How much are closing costs on a USDA loan?

How much are USDA closing costs? USDA mortgages require no down payment. Compare that to an FHA loan for which you need 3.5% down, and a conventional loan that requires 3-5% down. For a $200,000 home loan, the following down payments would apply.

Is a USDA loan a good down payment?

The USDA loan program is one of the best mortgage loans available for qualifying borrowers. There’s no down payment required, and mortgage insurance fees are typically lower than for conventional or FHA loans. USDA interest rates tend to be below-market, too.

Does the USDA Rural Development Program pay for the extra payment?

Actually, the extra monthly payment from financing the USDA guarantee fee is only a few dollars a month, depending on the interest rate. Also, like most low down payment programs, USDA Rural Development loans require mortgage insurance (commonly called PMI).

What is the USDA guarantee fee on government loans?

So, each government loan has an up-front and financed guarantee or funding fee. This fee is paid directly to the government agency. In this case, the USDA Guarantee fee is collected by the lender at closing and is paid to the U.S. Department of Agriculture.

How much money is the USDA allocated each year?

The budget assumes a pay cost increase of 2.7 percent and includes an increase of $200 million across the Department to cover the pay and benefit increases. Under current law, USDA's total outlays for 2022 are estimated at $230 billion. Outlays for mandatory programs are $184.2 billion, 80 percent of total outlays.

How does the USDA make money?

USDA programs are funded through the annual Agriculture, Rural Development, Food and Drug Administration, and Related Agencies appropriations bill.

What is the USDA debt to income ratio?

29%/41%USDA Loan Approval The standard debt to income (DTI) ratios for the USDA home loan are 29%/41% of the gross monthly income of the applicants. The maximum DTI on a USDA loan is 34%/46% of the gross monthly income.

What does the USDA spend money on?

Mandatory outlays include crop insurance, nutrition assistance programs, farm commodity and trade programs, and a number of conservation programs.

Is USDA funded by taxes?

Although the United States Department of Agriculture (USDA) Wildlife Services (WS) uses Federal funds to conduct its activities, each year approximately 50 percent of the program's total budget is provided through cooperative agreements with State and county governments, other Federal agencies, private organizations, ...

How much profit do farmers make per acre?

Average four-crop gross income per acre = approximately $790 per acre.

How long does USDA final approval take?

Once you've signed a purchase agreement, the USDA loan application process typically takes around 30-45 days. The faster all parties work together to complete and provide documents for loan approval, the quicker final loan approval and closing can happen.

Can I get a USDA loan with collections on my credit?

Tim: Yes, you can still get approved for a USDA loan after paying off collections or making arrangements to pay them. However, paying off collections can actually make your credit scores go down since that makes the collection accounts look new. Your middle credit score should be at or above 640 for a USDA loan.

What is the maximum square footage for a USDA loan?

2,000If you want to apply for a direct loan for a single-family home, your property must meet certain requirements. Its square footage can't exceed 2,000 and it can't be an income-producing property. What's more, the home's market value can't exceed the local limit.

Is working for the USDA a good job?

7, 2017 – The U.S. Department of Agriculture (USDA) has been rated by employees as among the top ten best places to work in the federal government, moving up two notches to come in at seventh place in the 2017 rankings. That is an improvement over 2016's rankings, when USDA came in tied for ninth place.

