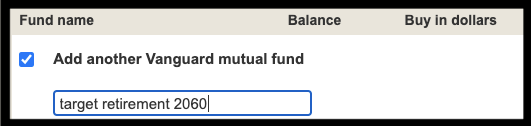

If you are adding money to a fund you already own, check the box next to the fund and type in the dollar amount. If you are buying a new fund, check the box next to Add another Vanguard mutual fund. You can type in the fund name, symbol, or number.

Full Answer

How does Vanguard make money?

Vanguard does not make its money through hidden fees or through stock or ETF commissions. Instead, they operate essentially at cost, as the company is owned by its funds, making fund and ETF shareholders partial owners in Vanguard. In general, everything is low-cost or free with Vanguard. Although they have massive revenues and more than $7 ...

What is the interest rate on Vanguard money market?

Vanguard Treasury Money Market Fund: Short-term, U.S. Treasuries: $3,000: 0.09%: 0.09%: VMSXX Vanguard Municipal Money Market Fund: Short-term, tax-exempt securities: $3,000: 0.05%: 0.15%: VCTXX Vanguard California Municipal Money Market Fund: Short-term California municipal securities: $3,000: 0.01%: 0.16%: VYFXX Vanguard New York Municipal Money Market Fund

What happened to Vanguard Prime money market?

- Name change. Vanguard Prime Money Market Fund will change its name to Vanguard Cash Reserves Federal Money Market Fund.

- Even safer. It will now invest only in securities fully backed by the U.S. ...

- Even cheaper. Basically, everyone will get the lower expense ratio from Admiral shares which previously had a $5,000,000 minimum (!). ...

- No more checkwriting. ...

How to send money to Vanguard?

Invest by sending a check

- Don't send a check without a purchase form.

- Make your personal check payable to Vanguard. ...

- Be sure to sign your check. ...

- If you're submitting an employer's check, simply enclose it without endorsing it.

- Don't include additional forms or hand-written instructions with your check.

How do I add money to my Vanguard fund?

How do I add cash?Log into your account.Select 'Payments' from the 'My Portfolio' menu.Click the 'Add cash' button next to the account you want to add cash to.Follow the on-screen instructions. It will take 1 business day for your debit card payment to clear and for the cash to become available for you to invest.

How do I put money in a money market fund?

Buy into a money market fund. Your online brokerage or other services (such as mutual fund companies) will help you invest a specific amount of money into money market funds by writing a check or making an online transfer.

What is a Vanguard money market settlement fund?

Money market fund A mutual fund that seeks income and liquidity by investing in very short-term investments. Money market funds are suitable for the cash reserves portion of a portfolio or for holding funds that are needed soon.

How do I transfer money from Vanguard settlement funds?

Once the proceeds from your sale settle in the settlement fund, you can transfer the money to your linked bank account. From the Vanguard homepage, search "Sell funds" or go to the Sell funds page. Select your bank account from the drop-down menu in step two under Where is your money going?

Can you regularly add money to a money market account?

And you can add money to the account whenever you like, unlike with certificates of deposit (CDs.) The number of checks you can write and the number of transactions allowed per statement cycle are limited, but access is still more flexible than what you get .

Can Vanguard settlement fund lose money?

An investment in the fund could lose money over short or even long periods. You should expect the fund's share price and total return to fluctuate within a wide range, like the fluctuations of the overall stock market.

Can you put your 401k in a money market account?

You should also consider opening up an IRA, a 401(k), or a Roth IRA, in which you can hold a retirement money market account. If you have an employer-sponsored plan, don't overlook it.

Are Money Market Funds Worth It?

Money market funds are considered a good place to park cash, because they're much less volatile than the stock or bond markets. Money market funds are used by investors who want to protect rather than grow their retirement savings, but still earn some interest — somewhere between 1% and 3% a year.

How does a money market fund work?

How Do Money Market Mutual Funds Work? Like other kinds of mutual funds, money market funds assemble a portfolio of securities and sell shares to investors, who earn returns from the portfolio in the form of income and capital gains.

Can you transfer funds between Vanguard accounts?

You can transfer between like account types—such as an individual account to an individual account—or unlike account types—such as an individual account to a joint account. However, please note that any transfers between unlike account types may require paperwork.

How long does it take for funds to settle Vanguard?

Each trade settles in 2 business days, so you'll be late paying for stock X, which you bought on Monday. Any 3 violations in a rolling 52-week period trigger a 90-day funds-on-hand restriction. During this time, you must have settled funds available before you can buy anything.

Can you move money from one Vanguard fund to another?

You can select multiple funds to exchange into and divide the fund proceeds however you like. You also have the option to distribute the funds by specific dollar amount, percentage, or evenly. Once you've decided, click Continue.

How much interest does a money market account pay?

You will often find money market accounts that earn according to a balance tier. This simply means that your exact interest rate depends on your account balance, with higher balances usually earning at a higher rate. Average money market rates fall between 0.08% APY and 0.11% APY, again depending on your balance.

