What is a life settlement and how does it work?

A life settlement occurs when you sell your existing life insurance policy to a third party for a one-time payment. Life settlements offer an alternative to cashing out your policy—a.k.a. getting the policy’s cash surrender value or cash value. After selling your policy, the buyer pays your premiums and receives the death benefit when you die.

What is a good amount for a life insurance settlement?

While most life settlement providers are looking for policies with a death benefit of at least $100,000, Institutional Life Services accepts policies as low as $50,000. If you’re short on cash and have a policy smaller than $100,000, Institutional Life Services is our choice as best for small policies.

Will a life settlement buy out my life insurance policy?

Most life settlement companies will not buy out a life insurance policy unless it has a face value of $50,000 or more. There are only a few types of life insurance policies that can be sold through a life settlement.

How does age affect the value of a life settlement?

Beyond eligibility, your age also affects the value of a life settlement for your insurance policy. In most cases, the older you are, the more highly a life settlement investor will value your life insurance policy, and the estimate you receive from a life settlement calculator will reflect that fact.

How much do you get from life insurance payout?

This is a difficult question to answer because so many variables are involved, including the type of life insurance policy, the age and health of the insured person, and the death benefit. However, some industry experts estimate that the average payout for a life insurance policy is between $10,000 and $50,000.

Do you get full payout of life insurance?

Premiums are usually the same for policy's duration, and your policy pays out a death benefit if you pass away during the covered term. You earn no cash value with term life insurance—a payout only happens if you die—making it similar to other forms of insurance.

What is the highest life insurance payout?

1. $212 Million. This policy was written by Tony Steigerwald of Dunhill Marketing and Insurance for an extremely wealthy client who declined to have their name publicly released.

How fast do you get life insurance payout?

within 60 daysLife insurance providers usually pay out within 60 days of receiving a death claim filing. Beneficiaries must file a death claim and verify their identity before receiving payment. The benefit could be delayed or denied due to policy lapses, fraud, or certain causes of death.

How long does it take to get a life insurance check after someone dies?

30 to 60 daysLife insurance companies pay out the proceeds when the insured dies and the beneficiary of the policy files a life insurance claim. You should be able to collect the life insurance payout within 30 to 60 days after you have submitted the completed claim forms and the supporting documents.

How is life insurance paid out after death?

Life insurance benefits are typically paid when the insured party dies. Beneficiaries file a death claim with the insurance company by submitting a certified copy of the death certificate.

What is the average life insurance amount?

The average cost of life insurance is $26 a month. This is based on data provided by Quotacy for a 40-year-old buying a 20-year, $500,000 term life policy, which is the most common term length and amount sold. But life insurance rates can vary dramatically among applicants, insurers and policy types.

What reasons will life insurance not pay?

If you commit life insurance fraud on your insurance application and lie about any risky hobbies, medical conditions, travel plans, or your family health history, the insurance company can refuse to pay the death benefit.

Do you pay taxes on life insurance?

Answer: Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them. However, any interest you receive is taxable and you should report it as interest received.

How do you calculate life insurance?

You take your annual income and multiply it by 10. That's it. So, if you're making $100,000 annually, you'd multiply that by 10. That's $1 million of suggested coverage.

How do insurance companies pay claims?

Most insurers will pay out the actual cash value of the item, and then a second payment when you show the receipt that proves you'd replaced the item. Then you'll get the final payment. You can often submit your expenses along the way if you replace items over time.

How much does a million dollar life insurance policy cost monthly?

The cost of a $1,000,000 life insurance policy for a 10-year term is $32.05 per month on average. If you prefer a 20-year plan, you'll pay an average monthly premium of $46.65. In addition to term length, factors such as your age, health condition or tobacco usage may affect your rates.

What is a million dollar life insurance policy?

Just like it sounds, this policy means your life insurance company will provide a $1 million cash payout to your beneficiaries if you die while the policy is active. The money comes with no strings attached, so your family can use it to replace your income, pay debts, or cover any other expenses.

How much does a life insurance policy have to be to be eligible for settlement?

Most life settlement companies will not buy out a life insurance policy unless it has a face value of $50,000 or more.

How do life settlement investors pay?

Life settlement investors pay all future premiums until the policy matures upon the death of the person who is insured, they consider that expense when evaluating a policy’s worth.. They multiply the annual premium amount by the insured person’s estimated life expectancy in years.

How Much Is Your Life Insurance Policy Worth?

