The divorce property settlement split has decided to divide the property 65/35, meaning John will receive $650,000 and Jane will receive $350,000 As for who keeps the family home after separation, that is another consideration entirely, and we suggest you read our article about this here.

Full Answer

What is included in a divorce settlement?

What Is Included in a Divorce Settlement? A divorce settlement agreement is a document where divorcing couples agree on what the terms of a divorce should look like. The agreement may cover several issues, including: Before your assets can be divided, you have to determine whether a given property is marital property or separate property.

How does a divorce settlement agreement affect child support payments?

A divorce settlement agreement will also take the above into consideration and adjust the child support payments to be fair to both spouses. If one spouse depended financially on the other, alimony may be awarded. Courts look into different factors to see whether alimony should be awarded. These include:

Do you have to pay tax on a divorce settlement?

Finally, while transfers of retirement funds made in the course of a divorce are not taxable, normal tax and penalty provisions do apply on any withdrawals or payments made from the account after the divorce is finalized. This article provides all the answers about do you pay tax on divorce settlement?

Can I get more assets in a divorce settlement?

If it is determined that you will be unable to maintain your lifestyle with the proposed offer, you have established a good case to request more assets, alimony or child support. Hopefully, you're not in a situation where you distrust your spouse and fear there are hidden assets that should be included in the settlement.

How much of my 401k will my wife get in a divorce?

If you decide to get a divorce from your spouse, you can claim up to half of their 401(k) savings. Similarly, your spouse can also get half of your 401(k) savings if you divorce. Usually, you can get half of your spouse's 401(k) assets regardless of the duration of your marriage.

What a woman should ask for in a divorce settlement?

What Should I Ask for in a Divorce Settlement?Your Marital Home. Think about what you want from your marital home. ... A Fair Share of Assets. ... Retirement and Investment Accounts. ... Fair Debt Division. ... Parenting Time. ... Child Support and Alimony. ... Your Child's Future Needs. ... Take the First Step with Coumanis & York.

Do you have to pay taxes on a 401k divorce settlement?

In short, 401k and other retirement transfers pursuant to a divorce are generally non-taxable.

Is divorce settlement taxed?

In most cases the IRS does not tax property transfers between ex-spouses as part of the divorce process. For all divorce settlements reached after Jan. 1, 2019, meanwhile, the individual receiving alimony payments owes no taxes on that income.

What happens to 401k in divorce?

This court order gives one party the right to a portion of the funds in their former spouse's 401k retirement plan. Typically, the funds from a 401k will be split into two new accounts, one for you and one for your ex-spouse.

What should you not forget in a divorce agreement?

5 Things To Make Sure Are Included In Your Divorce SettlementA detailed parenting-time schedule—including holidays! ... Specifics about support. ... Life insurance. ... Retirement accounts and how they will be divided. ... A plan for the sale of the house.

Can ex wife claim my 401k years after divorce?

Your desire to protect your funds may be self-seeking. Or it may be a matter of survival. But either way, your spouse has the legal grounds to claim all or part of your 401k benefits in a divorce settlement.

How long do you have to be married to get half of retirement?

How long does someone have to be married to collect Social Security spouse benefits? To receive a spouse benefit, you generally must have been married for at least one continuous year to the retired or disabled worker on whose earnings record you are claiming benefits. There are narrow exceptions to the one-year rule.

Can you lose your IRA in a divorce?

IRAs — Roth and traditional These accounts are divided under what's called a transfer incident to divorce. Even though money will leave the account, the account owner doesn't owe income taxes because it's part of a divorce settlement.

Who pays capital gains in divorce?

Property Settlements When this occurs and the property has increased in value since the time of the divorce, the seller may owe capital gains taxes based on the value of the property at the time of acquisition.

Is the wife entitled to half of everything in a divorce?

Are matrimonial assets split 50/50? No, this is a common misconception. It is not a rule that matrimonial assets be split 50/50 on divorce; however, it is generally a starting point. The court's aim is to divide assets in a way that is fair and equal, but this does not necessarily mean half and half.

