What is the federal black lung benefits program?

The Division of Coal Mine Workers' Compensation, or Federal Black Lung Program, administers claims filed under the Black Lung Benefits Act. The Act provides compensation to coal miners who are totally disabled by pneumoconiosis arising out of coal mine employment, and to survivors of coal miners whose deaths are attributable to the disease.

Can you get disability for black lung?

Black Lung Benefits and Social Security Disability. Black lung benefits are payments to coal miners—and their survivors—who become disabled from a lung disease known as pneumoconiosis as a result of breathing fine dust-like particles of coal while working in the mines.

How do I contact the Department of Labor about black lung benefits?

Please contact the appropriate U.S. Department of Labor Black Lung district office, if there are any questions concerning benefit rates or any other questions about Black Lung benefits.

What is the SSA’s role in the Black Lung Program?

The SSA has some responsibility for program administration and policy-making of black lung benefits. Furthermore, it handles black lung benefit appeals. But if you have any questions about black lung benefits, the SSA will refer you to the DOL.

How much is a black lung settlement?

Division of Coal Mine Workers' Compensation (DCMWC)ClaimBenefit RatePrimary beneficiary$708.00Primary beneficiary and one dependent$1,063.00Primary beneficiary and two dependents$1,240.00Primary beneficiary and three or more dependents$1,417.00

How hard is it to get Black Lung benefits?

Over the last decade, 52,537 miners have applied to the Labor Department for black lung benefits. The department determined that only 7,252, or about 14 percent, were eligible, according to its data. The industry then challenged 70 percent of those claims, often denying the presence of the disease.

How many people receive Black Lung benefits?

25,699Figure 1 below shows the total number of black lung beneficiaries, federal and private, each year since the federal program began in 1979. In 2019, 25,699 total beneficiaries received black lung benefits, including 18,643 primary beneficiaries and 7,056 dependents.

Will Black Lung benefits increase in 2021?

The Growing Strain on the Black Lung Disability Trust Fund The funding was later raised to $1.10/ton for underground coal and $0.55/ton for surface coal in a series of enactments by Congress, the last of which was a one-year authorization in December 2020 covering calendar year 2021.

How much does Federal black lung pay per month?

The basic black lung benefit is now $153.10 a month for a miner or widow and may rise to $306.10 if there are three or more dependents.

Who qualifies for black lung?

coal minersThe Black Lung Benefits Act provides monthly benefits to eligible surviving family members of coal miners whose deaths were due to black lung disease, or "pneumoconiosis." The Act also provides monthly benefits to survivors of miners who were entitled to benefits based on their own lifetime claims.

How long does it take to get black lungs?

It can take years or decades for the disease to develop. Some people don't have symptoms until they retire. (Most of the people diagnosed with the disease are over age 50.)

Is COPD the same as black lung?

The inhalation and accumulation of coal dust into the lungs increases the risk of developing chronic bronchitis and chronic obstructive pulmonary disease (COPD). Although black lung disease may share many of the symptoms of COPD, it is not COPD and is not treated like COPD.

When did black lung benefits start?

The Black Lung Benefits Act (BLBA) is a U.S. federal law which provides monthly payments and medical benefits to coal miners totally disabled from pneumoconiosis (black lung disease) arising from employment in or around the nation's coal mines.

Is black lung benefits taxable?

Black lung benefit trusts are subject to excise taxes on: • certain acts of self-dealing, IRC Section 4951 • taxable expenditures, IRC Section 4952 • excess contributions to these trusts, IRC Section 4953.

What should a patient with black lung benefits be presenting with when they arrive for services?

You should present your Black Lung card whenever you seek treatment for your lung condition. Showing a medical provider your card will identify you as a Federal Black Lung Program beneficiary, and will help the medical provider determine the proper way to bill for services.

What is black lung insurance?

The Black Lung Benefits Act provides monthly payments and medical benefits to coal miners totally disabled from pneumoconiosis (black lung disease) arising from their employment in or around the nation's coal mines. The Act also provides monthly benefits to a miner's dependent survivors.