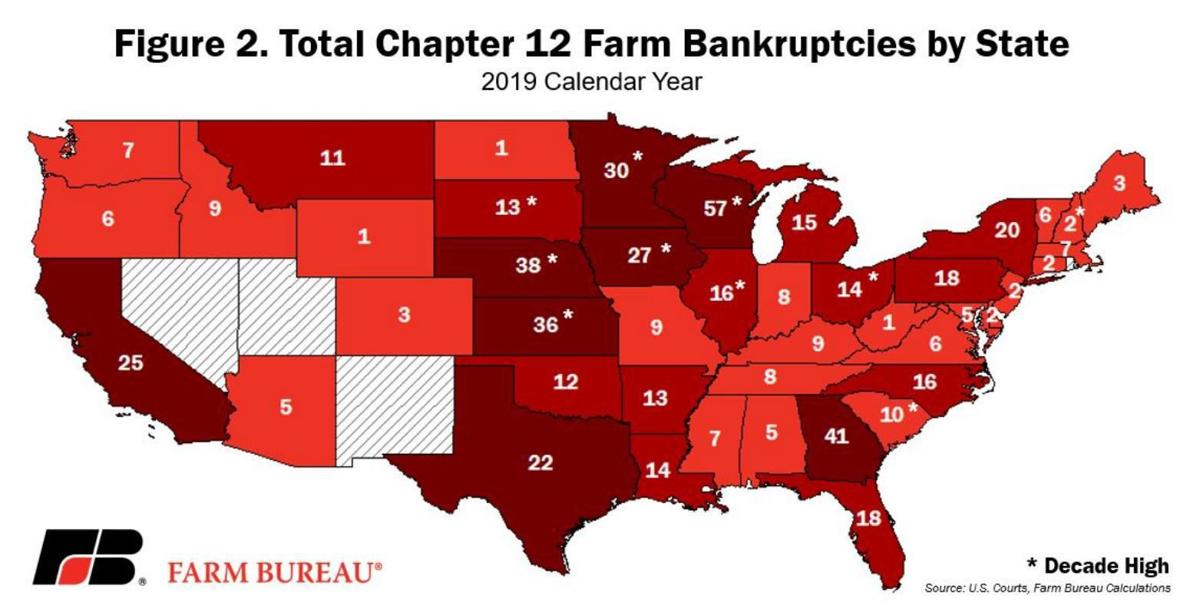

Which states get the most farm subsidies?

Farm Subsidy Payments Between Program Years 2014 and 2020 The majority of payments went to just eight states – Illinois, Iowa, Kansas, Minnesota, Nebraska, North Dakota, South Dakota and Texas. Farmers in those states received more than $41 billion, or 51 percent of the total.

How much does the US pay in farm subsidies?

Farm Bill Overview These programs are included in legislation known as the “Farm Bill” and reauthorized (and occasionally reformed) every five years or so, most recently through the Agriculture Improvement Act of 2018. Subsidies for farmers averaged $16 billion per year over the past decade.

Does USDA require collections to be paid?

USDA does not require medical collection accounts to be paid.

What is the max DTI for VA loan?

41%DTI for VA loan The VA prefers a debt-to-income ratio, or DTI, of no more than 41%. But borrowers with higher DTI ratios can get approved if they have enough "residual income," another factor lenders consider when reviewing mortgage applications.

How do I calculate my debt-to-income ratio?

To calculate your debt-to-income ratio:Add up your monthly bills which may include: Monthly rent or house payment. ... Divide the total by your gross monthly income, which is your income before taxes.The result is your DTI, which will be in the form of a percentage. The lower the DTI, the less risky you are to lenders.

How long does it take to file a loss claim on a REO?

The servicer should file the loss claim within 45 days of the RE O sale date or the claim may be rejected or reduced. Documentation of expenses associated with a loss claim request must be retained in the servicer’s permanent file.

How long does the REO agency have to sell a property?

For properties located on American Indian restricted land, the Agency allows a 12 month marketing period from foreclosure, or the from the expiration of a redemption period, whichever is later.

When are subsidies subject to recapture?

Payment subsidies received on loans approved after October 1, 1979 are subject to recapture. This means that when the property is sold, transferred, or no longer occupied by the customer, all or part of the subsidy granted must be repaid to the government. The amount of subsidy recapture will be determined by the increase in property value ...

When does subsidy recapture have to be paid?

Subsidy recapture must be paid when the property is sold, transferred, or no longer occupied by the customer. If the loan is being paid off but the customer continues to live in the property there are two payment options: Pay the subsidy recapture when the loan is paid off. The subsidy recapture will be discounted by 25% if this option is chosen.

Who pays closing costs on USDA loan?

USDA Closing Costs Paid By Seller. Rather than bringing more cash to close, USDA loans allow the seller to pay up to 6% of the sales price towards the buyer’s closing costs. Therefore, the seller may pay part or all of the buyer’s closing costs.

What is the USDA guarantee fee?

Currently the USDA guarantee fee is 1% of the base loan amount. Fortunately for buyers, the fee is financed on top of the base loan amount, which does not require borrowers to bring it to closing or verify funds to cover the fee.

What is USDA loan?

This fee is paid directly to the government agency. In this case, the USDA Guarantee fee is collected by the lender at closing and is paid to the U.S. Department of Agriculture. Over time, the USDA guarantee fee has fluctuated in the amount charged. It can change at the beginning of each USDA fiscal year.

How does USDA PMI work?

This is why it is called a USDA annual fee. Each year, the USDA PMI is figured by calculating the new balance times the .35% annual fee, then dividing by 12 months. Additionally, paying down the mortgage balance quicker than the 30 year term also reduces the USDA loan PMI quicker than the scheduled amount.

How much does a septic inspection cost?

For lenders, the USDA conditional commitment should be reviewed for septic requirements. Typical costs for a septic inspection ranges from $200 – $500.

How to lower costs at closing?

Another option for a buyer to lower their costs at closing is to receive a lender credit. Often, a lender has the option of raising the interest rate so that the lender is able to provide a credit towards the buyer’s costs. Yes, the interest rate is higher. But, sometimes paying a little higher rate and monthly payment is more important to a buyer than bringing more funds to closing. Having a strategy discussion with an experienced USDA lender could determine if this strategy fits.

