Full Answer

What does the $500 million settlement with Wells Fargo mean?

This settlement holds Wells Fargo responsible for its fraud and furthers the SEC’s goal of returning funds to harmed investors.” In addition to the $500 million, investors previously settled its “fake accounts” class action with Wells Fargo for $480 million in late 2018. Investors were led by lead plaintiff Union Asset Management Holding AG.

What is the Wells Fargo ERISA fee settlement home page?

Welcome to the Wells Fargo ERISA Fee Settlement Home Page. A settlement of has been proposed to resolve claims by Former and Current Participants in the Wells Fargo & Company 401 (k) Plan (the “Plan”) who invested in certain Plan investments (“Challenged Funds”) since March 13, 2014 through the date on which the Settlement becomes Final.

How do I know if I’m in the Wells Fargo settlement?

You can check www.wfsettlement.com to track the progress of payments. How do I know if I’m included? The Wells Fargo settlement includes anyone who had fake accounts applied for or opened in their name, as well as anyone who obtained fraud protection services during the 15-year time frame.

What accounts are included in the Wells Fargo settlement?

These accounts included credit cards, lines of credit, checking accounts and savings accounts, with the wrongdoing spanning a 15-year period between 2002 and 2017. There are three reasons a person may be included in the Wells Fargo settlement:

See more

Did Wells Fargo send out settlement checks?

Initial Distribution Plan checks began mailing mid-June 2020 and mailing of these checks has now concluded. Re-distribution checks began mailing early January 2022 and mailing of these checks has now concluded. . You do not need to submit a claim to receive a Distribution Plan payment.

How much is the Wells Fargo gap settlement?

Customers have also received compensation under the $142 million class-action settlement for accounts dating back to 2002 if the customer submitted a claim form before the July 7, 2018 deadline or if they complained to Wells Fargo in the past about an unauthorized account.

Is Wells Fargo refunding money?

Wells Fargo will begin issuing refunds in 2020 to some checking account customers who were charged a monthly fee because of a bank policy Rep. Katie Porter, D-CA, last month called out as unclear. Wells Fargo CEO Charlie Scharf, in a Monday letter to Porter, did not indicate how much the bank expects to pay out.

How can I find out if Wells Fargo owes me money?

The bank has promised to reach out to affected account owners, but you can start by calling Wells Fargo's dedicated hotline: 877-924-8697.

How do I check the status of my Wells Fargo claim?

You can view the status of your claim by signing on to Wells Fargo Online®. When we complete our research, you will receive a final resolution letter.

Why is Wells Fargo sending out checks?

The checks should be the mail for consumers affected by alleged improper auto loan and mortgage practices at lending giant Wells Fargo. The Consumer Financial Protection Bureau and the Office of the Comptroller of the Currency announced a $1 billion settlement with the bank on Friday.

Why did I receive a cashier's check from Wells Fargo?

The bank will first check your account to ensure you have sufficient funds to cover the amount. If not, you'll want to deposit more cash into your account. Money is then drawn from your account and deposited into the bank's account. Once the bank creates a cashier's check, it guarantees to pay the amount.

How long does it take to get a refund from Wells Fargo?

When do I get my tax refund? If you electronically filed your taxes, you can generally expect your refund within 10-21 days.

What is a remediation check?

The Pre-Check Remediation is a check that is performed on the host or the cluster that displays a table that lists possible problems that might prevent a successful remediation, and a recommendation on how to fix the issues.

How long does it take to get a refund from Gap?

4-6 weeksGap insurance refunds usually take 4-6 weeks. Staying in contact with your gap insurance provider and promptly returning signed paperwork can expedite the process, though.

Is Wells Fargo being sued for gap insurance?

A federal judge on Monday approved $23.1 million in attorney fees in a class action over Wells Fargo's auto insurance gap coverage program, a final step in a settlement that's changing how the banking giant operates. The award is more than half the $45 million settlement fund, but U.S. District Senior Judge James V.

