Full Answer

Should you invest in Vanguard dividend funds?

Therefore, Vanguard dividend funds are best suited for investors with a minimum of three years to invest. What is a dividend? A dividend is a distribution of part of a company's earnings to certain shareholders.

What can I do with MY vanguard settlement fund?

The role of your settlement fund You should consider keeping some money in your settlement fund so you're ready to trade. You can use your settlement fund to buy mutual funds and ETFs (exchange-traded funds) from Vanguard and other companies, as well as stocks, CDs (certificates of deposit), and bonds.

What is the minimum investment in Vanguard taxable money market funds?

All Vanguard taxable money market funds have a minimum initial investment of $3,000. There are three taxable Vanguard money market funds: 1. Vanguard Cash Reserves Federal Money Market Fund

What is the expense ratio for the vanguard money market fund vmsxx?

The expense ratio for the fund is 0.15%, while the seven-day SEC yield is 0.01%. As of March 31, the one-year return for VMSXX was 0.15%. To learn more about Vanguard money market funds, visit the provider's website.

Do you earn dividends on Vanguard money market account?

Vanguard fund investments in stocks or bonds typically pay dividends or interest, which Vanguard distributes back to its shareholders in the form of dividends to meet its investment company tax status.

What is a Vanguard money market settlement fund?

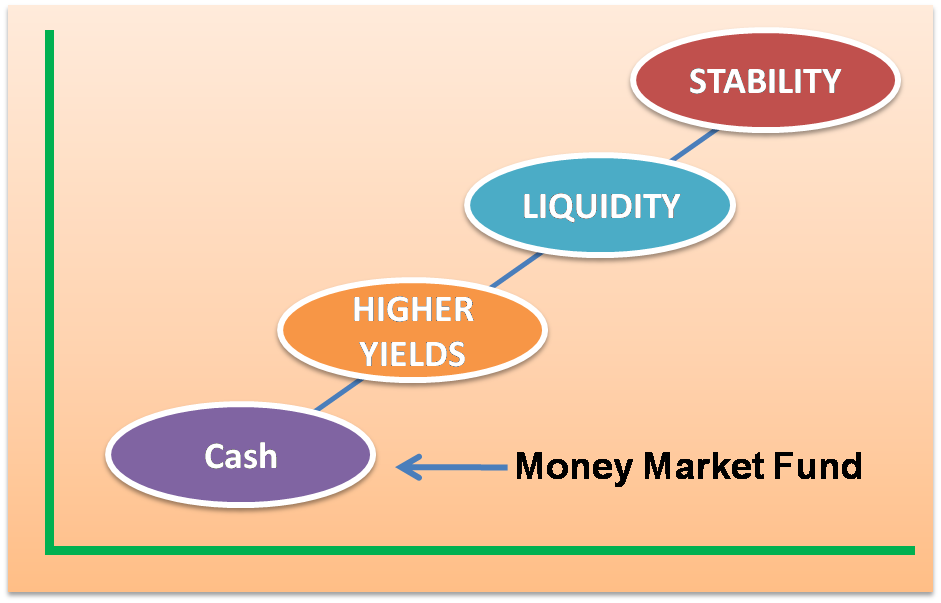

Money market fund A mutual fund that seeks income and liquidity by investing in very short-term investments. Money market funds are suitable for the cash reserves portion of a portfolio or for holding funds that are needed soon.

What is the yield on Vanguard money market account?

Total returnsMonth-end1 YEARVMFXX0.13%0.30%BenchmarkU.S. Government Money Market Funds Average20.09%0.18%+/- Benchmark The difference in a fund's non-fee adjusted return versus an identified benchmark or peer group.0.04%0.12%

Does Vanguard money market fund earn interest?

A money market fund is a mutual fund investment that holds short-term treasuries and other money market instruments. A money market account is a bank product that credits depositors a rate of interest and is FDIC-insured. Vanguard. "Vanguard at a Glance."

Can Vanguard settlement fund lose money?

You could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so.

What is the interest rate on Vanguard settlement fund?

The expense ratio is 0.16% ($16 annually for every $10,000 invested) and the seven-day SEC yield, which reflects the interest earned after deducting fund expenses for the most recent seven-day period, is 0.01%. The one-year return as of March 31 was 0.14%.

What is the average return on money market funds?

