Full Answer

How to send money to Vanguard?

Invest by sending a check

- Don't send a check without a purchase form.

- Make your personal check payable to Vanguard. ...

- Be sure to sign your check. ...

- If you're submitting an employer's check, simply enclose it without endorsing it.

- Don't include additional forms or hand-written instructions with your check.

What is Vanguard federal money market settlement fund?

Your money market settlement fund is used to pay for and receive proceeds from brokerage transactions, including Vanguard ETFs®, in your Vanguard Brokerage Account. Vanguard Federal Money Market Fund is the only settlement fund available. Money market mutual funds are one of the most conservative places to keep your cash.

How to withdraw money from Vanguard?

To withdraw money from Vanguard, you need to go through the following steps: Log in to your account Select ‘Withdrawal’ or ‘Withdraw funds’ from the appropriate menu Select the withdrawal method and/or the account to withdraw to Enter the amount to be withdrawn, and, if prompted, a short reason or description Submit your request

What if Vanguard or fidelity went bankrupt?

Vanguard, Fidelity, and E*Trade are all members of SIPC. So if any one of them ever filed for bankruptcy, the securities held at the firm would be insured by SIPC. The bankruptcy of the brokerage would not affect the value of stocks, bonds, mutual funds, and other assets held at the firm.

Can Vanguard settlement fund lose money?

An investment in the fund could lose money over short or even long periods. You should expect the fund's share price and total return to fluctuate within a wide range, like the fluctuations of the overall stock market.

Is Vanguard settlement FDIC insured?

Although the Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Should I keep money in my settlement fund?

While you're not required to have a balance in your settlement fund at all times, keeping some money in the settlement fund has these advantages: You're more likely to have money to pay for purchases on the settlement date, when your account will be debited for the amount you owe.

What is a settlement fund at Vanguard?

Your settlement fund is used to pay for and receive proceeds from brokerage transactions, including Vanguard ETFs®, in your Vanguard Brokerage Account.

What is the interest rate on the Vanguard settlement fund?

The expense ratio is 0.16% ($16 annually for every $10,000 invested) and the seven-day SEC yield, which reflects the interest earned after deducting fund expenses for the most recent seven-day period, is 0.01%. The one-year return as of March 31 was 0.14%.

Where should you invest your emergency fund?

Here are your emergency fund investment options:Certificates of Deposit (CD) ... Money Market Accounts. ... Money Market Mutual Funds. ... Roth IRA. ... Brokerage (Taxable Investment) Accounts. ... Health Savings Account (HSA) ... A 401k, 403b, or 457.

How long does it take for funds to settle Vanguard?

Each trade settles in 2 business days, so you'll be late paying for stock X, which you bought on Monday. Any 3 violations in a rolling 52-week period trigger a 90-day funds-on-hand restriction. During this time, you must have settled funds available before you can buy anything.

Does Vanguard have high yield savings accounts?

Income: The Vanguard Prime Money Market Fund pays a better yield than most savings accounts, checking accounts, and short-term CDs do. Although the fund's current annualized yield is only about 0.50%, it's far better than the sub-0.10% returns many savings accounts are offering.

How do I change my Vanguard settlement fund?

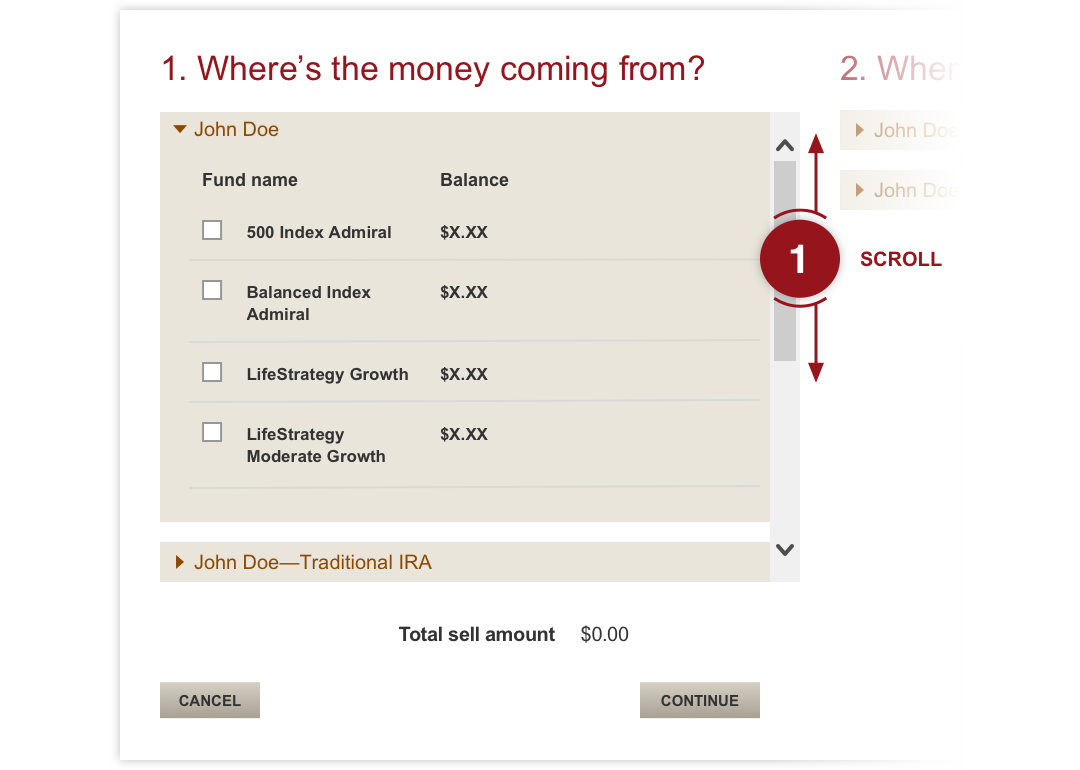

How do I exchange a Vanguard mutual fund for another Vanguard mutual fund online?From the Vanguard homepage, search "Exchange funds" or go to the exchange funds page. ... Select the checkbox next to the fund name you want to exchange from.Enter the dollar amount you want to exchange into the textbox.More items...