Is black lung considered a disability?

Pursuant to federal law, Black Lung Disease becomes a “total disability” once it reaches a level of severity where the miner is not only unable to do his previous coal mining work, but also cannot (with consideration of education, work experience and other various work available) meet the physical demands of other coal ...

Can you draw black lung benefits and still work?

Medical Examination Under this examination, the Department of Labor will determine whether the applicant is disabled to work due to black lung disease. As such, even when you have already contracted such, if you are still able to seek employment, then your claim will be denied.

Is black lung a disability?

The Black Lung Benefits Act provides monthly payments and medical benefits to coal miners totally disabled from pneumoconiosis (black lung disease) arising from their employment in or around the nation's coal mines. The Act also provides monthly benefits to a miner's dependent survivors.

How do they test for black lung?

There is no specific test for black lung disease. If you are concerned about your symptoms, your doctor will first want to take a detailed medical history, asking about your job history in detail to determine the likelihood of exposure.

What is a black lung class action lawsuit?

Black Lung Class Action Lawsuit. Lawsuits are being filed by coal miners who were diagnosed with black lung disease after using defective dust masks or respirators that did not prevent breathing toxic coal dust.

What is Black Lung?

Black lung disease, also known as pneumoconiosis, is an occupational hazard faced by coal miners that is caused by breathing in coal dust. Over several years of breathing coal dust, tiny particles accumulate in the lungs and cause inflammation and tissue damage.

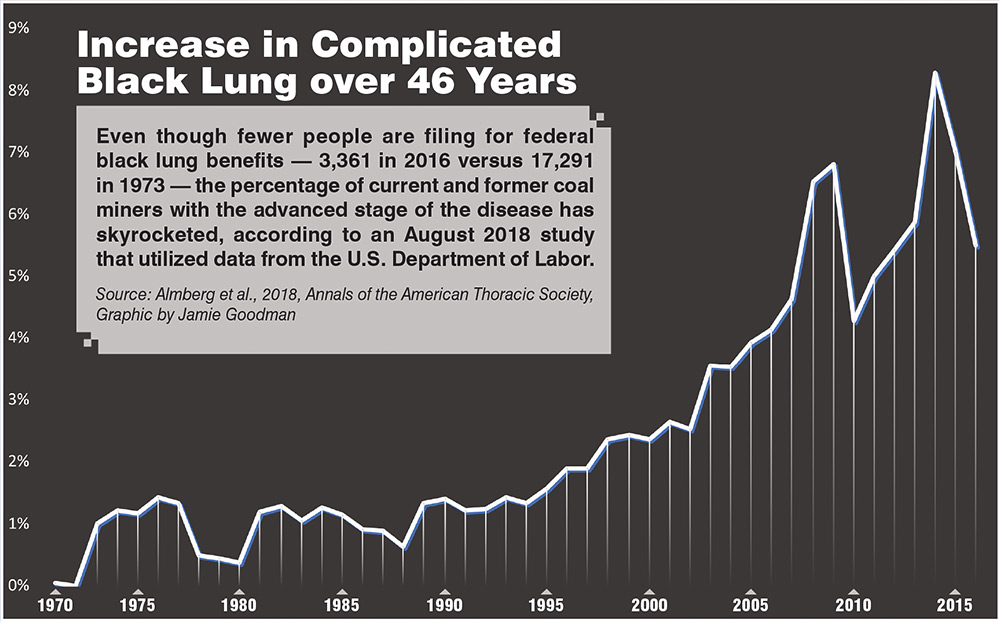

How many coal miners died from black lung disease?

Black lung disease is a well-known occupational hazard for coal miners, with more than 78,000 deaths since the 1970s. The number of cases dropped off sharply after dust limits for coal miners were set by the 1969 Coal Act — but now, the disease has come roaring back.

What did James Couch do?

In February 2016, $8 million was awarded to James Couch, a coal miner from Kentucky who suffered black lung disease after using a dust mask made by Mine Safety Appliances. His lawyers told the jury that the mask failed to protect him from breathing in toxic coal dust, which led to his black lung.

