examples of real-time processing are bank ATM transactions, customer services, radar system, weather forecasts, temperature measurement etc.

What does batch mean in accounting?

Batch accounting refers to a system of transferring items from journal, to ledger, to financial statement in a linear order. In this system, transactions are grouped and processed by subledger and results in entries that will not instantly appear in your general ledger.

What do you need to know about batch settlements?

What You Need to Know About Batches and Settlements. If you’re a merchant accepting credit and debit payments for your business, then batches and settlements are an important part of your day-to-day. Settling the day’s transactions is what gets the money you earned from your customers into your business’s bank account.

How long does it take to settle a batch of cash?

If batches are left open for too long (typically 48 hours to 6 days), some processors will choose to automatically close and settle the batch, while others will let the unsettled transactions expire.

What is a Batch?

A batch is a group of transactions that have been processed but have yet to be settled. When a transaction is approved, it is added to your batch. When a batch hasn’t been settled yet, it is called an open batch, and transactions in the batch can still be voided and reversed if needed. This is important to know because voiding a transaction is less costly and time-consuming than refunding a transaction.

What is a Settlement?

Once a batch is closed and submitted, the business’s credit card processor receives the processed funds from each issuing bank whose credit cards were part of the batch (in other words, retrieving the money from every customer’s account). The total batch amount will then be transferred via bank-transfer to the merchant’s bank account.

Why are credit cards processed in batches?

If you’ve ever looked at your credit card statement in your online banking app for example, you’ll notice pending and posted transactions, right ? Well, those transactions are all tied to this two step process. When you tap your credit card, you and the merchant both see an “approved” message flash across the screen. This means the merchant’s terminal has communicated with your issuing bank to determine that there are enough funds on that card to pay for whatever it is you’re buying. So far so good!

How long does it take for a closed batch to settle?

Without holds, funds should appear in your bank account within 1-2 business days. Some processors have longer wait times and might make you wait 7-10 business days to receive your funds, while others might offer same-day deposits, but for a higher fee.

How long does it take for a transaction to be aggregated?

Several transactions, usually within a 24-hour time frame , are aggregated together into a batch and all the transaction information is sent to the payment processor.

Do you get paid when you settle a receivable?

You don't get paid until you settle your authorizations. Your customer’s funds are held when an authorization request is approved, but the money is only transferred to your bank account after you have submitted the day’s charges for settlement. That means constant work for your receivables team – and a high potential for disruptions in your cash flow.

Does Curbstone charge a processing fee?

Every day you delay submitting your transactions, the higher your processing fee. If you don’t settle within the industry’s specified time frames, you pay a compounding downgrade fee – but Curbstone makes timely settlement simple.

How much is Erisa settlement?

ERISA Class Settlements Rebounded to $449 Million in 2019. Class settlements in employee benefit disputes hit $449 million in 2019, up significantly from 2018 and nearly reaching 2017 levels, a Bloomberg Law analysis found.

How much was Franklin Templeton's settlement?

Dozens of companies have been sued over this practice, and in 2019, four signed class settlements totaling about $31 million. Franklin Templeton’s $13.9 million deal was the largest, followed by Massachusetts Financial Services Co. ($6.9 million), SEI Investments Co. ($6.8 million), and Eaton Vance Corp. ($3.5 million).

What is the lawsuit against universities?

These lawsuits claim the schools’ plans offer expensive, poorly performing investments and charge excessive, unnecessary administrative fees.

How much did ABB settle?

The largest, a $55 million deal signed by ABB Inc., ended a 12-year legal clash that spawned two trips to a federal appeals court and multiple unsuccessful appeals to the U.S. Supreme Court. Another noteworthy settlement was the $8.75 million deal struck by the trustees of the Supplemental Income Trust Fund.

When will ERISA settlements be filed?

Several companies targeted by ERISA class actions have announced plans to file settlement paperwork in 2020. Northrop Grumman Corp., Oracle Corp., and Invesco Holding Co. are all expected to seek approval for ERISA class settlements in early 2020. Each was sued over the fees in its 401 (k) plan.

