How much is a slip and fall accident settlement worth?

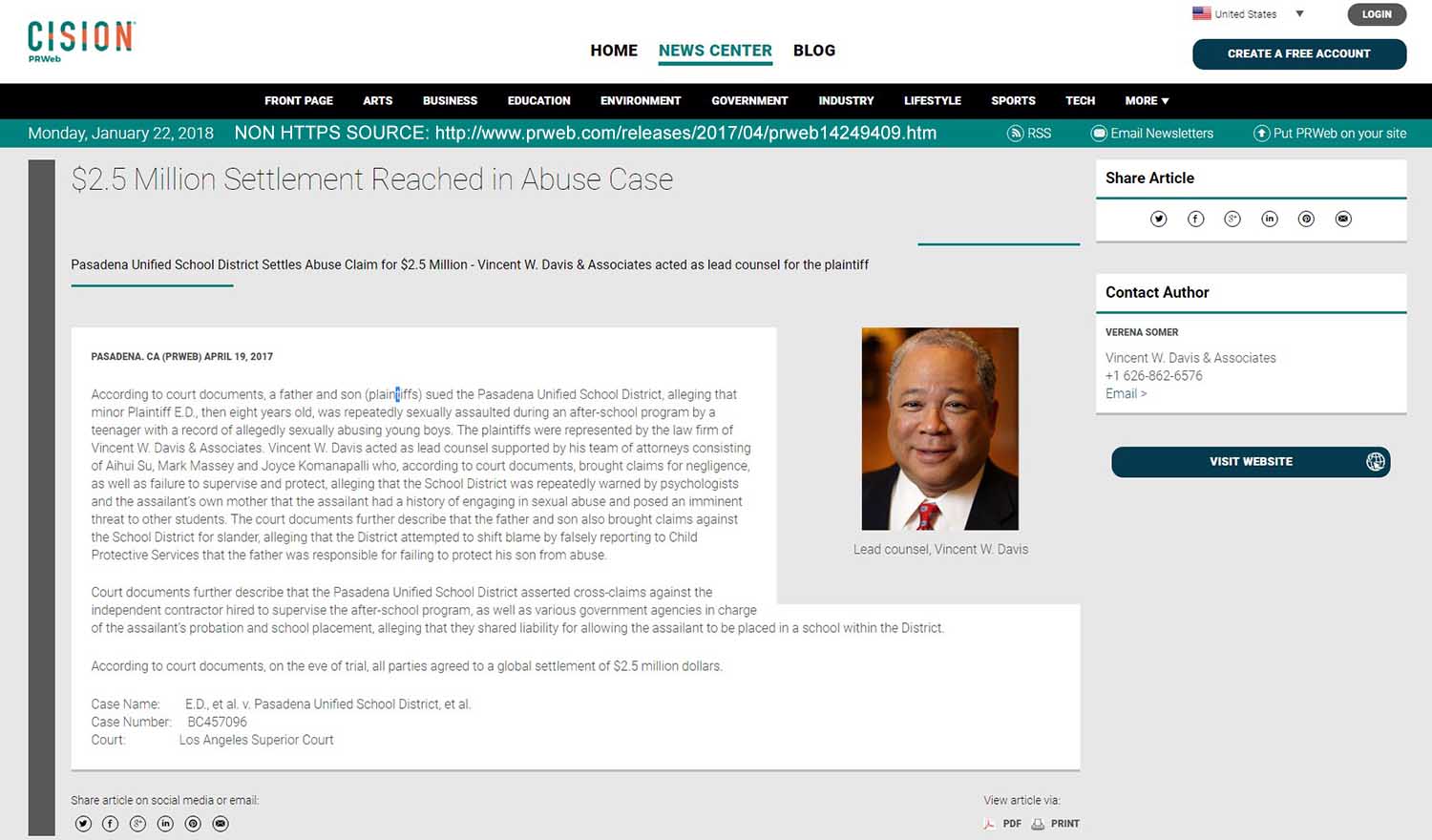

The personal injury lawyer gathered a lot of evidence, and she got the slip and fall accidents settlement amount of $120,000 from that case. A lawyer’s experience is very crucial for slip and fall settlement cases.

How does age affect the value of a life settlement?

Beyond eligibility, your age also affects the value of a life settlement for your insurance policy. In most cases, the older you are, the more highly a life settlement investor will value your life insurance policy, and the estimate you receive from a life settlement calculator will reflect that fact.