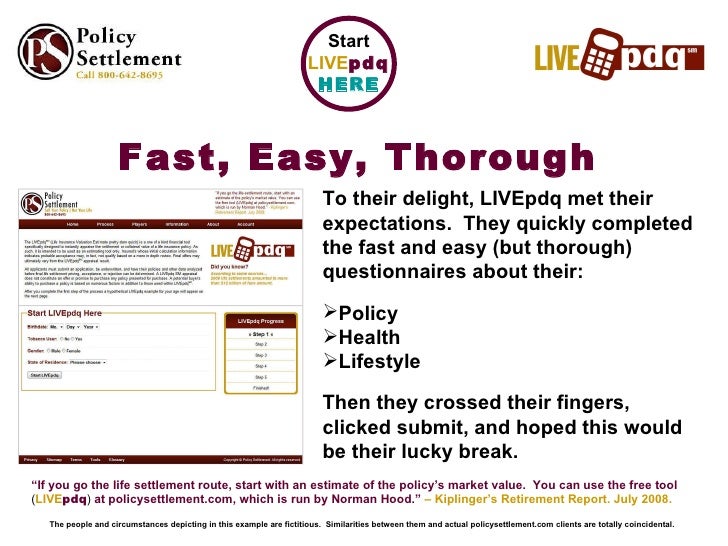

You’ve heard about the possibility of selling a life insurance policy you don’t need or can’t afford, and you’re thinking you could use the cash to pay medical or long-term care bills, or to invest in a more comfortable retirement. This transaction is known as a life settlement, or sometimes referred to as a life insurance buyout. But before you take the step of contacting a life settlement company, you’d like to get some idea of how much your life insurance policy is worth – and whether you’re even eligible to sell it. You may have seen online life settlement calculators that can quickly provide an estimate of your life insurance payout, but you should be aware of the limitations many of these have.

What Are All of the Factors for Calculating a Life Settlement Value?

Some life settlement calculators will give you an estimate solely based on the information collected from eligibility related questions. However, the value of a life settlement is tied to several other factors as well. To help you determine what your life insurance is worth, you should be aware of all the factors that affect life settlement valuation. Here is the comprehensive list of factors used in the life settlement valuation process.

Why is health important in life insurance?

This is because health status affects your life expectancy and, as you can probably guess, that number will be lower if you have serious health problems. It may seem odd to think of poor health as being a financial asset, but because life settlement buyers want to minimize the number of years they will have to pay a seller’s insurance premiums, the sicker you are, the more valuable your policy will be.

What happens if you pass away before paying off your life insurance?

That’s because, if you should pass away before paying off the loan, the amount you owe, including the principle balance and the interest will be deducted from the death benefit the company who purchased the life insurance policy.

Why do prospective buyers look at life insurance?

Prospective buyers will also consider the financial stability of your life insurance issuer, because they want to be sure the company will be able to pay the death benefit claim when it comes due. They will look at how insurance industry rating agencies assess the company’s solvency, and the amount they bid will reflect how high that rating is. If the rating is too low, the life settlement provider might consider the policy too risky to bid on at all.

How much do you get when you sell a life insurance policy?

A policyholder could receive anywhere between 10% to 35% of the amount that would be paid when they die. On average, policyholders receive an upfront cash settlement that equals 20% of their life insurance policy death benefit. The larger the life insurance policy size, the larger the life settlement offer.

When does a life insurance policyholder receive payment?

A policyholder would receive payment as soon as the necessary documents have been signed and the insurance company provides written confirmation that the owner and the beneficiary on the policy have been changed. It’s important to note that when selling a life insurance policy, the policyholder forfeits any money that would normally be paid when they die.

How old do you have to be to sell life insurance?

To be eligible to sell your life insurance policy, it is best to be over 65 years of age or have a serious medical condition. Most often the insured has a life expectancy of 15 years or less.

Can an insured in their 80s sell a life insurance policy?

The exception would be an insured in their early 80’s or older that is healthy, could still qualify to sell their policy .

Do life insurance settlements work?

Life settlements may not work for everyone, but they’re a valuable option that many people don’t consider. If you or a client has a life insurance policy you’re planning to surrender, consider a life settlement. It might provide you with a valuable alternative. You can see if it’s a good fit by using our qualification life settlement calculator.

Is life insurance income taxed?

Possibly. Some of the money a policyholder could receive from a life settlement may be taxed as income or capital gains. Just like the sale of any other asset, a policyholder would likely have to pay taxes on the money they receive from a life settlement above their basis in the policy. The death benefit of a life insurance policy is tax-free to your beneficiaries.

How Do Life Insurance Settlements Work?

Typically, a life settlement transaction will be an option for those 65 years and older with a policy worth at least $100,000 in death benefits. This is not always the case, but it’s a good place of reference for you to compare to. A typical life settlement payout will be around 20% of your policy size, but the range could be anywhere from 10% to 25%+. For example, if you have a policy valued at $300,000 and you choose to sell it in a life settlement, your final return will be around $60,000.

Are Life Settlements Tax Free?