Does USDA require mortgage insurance?

Also, like most low down payment programs, USDA Rural Development loans require mortgage insurance (commonly called PMI). USDA PMI is actually called a USDA annual fee. Even though it is included in a borrower’s monthly payment. Not technically a closing cost, it is something that affects a purchase’s affordability.

How much down payment is required for USDA closing costs?

How much are USDA closing costs? USDA mortgages require no down payment. Compare that to an FHA loan for which you need 3.5% down, and a conventional loan that requires 3-5% down. For a $200,000 home loan, the following down payments would apply. Loan Type. % Down. Down Payment.

What do USDA loan closing costs cover?

When you purchase a new home with a USDA loan, you will be responsible for a number of fees at closing.

What are closing costs for 0% down?

Closing costs come in two categories: Costs to acquire the loan and transfer title. Expenses associated with the property.

How much is homeowner's insurance per year?

Plus, your homeowner’s insurance is $600 per year. The lender would collect approximately: $1,000 in prepaid taxes (6 months) $700 in prepaid insurance (14 months) After collecting the fees, the lender sends payment to the county tax office and your insurance company.

Can a seller get extra money for closing costs?

In some markets, the seller can “kick in” extra money for closing costs. Seller credits are typically available when a motivated seller is not getting many offers on the home.

Do expenses tied to a home change?

Typically, costs to acquire the loan and home vary by lender and company, which expenses tied to the property don’t change no matter where you get a loan.

Do you need to find a home with a USDA loan?

With a USDA loan, though, you only need to find a home in an eligible location — which is currently about 97% of U.S. land mass.

Who funds USDA single family housing?

The USDA single-family housing guaranteed program is partially funded by borrowers who use USDA loans.

When did the USDA change mortgage insurance rates?

USDA last changed its mortgage insurance rates in October 2016. Those rates remain in effect today. Today’s USDA mortgage insurance rates are: 1.00% upfront fee, based on the loan size (can be rolled into the loan balance) 0.35% annual fee, based on the remaining principal balance.

What are the requirements for a USDA loan?

Basic USDA loan requirements include: 1 Minimum credit score — 640 with most lenders 2 Clean credit history — No late payments or recent bankruptcy or foreclosure 3 Income requirements — Income limits vary by area; often $91,900 for a 1-4 person household 4 Employment — Borrowers need a steady income and employment history. Self-employment is eligible 5 Geographic requirements — You must own a home in an eligible area 6 Property requirements — Must be a single-family home you’ll use as your primary residence 7 Loan type — Only a 30-year, fixed-rate mortgage is allowed

What is the DTI for USDA loans?

In addition, most USDA lenders want borrowers to have a debt-to-income ratio (DTI) below 41 percent. That means your monthly debt payments (including things like credit cards, auto loans, and your future mortgage payment) shouldn’t take up more than 41% of your gross monthly income. This rule is not set in stone, though.

What is USDA eligibility?

USDA eligibility is based on a combination of household size and geography, in addition to the typical mortgage approval standards such as income and credit score verification.

How to find out if a home is eligible for a USDA loan?

So before you write off a USDA loan, check your area’s status. You can find out if a property is eligible for a USDA loan on USDA’s website. Most areas outside of major cities qualify.

How much income do you need to be a 1-4 person household?

Income requirements — Income limits vary by area; often $91,900 for a 1-4 person household. Employment — Borrowers need a steady income and employment history. Self-employment is eligible. Geographic requirements — You must own a home in an eligible area.

How long does it take to get a USDA loan note guarantee?

The lender must provide evidence the loan was properly closed and remit the upfront loan guarantee fee and the USDA technology fee within 30 days of closing the loan. A Loan Note Guarantee may not be issued beyond 30 days of the loan closing if the account is in default at the time the lender executes the Lender Certification.

What happens if a servicer fails to pay the scheduled annual fee?

If for any reason the servicer fails to pay the scheduled annual fee payment, submitted loss claims may be reduced by the cumulative amount of unpaid annual fees, late fees and/or additional late charges due the Agency.

What is late fee in 7 CFR 3555?

Payments received by the Agency after the payment dates prescribed in this section and supported by §3555.107(i) of 7 CFR 3555 shall include a late charge of four percent of the unpaid fee amount .

What is annual fee?

The amount of the annual fee is calculated from the original amortization schedule of the mortgage at loan closing. The annual fee does not include delinquent payments, prepayments, agreements to postpone payments, or loan modifications to the original mortgage.

Can the appraised value be exceeded?

The appraised value may only be exceeded by the amount of the upfront guarantee fee financed. Therefore, the entire upfront guarantee fee may be financed into the total loan.