- Private Lending. The first way to invest one million dollars is through private lending. ...

- Rental Income from Real Estate. Another way to invest one million dollars is to purchase real estate investment properties. ...

- Investing in Business. You could also take that million dollars and invest it in a great business idea. ...

- Investing in the Stock Market. Putting your money in the stock market has the potential to generate decent returns, especially if you invest wisely.

- Real Estate Investment Trusts (REITs) REITs have been growing in popularity for awhile now. ...

- Crowdfunding Real Estate. Another relatively new real estate investing option is crowdfunding. The idea is that individuals pool their money together to participate in larger real estate projects.

- Bonds. One of the safer ways to invest a million dollars is in U.S. Government Bonds, because they’re backed by the government.

- ETFs

Full Answer

Should I invest my settlement money?

Investing your settlement money can be a great opportunity to benefit from compound interest over time, watch your money grow, and get one step further to achieving your financial goals. While some settlement money is tax-free at the start, once you invest the money into things such as stocks or bonds, then the dividends earned are fully taxable.

How can I invest one million dollars?

Another way to invest one million dollars is to purchase real estate investment properties. If you invest in the right real estate markets, it’s possible to yield as much as a 9% return from the cash flow annually. Let’s say you bought 10 properties averaging $100,000 each, and rent them for $1,000/month.

What should I do with my lawsuit settlement money?

If you receive your lawsuit settlement money as a lump sum, you may want to consider investing the money in a long-term investment, such as mutual funds, that will provide you with income. This is particularly important if you have been disabled by an injury or illness.

How would you invest a Million Bucks?

How Would I Invest a Million Bucks? First, a million dollars is a lot of money, and investment decisions should be made by taking a holistic look at your financial situation and goals. I believe strongly that a financial professional is worth it to help guide you on your path. Ads by Money.

Where can I put 1 million cash?

10 Ways to Invest $1 Million DollarsStock Market. Stocks can generate returns through dividends and growth in share prices. ... Bonds. ... Rental Properties. ... ETFs. ... Buy a Business. ... CDs and Money Market Accounts. ... Fixed Rate Annuities. ... Private Lending.More items...•

What should I invest my settlement in?

Best practice is around 6 months' worth of living expenses so that if an emergency arises you won't need to take out a loan or be in debt. Invest the money: You may want to invest in education, a home, a business or something similar.

What is the safest investment for 1 million dollars?

The Best Ways to Invest $1 Million Dollars Right NowInvest in the Stock Market. ... Invest in Bonds. ... Invest in ETFs. ... Invest With a Robo Advisor. ... Private Lending or P2P Lending. ... Invest in a Business. ... Invest in Rental Properties. ... Invest in Real Estate Investment Trusts (REITs)More items...

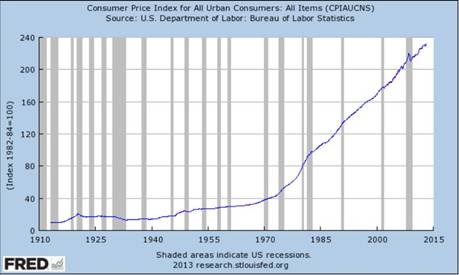

How much interest does $1 million dollars earn per year?

How Much Interest Can one Million Dollars Earn Per Year? A $1 million investment can earn interest from $33,000 per year invested in US Treasury bonds to around $1.2 million invested in real estate after a ten-year investment term.

What to do with a $100000 settlement?

What to Do with a $100,000 Settlement?Sort Out Tax Implications.Find a Financial Advisor.Pay Off the Debts.Invest in a Retirement Home.Start a Business or Help Friends and Family.Donate the Money to the Needy.Final Words.

What should I do with a large lump sum of money?

If you receive a lump sum of money, it's important to consider how you can use it to achieve your financial and personal goals.Pay down debt: One of the best long-term investments you can make is to pay off high-interest debt now. ... Build your emergency fund: ... Save and invest: ... Treat yourself:

Can you live off interest of 1 million dollars?

The historical S&P average annualized returns have been 9.2%. So investing $1,000,000 in the stock market will get you $96,352 in interest in a year. This is enough to live on for most people.

Where do millionaires keep their money?

Stocks and Stock Funds Some millionaires are all about simplicity. They invest in index funds and dividend-paying stocks. They like the passive income from equity securities just like they like the passive rental income that real estate provides. They simply don't want to use their time managing investments.

Can you live off interest of 2 million dollars?

And, can you live off the returns of a $2 million account? The answer is yes, if you're smart about it.

Where can I get 10% interest on my money?