How much did Dignity Health pay to end the church plan lawsuit?

Dignity Health agreed to pay $100 million to end a church plan lawsuit, although the judge hearing the case has withheld approval until the parties rethink how attorneys’ fees will be paid.

How much did MIT make before trial?

MIT’s $18.1 million deal, announced four days before the school was scheduled to begin trial, is the largest of these, which targeted other top-tier schools like Yale and Columbia.

Past Moves Perceived as Untrustworthy From Wyndham Hotel Group

Wyndham Rewards is a frequent guest loyalty program which has had a history of not being upfront with alerting its members of devaluations and changes of the terms and conditions of promotions while they are in effect — blindsiding its members with seemingly arbitrary changes to its promotions with little or no notice.

Summary

If you do decide to participate in this settlement, completion of the claim form supposedly will consume only a few minutes of your time; but do not expect any major windfall, as you will not exactly get rich from this settlement — you will receive your choice of either $22.00 or 2,200 Wyndham Rewards points — but that may be better than nothing at all..

What Is A Batch?

How Batch Credit Card Processing Works

- Once you’ve finished processing for the day and you’re ready to close up shop, you can close a batch and trigger what’s called a settlement (see below). For most merchants, settlement is typically done automatically at a set time each day. However, some merchants, like retailers and restaurants, prefer to manually settle their batches during their end-of-day cash out. If batches a…

Why Batch Credit Card Processing Is Used

- The reason credit cards are processed in batches is because credit card transactions are a two-step process. If you’ve ever looked at your credit card statement in your online banking app for example, you’ll notice pending and posted transactions, right? Well, those transactions are all tied to this two step process. When you tap your credit card, you and the merchant both see an “appr…

What Is A Settlement?

- Once a batch is closed and submitted, the business’s credit card processor receives the processed funds from each issuing bank whose credit cards were part of the batch (in other words, retrieving the money from every customer’s account). The total batch amount will then be transferred via bank-transfer to the merchant’s bank account. How fast a closed batch is settled …

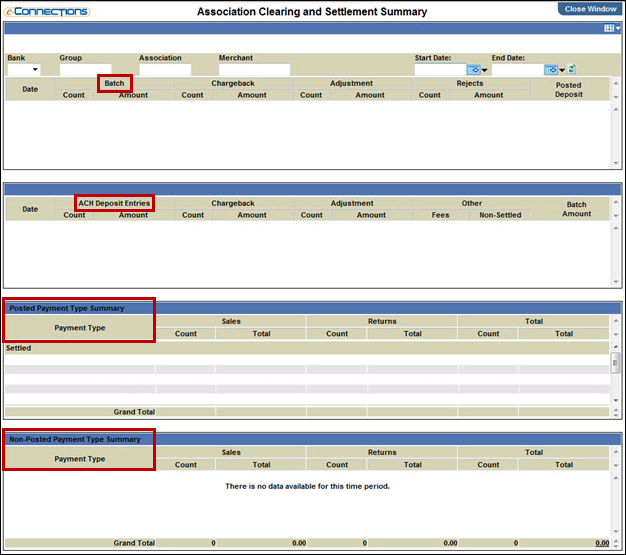

How Does The Settlement Process Work?

- Settling a batch triggers the process of delivering funds to the merchant and charging the customer’s account. Here are the steps involved in a batch settlement: 1. Several transactions, usually within a 24-hour time frame, are aggregated together into a batch and all the transaction information is sent to the payment processor. 2. The processor then transfers the funds to the …

Batches and Settlements History

- In the earlier days of credit card processing, each card-brand (Visa, Mastercard, etc.) would require a separate processor and financial arrangement. This required individual batches and settlements for each type of card, resulting in multiple bank deposits. Changes in laws have since allowed banks to issue and process multiple card types, letting processors offer merchant acco…

Understanding Gross Settlements vs. Net Settlements

- Some merchant accounts are configured for gross settlements, meaning that the total batch amount you processed will be deposited into your bank account for that day. The actual processing fees that applied to those transactions, and all other transactions that month, are then withdrawn from your bank account on the 1st day of the following month. Other processors will …