Can I pay my divorce settlement in installments?

Every case is different and how the payment is made is usually specific to the needs of those involved. The payment could be made in instalments or in one lump sum.

What does a woman get in a divorce?

In general, the wife gets one-third of his salary; but it can change. The alimony is the full and final settlement; it is a lump sum amount. Maintenance can be interim maintenance, which is the amount given to the wife during the course of the case.

What are the rights of a woman after divorce?

She has the right to stay in the house until the time their marriage is annulled by a competent authority. After they are divorced, the wife has the right to ask for maintenance and livelihood costs for her and her children, however, she cannot ask for the property in a divorce settlement.

What is the usual split in a divorce?

The Court will normally consider a 50/50 split of the matrimonial assets when dealing with a long marriage following the 'yardstick of equality'. With short marriages, capital contributions become more relevant in deciding how assets are divided in a divorce. Age is also an important consideration.

How can a woman protect herself in a divorce?

5 Helpful Tips to Protect Yourself When Your Spouse Files for...Hire An Attorney. You may not know that you are not actually required to litigate a divorce. ... Cancel Joint Credit Cards. ... Keep Tight Records. ... Don't Sign Anything. ... Choose Your Words Carefully. ... Protect Yourself.

Do I need a lawyer to prepare my divorce agreement?

Do you need one? No. Should you get one? Absolutely. Even if you and your spouse draft your own divorce settlement agreement—which is not recommend...

Do we need to enter into a divorce settlement before we separate?

No. Most couples separate because they can no longer live together. It’s almost impossible to negotiate a settlement while you are still in daily c...

What if I don’t like the divorce settlement agreement my spouse sends?

Don’t sign the agreement. You should never sign an agreement unless you agree with and are comfortable with all the terms and conditions. If you si...

How does the divorce agreement become enforceable?

As soon as you sign a divorce agreement, it becomes a binding contract. It does not go into effect until the judge approves it, enters the final di...

Can I change the terms of the divorce agreement after it’s signed?

Once an agreement is signed, it can only be changed by agreement of both parties. Once it becomes part of your divorce judgment, it can only be cha...

What if my ex-spouse violates the terms of the divorce agreement?

If your spouse violates any of the terms of the divorce agreement, you can file a motion for enforcement with the court. You will need to prove to...

Division of Property and Debt

Not all accounts and personal property are fair game in divorce.

Equal vs. Equitable

Most states require an equal division of property, while others use the word “equitable” which means almost the same thing, but indicates that a mediator or judge’s discretion is used to determine the division of assets. That may mean:

Divorce Alimony Rules

Alimony, or spousal support, is money given by one person to their ex-spouse after a divorce. Either party is eligible for alimony if there is a significant imbalance in finances after the divorce. Traditionally the wife was awarded alimony for supporting her husband and caring for the home and children while he worked.

Divorce and Child Custody & Child Support

Child custody is a big issue in divorce because the disruption can have a significant impact on a child’s development and learning.

What is the power of the court in divorce?

The Court has wide sweeping powers in divorce, nullity and judicial separation proceedings to make a number of financial orders in favour of either party to the proceedings and/or for the benefit of any children of the family. The range of Orders include: lump sum Orders, property adjustment Orders, pension sharing/earmarking Orders (in the case of divorce or nullity proceedings), interim and/or final periodic payments Orders, and maintenance pending suit Orders.

What is the purpose of the settlement section?

The aim of this section is to provide a guide to what the law says about calculating a fair financial settlement. Although there are varies guidelines and benchmarks defined in Family Law and clarified by Case Law, it remains notoriously difficult to work out a precise settlement.

Should husband and wife be divided?

Firstly, the assets of the husband and wife should be divided primarily so as to make provision for their housing and financial needs to take into the account the various criteria.

What does equal mean in divorce?

When negotiating a divorce settlement it's imperative that you understand that "equal" doesn't mean a 50/50 split. Equal means what is fair to both parties involved. You won't get everything you believe you are entitled to and, you will need to be able to compromise for the sake of all involved.