Why is our law firm filing individual lawsuits as opposed to a class action?

The problem is that class actions can have major disadvantages for individuals who have far more serious legal claims than the average person.

Do I have a Black Lung Lawsuit?

The Schmidt Firm, PLLC is currently accepting black lung induced injury cases in all 50 states. If you or somebody you know is a coal miner who has been diagnosed with black lung disease (pneumoconiosis), you should contact our lawyers immediately for a free case consultation. Please use the form below to contact our Disease Litigation Group or call toll free 24 hours a day at (866) 920-0753.

How much is the black lung tax?

Until the end of 2018 the tax was $1.10 per ton for coal from subsurface mines and $0.55 per ton for surface mines, limited to a maximum of 4.4% of the coal’s selling price. Starting January 1, 2019 ...

When was the Black Lung Benefits Act passed?

Signed into law by President Richard M. Nixon on May 19, 1972. The Black Lung Benefits Act (BLBA) is a U.S. federal law which provides monthly payments and medical benefits to coal miners totally disabled from pneumoconiosis (black lung disease) arising from employment in or around the nation's coal mines. The law also provides monthly benefits ...

Which state was the first to provide compensation for coal workers?

History. In 1952, Alabama became the first state to provide compensation for coal workers' pneumoconiosis. In 1969, the United Mine Workers convinced the United States Congress to enact the landmark Federal Coal Mine Health and Safety Act which provided compensation for miners suffering from Black Lung Disease.

When did the SSA start processing black lung claims?

The Federal Coal Mine Health and Safety Act of 1969 assigned initial responsibility for processing black lung benefit claims to the SSA.

What is black lung disability?

Black lung benefits are payments to coal miners—and their survivors—who become disabled from a lung disease known as pneumoconiosis as a result of breathing fine dust-like particles of coal while working in the mines.

Does the SSA have a black lung?

The SSA has some responsibility for program administration and policy-making of black lung benefits. Furthermore, it handles black lung benefit appeals. But if you have any questions about black lung benefits, the SSA will refer you to the DOL. Continue reading here: What Payments Do Not Affect Your Social Security Disability Benefits.

How long can you work in coal mines to get a black lung?

The 2010 Black Lung Benefits Act has been modified so that coal miners who have black lung disease – also called pneumoconiosis – can automatically apply for benefits if they worked in coal mines for at least 15 years and have a respiratory illness that renders them totally disabled.

Which state has the worst black lung disease?

Eastern Kentucky has one of the worst records for black lung disease, according to the Lexington newspaper. Nine percent of the coal miners screened in a NIOSH study between 2005 and 2009 had black lung disease – a higher prevalence than in any other state.

What causes black lung disease?

Black lung disease is caused by inhaling coal dust. The dust can cause serious breathing problems, scarring in the lungs and premature death. There is currently no cure.

Why do people get black lung?

Experts suggest the reasons for the increase in black lung cases may be due to several things, including: Failure to take measures to keep dust down to acceptable levels. If you work or have worked in a coal mine, you may experience symptoms of black lung disease, which include shortness of breath and coughing.

Can black lung cause bronchitis?

In addition to the symptoms of the disease itself, black lung can also cause chronic bronchitis, respiratory failure and other lung disorders. It is important to be evaluated by a physician as soon as you begin to show signs of illness, because the condition can be more disabling the longer it goes untreated.

Does the black lung benefit transfer to the deceased?

The other change automatically transfers the black lung benefits from the deceased miner to his or her survivors.

Can you get workers compensation for black lung disease?

If you suspect that you may have contracted black lung disease, you may be entitled to workers’ compensation and other benefits from your employers and their insurers. Our Lexington, Ky. lawyers strongly urge you to pursue screenings despite any reservations you may have about a black lung diagnosis.

How many beneficiaries are there for the Black Lung Program?

Under the law, there are only two beneficiaries under the black lung program.

What forms are needed for a black lung claim?