You can probably expect around 2–3% returns from a money market fund. And while that might be better than the returns you'll find with a savings account, it's still nothing to write home about. Plus, that's before the fees and expenses, which cut into your returns even more.

What is the average return on Vanguard funds?

10.29%Past performance is no guarantee of future returns....100% Equity.Average annual return10.29%Years with a loss26 of 942 more rows

Can a money market fund lose money?

Because money market funds are investments and not savings accounts, there's no guarantee on earnings and there's even the possibility you might lose money.

Are money market funds Worth It?

Money market funds are considered a good place to park cash, because they're much less volatile than the stock or bond markets. Money market funds are used by investors who want to protect rather than grow their retirement savings, but still earn some interest — somewhere between 1% and 3% a year.

Should I use a money market fund?

A money market fund is an excellent option if you're looking for a safe, short-term, and liquid vehicle to park your cash. These mutual funds are designed to provide low costs, great liquidity and very low risk.

What is the point of money market funds?

The primary purpose of a money market fund is to provide investors a safe avenue for investing in secure and highly liquid, cash-equivalent, debt-based assets using smaller investment amounts. In the realm of mutual-fund-like investments, money market funds are characterized as a low-risk, low-return investment.

What are settlement funds?

Settlement Funds means money to be paid by the City pursuant to Part 5 of this Settlement Agreement, consisting of the Reversionary Amount, the Non-Reversionary Payments, and the Unconditional Individual Amount to be paid to each member of the Settlement Class.

How do I withdraw money from my Vanguard money market account?

How do I make a withdrawal?Log into your account.Select 'Payments' from the 'My Portfolio' menu.Select 'Money out'Any money held as cash and available for withdrawal will be shown here. Select 'Withdraw cash'Follow the on-screen instructions.

How does money market funds work?

How Do Money Market Mutual Funds Work? Like other kinds of mutual funds, money market funds assemble a portfolio of securities and sell shares to investors, who earn returns from the portfolio in the form of income and capital gains.

What happened to Vanguard Prime money market fund?

Vanguard shifting prime money market fund to safer U.S.-backed investments. Next month, Vanguard will transition its $125.3 billion Prime Money Market Fund into a government money market fund and rename it the Vanguard Cash Reserves Federal Money Market Fund.

How much investment is required for Vanguard Total Stock Market Index fund?

The minimum investment requirement for that fund is $3,000.

How long does it take to transfer money to Vanguard?

A transfer from your bank to your Vanguard account can take a few days before the money is cleared and ready to use. So having that money ready is crucial.

What Is A Settlement Fund?

A settlement fund is a fund where your money sits after you sell your investments or receive dividends. You can withdraw that money and transfer it to your regular checking account.

Where do dividends go?

Dividends you receive from your stocks or other securities go directly to your settlement fund. So if you want to grow your investments, set your account to “reinvest” so that the dividends can automatically be used to buy more shares.

Does a settlement fund earn interest?

Your settlement fund will earn you some interest on the money it contains , but not a lot. To learn more about the interest, visit Vanguard.

What are dividends?

Dividends are payments of income from companies in which you own stock. If you own stocks through mutual funds or ETFs (exchange-traded funds), the company will pay the dividend to the fund, and it will then be passed on to you through a fund dividend.

What are qualified dividends?

Dividends can be "qualified" for special tax treatment. (Those that aren't are called "nonqualified.") Most payments from the common stock of U.S. corporations are qualified as long as you hold the investment for more than 60 days.

What's the tax rate on dividends?

Qualified dividends are subject to a 0%, 15%, or 20% tax rate, depending on your level of taxable income.*

Get more from Vanguard. Call 1-800-962-5028 to speak with an investment professional

Get more from Vanguard. Call 1-800-962-5028 to speak with an investment professional.

Investor Education

Vanguard funds not held in a brokerage account are held by The Vanguard Group, Inc., and are not protected by SIPC. Brokerage assets are held by Vanguard Brokerage Services, a division of Vanguard Marketing Corporation, member FINRA and SIPC.

How to learn more about Vanguard money market funds?

To learn more about Vanguard money market funds, visit the provider's website.

What is Vanguard cash reserve?

With a history going back to 1975, Vanguard Cash Reserves Federal Money Market Fund ( VMMXX) is Vanguard's oldest money market fund. Holdings are made up of cash, U.S. government securities and/or repurchase agreements collateralized by U.S. government securities.

