Full Answer

How much did the Equifax settlement pay out to consumers?

If you filed for a cash payout from Equifax as part of the credit bureau’s settlement for its massive 2017 data breach, you’re probably not getting anywhere close to $125. On Thursday, Dec. 19, a Georgia federal judge awarded $77.5 million to the attorneys representing the class of consumers against Equifax.

What happened to Equifax?

In September of 2017, Equifax announced a data breach that exposed the personal information of 147 million people. The company has agreed to a global settlement with the Federal Trade Commission, the Consumer Financial Protection Bureau, and 50 U.S. states and territories.

How do I contact the administrator about the Equifax settlement?

>. The administrator will not call you about the settlement, but you can reach the administrator by phone at 1-833-759-2982. In September of 2017, Equifax announced a data breach that exposed the personal information of 147 million people.

Why did the FTC sue Equifax?

In its complaint, the FTC alleges that Equifax failed to secure the massive amount of personal information stored on its network, leading to a breach that exposed millions of names and dates of birth, Social Security numbers, physical addresses, and other personal information that could lead to identity theft and fraud.

See more

How much will each person get from Equifax settlement?

Under the settlement terms, Equifax agreed to set up a fund to provide free credit monitoring and identity theft protection to consumers, as well as provide cash payments to people affected by the breach—up to $20,000 per person.

Has Equifax settlement been paid?

Equifax data breach settlement. In 2017, Equifax announced a breach that exposed the personal data of approximately 147 million people. The legal settlement is now final. Here's how you can use the services provided through the settlement to protect and monitor your credit.

How much can you sue Equifax for?

Other plaintiffs who wish to remain anonymous have won against Equifax after the data breach in September 2017. Depending on the court you file your case in, you could win up to 25,000$.

How much can you get from a data breach settlement?

How much can I receive from the Capital One settlement? Class members can collect up to $25,000 in cash for lost time and out-of-pocket expenditures relating to the breach, including unreimbursed fraud charges, money spent preventing identity theft and fees to professional data security services.

What happened to the Equifax lawsuit?

Equifax denied any wrongdoing and no judgment or finding of wrongdoing was made. If you are a Class Member, the deadline to file Initial Claims Period claim(s) for free credit monitoring or up to $125 cash payment and other cash reimbursement passed on January 22, 2020. The Settlement is now effective.

How do I check my Equifax claim?

You can also log into your myEquifax account and view your status by clicking the “check status of a dispute” button. If you are checking your status by mail or phone, please make sure you have the confirmation number that was provided to you when you submitted your dispute.

How long does Equifax dispute take?

within 30 daysIf you file a dispute regarding information on your Equifax credit report, you can generally expect to receive the results of the investigation within 30 days. If the information on your credit report is found to be inaccurate or incomplete, your credit report will be updated, generally within about 30 days.

Who qualifies for Equifax settlement?

You are a Settlement Class Member if you are among the approximately 147 million U.S. consumers identified by Equifax whose personal information was impacted by the Equifax Data Breach.

Can you take Equifax to court?

You can sue Equifax, but you may need to take certain steps depending on the reason. Suing Equifax requires that Equifax did something wrong like Equifax reporting you as dead, Equifax mixed you up with someone else, Equifax refused victim's rights with identity theft, or failed to investigate a credit error.

Is Equifax being sued?

In 2017, hackers broke into Equifax in a breach that exposed the financial information of 147 million Americans. A federal court in 2020 approved a $380 million settlement of class actions lawsuits, with no finding or judgment of wrongdoing made.

What happens if impacted by breach of Equifax?

Information Assurance recommends that anyone who may have been affected by the Equifax data breach take the following five actions:Put a fraud alert on your credit report. ... Keep an eye on bank account and credit card statements. ... Check your free credit reports. ... Turn on two-factor for Weblogin and for personal accounts.More items...•

Does Equifax sell your information?

We use and sell personal data to nonaffiliated third parties for the following commercial purposes: Consumer credit reporting. Some of our affiliates collect, use, and sell personal data when acting as a consumer reporting agency, as this activity is regulated by the FCRA.

Can I sue the credit bureaus?

If a credit bureau, creditor, or someone else violates the Fair Credit Reporting Act, you can sue. Under the Fair Credit Reporting Act (FCRA), you have a right to the fair and accurate reporting of your credit information.

Can I sue Equifax for wrong information?

If you see information on your Equifax credit report that you believe is inaccurate or incomplete, simply file a dispute, and we'll look into it right away.

How do I sue Experian?

You can start an Experian credit report dispute in the following ways: Write a dispute letter and mail it to the Experian dispute address listed below. Fill out Experian's online dispute form from their website. Contact Experian by phone at (888) 397-3742.

How do I dispute a credit report and win?

Bottom lineFill out a credit bureau dispute form.Print your credit report and circle the errors.Attach documents that support your dispute.Write a letter to the credit bureau explaining the errors.Send your documents by certified mail with a return receipt, so you know they received your letter.

How long does Equifax monitor credit?