These are:Miner’s Claim for Benefits under the Black Lung Act (form CM-911)Employment History (form CM-911a)Aut horization to Obtain Earnings Data from the Social Security Administration (SSA-581)Selection of an Examining Provider To prove the information in your application, the state may ask for additional documents. So, to make the process faster, prepare documents such as all of the family member’s birth certificates, marriage certificates, proof of enrollment, or death certificates, as the case may be.

What is Black Lung Disease?

The Black Lung Disease weakens the organs, shortens breath, and produces chronic coughing. This is usually contracted by miners exposed to asbestos, rock dust, sand dust, and coal dust.

What was the purpose of the Black Lung Benefits Act of 1973?

The act sought the protection of exposure from the coal dust of the miners by setting mining standards. The law then prompted the creation of the Black Lung Benefits Act of 1973.

What is the basic rate for mining disability?

For the reason that the miner is now unable to seek similar mining employment due to the disease, the government provides monthly cash disability benefits to him or his survivors. On average, the basic rate is up to 37%; however, when the miner has dependents, then the rate will increase accordingly, subject to regulations.

How do you know if you have black lungs?

The following are signs that a worker has contracted black lungs: Coughing without mucus production, chest tightness, and breathlessness.

How often do you have to get an x-ray for coal mining?

For those who are already working as an underground coal miner when the act was enacted, they must be given an x-ray examination every five years within the six months provided by the mining company and the National Institute for Occupational Safety and Health

How to determine if a miner is disabled?

Under published regulations a miner is found to be totally disabled if he meets an irrebut- table presumption described in the law-i.e., that X-ray or pathological findings show that he has what is commonly referred to as “complicated” pneumoconiosis. Alternatively, he can be found to be totally disabled if (1) he meets certain medical criteria showing severe breathing im- pairment due to pneumoconiosis or (2) he has another serious condition resulting from pneumo- coniosis, e.g., car pulmonale. If he is not disabled by any of these prescribed medical criteria, he may nevertheless be found to be totally disabled if he has pneumoconiosis and such functional breathing limitation as to prevent him from engaging in any type of sub- stantial gainful activity consistent with his voca- tional competence. Under this evaluation guide the older, long-term miner with minimal educa- tion and skills, who is shown to be unable to do heavy work because of pneumoconiosis, will ordinarily be found to be totally disabled.

How many coal miner claims were denied in 1971?

Of the claims completed by April 30, 1971, 120,000 were allowances (68,000 miners and 52,000 widows) and 125,000 were denials (96,000 miners and 29,000 widows) (table 3). Of the miners approved for benefits, more than 95 percent are aged 55 or older; more than 71 percent are aged 65 or older. Among the eight major coal mining States, the miner beneficiaries in three (West Virginia, Kentucky, and Virginia) are somewhat younger on the average (table 4). Most miners’ claims were denied because X-ray evidence did not disclose the presence of pneumo- coniosis. Most. widows’ claims were denied be- cause there was no evidence that the miner’+ death was due to pneumoconiosis or qualifying “respirable disease” (table 5). over $273 million and monthly recurring pay- ments were over $21 million. Considering augmentation for dependents, the average monthly benefit paid to a miner or widow was $187.26 (table 3). For fiscal year 1972, disbursements are expected to approach $400 million and total beneficiaries at the end of the year will approximate 260,000 (160,000 miners and widows and 100,000 de- pendents).

What is the Social Security off set?

