A standard settlement statement has a column for the seller’s debits and credits on one side, a column for the buyer’s debits and credits on the other, and a description of the charge in the middle. Below we use the ALTA form as an example and break it down, line by line. Source: (American Land and Title Association)

Full Answer

What is an Alta statement and why do I need one?

What is an ALTA Statement? The ALTA settlement statement is an itemized list of all of the fees or charges that the buyer and seller will pay during the settlement portion of a real estate transaction. Everything from the sale price, loan amounts, school taxes and other pertinent information is contained in this document.

Is the Alta settlement statement the same as HUD 1?

Is the ALTA Settlement Statement the Same as HUD 1? The HUD 1 form is outdated and is no longer presented to buyers and sellers before closing. It was replaced in 2015 by the Loan Estimate that the buyer receives and the Closing Disclosure forms given to both buyers and sellers.

Is it possible to have a combined Alta buyer’s statement?

But please note that it is possible to have a combined ALTA Buyer’s or Seller’s statement. ALTA Settlement Statement Combined – The Combined settlement is a document that bundles together all transactions as they apply to both the buyer and the seller.

What is an Alta Closing Disclosure?

The Closing Disclosure was introduced in 2015 as a document that instead contains this information strictly for the buyer. ALTA statements were put into use to provide thorough breakdowns for agents and brokers to receive at the end of the transaction. Are ALTA Settlement Statements the Same as Net Sheets?

How do I read my Alta settlement statement for taxes?

4:0613:06How To Read A Closing Statement - YouTubeYouTubeStart of suggested clipEnd of suggested clipSide description in the middle. And buyer on the right. Side under both seller and buyer you'll seeMoreSide description in the middle. And buyer on the right. Side under both seller and buyer you'll see two columns one called debit. And the other credit.

How do you read an Alta statement?

The ALTA statement is an itemized list of all the cost components that the seller and the buyer are supposed to pay during the home closing process to multiple parties. The statement segregates these cost components into 8-9 sections. Each cost component could either be debited or credited to the concerned party.

What is a settlement statement for taxes?

The HUD-1 Settlement Statement is a breakdown of the expenses home sellers and homebuyers incur in a real estate sale. The settlement statement gives both parties a full picture of the expenses attached to the transaction.

How do you read a borrower's settlement statement?

4:567:31How To Read A Settlement Statement From Your Real Estate ClosingYouTubeStart of suggested clipEnd of suggested clipSo the first part of that left side is showing you what you owe which is usually your sale priceMoreSo the first part of that left side is showing you what you owe which is usually your sale price plus closing costs plus any pro rated items like hoa dues.

Where does the purchase price appear on a settlement statement?

Where does the purchase price appear on the settlement statement? debit for the buyer credit for the seller. Where does the buyers new loan appear on the settlement statement? Credit buyer- The buyers debit column lists all the charges to the buyer; the credit column shows how the buyer is going to pay the charges.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

Can you deduct property taxes?

Homeowners who itemize their tax returns can deduct property taxes they pay on their main residence and any other real estate they own. This includes property taxes you pay starting from the date you purchase the property.

Do you pay tax on a settlement agreement?

Usually a settlement agreement will say that you will be paid as normal up to the termination date. These wages are due to you as part of your earnings and so they will be taxed in the normal way.

What items are tax deductible on a closing statement?

Typically, the only closing costs that are tax deductible are payments toward mortgage interest, buying points or property taxes. Other closing costs are not.