What are the disadvantages of a money market account?

Disadvantages of a Money Market AccountMinimums and Fees. Money market accounts often need a minimum balance to avoid a monthly service charge, which can be $12 per month or more. ... Low Interest Rate. Compared to other investments, money market accounts pay a low interest rate. ... Inflation Risk. ... Capital Risk.

How often does a money market account pay interest?

monthlyInterest on money market accounts is usually compounded daily and paid monthly. The cool thing about compounded interest is that the bank is paying you interest on the money they've paid you in interest. Interest rates paid by money market accounts can vary quite a bit from bank to bank.

How do I set up a money market account?

How to open a money market accountSubmit an application. “You should be able to open most money markets online, over the phone or at a local branch,” Li-Cain says. ... Complete any verification requirements. ... Fund your new money market account.

How much investment is required for Vanguard Total Stock Market Index fund?

The minimum investment requirement for that fund is $3,000.

How long does it take to transfer money to Vanguard?

A transfer from your bank to your Vanguard account can take a few days before the money is cleared and ready to use. So having that money ready is crucial.

What Is A Settlement Fund?

A settlement fund is a fund where your money sits after you sell your investments or receive dividends. You can withdraw that money and transfer it to your regular checking account.

Where do dividends go?

Dividends you receive from your stocks or other securities go directly to your settlement fund. So if you want to grow your investments, set your account to “reinvest” so that the dividends can automatically be used to buy more shares.

Does a settlement fund earn interest?

Your settlement fund will earn you some interest on the money it contains , but not a lot. To learn more about the interest, visit Vanguard.

How to add another Vanguard mutual fund?

If you are buying a new fund, check the box next to Add another Vanguard mutual fund. You can type in the fund name, symbol, or number. You can also view a list of Vanguard mutual funds and select one from the list.

Is investing subject to risk?

All investing is subject to risk, including the possible loss of the money you invest.

How to learn more about Vanguard money market funds?

To learn more about Vanguard money market funds, visit the provider's website.

What is Vanguard cash reserve?

With a history going back to 1975, Vanguard Cash Reserves Federal Money Market Fund ( VMMXX) is Vanguard's oldest money market fund. Holdings are made up of cash, U.S. government securities and/or repurchase agreements collateralized by U.S. government securities.

What Are Money Market Funds?

Not to be confused with a money market account, a money market fund is a type of mutual fund that holds cash and high-quality, ultra-short-term cash-equivalent securities.

What is a VMSXX?

3. Vanguard Municipal Money Market Fund. For investors residing in states other than California or New York, the Vanguard Municipal Money Market Fund ( VMSXX) is a good choice for a money market fund in a taxable brokerage account. Tax-exempt at the federal level, VMSXX holds short-term, high-quality debt securities.

Does Vanguard have cash?

But just about every Vanguard investor's assets are held in one of these cash accounts, even if only for a brief period. Thus, it's wise to know how Vanguard's money market funds work, and which one is best for your needs.

Do Vanguard funds get attention?

Vanguard money market funds don't get a lot of love from the investment community, nor do they receive much attention in financial media.

Is Vanguard money market tax exempt?

If the investor holds a money market fund with tax-exempt bonds issued in their state of residence, interest may also be tax-exempt at the state level. All Vanguard non-taxable money market funds have a minimum initial investment of $3,000.

How to add another Vanguard mutual fund?

If you are buying a new fund, check the box next to Add another Vanguard mutual fund. Then type in the fund name, symbol, or number. If you aren’t sure which fund, you can view a list of Vanguard mutual funds by clicking the Select from a list of our fundslink.

Who holds Vanguard assets?

All investing is subject to risk, including the possible loss of the money you invest. Brokerage assets are held by Vanguard Brokerage Services, a division of Vanguard Marketing Corporation, member FINRA and SIPC.

Do you need to move money into settlement fund?

Note:If you’re buying a brokerage product like a stock or ETF, you’ll need to move money into your settlement fund to cover the trade.

Does Vanguard have a contribution?

Vanguard.com defaults to a contribution. If this isn’t a contribution select Yesin the question that states Is this a rollover from an employer-sponsored plan or IRA? Then continue with the transaction.

Is Vanguard a brokerage?

Vanguard funds not held in a brokerage account are held by The Vanguard Group, Inc., and are not protected by SIPC. Brokerage assets are held by Vanguard Brokerage Services, a division of Vanguard Marketing Corporation, member FINRA

When to move Vanguard funds?

If you consent to move your Vanguard mutual fund assets before the market closes (typically 4 p.m., Eastern time), the move will generally be complete as soon as the next business day. If you consent to move your Vanguard mutual fund assets after the market closes, those assets will generally appear in your brokerage account as soon as the second business day.

Can you reinvest Vanguard funds?

If you sell a stock or bond, you can reinvest the proceeds in Vanguard funds the same day. As always, you won’t pay commissions to buy or sell Vanguard mutual funds and ETFs in a Vanguard Brokerage Account.**