How does a life settlement calculator work?

A life settlement calculator will also factor in information about the policy you own. The types of policies that qualify for life settlements include universal life (which makes up the bulk of policies sold on the secondary market), whole life, and term life policies that can be converted to permanent.

How old do you have to be to get a life settlement?

In most cases, you must be 70 years old to qualify for a life settlement. Viatical settlements may be an option for younger policyholders if they have a chronic or terminal illness.

How is settlement value calculated?

How Do Insurance Companies Determine Settlement Amounts?The type of claim you are making. ... The policy limits and amounts allowed for recovery. ... The nature and extent of your injuries. ... The long-term effects of your accident on your life. ... The strength of your case. ... The distribution of fault. ... Previous matters.

What is the highest personal injury settlement?

Here are the Largest Personal Injury Settlements in US History$150 Billion For The Family of Robert Middleton. ... $4.9 Billion For The Anderson Family From General Motors. ... Gas Station Manager Awarded $60 Million After Suffering Brain Injuries Caused by Derailed Train. ... Ford Motor Co.More items...•

How much are most car accident settlements?

The average settlement amount for a car accident is approximately $41,783.00. This figure may be high in comparison to national averages across the United States because the data includes more car accident settlements involving serious injuries.

How do you calculate an insurance settlement?

The basic formula insurance companies use to calculate auto accident settlements is: special damages x (multiple reflecting general damages) + lost wages = settlement amount.

How long does a personal injury claim take to settle?

A straightforward injury claim could take around six months to settle, while a more challenging case could take three years or longer to come to an end.

How long does it take to settle out of court?

Generally a case can take anywhere from 3 months to 18 months to settle which will vary on the specific facts of the case and whether litigation is required through the Court.

How long does a car insurance claim take to settle?

Total loss claim – this means your car isn't repairable (also known as a write-off). At this point, your insurer will agree a settlement figure with you which is likely to be agreed within 30 days, once your insurer has assessed the car and agreed it is a write off.

How long does an insurance company have to investigate a claim?

In general, the insurer must complete an investigation within 30 days of receiving your claim. If they cannot complete their investigation within 30 days, they will need to explain in writing why they need more time. The insurance company will need to send you a case update every 45 days after this initial letter.

How much money can you get from a neck injury?

How much is a neck injury worth? It will vary depending on the type of injury, but the average payout for a neck injury is between $5,000 and $50,000. Soft tissue neck injury claims are worth between $5,000 and $20,000 on average. Neck disc injury cases that result in surgery average over $200,000.

How do you calculate emotional pain and suffering?

These types of compensation are called pain and suffering. Generally, pain and suffering awards will be calculated by adding up the economic damages and multiplying them by a number between 1.5 and 5, depending on the severity of the injury.

What is the formula for personal injury settlements?

The formula goes like this: Damages = Economic damages x 1.5 (based on the injury severity) + lost income. For instance, assuming you fractured an arm in a motor collision and the medical expenses sum up to $10,000. Let's also assume that the injury made you miss 2 months of work which would have paid you $20,000.

What is the largest punitive damages ever awarded?

The class action lawsuit, originally filed by a husband and wife legal team, Stanley and Susan Rosenblatt, in 1994 on behalf of an estimated 300000-700000 smokers in Florida, created a sensation as the largest punitive damages award in US history.

What is the largest slip and fall settlement?

5 Largest Slip and Fall Lawsuit Settlements and WhyFall From an Exam Table in Covington, Georgia – $15 Million. ... Lowe's Home Center in Las Vegas, Nevada – $13 Million. ... Convenience Store in Williamsburg, Virginia – $12.2 Million. ... Walmart in Greeley, Colorado – $10 Million. ... Walmart in Phenix City, Alabama – $7.5 Million.

What is the usual result of a settlement?

After a case is settled, meaning that the case did not go to trial, the attorneys receive the settlement funds, prepare a final closing statement, and give the money to their clients. Once the attorney gets the settlement check, the clients will also receive their balance check.

How are personal injury settlements paid?

When a settlement amount is agreed upon, you will then pay your lawyer a portion of your entire settlement funds for compensation. Additional Expenses are the other fees and costs that often accrue when filing a personal injury case. These may consist of postages, court filing fees, and/or certified copy fees.

How do life settlement investors pay?

Life settlement investors pay all future premiums until the policy matures upon the death of the person who is insured, they consider that expense when evaluating a policy’s worth.. They multiply the annual premium amount by the insured person’s estimated life expectancy in years.