How Do I Earn a 10% Rate of Return on Investment?Invest in Stocks for the Long-Term. ... Invest in Stocks for the Short-Term. ... Real Estate. ... Investing in Fine Art. ... Starting Your Own Business (Or Investing in Small Ones) ... Investing in Wine. ... Peer-to-Peer Lending. ... Invest in REITs.More items...•

How much monthly income will 1 million generate?

A 1 million dollar annuity would pay you approximately $5,157 each month for the rest of your life if you purchased the annuity at age 65 and began taking payments immediately.

How do millionaires live off interest?

are popular investments for millionaires. Examples of cash equivalents are money market mutual funds, certificates of deposit, commercial paper and Treasury bills. Some millionaires keep their cash in Treasury bills that they keep rolling over and reinvesting. They liquidate them when they need the cash.

How can I protect my settlement money?

Keep Your Settlement Separate Rather than depositing the settlement check directly into your standard bank account, keep the settlement money in its own separate account. This can help you keep it safe from creditors that may try to garnish your wages by taking the money you owe directly out of your bank account.

How do I avoid taxes in a lawsuit settlement?

Spread payments over time to avoid higher taxes: Receiving a large taxable settlement can bump your income into higher tax brackets. By spreading your settlement payments over multiple years, you can reduce the income that is subject to the highest tax rates.

Do you get taxed on settlement money?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

Will I lose my SSI if I get a settlement?

One question that we are asked quite often from our clients and their families is how a personal injury settlement will affect their Supplemental Security Income (SSI) benefits. The short answer is “Yes, a personal injury settlement will likely affect your SSI benefits.”

How much interest will I earn on $1 million dollars?

To use a basic example, say you had an account with $1 million that paid 4% annually--in such a case, you'd earn $40,000 per year. What's great abo...

How should I invest $1m to make $2 million dollars?

To effectively double $1 million, you’ll need to use the rule of 72, which is a formula that has you divide 72 by your expected annual rate of retu...

How can I invest $1m wisely?

To invest $1m wisely, you should look for investments that will net you an average of 4-6% on average, annually. For this, you should look at inves...

What’s the best way to invest $1m short term?

The best short-term investment for $1m is a low-cost index fund that broadly diversifies your investments in stocks across a variety of industries....

Can I retire with $1 million dollars?

You can retire with $1 million dollars if you manage your withdrawals appropriately. The Rule of 4 says that you should withdraw no more than 4% of...

How can I earn passive income with $1 million?

The best way to earn a passive income with $1 million is to put it into something like real estate, where you own the property and can collect rent...

Can you live off the interest on $1 million?

You can live off the interest on $1 million, but you will have to budget carefully. You will also have to have a plan to protect your principal, wh...

How much will a $1 million dollar annuity pay?

A $1M annuity can pay anywhere from $50K to $80K a year. How much an annuity pays depends on several factors, including whether you want it to cove...

Can you keep $1 million in the bank?

You can keep $1 million in the bank, but the FDIC only insures deposits up to $250,000. You can break up the $1 million into accounts at several ba...

Is $1 million enough to retire on?

Many people can retire on $1 million. Whether that amount is right for you depends on your retirement goals and how you invest the $1 million. You...

What is the average retirement nest egg?

The average person retires with roughly $96,000 saved. However, retirement nest eggs vary widely. Some people are more comfortable in a modest reti...

How Would I Invest a Million Bucks?

First, a million dollars is a lot of money, and investment decisions should be made by taking a holistic look at your financial situation and goals. I believe strongly that a financial professional is worth it to help guide you on your path.

How long should I sit on 500000?

You sit on it for at least three, preferably six months. This is the best advice I can give for any large lump of money, even if you ask what to do with 500000 dollars! Sit on it, and save that money!

What is the Financial Success Blueprint?

By the way, if you’re investing for retirement, you might want to check out The Financial Success Blueprint™ – my very own comprehensive retirement plan review that will help you determine if you’re on track or if you need to make changes.

How to get competitive interest rates?

You can get some fiercely competitive interest rates by opening your savings account or CD with an online bank like our favorites Capital One 360 and CIT Bank. (And since they are online, you should be able to bank with them no matter what state you live in. Or decide to buy your mansion in. Whichever.)

Is it okay to have more cash than you have in your life?

It’s probably more cash than you’ve had in your entire life sitting there doing nothing, but that’s okay. You’ve now turned a new leaf. It’s a new you, so enjoy it.

Is it realistic to get a high yield on a bond?

Trying to get a high yield on a bond these days is about as realistic as trying to get an In-and-Out Burger in the Midwest. It ain’t going to happen!

Is CD a good investment?

A CD is pretty much the safest and most guaranteed investment you can make. There will be plenty of time later for you to decide where all to put your money, but in the meantime, you can earn interest while you decide where to invest long-term and count on your money sitting safe and sound.

