The total cost of private divorce mediation is typically between $3,000 and $8,000, but it can be outside of that range in some cases. If you and your spouse split the fee 50-50, as most couples do, that would translate to a typical cost of $1,500 to $4,000 for each of you.

| Divorce circumstances | Average (mean) cost | Median cost |

|---|---|---|

| With no major contested issues | $4,100 | |

| Without alimony-related disputes | $7,800 | $4,250 |

| Without child-related disputes | $10,100 | $6,000 |

| With disputes settled out of court | $10,600 |

Do you have to pay taxes on a divorce settlement?

You do not usually have to pay Capital Gains Tax if you give, or otherwise ‘dispose of’, assets to your husband, wife or civil partner before you finalise the divorce or civil partnership. Assets...

Do you pay taxes on divorce settlements?

This means that every individual has their own personal tax allowance and pays personal tax on their own income. Separation or divorce does not affect this. Note that there is no Income Tax to pay when you transfer assets under a divorce settlement.

Are divorce settlements taxable income?

June 6, 2019 1:40 AM. Generally, money that is transferred between (ex)spouses as part of a divorce settlement—such as to equalize assets—is not taxable to the recipient and not deductible by the payer. This is different than alimony, also called spousal maintenance, which is taxable (and deductible) unless the settlement specifies that it ...

How to get a fair divorce settlement?

Method 2 Method 2 of 4: Negotiating Wisely

- Prioritize your goals. Whether you are in an uncontested or contested divorce, you need to be ready to discuss a settlement with the other side.

- Don’t let anger do the negotiating. While marriage is a personal relationship, it's more productive to treat divorce as a business relationship.

- Organize your financial information. ...

How much will I lose in a divorce?

Most men experience a 10–40% drop in their standard of living. Child support and other divorce-related payments, a separate home or apartment, and the possible loss of an ex-wife's income add up.

Do most divorce cases settle?

More than 90 percent of divorce cases settle prior to trial either by one spouse offering a settlement that the other accepts, or at mediation.

How much does a PA divorce cost?

approximately $14,300The average cost of divorce in Pennsylvania state is approximately $14,300. The expenses can reach $21,500 if there are children or property involved. The average filing fees in Pennsylvania are $350.

What is a normal divorce settlement UK?

In the UK, divorce settlements typically aim to achieve a 50/50 split for both parties. However, this split is often not met due to other circumstances that arise, meaning that one party receives a larger portion of the matrimonial assets than the other.

How is divorce settlement calculated?

As well as looking at actual earnings, the Court will also assess the parties' future potential earnings. The Court will take a realistic approach when calculating the settlement and will take account of the individual's skills, time out of work, age and the possibility and cost of retraining and the job market.

How long does it take for divorce settlement?

How long does it take for a settlement agreement to be reached in an uncontested divorce? In uncomplicated estates, where parties are able to settle on issues of care, contact and maintenance of their children, then an uncontested divorce is suitable and may take as few as 3 – 4 months to complete.

Who pays attorney fees in divorce?

Traditionally, the parties each pay for their own attorney in a divorce suit. The spouses are not allowed to share an attorney, so each party must provide their own attorney for the legal process.

What is a wife entitled to in a divorce in Pennsylvania?

Contributions of one spouse to the other's education. Future earning capability of each spouse. Income of both parties, including medical insurance and retirement benefits. Contribution of each spouse to the marriage, including income and homemaking.

What qualifies you for alimony in PA?

Am I entitled to alimony in PA? No, there is no entitlement to alimony in Pennsylvania. Instead, it's purely discretionary with the court, and based on 17 factors listed in Section 3701 of the PA Divorce Code.

What is ex wife entitled to after divorce?

Generally, a former spouse is entitled to claim against your money or assets at any point up until they re-marry unless a financial consent order has been approved by the court. Many separating couples are under the impression that getting divorced breaks all financial ties.

What a woman should ask for in a divorce settlement?

What Should I Ask for in a Divorce Settlement?Your Marital Home. Think about what you want from your marital home. ... A Fair Share of Assets. ... Retirement and Investment Accounts. ... Fair Debt Division. ... Parenting Time. ... Child Support and Alimony. ... Your Child's Future Needs. ... Take the First Step with Coumanis & York.

What can wife claim in divorce?

For example, under the Hindu Marriage Act, 1955, both the husband and wife are legally entitled to claim permanent alimony and maintenance. However, if the couple marries under the Special Marriage Act, 1954, only the wife is entitled to claim permanent alimony and maintenance.