What Are Money Market Funds?

Not to be confused with a money market account, a money market fund is a type of mutual fund that holds cash and high-quality, ultra-short-term cash-equivalent securities.

What is a VMSXX?

3. Vanguard Municipal Money Market Fund. For investors residing in states other than California or New York, the Vanguard Municipal Money Market Fund ( VMSXX) is a good choice for a money market fund in a taxable brokerage account. Tax-exempt at the federal level, VMSXX holds short-term, high-quality debt securities.

Does Vanguard have cash?

But just about every Vanguard investor's assets are held in one of these cash accounts, even if only for a brief period. Thus, it's wise to know how Vanguard's money market funds work, and which one is best for your needs.

Do Vanguard funds get attention?

Vanguard money market funds don't get a lot of love from the investment community, nor do they receive much attention in financial media.

Is Vanguard money market tax exempt?

If the investor holds a money market fund with tax-exempt bonds issued in their state of residence, interest may also be tax-exempt at the state level. All Vanguard non-taxable money market funds have a minimum initial investment of $3,000.

Fund Description

The fund invests in a variety of high-quality, short-term municipal securities. It invests in securities with effective maturities of 397 days or less, maintains a dollar-weighted average maturity of 60 days or less, and maintains a dollar-weighted average life of 120 days or less.

Justin Schwartz

Justin A. Schwartz, CFA, Portfolio Manager at Vanguard. He has been with Vanguard since 2004, has worked in investment management since 2005, has managed investment portfolios since 2010. Education: B.S., University of Richmond.

What is Vanguard investment?

Vanguard Investments is a mutual fund company that offers some of the best low-cost, no-load mutual funds available to investors today. Their dividend funds are among Vanguard's best funds. Dividends can be received as a source of income or they can be used to buy more shares of the mutual fund. 1

What is Vanguard dividend appreciation index?

Vanguard Dividend Appreciation Index Fund ( VDADX) is a large blend stock fund that provides exposure to U.S. companies with a history of increasing their dividends. It is ideal for investors who are growing a long-term portfolio. As of November 2021, its current yield is 1.60% with an expense ratio of only 0.08%, and the minimum initial purchase is $3,000. 7

What is Vanguard high dividend yield?

Vanguard High Dividend Yield Index ( VHYAX) is ideal for investors looking for income now with high yields for stocks. The portfolio consists primarily of large-cap value stocks of companies in the United States that pay high dividends compared to similar companies. As of November 2021, the current yield for VHYAX is an impressive 2.70%. The expense ratio for VHYAX is a rock bottom 0.08%, though the minimum initial purchase is $3,000. 6

What is Vanguard Utilities Index?

Vanguard Utilities Index Adm ( VUIAX) focuses on stocks in the utilities sector, which is highly sought for its high dividends. The portfolio holdings consist of large-cap U.S. stocks of utility companies, such as Duke Energy Corporation (DUK) and Southern Company (SO). As of November 2021, the current yield is 2.92%. The expense ratio for VUIAX is an attractively low 0.10%. However, this mutual fund is only offered in Vanguard's "Admiral" share class, which has a minimum initial purchase of $100,000. 4 As an alternative, investors can buy the ETF version of the fund ( VPU) for no minimum initial investment. 5

What is mutual fund?

A mutual fund is an investment vehicle that takes funds from many investors and pools them together to invest them into stocks, bonds, and other securities. Dividend mutual funds invest in stocks that pay dividends. The dividends can be paid in cash or reinvested in more shares.

Why do people buy dividend mutual funds?

Because of their income-generating nature, dividend mutual funds are best-suited for retired investors.

What is dividend in stock?

A dividend is a distribution of part of a company's earnings to certain shareholders. They can be paid out as cash or additional stock. Shareholders must vote to approve dividends. There are also dividend-paying mutual funds and ETFs.

Why isn’t it common practice for people to just put their money in an S&P Index Fund instead of hiring a FA?

I honestly don’t understand this. So much research demonstrates that simple investing beats FAs a VAST majority of the time. Meanwhile, the fees for most FAs rob you blind.

Do dividends reinvest in retirement fund?

On the balances and holding page of the retirement fund, the dividends/capital gains elections is all set to reinvest. But on the Money Market Fund, I saw that the dividends/capital gains elections for this fund were set to N/A so I changed them to reinvest as well.