In short, no, life settlements are not tax free. They are taxable to the extent that you turn a profit upon selling the policy. Life settlement proceeds greater than the amount of premiums you have paid are treated. If you’re concerned about a life settlement increasing your tax liability, you should talk with a financial advisor about how to offset the gains through other investments and tax strategies.

How many settlement options are there for life insurance?

This is one of the more confusing life insurance settlement options because there are four types of options to choose from. Along with the straight life income option explained above, there are three other options.

What is settlement in life insurance?

A settlement is the way in which your life insurance policy proceeds are paid out. There are many life insurance settlement options that can be confusing at first; your policy may pay out a lump-sum cash payment, life income, a fixed amount, or interest paid periodically. As a policyholder, you can usually choose the settlement method you prefer ...

What is a specific life option?

The specific life option allows the beneficiary to give the insurance company a payout schedule to follow. If the beneficiary dies before the period is over, a secondary beneficiary will receive the rest of the payments.

How long does a beneficiary receive death benefit?

With a $100,000 death benefit, the beneficiary can choose to receive $10,000 per year (or another amount). The beneficiary receives payments until the benefit is used; in this case, that would be more than 10 years as the insurance company will also pay interest on money not paid out.

What is life income option?

The life income option means the beneficiary will receive payments for his or her entire lifetime. If the beneficiary chooses this settlement option, the insurance company will decide how much income the beneficiary will receive each year based on age and gender although the company may purchase an annuity instead.

What is lump sum life insurance?

The lump sum option is by far the most common of all life insurance settlement options and the most simple to understand. With a lump sum payment, the beneficiary receives the full death benefit all at once and income tax-free. The beneficiary can choose what he or she wants to do with the payout, including investing the money. If the insured had a loan against the cash value of the policy, the amount owed will be subtracted from the death benefit.

How much would a 55 year old receive if he died?

With a straight life income option, a 55-year-old male beneficiary would receive $6,250 per year. If the beneficiary dies after just five years, he would have received just $31,250 of the $100,000 death benefit.

What age do you have to be to get a life insurance settlement?

There are three main factors to consider. Life settlement providers prefer that the insured person is over the age of 65. They want permanent life insurance policies and term policies that you can convert to permanent policies with a face value of more than $100,000. .

How much does a broker charge for life insurance?

Using a broker also reduces the final amount of money you’ll get. Fee structures vary, but the most a broker can charge by law is 30% of the life insurance sale price . . There are a few important factors that affect how much money your life insurance is worth. The first is the face value of the policy.

Why are life insurance policies worth more?

Policies with lower premiums cost investors less over time, so they are typically worth more than policies with high premiums. When interest rates are low, it costs investors less money to finance their purchases, allowing them to pay more for life insurance policies.

What does a life insurance underwriter look for?

A life expectancy underwriter will look closely at the insured person’s medical records and consider their age among other factors to provide investors with an estimated life expectancy. Investors will use this number among others to determine whether purchasing your life insurance policy could provide a profit for them.

How to know how much your life insurance policy is worth?

The best way to understand how much money your life insurance policy may be worth in a life settlement is to consult an experienced licensed broker. So many factors go into formulating a life settlement offer that doing a bit of research and contacting a provider is a smart move.

How to get money out of life insurance?

There are other ways to get cash out of your life insurance policy. Depending on the type of policy, you may be able to take out a loan. You probably won’t be able to access as much money as you could with a life settlement, but your beneficiaries will still receive a payout upon your death. Taking a loan out against your life insurance policy doesn’t relieve you of the burden of premium payments. If you need a small amount of money in a short amount of time, a loan may be a better option for you than a life settlement. The amount of money you can get depends on the accumulated cash value that’s built up inside the policy.

What are the factors that affect life insurance?

Taxes are another factor that could impact how much your life insurance policy is worth. Since individual financial situations vary, you should consult a CPA with experience in life settlements to find out whether you’ll face a big tax bill after receiving money via a life settlement.

How to start a life insurance settlement?

You can start the life settlement process by submitting a questionnaire, authorization, insurance carrier illustrations, and your past five years of medical records. The company does complete a background check to prevent fraud. Coventry also offers a retained death benefit, allowing you to keep part of your policy’s payout after you stop paying premiums.

What is life settlement?

A life settlement occurs when you sell your existing life insurance policy to a third party for a one-time payment. Life settlements offer an alternative to cashing out your policy—a.k.a. getting the policy’s cash surrender value or cash value. After selling your policy, the buyer pays your premiums and receives the death benefit when you die. You may qualify for a life settlement if you are over 65 years old and have had your policy long enough to meet your state’s minimum. Typically, the death benefit of your policy must be at least $100,000.

Why do people give up life insurance?

