What is a a life settlement?

A life settlement is the selling of one’s insurance policy for a cash payment of less than the face amount but for more than the cash surrender value.

How does age affect the value of a life settlement?

Beyond eligibility, your age also affects the value of a life settlement for your insurance policy. In most cases, the older you are, the more highly a life settlement investor will value your life insurance policy, and the estimate you receive from a life settlement calculator will reflect that fact.

Can an online life settlement calculator help you sell your life insurance?

An online life settlement calculator can provide a quick general assessment of your eligibility to sell your life insurance policy and the potential value of a life settlement. However, you should be aware that quick online calculators cannot replace the in-depth medical underwriting process required to accurately estimate the value of that policy.

Will a life settlement buy out my life insurance policy?

Most life settlement companies will not buy out a life insurance policy unless it has a face value of $50,000 or more. There are only a few types of life insurance policies that can be sold through a life settlement.

Are life settlements worth it?

Life settlements can be a valuable source of liquidity for people who would otherwise surrender their policies or allow them to lapse—or for people whose life insurance needs have changed. But they are not for everyone. Life settlements can have high transaction costs and unintended consequences.

How does a life settlement work?

A life settlement refers to the sale of an existing insurance policy to a third party for a one-time cash payment. The policy's purchaser becomes its beneficiary and assumes payment of its premiums, and receives the death benefit when the insured dies.

What is a single life settlement option?

A single-life payout is an annuity or pension option that means that payments will stop when the annuitant dies. In a joint-life payout, payments continue after death to the annuitant's spouse. Single-life payouts are generally larger on a per month basis since the payments stop upon the death of the annuitant.

Are life settlements safe?

Some clients who hear about the idea of a life settlement may ask you: Are life settlements safe and secure? The answer is yes: Life settlement transactions are among the safest and most secure financial transactions in both the insurance and financial services markets. One reason is regulation.

Is a life settlement tax Free?

Is A Viatical Settlement Taxable? Most of the time, viatical settlements are not taxable. Settlement proceeds for terminally ill insureds are considered an advance of the life insurance benefit. Life insurance benefits are tax-free, and so it follows that the viatical settlement wouldn't be taxed, either.

Are life settlements taxable?

To recap: Sale proceeds up to the amount of the cost basis are not taxable. Sale proceeds above the cost basis and up to the policy's cash surrender value are taxed as ordinary income. Any remaining sale proceeds are taxed as long-term capital gains.

How are payments determined on life income settlement option?

Life Income A life income settlement is also known as a life annuity. It lets you convert the death benefit to fixed, regular annuity payments for the rest of your beneficiary's life. The insurer guarantees an annual annuity amount based on the beneficiary's expected lifespan and the death benefit amount.

How long will beneficiary receive payments under the single life settlement option?

Lump Sum: The beneficiary will receive the full amount of the death benefit at one time. Fixed Period: The death benefit can be received as an annuity over a fixed period of one to 30 years.

How are settlement options paid?

The four most common alternative settlement approaches are: the interest option, under which the insurer holds the proceeds and pays interest to the beneficiary until such time as the beneficiary withdraws the principal; the fixed period option, under which the future value of the proceeds is calculated and paid in ...

How do I get a life settlement?

The life settlement process starts with a policyholder presenting their policy to a provider, broker, or life settlement company to determine their eligibility. During this time, the third party will review medical records and policy information to see if the person qualifies for a life settlement.

How much do you get for selling life insurance policy?

Typically, a life insurance agent receives anywhere from 30% to 90% of the amount paid for a policy (also known as the premium) by the client in the first year. In later years, the agent may receive anywhere from 3% to 10% of each year's premium, also known as "renewals" or "trailing commissions."

Can I sell my life insurance for cash?

Selling an insurance policy through a viatical settlement is one option that may be used to provide cash to help with current medical and living expenses. Like life settlements, viatical settlements involve the sale of a life insurance policy to a third party.

How do I get a life settlement?

The life settlement process starts with a policyholder presenting their policy to a provider, broker, or life settlement company to determine their eligibility. During this time, the third party will review medical records and policy information to see if the person qualifies for a life settlement.

What are the basic settlement options for life insurance?

Common Life Insurance Settlement OptionsLump-Sum Payment. A lump-sum payment is perhaps the easiest to understand. ... Interest Only. ... Interest Accumulation. ... Fixed Period. ... Lifetime Income. ... Lifetime Income With Period Certain.

How long will the beneficiary receive payments under the single life settlement option?

Under a single life annuity with a 10 or 15 year certain period, guaranteed monthly payments will be made to you for at least a specified number of years. (You can choose either a 10-year period or a 15-year period.) Under this form of annuity, you will receive monthly payments for as long as you live.