Does living with a new partner affect financial settlement?

There is no fixed rule when it comes to new partners and the divorce settlement. The court is obliged to consider the impact of a new partner but whether the new partner influences the final decision can come down to numerous factors including; The length and stability of the new relationship.

Is a divorce settlement final?

The starting point is a 50/50 split, though the court has the final say in all settlements.

Can I get divorced without a financial settlement?

The most important thing to stress is that if you've already divorced without reaching a financial settlement, it's not too late. While it's usually advised you reach a financial settlement and get a financial order from court at the time of divorce, you can still do this after you're divorced.

Can you sue your ex wife after divorce?

In general, yes you can sue. Whether you will be successful or the judge will toss your case out of court is a different question altogether. You may also be required to pay for your ex's lawyer for filing a frivolous lawsuit.

What is the purpose of the settlement section?

The aim of this section is to provide a guide to what the law says about calculating a fair financial settlement. Although there are varies guidelines and benchmarks defined in Family Law and clarified by Case Law, it remains notoriously difficult to work out a precise settlement.

What is the power of the court in divorce?

The Court has wide sweeping powers in divorce, nullity and judicial separation proceedings to make a number of financial orders in favour of either party to the proceedings and/or for the benefit of any children of the family. The range of Orders include: lump sum Orders, property adjustment Orders, pension sharing/earmarking Orders (in the case of divorce or nullity proceedings), interim and/or final periodic payments Orders, and maintenance pending suit Orders.

Should husband and wife be divided?

Firstly, the assets of the husband and wife should be divided primarily so as to make provision for their housing and financial needs to take into the account the various criteria.

What does equal mean in divorce?

When negotiating a divorce settlement it's imperative that you understand that "equal" doesn't mean a 50/50 split. Equal means what is fair to both parties involved. You won't get everything you believe you are entitled to and, you will need to be able to compromise for the sake of all involved.

How long does Joan have to pay spousal support?

Divorce Settlement: The marital assets are split 50/50 and Joan is ordered to pay Mark rehabilitative spousal support for a term of five years. The long-term marriage established a lifestyle that both Mark and Joan had become accustomed to.

Why was the marital assets split 60/40?

The marital assets were split 60/40 in Lance’s favor because the judge felt that Lance, being the lower income earner and caretaker of their children should continue to live the standard of living he and his children had become accustomed to.

Why did Mark's standard of living decrease after a divorce?

Mark's standard of living will decrease once there is a divorce due to the fact that he makes less than Joan. The two went to mediation and Joan chose to pay temporary spousal support that is deductible at tax time rather than splitting assets in John’s favor.

Can a divorce be split 50/50?

That is not the case in this divorce scenario. It only makes sense that assets be split 50/50 and both spouses move on and rebuild their lives.

Will you come to a fair resolution at the end of your marriage?

In the hope of helping those who are in the dark about what is and isn’t fair, here is a collection of examples of different scenarios and what we believe to be fair divorce settlements .

Is a lump sum payment in a divorce settlement taxable?

Lump-sum payments of property made in a divorce are typically taxable. Now those payments are no longer deductible.

Is a cash settlement in a divorce taxable?

Generally, money that is transferred between (ex)spouses as part of a divorce settlement—such as to equalize assets—is not taxable to the recipient and not deductible by the payer. Such plans are always taxable on withdrawal because the money was not taxed when it was contributed.

Do divorce payments get taxed?

The Tax Cuts and Jobs Act enacted new tax rules regarding spousal support payments, also known as alimony. In divorces finalised after January 1, 2019, the person paying spousal support can no longer deduct the amount from their taxes. For recipients, spousal support payments are no longer considered taxable income.

Do you pay tax on a divorce settlement UK?

In England and Wales the majority of divorce settlements will not be taxable. The main tax provisions which relate to people going through a divorce or separation cease to apply when the relationship has broken down, rather than by reference to the date of Decree Absolute or Final Dissolution Order.

Do you have to report settlement money on your taxes?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money, although personal injury settlements are an exception (most notably: car accident settlement and slip and fall settlements are nontaxable).

Does a divorce settlement affect benefits?

Most income replacement benefits including Universal Credit, Jobseekers Allowance, Income Support and Employment and Support Allowance would be affected by a settlement. Your divorce financial settlement may see you receive assets such as property, cars and other possessions.

Is divorce maintenance taxable?