What is the Wells Fargo mediation program?

This mediation process will provide an opportunity for customers to be compensated for harm above and beyond any fees or penalties they were charged. For example, if a customer's credit score was damaged because an unwanted account was opened, mediation will help achieve a satisfactory resolution for that customer.

Is there a class action lawsuit against Wells Fargo?

NEW YORK, June 28, 2022 /PRNewswire/ -- Pomerantz LLP announces that a class action lawsuit has been filed against Wells Fargo & Company ("Wells Fargo" or the "Company") (NYSE: WFC) and certain of its officers.

Who was ousted as CEO of Wells Fargo?

Weeks later, John Stumpf was ousted as the company’s Chairman & CEO. This $500 million is a part of a larger $3 billion settlement with the Department of Justice and SEC. The SEC’s Co-Director of the Division of Enforcement, Stephanie Avakian, stated earlier this year: “Wells Fargo repeatedly misled investors, including through a misleading ...

When was the Fair Fund settlement agreed to?

Securities & Exchange Commission issued its Proposed Plan of Distribution related to the $500 million “Fair Fund” settlement originally agreed to on February 21, 2020. The plan, available at https://www.sec.gov/litigation/fairfundlist.htm, details which individuals and entities that purchased Wells Fargo & Company common stock on the NYSE are eligible.

How many checking accounts were opened without authorization?

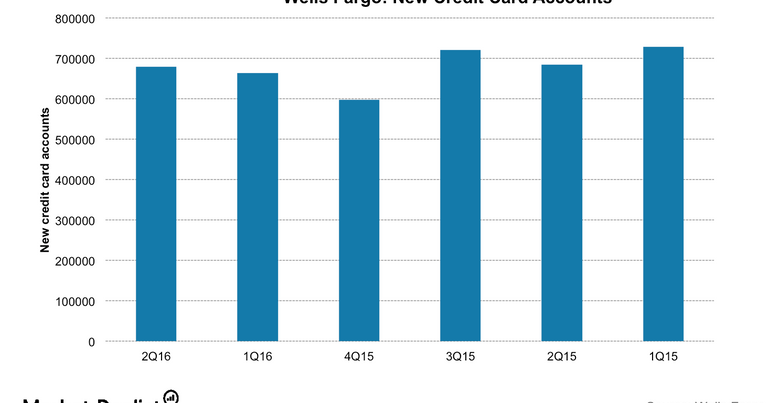

It was widely reported at the time that more than 1.5 million checking & savings accounts, along with 500,000 credit card accounts, were opened without authorization. News of this scandal, which came to light on September 8, 2016, caused a drop in Wells Fargo’s stock price. Weeks later, John Stumpf was ousted as the company’s Chairman & CEO.

Is Wells Fargo responsible for fraud?

This settlement holds Wells Fargo responsible for its fraud and furthers the SEC’s goal of returning funds to harmed investors.”. In addition to the $500 million, investors previously settled its “fake accounts” class action with Wells Fargo for $480 million in late 2018.

Pizza Hut says they got me covered. They lied

On September, I went to ER for 2nd degree burns while I was working for Pizza Hut and I had to go to the hospital. My RGM at the time said that the company would cover my bills.

I've been paying my deceased brother's mortgage for 14 years

I've been paying my deceased brother's mortgage for 14 years. We lived in the same home together before he passed away and I still live there, that's why I continue to pay. The loan is completely in his name and I tried to talk to the company before but they wouldn't unless I had the death certificate. I never did that and now it has been 14 years.

Too expensive to live alone?

Hi, I moved to Hawaii for a job. Rent is $2600 a month for a tiny old unit in a roach infested building, I take home about $4400 split across 2 paychecks a month. Parking, gas, insurance, food, etc leaves me with very little each month. It also doesn't help that my mom died, and I had to pay her mortgage to keep her house in the estate.