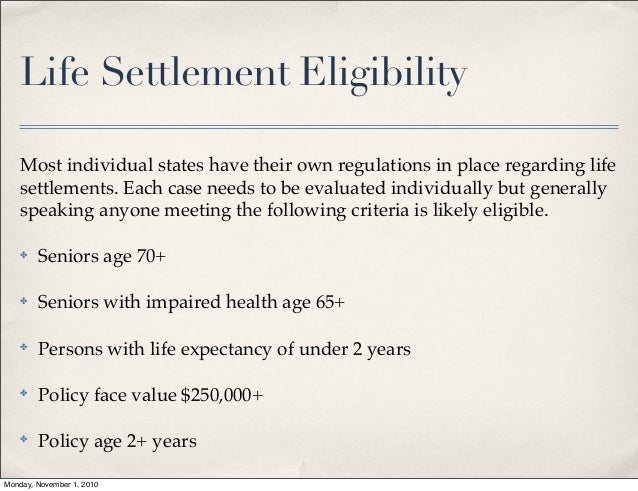

What is the minimum age at which a life settlement is normally permitted?

Age. In the majority of cases, an individual must be over 65 to qualify for a life settlement, although younger people might enter into settlements if they have certain medical conditions.

How Do Life Insurance Settlements Work?

Typically, a life settlement transaction will be an option for those 65 years and older with a policy worth at least $100,000 in death benefits. This is not always the case, but it’s a good place of reference for you to compare to. A typical life settlement payout will be around 20% of your policy size, but the range could be anywhere from 10% to 25%+. For example, if you have a policy valued at $300,000 and you choose to sell it in a life settlement, your final return will be around $60,000.

Are Life Settlements Tax Free?

In short, no, life settlements are not tax free. They are taxable to the extent that you turn a profit upon selling the policy. Life settlement proceeds greater than the amount of premiums you have paid are treated. If you’re concerned about a life settlement increasing your tax liability, you should talk with a financial advisor about how to offset the gains through other investments and tax strategies.

What is viatical settlement?

A viatical settlement involves an insured with a life expectancy of less than 24 months or as defined by the Department of Insurance for the applicable ownership state. If the insured has a life expectancy of more than 24 months or doesn’t meet the qualifications defined by the Department of Insurance, the transaction is considered ...

How old do you have to be to sell life insurance?

Most people who sell their life insurance policies are over 65 years old or have a significant health impairment. Policy Size. Eligible life insurance policies are Universal Life, Term and Whole Life. Policy Type.

How to determine the value of a life insurance policy?

The main factors for determining the value of a life insurance policy are the age and medical condition of an insured. Take our PYC questionnaire or contact us to find out if a life settlement is right for you. Be sure to checkout our Life Settlement Calculator to see the value of your Life Insurance Policy.

Why do people sell life insurance policies?

Reasons for selling a policy include (but are not limited to): Paying off debt, supplementing retirement income, changes to estate planning, getting rid of expensive premium payments , selling policy and using money from sale to obtain a policy with superior coverage. Due to changes in family circumstances, a life insurance policy owner may no longer need the insurance provided by the policy. A spouse may have died, children may have grown up, or a company with life insurance on a key officer may have been sold or gone out of business.

Is life settlement taxable?

Life settlement proceeds may be taxable. You should consult your tax advisor for additional information.

Can life insurance be sold?

Yes, the Supreme Court of the United States declared that your life insurance is personal property that can be sold, traded or even given away. Your life insurance company has no right to question or prevent you from doing this.

What is the most common settlement for life insurance?

If you are considering selling your life insurance policy, you have several life settlement options — the most common being traditional, viatical, and a retained beneficiary payout. A traditional life settlement is the most common type of life settlement. If you are over 65 years old and have a whole, universal, ...

How old do you have to be to get a life insurance settlement?

If you are over 65 years old and have a whole, universal, or convertible term policy valued over $100,000, you may be eligible for a traditional life settlement.

What is retained beneficiary payout?

A retained beneficiary payout allows you to maintain a portion of your beneficiary payout after a life settlement. In other words, you are not cashing out your full policy. As a result, a retained beneficiary payout typically yields a smaller settlement.

What is a viatical settlement?

Viatical Settlement. A policyholder who is chronically or terminally ill may opt for a specific type of life settlement, known as a viatical settlement. Payouts from viatical settlements are typically higher than those from traditional life settlements, since a buyer’s investment will likely be realized sooner.

What is cash surrender value?

Cash surrender value is the actual amount you would receive from your policy’s cash value. Your premium costs. For buyers, the cost of keeping a policy active, or in force, is another significant consideration. Lower premiums usually generate a higher life settlement payout. Outstanding policy loans.

What is universal life insurance?

Typically, universal life insurance is the most sought-after option for life settlement buyers, followed by whole life insurance. Both of these policy types provide a beneficiary payout and a built-in cash value that accumulates during the policyholder’s lifetime.

What is the principle of life settlement?

In general, the older you are, the greater your life settlement payout will be. This concept is built on a financial principle known as the time value of money. This principle states that a dollar today — which, theoretically, can be invested sooner and collect interest faster — is worth more than a dollar tomorrow.

What happens when you take a life settlement?