Certain alimony or separate maintenance payments are deductible by the payer spouse, and the recipient spouse must include it in income (taxable alimony or separate maintenance). Alimony and separate maintenance payments you receive under such an agreement are not included in your gross income.

What is the recapture rule in divorce?

For instance, if a divorce decree orders the husband to pay his wife a large amount of alimony for one year with a lower amount to follow, the IRS uses the “recapture rule.”. This requires the paying party to “recapture” some of the money as taxable income. As if a divorce is not complicated enough, it is challenging to understand what part ...

Do you have to live separately to exchange money?

To begin, the exchange must be in cash or an equivalent, payment must be made under a court order, the parties must live separately, there are no requirements of payment after the receiving party dies and each party files tax returns separately.

Is it better to give one party a lump sum settlement?

For instance, when the couple has a home with a mortgage, it is common for one party to keep the house and pay the other spouse the equity as a property settlement. No taxable gain or loss is recognized.

Is child support deductible in divorce?

When a divorcing couple has children, child support is often part of the settlement. This money is not deductible. Besides alimony, divorce usually contains a property settlement as well. Many times, it is not recommended for a couple to equally divide marital assets.

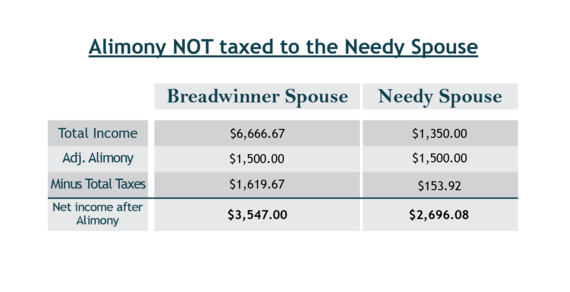

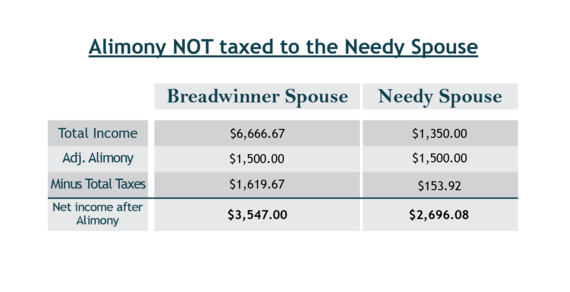

Is alimony settlement taxable?

Is Divorce Settlement Money Taxable? After a divorce is final, assets change hands. It is important to understand what part of the settlement is taxable and to what party. In the case of alimony, the amount is taxable to the person who receives the support. In return, the person paying the money receives a tax deduction.

Who pays tax on divorce settlement?

Marital property is commonly described as property acquired by the spouses during their marriage (for example, a family home or retirement plan assets).

Why is it important to provide an extra copy of a settlement proposal?

It is beneficial to provide an extra copy for your partner during negotiations so that he or she can see what basis you are working on when making settlement proposals.

What is equitable distribution?

As a result, equitable distribution refers to a fair, but not strictly equal, division of marital assets.

What to do when you are approaching the end of your divorce?

If you’re approaching the end of your divorce, it may be a good idea to consult with your partner to get formal appraisals or estimates on the more valuable items.

Is cash traded between spouses deductible?

Cash traded between (ex)spouses as a component of a separation repayment—for instance, to adjust resources—is for the most part not available to the collector and not duty deductible to the payer.

Is spousal support taxable?

This is not to be confused with alimony, also known as spousal support, which is taxable (and deductible) unless the settlement stipulates otherwise.

Do you have to accept the divorce?

Irrespective of how you feel about it, the fact remains that you agreed to the divorce and must accept the obligations that come with it.

What Is a Divorce Settlement Agreement?

A divorce settlement or a separation agreement is the most important document that you’ll need to sign when ending your marriage. It contains the terms you and your spouse have agreed to get divorced on.

How much does a woman's finances drop after divorce?

Statistics speak for themselves— women’s finances drop by 41% after a divorce. When children are involved, women can take an additional hit, even in a friendly divorce.

Why do couples have equal parenting time?

Equal parenting time also reduces child care expenses and conflicts between spouses

What document do you need to sign when you get divorced?

A divorce settlement or a separation agreement is the most important document that you’ll need to sign when ending your marriage. It contains the terms you and your spouse have agreed to get divorced on.

What is asset distribution?

Asset distribution —Divide the assets, such as furniture or cars, and decide what goes to which spouse

How many women pay off debt after divorce?