Can Vanguard be trusted?

The company is regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Vanguard is considered safe because it has a long track record and it is overseen by top-tier regulators. You can open an account at Vanguard if you live in United States.

Which Vanguard fund has the highest return?

Fastest growing Vanguard funds worldwide in May 2022, by one year return. The fastest growing investment fund managed by U.S. asset management company Vanguard is the Vanguard Energy Index Fund. Over the year to May 1, 2022, the mutual fund generated an annual return of 60.64 percent.

Can I withdraw all my money from Vanguard?

While you can withdraw up to $100,000 (or 100% of your balance), you may not want to take out so much. Check your plan whether you can request additional withdrawals or loans. If you have a loan, suspend the payments.

Is Vanguard 401k FDIC insured?

Are 401(k)s Protected? Retirement accounts, such as 401(k) plans are protected from creditors and related lawsuits. However, they are not protected from failure of the 401(k) administrator the same way that bank accounts are protected by the Federal Deposit Insurance Corporation (FDIC).

How do I transfer money from Vanguard settlement to bank?

Once the proceeds from your sale settle in the settlement fund, you can transfer the money to your linked bank account. From the Vanguard homepage, search "Sell funds" or go to the Sell funds page. Select your bank account from the drop-down menu in step two under Where is your money going?

How long does it take for Vanguard funds to settle?

Each trade settles in 2 business days, so you'll be late paying for stock X, which you bought on Monday. Any 3 violations in a rolling 52-week period trigger a 90-day funds-on-hand restriction. During this time, you must have settled funds available before you can buy anything.

What is the difference between FDIC and SIPC?

Each helps protect assets in different kinds of accounts: SIPC insurance helps protect assets in a brokerage account (such as stocks, bonds, and ETFs), whereas the FDIC insures money you have in a deposit account with a financial institution.

How safe is Vanguard?

There are two main aspects to Vanguard’s safety to consider: security and insurance.

What is the security aspect of Vanguard?

The security aspect deals mainly with account and app security to protect your funds from unauthorized access. The insurance aspect is directly related to a potential loss of your funds. Insurance can protect your funds from loss in case that something happens to Vanguard or the custodian holding your funds.

What is Vanguard 2FA?

One important security feature that Vanguard has in place is two-factor authentication. 2FA is an additional security layer when logging in to your account. It makes it far more difficult for hackers to gain access without your knowledge.

What is Vanguard insurance?

Vanguard is a member of the Securities Investor Protection Corporation (SIPC) which protects investors’ funds up to $500,000. In addition, Vanguard has secured coverage from Syndicates at Lloyd’s of London up to an aggregate of $250 million. Vanguard brokerage accounts are also protected by two-factor-authentication to prevent unauthorized access.

What would happen if Vanguard went out of business?

If Vanguard went out of business, your funds would be safe. Here’s why: The Vanguard Group which administers all the funds and investment products does not own any of the funds. In fact, it’s the other way around. The funds – and thus the investors – own The Vanguard Group.

How much can you claim with SIPC?

The SIPC protects claims for investors’ securities up to a maximum of $500,000 of which $250,000 can be cash reserves. Pretty much all registered brokers or dealers have to be SIPC members by law.

What is Vanguard's mission?

Vanguard was built and grew on that very philosophy and mission. And up until today, they are striving to reduce costs for investors while increasing the quality of their investment products. Vanguard’s unique ownership structure is an expression of the above philosophy.

HSA savings should be the top retirement property, only your 401k employer match should have a higher priority

I've had a few conversations both on Reddit and with friends who don't fully understand the benefits of HSAs so I thought I would post some of the stuff we've talked about before.

Always question your medical bills!

I had two fillings replaced about a month ago. This was my first time at this office and the staff and dentist were great, no complaints there. I did have to pre-pay the estimate of my balance which I had never had to do before, but the math made sense (they charged $220/filling, my insurance covers 50%, so I paid $220 that day on my credit card).

Silly question alert: Why is 401k necessary?

I'm 21, just got a job at Whole Foods, and now I'm getting mail about signing up for their 401k plan.

Need a new car but afraid of lifestyle inflation

Household net income is $5500 a month. Have 3 months cash reserves. After all my bills I have about $1500 left over that's being used to pay off nearly $60,000 in student loans. But my car is failing. It's a 16 year old Hyundai.

Mortgage company is hounding me about lower interest rate

My mortgage company calls pretty much every day to tell me that they want to offer me a lower mortgage interest rate (I'm at 2.75% and they want to bring it to 2 or below). I've already done this once from 3.5%.

What are managers concerned about this spring's shake up in money market funds?

Managers are concerned that this spring’s shake-up in money market funds might lead to further regulatory changes, he said.

Why do people use money market funds?

Money market funds often provide investors a safe haven to stash cash and get a little yield, as well.

Is Vanguard a government money market fund?

Late next month, Vanguard will transition its $125.3 billion Prime Money Market Fund to a government money market fund, investing “almost exclusively” in U.S. government securities, cash and repurchase agreements backed by government securities or cash. The fund will be renamed the Vanguard Cash Reserves Federal Money Market Fund, the firm said.