This is typical for people who no longer work for the company. By taking a life settlement, the company can cash out on a policy that was previously illiquid. Life settlements generally net the seller more than the policy's surrender value, but less than its death benefit.

What Is a Life Settlement?

A life settlement refers to the sale of an existing insurance policy to a third party for a one-time cash payment. Payment is more than the surrender value but less than the actual death benefit. After the sale, the purchaser becomes the policy's beneficiary and assumes payment of its premiums. By doing so, they receive the death benefit when the insured dies.

How does a life insurance settlement work?

How Life Settlements Work. When an insured party can no longer afford their insurance policy, they can sell it for a certain amount of cash to an investor— usually an institutional investor. The cash payment is primarily tax-free for most policy owners. The insured person essentially transfers ownership of the policy to the investor.

What happens if you fail to pay insurance premiums?

Failure to pay the premiums may net the insured a smaller cash surrender value —or none at all, depending on the terms. A life settlement on a current policy, though, usually results in a higher cash payment from the investor. The policy is no longer needed. There may come a time when the reasons for having the policy don't exist anymore.

What happens to a viatic settlement after the insured dies?

After the insured party dies, the new owner receives the death benefit. Viatical settlements are generally riskier because the investor basically speculates on the death of the insured. Even though the original policy owner may be ill, there's no way of knowing when they will actually die.

What happens when you sell a life insurance policy?

By selling it, the insured person transfers every aspect of the policy to the new owner. This means the investor who takes over the policy inherits and becomes responsible for everything related to the policy including premium payments along with the death benefit. So, once the insured party dies, the new owner—who becomes the beneficiary after the transfer—receives the payout.

What happens to the death benefit after a policy is sold?

After the sale, the purchaser becomes the policy's beneficiary and assumes payment of its premiums. By doing so, they receive the death benefit when the insured dies.

What is life settlement?

A life settlement is the sale or exchange of a life insurance policy for a lump sum of cash greater than the cash surrender value but less than the death benefit value. What Is a Death Benefit? The death benefit is the amount on a life insurance policy provided to the beneficiary upon the death of the policyholder.

How long does it take to settle a life insurance claim?

On average, a life settlement transaction takes a few months to fully complete due to the involvement of outside entities. Consult with your financial advisor on specific details concerning your life settlement application.

What is cash surrender value?

The cash surrender value — also known as the cash value — is the cash amount offered to the policyholder in exchange for part or all of their insurance policy’s value. In cash value life insurance policies, policyholders are provided with a death benefit and a savings component that accumulates with every premium payment. If the owner chooses to terminate their life insurance contract before the end of the term period, they are able to receive the accumulated savings, or cash value, rather than the death benefit. An owner can also borrow from their cash value in the form of a loan, but then has to pay back the money with interest to maintain the full death benefit.

What happens to insurance when it is sold?

Once the policy is sold, all rights and ownership are transferred to the new owner or investor. They are then responsible for all future premium payments until the policy matures. At that point, the new owner will be able to receive the death benefit of the insurance contract.

How does a professional life expectancy firm calculate your lifespan?

Professional life expectancy firms calculate your lifespan based on your age, gender, medical history and medical condition as well as other factors against a similar group of individuals. The firm then provides you with an average life expectancy, and it is formulated based on your specific situation.

How long does it take to change your mind after a settlement?

This differs from one state to the next. Some states provide 15 to 30 days after receiving the settlement disbursement to change your mind. Be sure to discuss your options with all potential buyers.

Who is responsible for premiums after a policy is sold?

Once the policy is sold, the buyer, or new policy owner, will be responsible for future premium payments.

What is the difference between a medical malpractice settlement and a trial?

A medical malpractice settlement value is different from the trial value of a case. That’s because a settlement is a compromise—each side gives up something in exchange for the certainty of knowing what they will get or give up. No one can ever say what a judge or jury will do, so settlement is a way to play it safe. For this reason, the settlement value is almost always less than the trial value.

How long does it take to settle a medical malpractice case in Maryland?

The average length of time between the filing of a medical malpractice lawsuit in Maryland and the time that the case gets resolved (usually by out-of-court settlement) is 28 months. Most settlements occur after the discovery phase ends and before the trial is scheduled to start.

What percentage of malpractice is contingent?

A typical contingent fee percentage in a malpractice case is 33% if the case ends in settlement and 40% if the case goes to trial.

Why should victims of harm pay compensation?

Second, people who cause harm should have to pay compensation because, if they didn't, there would be less of an incentive to avoid causing injury.

Can a doctor pay for a second surgery?

If a doctor negligently performs a surgery that requires a second surgery, the victim’s health insurance may pay for that second surgery. However, in medical malpractice cases, there is an exception to this rule that limits the recovery to what the victim paid or will have to pay. A Sliding Scale: Settlement v.

Do lawyers and malpractice adjusters place different settlement values on cases based on what they think the relevant jury might do with?

Lawyers and malpractice adjusters will place different settlement values on cases based on what they think the relevant jury might do with the case.