As you get older, your life insurance policy only becomes more costly. It may even become unaffordable, so it's easy to see why so many people give up their policies. A 2019 study from the Society of Actuaries and LIMRA found that 4% of life insurance policies—worth billions of dollars—lapse every single year. 1 But if you need money, there is an alternative you may not have considered: life settlements.

What is premium insurance?

Premiums. Premiums are the amount paid to keep a life insurance policy in force. When a policy is sold to a life settlement company, premiums are now paid by the company, and not the individuals.

What is the number one life insurance settlement provider?

Coventry earned the top spot on our list because of the company’s size and strong reputation. The company pioneered the life settlement industry by creating a secondary market for life insurance over 35 years ago. It’s the country’s biggest life settlement provider by a large margin—accounting for 40% of all transactions in 2020. Coventry was named the number-one life settlement provider in 2020 by The Deal. 2

How long does it take to sell Coventry insurance?

The sales process may take up to 30 days. Coventry also offers a retained death benefit, allowing you to keep part of your policy’s payout after you stop paying premiums. To qualify, you must be at least 65 years old or have a serious health condition with a life expectancy of less than 20 years.

How long does it take to get a life settlement from Abacus?

You may also accomplish the same thing by calling their team. The company completes a federal background check with the sales process taking 14 to 21 days.

How to determine the value of a life insurance policy?

The main factors for determining the value of a life insurance policy are the age and medical condition of an insured. Take our PYC questionnaire or contact us to find out if a life settlement is right for you. Be sure to checkout our Life Settlement Calculator to see the value of your Life Insurance Policy.

Why do people sell life insurance policies?

Reasons for selling a policy include (but are not limited to): Paying off debt, supplementing retirement income, changes to estate planning, getting rid of expensive premium payments , selling policy and using money from sale to obtain a policy with superior coverage. Due to changes in family circumstances, a life insurance policy owner may no longer need the insurance provided by the policy. A spouse may have died, children may have grown up, or a company with life insurance on a key officer may have been sold or gone out of business.

What is viatical settlement?

A viatical settlement involves an insured with a life expectancy of less than 24 months or as defined by the Department of Insurance for the applicable ownership state. If the insured has a life expectancy of more than 24 months or doesn’t meet the qualifications defined by the Department of Insurance, the transaction is considered ...

What is a magna life insurance policy?

A life insurance policy is property that can be sold - so if your client has a policy they no longer want or need; it's a good idea to consider a Life Settlement transaction. A transaction between seniors and institutional investors - which is where Magna Life Settlements comes in. Magna creates financial opportunities for a better life now instead ...

How old do you have to be to sell life insurance?

Most people who sell their life insurance policies are over 65 years old or have a significant health impairment. Policy Size. Eligible life insurance policies are Universal Life, Term and Whole Life. Policy Type.

Is life settlement taxable?

Life settlement proceeds may be taxable. You should consult your tax advisor for additional information.

Can life insurance be sold?

Yes, the Supreme Court of the United States declared that your life insurance is personal property that can be sold, traded or even given away. Your life insurance company has no right to question or prevent you from doing this.

How long does it take to settle a life insurance claim?

On average, a life settlement transaction takes a few months to fully complete due to the involvement of outside entities. Consult with your financial advisor on specific details concerning your life settlement application.

What is life settlement?

A life settlement is the sale or exchange of a life insurance policy for a lump sum of cash greater than the cash surrender value but less than the death benefit value. What Is a Death Benefit? The death benefit is the amount on a life insurance policy provided to the beneficiary upon the death of the policyholder.

What is cash surrender value?

The cash surrender value — also known as the cash value — is the cash amount offered to the policyholder in exchange for part or all of their insurance policy’s value. In cash value life insurance policies, policyholders are provided with a death benefit and a savings component that accumulates with every premium payment. If the owner chooses to terminate their life insurance contract before the end of the term period, they are able to receive the accumulated savings, or cash value, rather than the death benefit. An owner can also borrow from their cash value in the form of a loan, but then has to pay back the money with interest to maintain the full death benefit.

What happens to insurance when it is sold?

Once the policy is sold, all rights and ownership are transferred to the new owner or investor. They are then responsible for all future premium payments until the policy matures. At that point, the new owner will be able to receive the death benefit of the insurance contract.

How does a professional life expectancy firm calculate your lifespan?

Professional life expectancy firms calculate your lifespan based on your age, gender, medical history and medical condition as well as other factors against a similar group of individuals. The firm then provides you with an average life expectancy, and it is formulated based on your specific situation.

How long does it take to change your mind after a settlement?

This differs from one state to the next. Some states provide 15 to 30 days after receiving the settlement disbursement to change your mind. Be sure to discuss your options with all potential buyers.

Who is responsible for premiums after a policy is sold?

Once the policy is sold, the buyer, or new policy owner, will be responsible for future premium payments.