The Social Security Act has since 1965 con- tained a “workmen’s compensation off set” provi- sion. For people who become disabled after June 1, 1965, and are under age 62, the Act limits the amount of combined income from social security disability insurance benefits and State or Federal workmen’s compensation payments. The amount that, may be received is either 80 percent of the worker’s average current earnings before he be- came disabled, or 100 percent of the amount of total family benefits under the social security disability benefits program, whichever is higher. If the combined benefits would exceed this amount, the social security disability benefits are reduced by the amount of the excess. This is not a dollar-for-dollar offset. As a result of this provision, some current social security disability insurance beneficiaries have these benefits reduced when they become entitled to Federal black lung benefits. Most miner appli- cants are aged 62 or older, however, and the offset therefore does not apply to them. Reduction of social security disability benefits has occurred in less than 5 percent of allowed miners’ black lung claims. In most instances where reduction is necessary, only a partial reduction rather than total offset of the social security disability benefit is required. The Federal Coal Mine Health and Safety Act contains a somewhat similar offset provision with similar intent, but a different method of applica- tion. The amount, of Federal black lung benefits payable is reduced if the miner or Gdow is re- ceiving benefits under a State program based on the miner’s disability. This is a dollar-for-dollar offset. For example, if a miner is receiving $120 a month under a State program, the Federal bene- fit is reduced by that amount. As of April 30, 1971, less than 5,000 recipients under the Federal program were receiving reduced benefits because of the receipt, of such State benefits.

How many requests for reconsideration were received in 1971?

As of April 30, 1971, 125,000 claims were denied and over 50,000 requests for reconsideration were received. Allowing for a reasonable lag between the denial notice and request for reconsidera- tion, the current rate of request for reconsidera- tion is estimated at over 50 percent. In projecting further into the future, it appears most likely that the workload of requests for hearings will be very large and severely tax the resources of social security hearing examiners. Plans are already being implemented, however, to gear up the hearing process and take whatever special measures will be required to handle the large influx of new hearing requests. It also appears likely that the Federal district courts in the coal mining region will eventually receive a substantial rolume of litigation from this claims workload.

How much was the dis- ability in 1971?

addition, obligations by State agencies for the development of medical evidence to support valid determinations regarding the existence of a dis- ability are estimated at $5.4 million in fiscal year 1971 and $1.1 million in fiscal year 1972.

How long does it take to get a claim back after a denied claim?

average of about, lo-12 weeks from filing to com- pletion. However, while the initial claims load has been largely processed, there is developing a substantial group of claims in which the denied claimant is exercising his right to request recon- sidera,tion. ( SLW section on reconsideration, hear- ings, and appeals.)

When were the regulations for deter mining?

These were published in the Federal Register on april 7, 1970. The regulations were developed in connection with many interested organizations and individuals, including the Pub- lic Health Service, the Department of Labor, the lynited Mine Workers of America, and the Social Security Administration Medical Advisory Commit,tee.

Overview

Black Lung Disability Trust Fund

The Black Lung Benefits Act established a government trust fund to pay for the benefits, financed by an excise tax on coal. Until the end of 2018 the tax was $1.10 per ton for coal from subsurface mines and $0.55 per ton for surface mines, limited to a maximum of 4.4% of the coal’s selling price. Starting January 1, 2019 the rate was reduced to $0.50 per ton for coal from subsurface mines …

History

In 1952, Alabama became the first state to provide compensation for coal workers' pneumoconiosis.

In 1969, the United Mine Workers convinced the United States Congress to enact the landmark Federal Coal Mine Health and Safety Act which provided compensation for miners suffering from Black Lung Disease. Arnold Miller (1923–1985) a miner and long time labor activist played a big r…

Adjudication and processing

Claims may be submitted to any of nine district offices of the Division of Coal Mine Workers' Compensation of the Department of Labor. The employment and medical history of the claimant are examined, including a complete pulmonary evaluation paid for by the Black Lung Disability Trust Fund. There may be a rebuttable presumption that pneumoconiosis resulted from such employment for miners long-term employed at one or more coal mines. Right of rebuttal is offer…

Benefits and medical services

Present and former coal miners, other workers who have been exposed to coal dust, and their surviving dependents may apply for medical and monthly financial benefits under the Act. The program provides for diagnostic testing to verify the presence of black lung disease and degree of associated disability. Benefits may include a monthly stipend, as well as such medical services as prescription drug coverage, hospitalization coverage, durable medical equipment, and outpatien…

See also

• Coalworker's pneumoconiosis

External links

• The Black Lung Benefits Act (BLBA)

• Black Lung - United Mine Workers of America

• Division of Coal Mine Workers' Compensation (DCMWC)