Tip One: Settlement Taxability

The first question you may have in mind is “is the money taxable?” This really depends on your situation. If it’s a settlement from a personal or physical injury, it’s usually non-taxable. Emotional distress settlement awards are typically non-taxable if the distress is attributable to a physical injury or physical sickness.

Tip Three: Giving Money to Family

Another common question that comes up is, “Should I give money to my family?” Your family members or relatives may not necessarily be in the best financial situation, so I totally understand if you feel the urge to help them out. There is nothing wrong with that. Or maybe they’re financially ok,, but they’ll still come knocking at your door.

Tip Five: Overall, what should you do with the settlement money?

The fifth and final question that I’d like to help answer is, “What should I do with the settlement money?” I would like to urge you to find some quiet time and reflect on your life goals. What is important to you? What brings you joy? And then think about how you can use the settlement money as a tool to help you live your best life.

Additional settlement money questions that you may have

Your financial goals and situation will dictate how you use a large settlement check. Working with a certified financial advisor will help you come up with a settlement check plan tailored to your unique needs. The money will then be less likely to be used on impulse. We share our top 5 tips on what to do with your settlement money in the blog.

Need help with your settlement money?

You probably have a lot more questions to ask on what to do with your settlement money. Feel free to schedule a free discovery call with one of our financial advisors to go through your personal situation.

Introduction

If I handed you one million dollars cash today and told you I wanted it back in 5 years with 6% interest, would you take it?

3 Questions to Consider Before Investing a Million Dollars

You should always create an investment plan based on your personal financial goals. If you don’t have a clear direction or goal in mind, how do you ever expect to accomplish it? Ask yourself what it is your are looking to accomplish financially.

How To Invest a Million Dollars?

The first way to invest one million dollars is through private lending. For example, you could borrow the funds and then turn around and lend them to someone else for more. That’s exactly what banks do. They borrow money from the Fed, mark it up about 3% and lend it to individual borrowers like us.

Note of Caution: Use the Power of Leverage Wisely

There are many ways to make money with money. When you borrow money, you can receive far greater returns than you could achieve using your own capital. That’s why financing is often referred to as “leverage”.

How to invest 1 million dollars?

Another way to invest $1 million is by funding loans to others. That way, you can earn a reliable income on the interest that the loans generate. With this strategy, you'll need to join a peer-to-peer (P2P) platform, which allows you to connect with borrowers all over the world.

What to do if you don't want to rely on your investments?

If you don't want to rely on your investments for income, determine how much you need to set aside to act as your base income before you invest the rest. Secure Your Retirement. It's crucial to review your retirement plan and make sure you are on track to retire comfortably before you invest.

What to do before investing?

Before you invest, consult with a professional to review your overall financial health. They'll likely ask about the following three things to get an idea of which investments are best for you:

How to get a $200 Discover bonus?

To get your $150 or $200 Bonus: What to do: Apply for your first Discover Online Savings Account, online or by phone. Enter Offer Code CY21 when applying. Deposit into your account a total of at least $15,000 to earn a $150 Bonus or deposit a total of at least $25,000 to earn a $200 Bonus. Deposit must be posted to account within 30 days of account open date. Maximum bonus eligibility is $200.

How long does it take to get a cash bonus?

Corresponding cash bonus will be credited to the account within 10 business days. Once the bonus is credited to the account, the bonus and qualifying deposit (minus any trading losses) is not available for withdrawal for 300 days. If the qualifying deposit is withdrawn, the bonus may be revoked.

Do stocks pay dividends?

Some stocks pay dividends for those looking for income. When you have $1 million to invest, remember to get advice from a professional before you buy stocks, especially if you're not familiar with the market. As a rule of thumb, never put all your investment money into one stock.

Can you diversify your risk?

You can even diversify your risk by lending money to multiple borrowers at once. Your $1 million could fund many borrowers.

What to do if you receive a huge settlement?

If you receive a huge cash settlement, you should consider hiring a financial professional. Avoid doing all the investing and saving all by yourself. You may be saving professional fees by not hiring a professional but you’ll have a greater chance of making investment and saving mistakes along the way.

Why do we get structured settlements?

You receive structured settlements or cash settlements because you deserve them. In my opinion, you’ll be more deserving if you give back to your community in the forms of donation to charity, donations to church, and the likes.

How to spend money when you receive money?

Spend based on your needs and not on your wants. Because of the money you receive, you may be tempted to buy whatever it is that you want. Avoid succumbing to that temptation. Always stick with what you need and remain as frugal as possible.

How to forget debt?