How long does Joan have to pay spousal support?

Divorce Settlement: The marital assets are split 50/50 and Joan is ordered to pay Mark rehabilitative spousal support for a term of five years. The long-term marriage established a lifestyle that both Mark and Joan had become accustomed to.

Why was the marital assets split 60/40?

The marital assets were split 60/40 in Lance’s favor because the judge felt that Lance, being the lower income earner and caretaker of their children should continue to live the standard of living he and his children had become accustomed to.

Why did Mark's standard of living decrease after a divorce?

Mark's standard of living will decrease once there is a divorce due to the fact that he makes less than Joan. The two went to mediation and Joan chose to pay temporary spousal support that is deductible at tax time rather than splitting assets in John’s favor.

Can a divorce be split 50/50?

That is not the case in this divorce scenario. It only makes sense that assets be split 50/50 and both spouses move on and rebuild their lives.

Will you come to a fair resolution at the end of your marriage?

In the hope of helping those who are in the dark about what is and isn’t fair, here is a collection of examples of different scenarios and what we believe to be fair divorce settlements .

How much is a $50,000 divorce payment worth?

Alimony received is taxable as ordinary income, so a $50,000 payment received is actually worth $35,000 after taxes, assuming a 30% marginal state and federal tax bracket.

What assets do you get in a divorce settlement?

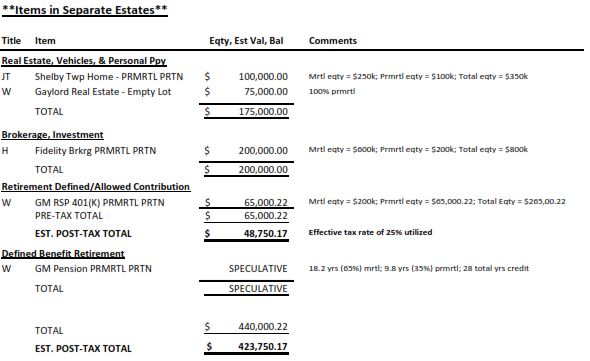

Often in a divorce settlement, one party will receive mostly illiquid assets, including the home, while the other party receives liquid assets such as retirement plans, brokerage accounts etc.

What insurance do you need for divorce?

Most divorce decrees call for one of the parties to obtain a life insurance policy to insure the value of alimony payments, child support or some other financial need. If you are the person for whom the insurance is obtained, it is critical that you are either the owner or irrevocable beneficiary of the policy.

How long can you be exempt from taxes after divorce?

Regarding income tax debt, even if the divorce is final, you may not be exempt from future tax liability. For 3 years after a divorce, the IRS can perform a random audit of a divorced couple's joint tax return. If it has good cause, the IRS can question a joint return for seven years.

What happens if my spouse is a business owner?

If your spouse is a business owner, corporate or partnership returns may show a change in salary, charging personal expenses to the company, or excessive retained earnings. Another common trick is to put a "friend" on the payroll, who agrees to give back the money paid to him after the divorce.

When can you sell your home before divorce?

In the case of your personal residence, the federal government eased the tax burden in 1997 by allowing a $250,000 capital gain exclusion per spouse if you've lived in your home for at least 2 of the past 5 years. If the home is to be sold and there is a considerable gain in value (over $250,000), you should consider selling before the divorce to take advantage of the full $500,000 exemption.

What are the most common mistakes made after divorce?

One of the most common mistakes made post-divorce is the failure to budget based on one's new lifestyle. We see this happen most often when one spouse keeps the home for the sake of the children or perhaps due to an emotional attachment. Because of the high value of the home, there are few other assets awarded in the settlement. The expense of maintaining the home and the lack of liquid assets often results in a rapid depletion of cash, leaving no choice but to sell the home.

What to consider when considering a lump sum divorce settlement?

