8 Auto Accident Settlement Negotiation Tips Initiate a Claim as Soon as Possible After an Auto Accident Keep Accurate Records About the Accident Calculate a Fair Settlement Send a Detailed Demand Letter to the Insurance Company Do Not Accept the First Offer Emphasize the Points in Your Favor Get Everything in Writing Know When to Hire an Attorney

Full Answer

What is the average insurance settlement for a car accident?

Your average car accident settlement might be approximately $21,000. It is likely to fall somewhere between $14,000 and $28,000. The settlement is generally higher for more severe or permanent injuries. You’ll also get paid more if the other driver was found to be driving under the influence.

What to expect with your car accident settlement?

What to Expect With Your Car Accident Settlement. If you’ve experienced the misfortune of a car accident at the fault of another person, you’re entitled to seek compensation for your short- and long-term harms and losses through a personal injury claim. This is designed to help you offset your economic losses, such as medical expenses and ...

How to negotiate car accident insurance settlements?

Your demand letter will include details about the accident such as:

- The location, date, and time the accident occurred

- How the accident happened

- A summary of your injuries and your medical treatment

- A summary of your damages and financial losses

- A request for compensation – the amount you are willing to settle for

How much are typical car accident settlement amounts?

Your typical automobile accident settlement may be around $21,000. It will most likely be between $14,000 and $28,000. In general, more serious or persistent injuries result in a greater settlement. You will also be compensated extra if the other motorist was determined to be under the influence.

How do you counter offer a car accident settlement?

Countering a Low Insurance Settlement OfferState that the offer you received is unacceptable.Refute any statements in the adjustor's letter that are inaccurate and damaging to your claim.Re-state an acceptable figure.Explain why your counteroffer is appropriate, including the reasons behind your general damages demands.More items...•

How do you respond to a settlement offer?

Steps to Respond to a Low Settlement OfferRemain Calm and Analyze Your Offer. Just like anything in life, it's never a good idea to respond emotionally after receiving a low offer. ... Ask Questions. ... Present the Facts. ... Develop a Counteroffer. ... Respond in Writing.

Can you negotiate a car settlement figure?

Even if the offer seems reasonable at first glance, you should always negotiate. After you research the value of your car, come up with a number that you feel is fair for a settlement. It should be the absolute minimum you are willing to accept.

How do you negotiate a settlement with an insurance claims adjuster?

Begin the Settlement Negotiation Process (5 Steps)Step 1: File An Insurance Claim. ... Step 2: Consolidate Your Records. ... Step 3: Calculate Your Minimum Settlement Amount. ... Step 4: Reject the Claims Adjuster's First Settlement Offer. ... Step 5: Emphasize The Strongest Points in Your Favor. ... First, Time is of The Essence.More items...•

Is it good to accept a settlement offer?

Never accept a settlement offer until your doctor understands the full impact of your injuries. Maximum medical improvement is the milestone in your recovery where the doctor acknowledges that there is nothing more they can do for you.

What is a reasonable settlement agreement?

By Ben Power 8 April 2022. A settlement agreement is a contract between two parties, usually (but not always) an employer and an employee, which settles the employee's claims against their employer.

What should you not say to an insurance adjuster?

Never say that you are sorry or admit any kind of fault. Remember that a claims adjuster is looking for reasons to reduce the liability of an insurance company, and any admission of negligence can seriously compromise a claim.

What happens if insurance doesn't pay enough?

If your insurance claim check is not enough, take a second (or third, or fourth) look through your insurance policy to see if you can find anything that might help you win your case against your insurance company to get them to give you a higher settlement.

How do you ask for more money in a settlement?

Send a Detailed Demand Letter to the Insurance Company Because the insurance company will likely reply with an offer for an amount lower than what you've asked for in the demand letter, you should ask for between 25 and 100 percent more than what you would be willing to settle for.

Can you argue with an insurance claims adjuster?

After considering their argument, you can form a counter-argument. An adjuster can bring up a few things, however, that you should prepare for. When you enter negotiations with the insurance company and/or claims adjuster you should have a desired settlement in mind, as well as a minimum settlement you will accept.

How do insurance adjusters determine the value of a car?

