How much does it cost to buy a structured settlement?

Depending on how a structured settlement works, buyers typically charge from nine percent to 18 percent of the purchase price when buying your structured settlement. You may find lower rates, but be wary of buyers charging higher rates. If it’s more than 10 percent, shop around and remember it is acceptable to negotiate for a lower rate.

What are the different types of structured settlement companies?

There are two types of structured settlement companies: brokers and direct-funded agencies. A structured settlement broker will help a company to buy out your settlement and usually receives payment for services from the buyer, but sometimes you pay for that service.

Do structured settlement companies buy annuities?

Structured settlement companies, also known as factoring companies, will buy your structured settlement or annuity payments for a lump sum of cash. You should shop around for a highly-rated company and compare offers. How much do structured settlement buyers charge?

What is a 20 percent discount on a structured settlement?

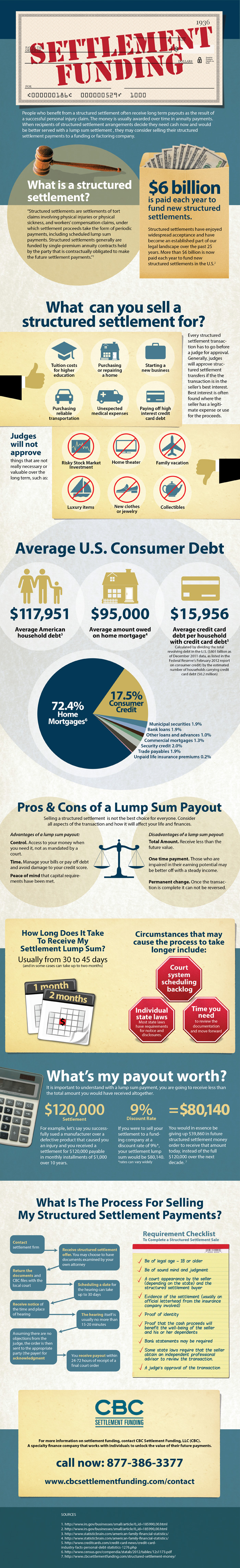

For example, if you have a $100,000 structured settlement, a company may offer you a 20 percent discount rate, meaning you will receive 20 percent less than the value of your settlement, or $80,000. The lower the discount rate, the better it is for the consumer, because that means you will receive more money.

What percentage does J.G. Wentworth take?

9% to 15%Typically, JG Wentworth's fees range from 9% to 15% of the asset's total value. Its representatives provide free quotes over the phone to help you evaluate the cost of cashing in your structured settlement, winnings or annuity.

Do you get more money with structured settlement?

Payments are guaranteed by the insurance company that issued the annuity. A structured settlement often yields, in total, more than a lump-sum payout would because of the interest your annuity may earn over time.

How is a structured settlement paid out?

A structured settlement can be paid out as a single lump sum or through a series of payments. Structured settlement contracts specify start and end dates, payment frequency, distribution amounts and death benefits.

How long does it take to sell a structured settlement?

How long does it take to sell my structured settlement? After you've signed the contract, on average it takes about 45 days to receive your money. However, keep in mind that every structured settlement purchase transaction is different due to each state's laws regulating such purchase transactions.

What to do with a $100000 settlement?

What to Do with a $100,000 Settlement?Sort Out Tax Implications.Find a Financial Advisor.Pay Off the Debts.Invest in a Retirement Home.Start a Business or Help Friends and Family.Donate the Money to the Needy.Final Words.

What is a disadvantage of a structured settlement?

A major drawback of a structured settlement is that it may jeopardize the beneficiary's eligibility for public benefits, which may be particularly problematic when the person's medical needs are covered by Medicaid rather than private health insurance.

Do you have to pay taxes on structured settlement?

Under a structured settlement, all future payments are completely free from: Federal and state income taxes; Taxes on interest, dividends and capital gains; and. The Alternative Minimum Tax (AMT).

What is better a lump sum or structured settlement?