How do you explain a settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

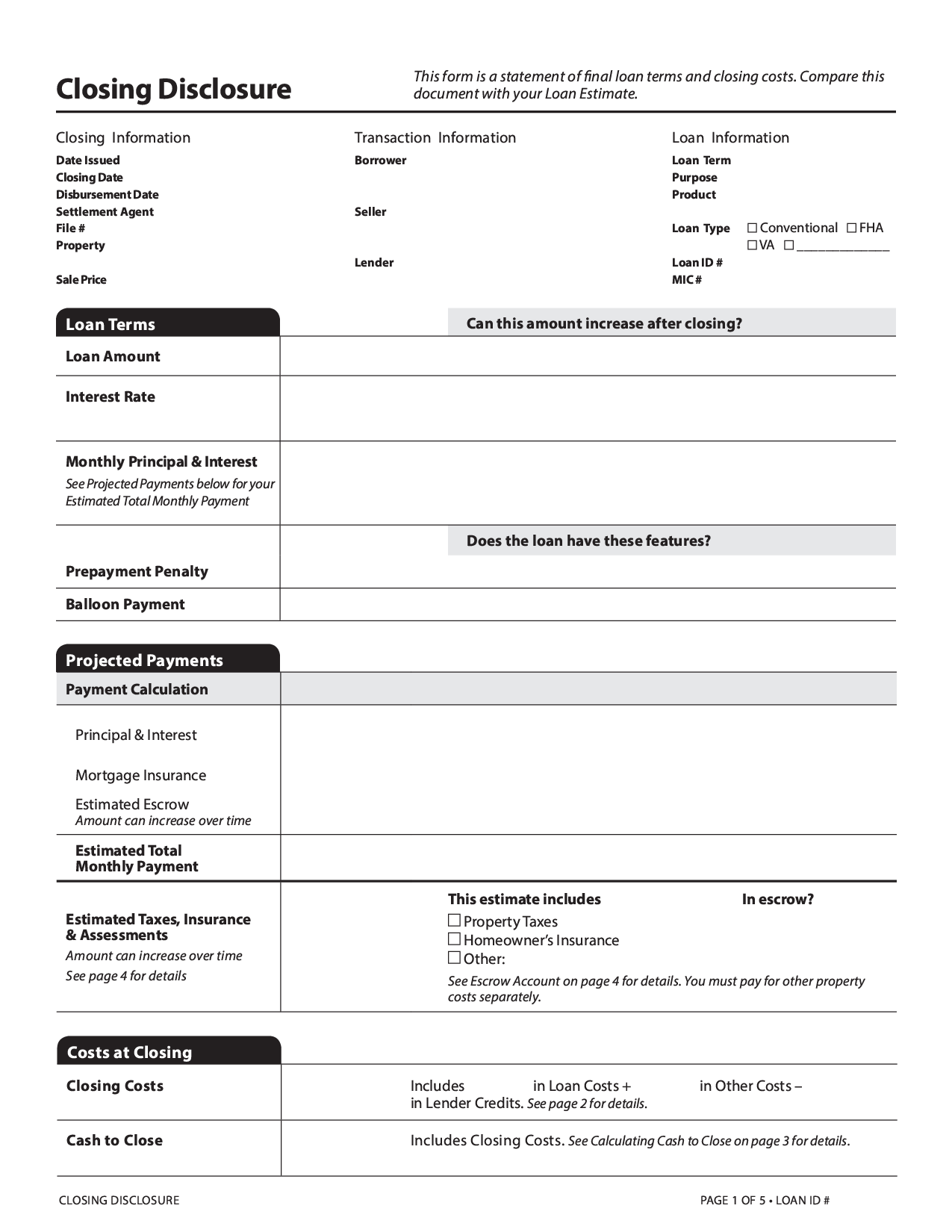

Which two items will appear on a closing disclosure?

Closing disclosure form sectionsLoan information. This section should match your loan estimate regarding the loan term, loan purpose and loan program (conventional, FHA, VA or USDA).Loan terms. ... Projected payments. ... Costs at closing. ... Late payment fee. ... Escrow account.

How is the tax certificate fee shown on the worksheet on a transaction with a VA loan quizlet?

How is the tax certificate fee shown on the Worksheet on a transaction with a VA loan? As a credit to the buyer and a debit to the seller. As a debit to the buyer and a credit to the seller.

What is a final closing statement?

DEFINITION. A closing statement is a written record of the terms of a loan or other financial transaction, disclosing the final terms of an agreement.

What is true of earnest money and the closing statement?

What is TRUE of earnest money and the closing statement? Earnest money will not be paid until after the closing statement. The buyer will receive a credit for the money that they have prepaid. The seller will receive a credit for the money that they have prepaid.

Is closing disclosure the same as closing statement?

A closing statement or credit agreement is provided with any type of loan, often with the application itself. A seller's Closing Disclosure is prepared by a settlement agent and lists all commissions and costs in addition to the net total to be paid to the seller.

What is a closing statement?

A closing statement is a form used in a real estate transaction that includes an itemized list of all the buying or selling costs associated with that transaction. It's a standard element of home sales, especially those that involve mortgages, and refinancings.

What is the ALTA Settlement Statement?

The ALTA Settlement Statement is a form that itemizes all of the credits and costs associated with a real estate transaction. There are four different versions of this form, including:

What Information Does the ALTA Settlement Statement Contain?

The charges listed in the ALTA Settlement Statement are broken down into ten different categories, including:

What is excess deposit?