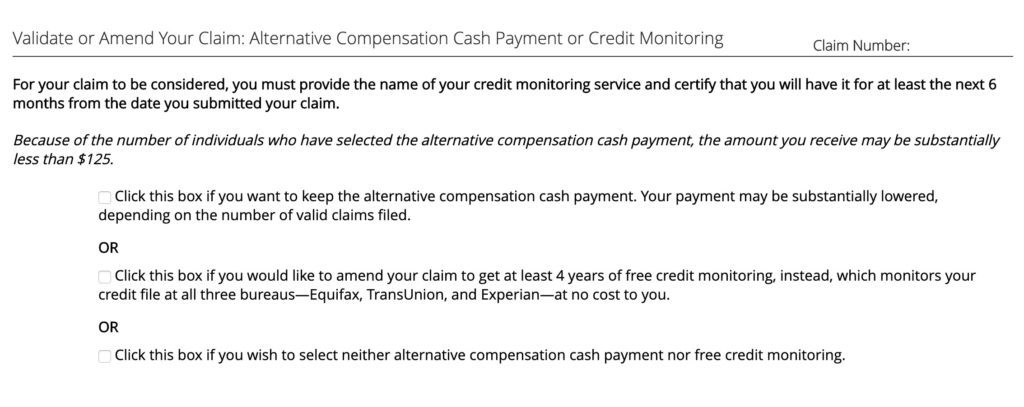

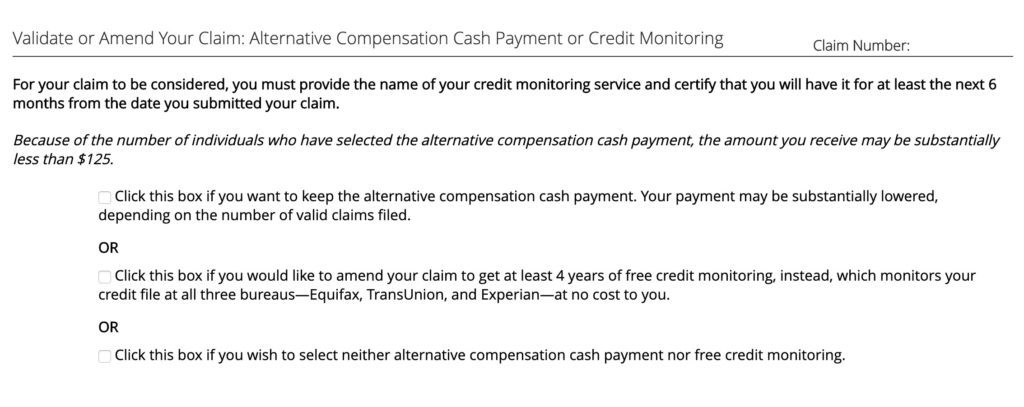

Part of the Equifax settlement included a choice for consumers. They could opt for free credit monitoring for up to 10 years or get up to $125. For about a week, there was anticipation that many affected consumers who get credit monitoring on their own could receive some decent money from Equifax.

How much money did the CFPB pay to the CFPB?

The company has agreed to pay $175 million to 48 states, the District and Puerto Rico, as well as $100 million to the CFPB in civil penalties.

How many Social Security numbers were stolen?

The FTC said hackers stole names and dates of birth and 145.5 million Social Security numbers. They also were able to get 209,000 payment card numbers and expiration dates. Read: Security alerts on credit cards work. Just be sure to set them at the lowest amount possible.

What does contingency fee mean in a case?

The attorneys took the case on a contingency-fee basis, which means that they covered all of the case expenses and have not been paid any money in relation to their work, according to the settlement. The settlement lays out what the four attorneys did.

How much did Equifax settle?

That’s over 20% of the roughly $380 million settlement fund Equifax agreed to set up to directly help consumers affected by the breach, according to the Hamilton Lincoln Law Institute, which house the Center for Class Action Fairness and opposed the high fee award.

How much did Equifax pay for 2017?

If you filed for a cash payout from Equifax as part of the credit bureau’s settlement for its massive 2017 data breach, you’re probably not getting anywhere close to $125. On Thursday, Dec. 19, a Georgia federal judge awarded $77.5 million to the attorneys representing the class of consumers against Equifax. That’s over 20% of the roughly $380 ...

How much did Equifax pay for data breach?

In July, credit bureau Equifax agreed to pay a total of nearly $700 million for its role in the massive 2017 data breach, which impacted 147 million consumers. The settlement included a $380.5 million restitution fund dedicated to consumer compensation and fees associated with the case.

How much money can you get from a data breach?

Under the terms of the settlement, affected consumers could potentially get up to $20,000 in reimbursement for out-of-pocket expenses they incurred because of the data breach. But even if you didn’t suffer any direct harm from the breach, you could claim free credit monitoring or a flat cash payout of up to $125 if you already have credit services in place.

What happens if you don't file a non cash claim?

If consumers failed to file the additional information before Oct. 15, 2019, the notice said their claim would be completely rejected.

Is credit monitoring worth money?

In fact, the FTC took the unusual step of urging consumers to pick the free credit monitoring instead of the cash payment, saying the service was worth “hundreds of dollars” and comes with identity theft insurance and restoration services.

Did Equifax give $125?

It’s also one more reason why the consumers who sought a cash settlement from Equifax won’t be getting the full $125 as initially expected. In fact, consumers were never going to get $125, says Ted Frank, director of litigation for Hamilton Lincoln. “That’s down to $6 or $7 [per consumer] now.