When considering the adequacy of a lump sum divorce settlement, the most significant variables to consider include planning for the growth of your money (investment returns), which itself is subject to a plethora of financial variables, as well as the cost of supporting your future lifestyle, which is subject to both inflation and your evolving needs. It is extremely difficult for even the financially savvy to model how much money in today’s dollars is needed to fund a person’s future lifestyle, or conversely, what would one’s future lifestyle look like based on receiving a lump sum of money today. This is the time, during settlement negotiations, not afterwards, when engaging an experienced professional financial planner can be extremely helpful.

Why is a lump sum divorce settlement so abstract?

But when the non-moneyed spouse is offered a lump-sum divorce settlement – either as an addition to, or as an alternative to ongoing maintenance and support payments – the lump-sum payment, the engine that will be required to support your future lifestyle, often becomes pretty abstract. This is because money itself is inherently abstract.

How difficult is it to anticipate future expenses?

Anticipating future expenses is difficult, and projecting the sources of cash required to fund these expenses is even more difficult. Investment returns are highly dependent on your portfolio asset allocation, which in turn is dependent on factors such as your investment risk tolerance (itself a complicated process), your age, other available economic resources and the ability to replace lost capital. Estimates for investment rates of return should be conservative with plenty of margin for error, as the financial markets do not always cooperate with our expectations and needs. Also, the income tax bite on portfolio income is an extremely important consideration. Often, taxes are a household’s largest cash outflow. Once completed, a thoughtful multi-year cash flow projection becomes the rock of your financial planning as it quantifies your financial lifestyle down the road. Generally, we update our clients’ cash flows annually or as they experience changes in their financial lives.

Will the Lump Sum Divorce Settlement Meet Your Future Needs?

Unlike many attorneys, a financial planner with experience working on matrimonial matters knows how to navigate these financial abstractions and interpret and communicate alternative scenarios to his or her client. When we take on matrimonial engagements, our primary tool is a multi-year cash flow projection that is built on reasonable assumptions.

Who pays tax on divorce settlement?

Marital property is commonly described as property acquired by the spouses during their marriage (for example, a family home or retirement plan assets).

What to do when you are approaching the end of your divorce?

If you’re approaching the end of your divorce, it may be a good idea to consult with your partner to get formal appraisals or estimates on the more valuable items.

What is equitable distribution?

As a result, equitable distribution refers to a fair, but not strictly equal, division of marital assets.

Why is it important to provide an extra copy of a settlement proposal?

It is beneficial to provide an extra copy for your partner during negotiations so that he or she can see what basis you are working on when making settlement proposals.

Is cash traded between spouses deductible?

Cash traded between (ex)spouses as a component of a separation repayment—for instance, to adjust resources—is for the most part not available to the collector and not duty deductible to the payer.

Is spousal support taxable?

This is not to be confused with alimony, also known as spousal support, which is taxable (and deductible) unless the settlement stipulates otherwise.

Do you have to accept the divorce?

Irrespective of how you feel about it, the fact remains that you agreed to the divorce and must accept the obligations that come with it.

Section 25 of The Matrimonial Causes Act 1973

Equality

- In October 2000, the House of Lords delivered a very important judgment in a case involving “big money”, called White vs White. In that judgment, the House of Lords said that:- 1. In seeking to achieve a fair outcome, there was no place for discrimination between husband and wife and their respective roles; 1. The Court's aim should be to achieve a fair result and before making a divisio…

The Overriding Objective

- The ancillary relief rules are a procedural code with the overriding objective of enabling the Court to deal with cases justly. Dealing with a case justly includes, so far as is practicable:- 1. Ensuring that the parties are on an equal footing; 2. Saving expense; 3. Dealing with the case in ways which are proportionate:- 3.1. to the amount of money involved; 3.2. to the importance of the case; 3.3…

The Parameters

- The factors that directly impact the shape of the order that a court is likely to make (if an agreement cannot be negotiated) include: The length of the marriage 1. Co-habitation versus marriage 2. Co-habitaion before marriage Income 1. Earning capacity 2. Ability to work / illness 3. Support whilst re-training The needs of each party 1. What is really meant by need 2. How is nee…