Full Answer

Do you have to pay closing costs for HELOC?

But in reality, most HELOCs require closing costs as well. Closing costs for a HELOC are often a bit lower than the costs of closing a primary mortgage, but the average closing costs for a home equity loan or line of credit (depending on the lender and the loan product) can add up to between 2 percent and 5 percent of your total loan cost.

How much can you borrow with a HELOC?

The amount you can borrow with a HELOC usually depends on how much home equity you have and your credit score. Typically lenders won’t let you tap into your home equity if you still owe more than 85% of your home’s value. However, there are exceptions; some lenders will let you borrow against your home equity at higher loan-to-value ratios.

How much does it cost to get a title for HELOC?

Title search fees are typically $75 to $100 and title insurance ranges from $1,000 to $1,500, depending on the size of the loan. Your HELOC loan documents must be filed with the county to secure the lender’s interest in your home. Fees vary by county but are usually $150 to $300.

How do I calculate the monthly payment on a HELOC?

Calculating the monthly payment on a HELOC is tricky, because the amount you owe each month will vary depending on several factors. Current interest rates: Home equity lines of credit have adjustable rates, so the amount of interest you're paying will vary. See today's HELOC rates. Age of the loan: HELOCs have two parts.

Can you settle a home equity line of credit?

If you are one of the many homeowners who have lines of credit or HELOC's on their homes, in a second position after their first mortgage, you may now be in a position to settle the debt.

How do you negotiate a HELOC settlement?

Contact the lender to negotiate a lump-sum settlement or payment plan. Lenders are often willing to settle equity loan debt for a fraction of the balance. If the home is foreclosed, the lender might walk away with nothing. You can start by offering 5 percent of the amount owed and negotiate from there.

Is there an early payoff penalty for HELOC?

Key Takeaways Many home equity lines of credit (HELOCs) have no early repayment penalties, but some do. Lenders charge a prepayment penalty in part to recoup the loss of the interest that they would have earned if you had paid your loan through the full term.

Can you get a lump-sum from a HELOC?

A home equity loan can provide you with cash in the form of a lump-sum payment that you pay back at a fixed interest rate, but only if enough equity is available to you.

What percentage should I offer to settle debt?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

Is it better to settle or pay in full?

Paid in full means the remaining balance of your debt, including interest, was paid off. Paying in full is an option whether your account is current, past due or in collections. It's better to pay in full than settle in full when it comes to paying off debt.

Should you close your HELOC?

Why you should close a HELOC. Sometimes, a lender will charge annual fees for open lines of credit. If you pay off your HELOC early and don't want to pay the annual fees, closing the line of credit can be a good idea. You cannot sell your home, get a second mortgage, etc.

Can you close out a HELOC early?

Yes, you can pay off a HELOC early. However, there are concerns to be aware of. There are two payment periods in a HELOC agreement: the draw period and the repayment period. The draw period is set by your lender and usually lasts about 10 years.

What are the disadvantages of a HELOC?

ConsVariable interest rates could increase in the future.There may be minimum withdrawal requirements.There is a set draw period.Possible fees and closing costs.You risk losing your house if you default.The application process for a HELOC is longer and more complicated than that of a personal loan or credit card.

What is the monthly payment on a $100 000 home equity loan?

Loan payment example: on a $100,000 loan for 180 months at 5.79% interest rate, monthly payments would be $832.55.

Is it smart to use HELOC to pay off mortgage?

Since HELOCs sometimes have lower interest rates than mortgages, you could save money and potentially pay off your mortgage sooner. Even if the rates are similar, refinancing your first mortgage with a HELOC might still be the best choice for you.

How can I get equity out of my home without refinancing?

Home equity loans and HELOCs are two of the most common ways homeowners tap into their equity without refinancing. Both allow you to borrow against your home equity, just in slightly different ways. With a home equity loan, you get a lump-sum payment and then repay the loan monthly over time.

Can you negotiate home equity loan rates?

Yes. You can and should negotiate mortgage rates when you're getting a home loan. Research confirms that those who get multiple quotes get lower rates. But surprisingly, many home buyers and refinancers skip negotiations and go with the first lender they talk to.

How do I get rid of a home equity loan?

You have three days to cancel a home equity loan; after that, you must repay itWhen you take out a home equity loan, you have three business days during which you can cancel it without consequence. ... After this period, you'll have to pay back the loan in order to get rid of it.More items...•

What happens to HELOC after foreclosure?

A home equity line of credit, or “HELOC,” is a form of second mortgage that gives you a line of credit based upon the equity you carry in your home. After foreclosure, the equity you enjoyed in your property disappears along with your ability to make new purchases using your line of credit.

What does it mean when a home equity loan is charged off?

If you're in default on a home equity loan, at some point your lender may send you a notice stating that your loan has been charged off. This signals that the loan is no longer an asset on the bank's books, but a liability.