Structured settlements can save you on taxes versus a lump sum, and for many people work as a form of income or annuity every year. Structured settlements can work in many instances. But they may be less than advantageous in others.

Do settlements get taxed?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Should I sell my structured settlement?

There's nothing wrong with getting a buyout of a structured settlement if the discount isn't super deep, but make sure you have a very good reason for selling your settlement. For example, it could be worth it if you're needing to pay for immediate medical care, pay off a mountain of debt, or buy a house.

Who buys structured settlement?

Structured Settlement & Annuity Buyers That Will Purchase Your Payments. A structured settlement purchasing company, also known as a factoring company, purchases all or a portion of your future structured settlement or annuity payments in exchange for a lump sum of cash.

Is JG Wentworth a ripoff?

Is JG Wentworth Legit? Yes, this is a legitimate financial services company founded in 1991. JG Wentworth offers structured settlement payment purchasing, debt relief services, and annuity purchasing. The company has an accredited BBB profile with an A+ rating.

Are structured settlements a good idea?

The best reason to support structured settlements is to have payouts of income to last throughout the beneficiary's lifetime. With guaranteed payments, there is less chance of losing principal to poor investments, spendthrift habits or the undue influence of family and friends.

Do you have to pay taxes on structured settlement?

Under a structured settlement, all future payments are completely free from: Federal and state income taxes; Taxes on interest, dividends and capital gains; and. The Alternative Minimum Tax (AMT).

How long does a structured settlement last?

If you receive a structured settlement instead of the $300,000 cash, you'll get payments over a term of years or your lifetime (however you choose), and each payment is fully tax free. Thus, a structure converts your after-tax earnings into a tax free return.

What does lump sum settlement mean?

A lump sum settlement is a payout that comes in one single, large payment. This type of settlement occurs following negotiations, and the single payment covers the entire agreed on amount.

Who uses a structured settlement company?

They are often paid monthly or annually in installments. Consumers who want to get their structured settlements paid out as a lump sum should work with a structured settlement company.

What is broker fee?

Broker fee: A company may charge a fee if it needs to hire a broker, or act as a brokerage itself, in order to secure the funds for the lump sum payment. Often, this fee is worked into the final payment amount.

What is Rapid Capital Funding?

Rapid Capital Funding is a structured settlement purchaser that can assist you with renegotiating your settlement and expediting payouts. Rapid Capital Funding offers an ATM debit card allowing for instant funding.

How long does it take to get cash for an annuity?

Get cash for structured settlements and annuities. Advances in as little as five days. Pays court fees and all costs associated with the transaction. No hidden fees. Choose check or wire transfer. Refer a friend and get $500.

When do you pay surrender fees?

Depending on the initial plan setup, surrender charges and fees must sometimes be paid when selling or transferring a structured settlement. Surrender charges are imposed by the company that owns the structured payments as a way to recoup the money spent in creating the plan in the first place.

Do you have to pay legal fees to sell a settlement?

Legal fees: Generally, since a structured settlement is a legally-binding agreement, you will need to appear in court in order to sell your payments to a company. Some companies pay the associated court fees, while others require you to pay any court costs or legal fees yourself.

Does settlement affect price?

Total amount of the settlement: Obviously, the total value of the settlement affects the price you can sell it for today. Structured settlements of lower value may not be easy to sell for a lump sum.

What is the present value of a structured settlement?

The present value of a structured settlement is the value of future payments in today's dollars. If you agree to receive $1 every year for ten years, the present value of that agreement is actually less than $10. This is because if you invested that $1 every year, it wouldn't earn nearly as much interest as $10 invested all at once.

Why is the present value of a structured settlement greater than the sum of all future payments?

However, if the inflation rate is higher than prevailing interest rates, the present value of a structured settlement will be greater than the sum of all future payments. This is because it takes a larger pool of money to fund a structured settlement when the dollars the payee receives are continually losing value due to inflation.

How to determine how much a structure is worth?