Excess Deposit—any money in escrow over the amount the buyer and seller agreed to pay

Why do buyers and sellers get different versions of closing disclosure forms?

This is partly because the Closing Disclosure contains personal information like your social security number you may not want others to know.

What is personal property?

Personal Property—the amount of money the buyer is paying to buy personal items like furniture from the seller. Existing Loans Assumed or Taken Subject To—only relevant if the buyer is taking over the seller’s mortgage. Excess Deposit—any money in escrow over the amount the buyer and seller agreed to pay.

What is the financial section of a mortgage?

The financial section includes important information about the sale of the property including the final purchase price, the amount of earnest money the buyer put down, and the loan amount issued to the borrower. If the seller agreed to pay for repairs or a portion of the buyer’s closing costs, that’s also reflected in this section of the form. You may see a few other charges you’re not familiar with, including:

How much commission does a seller have to pay for a home?

This section shows how much real estate commission the seller will need to pay. Real estate commission usually costs 5% to 6% of the sale price of the home and is split between the buyer’s and seller’s agent.

Where Can I Download a Sample ALTA Settlement Statement?

You can download a sample ALTA statement by clicking the text link below.

What is an ALTA Statement?

The ALTA settlement statement is an itemized list of all of the fees or charges that the buyer and seller will pay during the settlement portion of a real estate transaction. Everything from the sale price, loan amounts, school taxes and other pertinent information is contained in this document.

What is closing disclosure?

The closing disclosure is provided to the buyer and pertains a list of fees and costs and how they work into the buyer’s total expense. It is important to note that only the lender can provide the Closing Disclosure to the buyer 3 days prior to closing? And only the buyer should be able to see it unless they allow the release of it by signing a release disclosure. You should also know that the lender is obligated under the TRID regulations, and the lender can be penalized for failing to disclose 3 days after they’re loan application is approved and again 3 days prior to closing.

What is a settlement statement?

Settlement Statements – This is the version supplied solely to the buyer and contains only information pertinent to the buyers side of the transaction.

What is a HUD-1?

A Hud-1 used to be the primary statement associated with real estate and is used to document all cash transactions and how they affect both parties. It is now outdated. The Closing Disclosure was introduced in 2015 as a document that instead contains this information strictly for the buyer.

Why is a standard form required for title insurance?

Having a standard form for nearly all title insurance policy transactions maintains that all exchanges of land are done smoothly and efficiently.

Is ALTA the same as net sale?

No, an ALTA settlement statement is not the same as the net sale sheet. A net sheet is a document that can be provided throughout the sale process to give the seller an estimate on what they can expect to make. The net sale sheet is not final, and multiple sheets may be provided as offers are made and transactions process. An ALTA settlement statement is provided during the closing of a transaction and contains solid numbers rather than estimates.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

How much does it cost to sell a house in 2021?

A 2021 study we conducted found that it costs $31,000 on average to sell a home. But ideally your sale price covers the costs of all the transaction fees, your mortgage payoff, and then some, leaving you with a tidy sum to add to your bank account.

Who is responsible for taxes on a home?

Real estate taxes – Sellers are responsible for the portion of the taxes that are billed for the time they lived in the home. For example, if the bill comes out in September, and you close in August, you’ll owe the taxes for the entire year up to September. The buyer will be responsible for the taxes from September through the end of the year. You can then deduct the taxes that you owed on your tax return.

How to make sure you get all your deductions?

The best way to make sure you get all of your tax deductions is to talk to your tax advisor. With the Tax Reform and tax deductions changing so drastically, it’s best to get a professional opinion. As long as you make sure you tell your advisor about your home purchase, sale, or refinance and prove payment of the tax-deductible expenses, you may be able to lower your tax liability.

Can you deduct refinance costs on settlement?

Even if you refinance, you may be able to deduct some of the costs on your settlement statement.

Is a settlement statement tax deductible?

What Settlement Statement Items are Tax Deductible? Closing on a loan can cost you several thousand dollars. Before you let that prevent you from buying a home or refinancing, learn which settlement statement items are tax deductible. This lowers the overall cost of closing on a loan, by lowering your tax liability at the end of the year.

Do you include prepaid interest on closing statement?

Don’t forget to include the prepaid interest on your Loan Closing Statement in your taxes. Points paid – Again, lenders may charge origination fees or discount points. Luckily, the IRS lets you deduct these items even if you refinance. The difference, however, is how you deduct them.