How much does a life insurance policy have to be to be eligible for settlement?

Most life settlement companies will not buy out a life insurance policy unless it has a face value of $50,000 or more.

How Much Is Your Life Insurance Policy Worth?

You’ve heard about the possibility of selling a life insurance policy you don’t need or can’t afford, and you’re thinking you could use the cash to pay medical or long-term care bills, or to invest in a more comfortable retirement. This transaction is known as a life settlement, or sometimes referred to as a life insurance buyout. But before you take the step of contacting a life settlement company, you’d like to get some idea of how much your life insurance policy is worth – and whether you’re even eligible to sell it. You may have seen online life settlement calculators that can quickly provide an estimate of your life insurance payout, but you should be aware of the limitations many of these have.

What Are All of the Factors for Calculating a Life Settlement Value?

Some life settlement calculators will give you an estimate solely based on the information collected from eligibility related questions. However, the value of a life settlement is tied to several other factors as well. To help you determine what your life insurance is worth, you should be aware of all the factors that affect life settlement valuation. Here is the comprehensive list of factors used in the life settlement valuation process.

What happens if you pass away before paying off your life insurance?

That’s because, if you should pass away before paying off the loan, the amount you owe, including the principle balance and the interest will be deducted from the death benefit the company who purchased the life insurance policy.

Why do prospective buyers look at life insurance?

Prospective buyers will also consider the financial stability of your life insurance issuer, because they want to be sure the company will be able to pay the death benefit claim when it comes due. They will look at how insurance industry rating agencies assess the company’s solvency, and the amount they bid will reflect how high that rating is. If the rating is too low, the life settlement provider might consider the policy too risky to bid on at all.

How old do you have to be to get a life insurance settlement?

In most cases, you must be 70 years old to qualify for a life settlement. Viatical settlements may be an option for younger policyholders if they have a chronic or terminal illness.

What is settlement value?

Settlement Values and Jury Trial Awards. While the “settlement value” of your case is not necessarily the same amount that a jury might award to you if you were to win your trial, the “settlement value” is impacted by what the insurance company thinks you might be awarded if your case were to go to trial. If an insurance company thinks you have ...

How much insurance do you need to settle a lawsuit in Pennsylvania?

Another consideration is the amount of available insurance. If the person you are suing has a $100,000 (one-hundred-thousand-dollar) insurance policy, the insurance company will not, and, in fact, cannot, offer you more than $100,000. In Pennsylvania, physicians are required to carry a minimum of one million dollars of liability insurance coverage. Often, the amount of insurance can be the proverbial tail that wags the settlement dog. If there is only one million dollars of available insurance, the settlement value of your case effectively might be capped at one million dollars.

What happens if a defendant has a $1 million liability policy?

If the Defendant has a $1million liability policy and is concerned about the possibility of a jury verdict in excess of those policy limits, the Defendant may pressure the insurance company to settle the case precisely to avoid spending years in Bankruptcy Court.

What are the elements of damages?

At trial, the Judge will instruct your jury with respect to the recoverable elements of damages. Pain and suffering, lost wages, medical expenses, and the cost of future care are all elements that a jury can consider. Some elements of damage have hard numbers attached to them: the amount of past medical expenses and the amount of past lost earnings are often indisputable numbers. Future wage loss and future medical expenses may be the subject of testimony at trial by experts and are often matters that are vigorously contested. Your lawyer may retain a vocational expert to opine with respect to the vocational implications of your injury or hire a medical expert to plot out the cost of future medical care. Similarly, your lawyer may retain an economist to project the amount of future medical expenses and lost earnings. The value of your case may be a function of the types of numbers your lawyer’s experts can project.

How many jurors decide a case?

Remember, at the end of the day, the value of your case will be decided by 12 jurors, not 12 lawyers. The people who will decide your case are people just like you, who have no special training in the law. In some ways, you are just as able as your lawyer to make a prediction about how much money a jury might award in a case like yours.

Can you collect more than the available coverage?

Can’t you be awarded more than the available coverage? Of course, you can. But collecting any amount over the available insurance limits always poses challenges. The person who injured you might have assets above and beyond the available insurance coverage, but those assets may be held jointly by the Defendant and the Defendant’s spouse, often making them inaccessible to creditors. If you try to collect a judgment that is in excess of the available coverage, the Defendant may declare bankruptcy, and you might spend years navigating through Bankruptcy Court. However, the available coverage can often provide the Defendant with an incentive to settle. If the Defendant has a $1million liability policy and is concerned about the possibility of a jury verdict in excess of those policy limits, the Defendant may pressure the insurance company to settle the case precisely to avoid spending years in Bankruptcy Court.