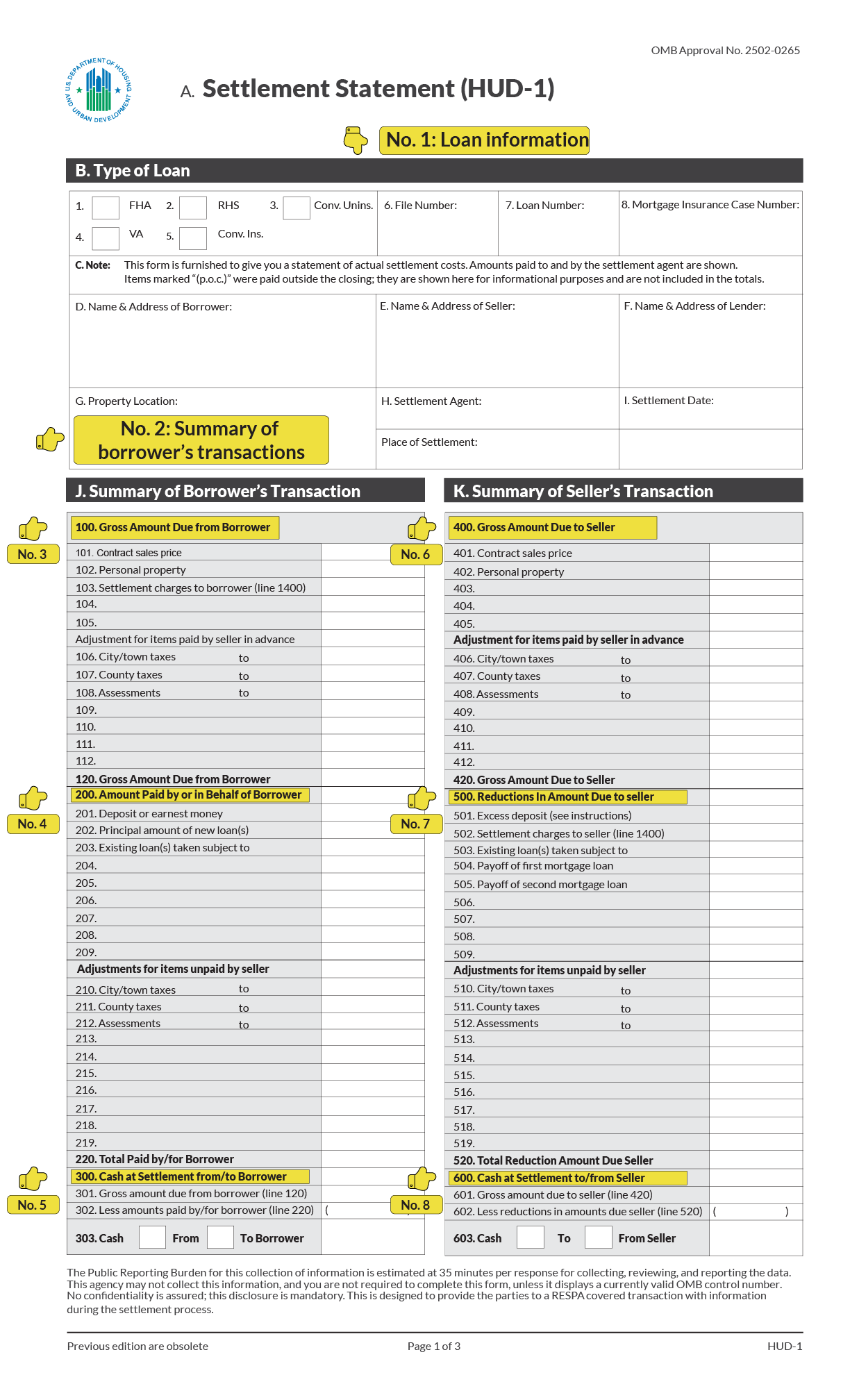

How Much Are Closing Costs for Home Equity Loans and HELOCs?

The average closing costs on a home equity loan or HELOC will usually amount to 2% to 5% of the total loan amount or line of credit, accounting for all lender fees and third-party services. These may be covered by the lender under "no-fee" HELOCs and home equity loans, however keep in mind that lenders may have already baked these fees into the interest cost of your loan. Remember to compare APRs, and not interest rates alone, when reviewing offers from multiple lenders.

How Do Closing Costs on Home Equity Loans and HELOCs Compare to Primary Mortgages?

Closing costs on home equity loans and HELOCs are usually lower than closing costs for primary mortgages. This is due, in part, to the relatively small loan sizes on home equity loans and HELOCs when compared to standard mortgages. According to the Federal Housing Finance Agency, the average mortgage loan amount in the U.S. is $312,900 (as of April 2018), while home equity loan products are capped at a maximum loan amount of $250,000 for most lenders.

How much is the annual maintenance fee for a home equity line of credit?

These can vary from as little as a $5 membership fee to as much as a $250 annual account maintenance fee.