Division of debt —Note that 44% of women make paying off the debt their primary post-divorce concern. To make this process simpler, you must list all debts you and your soon-to-be ex-spouse have, both jointly and individually. After that, determine who is liable for which debts

Is it important to divide retirement funds?

Retirement funds —If you’re nearing retirement age or if you’ve been married for a long time, settling on the division of retirement funds is super important

What to consider when considering a divorce settlement?

There are many factors to consider, including assets, incomes, living expenses, inflation, alimony, child support, taxes, retirement plans, investments, medical expenses and health insurance costs, and child-related expenses such as education.

What is the biggest mistake a divorced spouse can make?

The biggest mistake divorcing spouses can make is being in the dark about finances. If your spouse has always handled all of the financial decisions in your household and you don't have any information about you and your spouse's income and assets, your spouse will have an unfair advantage over you when it comes time to settle the financial issues in your divorce.

How to minimize taxes after divorce?

Work together with a divorce financial planner or tax accountant to minimize the total taxes you and your spouse will pay during separation and after divorce; you can share the money you save. Don't forget that both spouses are liable for taxes due as a result of audits on joint returns, so it's usually in your best interest to work together and minimize possible liabilities. If you're facing complicated tax issues in your divorce, it's best to consult with an experienced family law attorney and an accountant.

How does mediation help in divorce?

The mediation process involves a neutral third-party mediator (an experienced family law attorney trained in mediation) that meets with the divorcing couple and helps them reach an agreement on the issues in their divorce. Mediation is completely voluntary; the mediator will not act as a judge, or insist on any particular outcome or agreement.

How to know if you are getting a fair deal after divorce?

Sounds good, right? The only way to know if you're getting a fair deal is to determine the value of the investments on an after-tax basis, then decide if you like the deal. Again, you should speak with a tax professional about the impact of any proposed property division before you agree to it.

What to do if you suspect your spouse is planning a divorce?

If you suspect your spouse is planning a divorce, get as much information as you can now. Make copies of important financial records such as account statements (eg., savings, brokerage, and retirement) and all other data that relates to your marital lifestyle (eg., checking accounts, charge card statements, tax returns).

What is the difference between mediation and adversarial legal process?

Mediation also provides divorcing couples a lot of flexibility, in terms of making their own decisions about what works best for their family, compared with the traditional adversarial legal process, which involves a court trial where a judge makes all the decisions.

Claim

Dr. Phil's divorce settlement has finally been revealed as $1 million.

Origin

Since at least February 2021, online advertisements have promised details on a divorce settlement for television psychologist Dr. Phil. One of the ads featured a picture of Phil McGraw and his wife, Robin McGraw. It read: “Dr.

How much did Melissa Mathison and Harrison Ford settle for?

Without a prenuptial agreement, their settlement weighed in at a whopping $85 million. Mathison also negotiated some of her ex-husband's future earnings from "Indiana Jones" and "The Fugitive" sales, which he filmed during the couple's years together.

Did Mathison and Ford get divorced?

Unfortunately, Mathison and Ford's relationship was not meant to be and they filed for divorce 18 years after getting married, as reported by People. Ironically, the couple had at first separated in an attempt to reconcile some of their differences. They ended up getting back together for a few months before announcing their final legal separation. The couple sought joint custody of Malcolm and Georgia, and Ford's manager, Pat McQueeney, reported that the split was on good terms. "The separation is amicable, and the couple remain very friendly," McQueeney stated.

Section 25 of The Matrimonial Causes Act 1973

Equality

- In October 2000, the House of Lords delivered a very important judgment in a case involving “big money”, called White vs White. In that judgment, the House of Lords said that:- 1. In seeking to achieve a fair outcome, there was no place for discrimination between husband and wife and their respective roles; 1. The Court's aim should be to achieve a fair result and before making a divisio…

The Overriding Objective

- The ancillary relief rules are a procedural code with the overriding objective of enabling the Court to deal with cases justly. Dealing with a case justly includes, so far as is practicable:- 1. Ensuring that the parties are on an equal footing; 2. Saving expense; 3. Dealing with the case in ways which are proportionate:- 3.1. to the amount of money involved; 3.2. to the importance of the case; 3.3…

The Parameters

- The factors that directly impact the shape of the order that a court is likely to make (if an agreement cannot be negotiated) include: The length of the marriage 1. Co-habitation versus marriage 2. Co-habitaion before marriage Income 1. Earning capacity 2. Ability to work / illness 3. Support whilst re-training The needs of each party 1. What is really meant by need 2. How is nee…