Introduction to the 4 Variables

There are 4 variables that control the value of your case. It’s pointless to know what they are without understanding them first. Nonetheless, we won’t make you wait to learn what they are. For that reason, we will identify them now, and discuss them each in turn below. They are:

Case Study: Similar, but Not

The best way to see technique and intangibles in play is by comparing apparently similar cases. Let’s look at two personal injury cases, starting with the finish line and working backwards from there:

411 on Settlement Attorneys

There are good and not so good doctors, accountants and lawyers. What qualifies as good for one client may be bad for another. If your goal is to get the largest settlement or recovery, you want to veer away from attorneys who are in the business of forcing clients to settle.

We Are Here to Help

The real settlement amount of your case is not what you think it is. That number is buried behind a series of facts. Each of those facts is a needle in a haystack. You need a lawyer who will take the time to comb through that haystack. It is the only way you will make the insurance company pay you the full amount for what you are going through.

Our Lawyers Serve Clients in Los Angeles, California & Nationally

Serving all of Los Angeles, including Arcadia, Beverly Hills, Claremont, Canoga Park, Chino, Chino Hills, Covina, Diamond Bar, Downey, East Pasadena, El Monte, Encino, Highland Park, Inglewood, La Verne, Long Beach, Malibu, Montebello, Monterey Park, North Hollywood, Northridge, Pasadena, Pomona, Rancho Cucamonga, Reseda, Rosemead, San Gabriel, San Dimas, Santa Monica, Sherman Oaks, South Bay, South LA, South Pasadena, Sunland, Tarzana, Thousand Oaks, Torrance, Van Nuys, Venice, West Covina, West Hollywood, and Westlake Village..

What Is the Value of My Car Accident Claim?

There are many factors to deciding what’s a fair settlement for a car accident claim. They include:

How Much Can I Get from My Car Accident Settlement? What Can I Do to Increase It?

Your settlement value depends on what happened to you, but your actions, or failure to act, can also make a big difference. Here are issues to think about:

What is the Value of Your Car Accident Claim? Call Us to Find Out

The Mann Law Firm deals firmly and aggressively with insurance companies so they won’t take advantage of our clients. When a personal injury attorney takes a case, its settlement value normally greatly increases. After we’re involved, we will deal with the insurance company so you can focus on recovery and getting your life back together.

How Are Lawsuit Settlements Paid?

There are several steps you will need to follow in order to get your money. Read all the paperwork carefully.

What Types of Lawsuits are Taxed?

In general, lawsuits that deal with wages are treated as wages. A lawsuit that deals with injuries or damages are not. However, this is not cut and dried, so always speak with a professional to determine how your lawsuit is laid out and how the damages are allocated.

The Settlement Value of Your Case Is A Function of Multiple Factors

Jurys and Pennsylvania Counties

- No two courthouses are the same, either. The same case presented to a Philadelphia County jury and a Chester County jury may yield entirely different results. Chester County juries have a reputation for being more defense-oriented and conservative; Philadelphia juries have a reputation of being more sympathetic to the plight of an injured claimant. Those reputations may or may n…

Settlement Values and Jury Trial Awards

- While the “settlement value” of your case is not necessarily the same amount that a jury might award to you if you were to win your trial, the “settlement value” is impacted by what the insurance company thinks you might be awarded if your case were to go to trial. If an insurance company thinks you have a realistic chance of being awarded a million dollars, it may make an offer to yo…

Settlement Values and Insurance Considerations

- Another consideration is the amount of available insurance. If the person you are suing has a $100,000 (one-hundred-thousand-dollar) insurance policy, the insurance company will not, and, in fact, cannot, offer you more than $100,000. In Pennsylvania, physicians are required to carry a minimum of one million dollars of liability insurance coverage....

Settlement Value and Verdict Value

- Ultimately, the jury decides what the case is worth. But the verdict value and the settlement value are usually two distinctly different numbers. If the insurance company offers a settlement, you will decide whether the case is settled or not. In this respect, the “settlement” value of your case is a function of your tolerance for risk. Are you prepared to gamble what has been offered in the hop…