Pay Off Your Debt and Save. To tell you the truth, it is really easy to forget your debt and to save when you suddenly receive a ton amount of money. Before you spend your money, make sure that your priorities are taken care off. Pay your debt so you won’t have to pay additional fees and interest.

What to do before you make a move with your money?

Before you even make any moves that involve using your money, make sure that you create or have a plan.

Is a settlement subject to taxes?

Your settlement may be subject to taxes. It is best to seek help with professionals such as CPAs and tax attorneys to make sure you pay the necessary taxes. If you neglect paying the taxes, you are looking at higher tax liabilities due to penalty and interest.

Should I stop learning about settlements?

Just because you receive a huge settlement doesn’t mean that you should stop learning and educating yourself. I have always believed that education is one of the best investments you can make for yourself.

What to do when you have a debt?

First, pay off debt, such as credit cards, lingering medical expenses, and high-interest loans.

What do we dream about when we dream about financial windfalls?

Of course, when imagining a financial windfall, most of us do spend time dreaming about all the cool stuff that money can buy . But instead of the fancy cars or boats that we typically fantasize about, consider treating yourself to new and exciting experiences, rather than simply material goods.

Is it important to research the costs of owning a house?

No matter what, though, it is still important to research the total costs of owning, your lifestyle and priorities, and make a careful decision before proceeding.". "A house is important, but don't over extend yourself," cautions Layton Cox, Financial Advisor for Pathways Financial Partners.

Can emotional distress settlements go either way?

Exceptions usually include settlement payments for personal injuries or physical sickness, says Grosz. Emotional distress settlements can go either way.

Do you have to hoard money?

If you have personal projects or family relations that you believe deserve a cash infusion, you don't have to hoard your money, but invest wisely. Do your research, lean on your financial advisor, and make sure to go through the proper legal channels to ensure that you don't get stuck owing money to someone you don't even know because your cousin Roger jerked you around.

How to evaluate your financial situation?

The best way to evaluate your financial situation is to hire a financial advisor who can objectively help you manage your wealth. Although it can seem like a hit to your pride to hire someone to tell you what to do with your money, these people are certified experts at not only helping you make money, but keeping you from losing it as well.

What are the hallmarks of wise investors?

Reason and moderation are the hallmarks of wise investors.

What to do if you inherit a nest egg?

If you’re lucky enough to inherit a nest egg that somebody else worked hard to build, you can honor your benefactor and delight your heirs by being a good steward of what you have received. No matter how large or how small your inheritance, manage it with care and pay it forward.

Is it safe to invest in a large basket of funds?

Your financial advisor will be able to help you invest wisely. The best thing to do for most people—they will probably echo this sentiment—is to invest widely in a large basket of funds that offer a solid return over time. It is considered safe, and often the smartest investment for young people with an inheritance.

Is it wise to hire an investment advisor?

Investing can seem intimidating, which makes it wise to hire an investment advisor to guide you to a secure financial future.

What to do with lump sum settlement?

If you receive your lawsuit settlement money as a lump sum, you may want to consider investing the money in a long-term investment, such as mutual funds, that will provide you with income. This is particularly important if you have been disabled by an injury or illness. You should consult with a certified financial consultant to determine the type of investment that will best meet your long-term needs.

What happens if you settle a lawsuit?

If you have a lawsuit settlement due to a personal injury, you may have medical bills to pay as well as living expenses from not being able to work. Even if your insurance company has paid for your treatment, some insurance companies have terms in their policies that require the insurance company to be reimbursed if there is a settlement. This money would be deducted from the total settlement amount. Check with your insurance company to determine whether they will take any share of the settlement money.

What is structured settlement?

In a structured settlement, you receive regular payments over an agreed period of time. What you do with the settlement money may depend on which type of settlement you receive, the total amount of the settlement and your personal circumstances. Advertisement.

Do you have to pay attorney fees after a settlement?

Following a settlement, you will also need to pay attorney's fees. If your attorney has worked on a contingency or no-win no-fee basis, they will usually take their fee directly out of the settlement money. For all attorneys, the method of payment will be agreed upon during the hiring process and should be clearly stated in the retainer agreement. Attorneys who work in exchange for a percentage of the settlement amount may calculate their fee based on the gross settlement amount (the amount before medical bills are paid) or on the net amount (the amount after medical bills are paid).

Do you have to pay taxes on a lawsuit settlement?

When you receive a lawsuit settlement, keep in mind that you may have to pay taxes on the money as if it were income. Internal Revenue Service (IRS) Tax Code section 61 states that any income you receive is taxable, unless it is excluded by the IRS.

Can you pay a lawsuit settlement as a lump sum?

Lawsuit settlement money may be paid as a lump sum or in installments.