In order to determine whether you are getting a fair price for your structure--indeed, in order to determine how much your structure is worth in the first place--you must compute its present value. The difference between what a structured settlement purchaser offers you and the present value of your settlement represents the true cost of the deal you are being offered.

Is selling a settlement bigger than buying a house?

For many people, the decision to sell a structured settlement may be the biggest financial transaction they ever undertake. Bigger, even, than purchasing a house. For this reason, wise consumers should hire an attorney to guide them through the process.

What is a rate when selling a structured settlement?

What is a "rate"? When you are offered to sell your structured settlement, buyers would cite a " discount rate " based on which your structured settlement will be valued.

What is the effective rate for structured settlement payouts?

You may be offered a discount rate of 5-6 percent, but deeper into the disclosure you'll be advised that an effective rate of 20% will be applied. THIS is the rate you should notice. The effective rate will determine how much money you will get.

What is the final price of a contract?

As a rule, the higher the effective rate, the LESS you'll get paid. The final price is what you are actually paid after taking off applicable fees and charges.

Who Will Buy My Structured Settlements?

Factoring companies specialize in purchasing structured settlement and annuity payments in exchange for quick cash at a discounted price.

How Do Structured Settlement Purchasing Companies Work?

When you contact a purchasing company, a representative will gather your information and calculate a quote based on how much cash you need and the number of payments you want to sell.

How Can Annuity.org Help Me Choose a Purchasing Company?

We always recommend you do your own research when investigating structured settlement buyers. But if you’re feeling overwhelmed or are looking for credible industry experts, we can recommend our partners. Together, we’ve helped thousands of people sell their periodic payments to get cash fast.

How long does it take to get an annuity approved?

The entire court approval process takes anywhere from 45 to 60 days to complete. Once a judge signs off on the sale, a copy of the transfer order is sent to the insurance company that administers your structured settlement annuity. Finally, the factoring company will send you a lump-sum payment.

How to get a better quote from multiple companies?

You may get a better quote if a buyer knows you’re a smart shopper looking for the best deal.

How to protect yourself from scams?

The best ways to protect yourself against potential scams and predatory practices is to have a firm grasp on your own immediate and future financial goals. If you know exactly how much money you need, you are less likely to be vulnerable to unscrupulous factoring companies.

When did structured settlements start?

Structured settlements emerged in the 1970s to ensure lifelong, fixed income for plaintiffs in personal injury and wrongful death cases. Usually, these payments are administered through an annuity or other qualified funding asset.

How Do Structured Settlements Work?

Legal settlements can be paid out in a one-time lump sum or through a structured settlement where periodic payments are made through a financial product known as an annuity. The key differences between these settlement options are in the areas of long-term financial security and taxes.

How are legal settlements paid?

Legal settlements can be paid out in a one-time lump sum or through a structured settlement where periodic payments are made through a financial product known as an annuity. The key differences between these settlement options are in the areas of long-term financial security and taxes. When a plaintiff receives a settlement through ...

What happens when a plaintiff receives a lump sum settlement?

When a plaintiff receives a settlement through a one-time lump sum, they might spend it too quickly, robbing them of the long-term financial security that future payments could provide. Moreover, any interest and dividends earned if the lump-sum were to be invested would be subject to taxes.

Why is structured settlement more than lump sum?

A structured settlement often yields, in total, more than a lump-sum payout would because of the interest your annuity may earn over time.

What are the pros and cons of structured settlement?

Structured Settlement Pros and Cons 1 Payments are tax-free. 2 In the event of the recipient’s death, the beneficiary can continue to receive tax-free payments. 3 Payments can be scheduled for almost any length of time and can begin immediately or be deferred for as many years as requested. They can include future lump-sum payouts or benefit increases. 4 Spreading out payments over time can reduce the temptation to make large, extravagant purchases and guarantees future income. This is especially helpful if the recipient has a medical condition that will require long-term care. 5 Unlike stocks, bonds and mutual funds, structured settlements do not fluctuate with market changes. Payments are guaranteed by the insurance company that issued the annuity. 6 A structured settlement often yields, in total, more than a lump-sum payout would because of the interest your annuity may earn over time.