How long does it take for a home equity appraisal to be accepted?

If an appraisal has been completed within six months, that report may be accepted and reviewed by the home equity lender, possibly requiring only a review fee rather than the full appraisal fee.

How long does a home equity loan have to be paid off?

These prepayment restriction periods usually last between a few months to a couple of years and are put in place to ensure a minimum return on investment for the lender.

What is appraisal fee?

Appraisal fees cover the cost of the appraiser's inspection. This is done to establish the fair market value of the property securing the loan, and it's also used to calculate your loan-to-value ratio.

What is application fee?

Application fees are viewed as an initial commitment to doing business. They go toward offsetting advertising and marketing costs for the lender. Processing and underwriting fees cover the lender's administrative costs of creating the loan and seeing it through to closing. Appraisal fees cover the cost of the appraiser's inspection.

What to do if your home is foreclosed on?

If the home is foreclosed, the lender might walk away with nothing. You can start by offering 5 percent of the amount owed and negotiate from there. If you need help with negotiating, a HUD-approved foreclosure prevention counselor can advocate on your behalf. Negotiate a home equity loan modification with the lender.

Can a lender adjust the interest rate on a home equity loan?

The lender may agree to adjust the interest rate, length or monthly payment amount. Requirements for a home equity loan modification vary among lenders. In most cases, you will need to suffer a financial hardship and demonstrate the ability to begin repaying the debt. Step 3.

Can a lender sue a borrower for a loan?

In some states , the lender is able to sue the borrower for the loan balance plus interest and legal fees . Like other creditors, lenders are open to negotiating a settlement. Step 1. Contact the lender to negotiate a lump-sum settlement or payment plan. Lenders are often willing to settle equity loan debt for a fraction of the balance.

How to get a discount on a HELOC?

It pays to shop around when searching for the best deal on a HELOC. Check with your primary bank or current mortgage lender, which might offer a discount. Take that quote and compare it with quotes from at least two other lenders.

What is the HELOC calculator?

The calculator will give your current loan-to-value ratio — the percentage of your home’s value that you owe to your mortgage lender — and whether you might qualify for a HELOC or need to wait. If it looks like you qualify, the HELOC calculator estimates how much you might be able to borrow.

What are the factors to consider when choosing a HELOC lender?

However, with HELOCs there are several factors to consider: rate markups, upfront costs, closing costs, annual fees, or prepayment penalties — just to name a few. Check out our list of best HELOC lenders .

What is the highest acceptable loan to value?

The highest acceptable loan-to-value (LTV) ratio differs by lender and property type (owner-occupied or investment). Lenders often require owner-occupied homes to have an LTV of no more than 80%; for investment properties, it usually can't be above 70%. This calculator assumes that this is an owner-occupied home.

What is home equity?

Home equity is the market value of your home minus what you owe on your mortgage. A home equity line of credit — often referred to as a “HELOC” (HE-lock) — lets you borrow against that home equity.

What is the lifetime cap on a home equity line of credit?

One is the lifetime cap, which is the highest interest rate you could possibly pay. The other is the periodic cap, which is how often the interest rate can change.

What happens if the housing market slumps?

What if the housing market slumps? Over the long haul, home prices generally rise, but they can take big dips, too. Plug in a lower home value to see its effect on your borrowing capability.

What is a HELOC line of credit?

If you are considering a home equity line of credit (HELOC) to help pay for home repairs, consolidate debt or achieve other financial goals, it's important to view the full picture of HELOC costs.

What is a title search fee?

Title search: This fee is to help the lender confirm that you have rightful ownership of the property title and make sure there are no issues with the title, such as unpaid taxes, assessments or easements.

What is a document prep fee?

Attorney/document prep fees: Before a home equity loan or HELOC is final, it needs to be reviewed by an attorney or financial document preparation ("doc prep") specialist. These professional service fees are often included in closing costs.

What is appraisal fee?

Appraisal fee: This fee pays a real estate expert to assess the current market value of your home. This assessed value is then used to calculate how much you can borrow from your equity with your HELOC.

How much does it cost to record a lien on a home?

Recording fee: This is a small payment ( usually $15 to $50) made to the local taxing authority where your home is located, such as the county recorder or other local official, to record the new lien against your home. As you evaluate your options, keep in mind that not all lenders charge the same closing costs.

Do HELOCs require closing costs?

HELOC closing costs. Many people think that closing costs are only for primary mortgages that are typically used to purchase a home. But in reality, most HELOCs require closing costs as well. Closing costs for a HELOC are often a bit lower than the costs of closing a primary mortgage, but the average closing costs for a home equity loan or line ...

Do all lenders charge the same closing costs for a home equity loan?

As you evaluate your options for which home equity lending option is right for you, make sure you are aware of any HELOC closing costs as well as other fees that are assessed to you as part of your loan. Not all lenders charge the same fees or require the same home equity line of credit closing costs. Costs and fees also often depend on which type ...