What is the role of a judge in an annuity sale?

The role of the judge is to decide if the sale is in the best interest of the annuity owner. Other rules may apply depending on the details of your annuity contract and the laws of the state where you live. The Structured Settlement Protection Act of 2002 provides federal guidelines on such transactions.

What was the purpose of the National Structured Settlements Trade Association?

By 1985, the National Structured Settlements Trade Association formed to preserve and promote structured settlements to injury claimants through education and advocacy.

What is structured settlement?

A structured settlement is a legal settlement resulting in tax-free payments from an annuity to the plaintiff over time. If you find yourself the recipient of a structured settlement and you prefer a lump-sum payment, a structured settlement company can buy out all or part of the contract and give you cash up front. You will pay a fee for this service, so you’ll have to weigh whether the cost of selling all or a part of your settlement balances your need for one large payment.

What are the best structured settlement companies?

The four best structured settlement companies are Peachtree Financial Solutions, Stone Street Capital, Fairfield Funding and J.G. Wentworth. In this guide, we will review essential information about structured settlements and structured settlement buyouts along with detailed information about each of our top company picks.

What to do before selling a structured settlement?

Meet with a legal or financial professional before selling a structured settlement to understand tax and other implications. You need to know if any other entity could have legal access to funds from the sale. For example, an insurance company that paid benefits for medical treatments for injuries resulting in a medical or personal injury structured settlement could seek reimbursement from a lump sum payout.

What does it mean to work with someone who knows your structured settlement case?

Working with someone who knows your structured settlement buyout case means you don’t have to explain the same details over and over. Denial Rate. A judge will deny a proposed structured settlement sale if the circumstances do not result in a deal that’s in your best interest.

What is district settlement finance?

District Settlement Finance is a small firm with annuity experts who offer personal service. The representatives take the time necessary to understand your financial needs and goals. Annuity specialists guide each client through court proceedings and each step of selling a structured settlement.

What are the factors to consider when choosing a structured settlement company?

Three other considerations are paramount to choosing a structured settlement company: customer service, denial rate and total dollars purchased.

How long does it take to get money from Stone Street Capital?

The company offers one-on-one consultations via phone, chat and email. Receiving cash can take from 45 to 90 days, depending on your state laws but Stone Street Capital provides a cash advance option.

What is a structured settlement company?

Structured settlement purchasing companies, also known as factoring companies, serve those selling their structured settlement payments. These companies offer settlement owners lump sums of cash in exchange for the rights to future payments or portions of future payments. These transactions between the settlement annuity holder and a third party are what is referred to as the secondary market for annuities.

How are settlements paid?

Structured settlements may also be paid through an “obligation of the United States government,” such as U.S. Treasury bonds or notes and savings bonds.

Why do we need structured settlements?

The federal government encourages structured settlements to help people who have suffered serious injuries and their family members to receive compensation and a reliable form of income to support their needs . In short, structured settlements provide injured people and their dependents financial security over the long term in a way that large, lump-sum payments might not.

What does a settlement buyer do?

Settlement buyers offer settlement owners immediate cash in exchange for selling future payments the owner is slated to receive.

Why are structured settlements considered compensation?

For more than 35 years, tax laws have treated structured settlements favorably for two reasons: They’re viewed as a way to keep victims from relying on public assistance and they’re considered compensation for harm, rather than income.

What happens when a buyer sends a contract to the seller?

The buyer sends the seller a contract spelling out the offer and any requirements and costs. Then, once the contract is signed, the buyer files the required paperwork and arranges for a court hearing. Federal law requires a judge to rule that the proposed transaction is in the best interests of the settlement holder.

Can you use structured settlements as collateral?

The laws that encourage structured settlements also bar them from being used as collateral for loans. While some companies claim to offer structured settlement loans, there really is no such thing.