To conduct an appraisal, the adjuster will assess the car's damage and then estimate how much it would cost to repair it. The adjuster is trying to determine how much your car would have been worth before the accident. Once they finish their investigation, the claims adjuster will decide if the car is worth fixing.

Do insurance companies try to get out of paying?

Insurance companies will seek to decrease or eliminate payments for injuries caused by an insured person's actions. After becoming injured, victims of accidents want nothing more than to move on from the traumatizing experience.

What is a Rule 49 offer to settle?

Rule 49 is a self-contained scheme containing cost incentives and penalties designed to encourage litigants to make and accept reasonable offers to settle. [3] An “offer to settle” is the term used for a written offer made by one party to another party to resolve one or more claims in a proceeding.

What happens if you pay a settlement offer?

As long as your creditors accept your offer – i.e. agree to sum of money in the settlement offer – they will accept partial settlement of your debt in exchange for writing off the remaining amount you owe. If the settlement offer is big enough, the money will be shared equally among all of your creditors.

What is a formal offer to settle?

Making an Offer to settle is a tactic that a Claimant or Defendant can use to encourage settlement of a lawsuit without the need to go to trial. The tactic is set out in Rule 10.1 of the Small Claims Court rules. To make an offer to settle, an Offer to Settle form is used.

What is the difference between clearance and settlement?

Clearing involves network operators routing messages and other information among financial institutions to facilitate payments between payers and payees. Interbank settlement is the discharge of obligations that arise in connection with faster payments either in real-time or on a deferred schedule.

Why should I settle my claim? Shouldn’t I file a personal injury lawsuit?

Most personal injury claims settle out of court because it’s faster, less expensive, and not as risky. Trials are stressful, and it can take months...

How does the insurance decide to offer a settlement?

Claims adjusters will divide damages into two categories: physical damages, such as medical bills and property damage, and emotional damage, such a...

Can I reject a settlement offer?

Claims adjusters will divide damages into two categories: physical damages, such as medical bills and property damage, and emotional damage, such a...

How is my lawyer paid?

Most personal injury attorneys are paid on a contingency basis. If your claim is successful, they will take a percentage of the final settlement. T...

What happens when you get involved in a car accident?

When you are involved in a car accident that causes significant damage to your vehicle, the next step is getting compensated by the insurance company that provides the policy on the car. However, getting a fair price for the damage is often a challenge, as an insurance company loses money when it has to pay out following an accident.

What should you consider when calculating a fair settlement?

When calculating the fair settlement amount, be sure to consider: Any suffering and pain caused by the accident. The cost of any required medical care and other related expenses.

How to negotiate with insurance company?

As you prepare for your negotiation with the insurance company, it's helpful to follow a few tips. The first is to avoid taking the first offer made. According to Nolo, Sutliff & Stout, and Findlaw.com, an insurance adjuster will often make an extremely low first offer to determine whether you know how to negotiate or understand the value of your car. Even if the offer seems reasonable at first glance, you should always negotiate.

Why do drivers get entangled with insurance companies?

In many cases, drivers find themselves entangled with insurance companies to get claims paid in a timely fashion. Dealing with the aftermath of a car accident can be a stressful situation. In many cases, drivers find themselves entangled with insurance companies to get claims paid in a timely fashion. If you're wondering how to negotiate an ...

What to do when an adjuster comes in near your minimum?

Additionally, if the first offer from an adjuster comes in near your minimum amount, you may want to consider increasing that amount .

How much do personal injury attorneys take?

Most personal injury attorneys take a cut of one-third of the settlement amount, so it has to be a high amount to make it worthwhile to hire an attorney. If you're negotiating a settlement, use these tips to increase your chances of a positive outcome.

How to describe a car accident?

Outline any injuries you sustained as a result as well as any medical treatment that was required for the injuries and ongoing health issues. Describe the extent of damage caused to your vehicle. Discuss any other losses or damages that occurred as a result of the accident.

What is a settlement offer in a car accident?

The insurance company for the at-fault driver in a car accident case might make a settlement offer. A settlement offer is an agreement to end the dispute. The insurance adjuster offers a specific amount of money to resolve your injury claim.

What happens when you accept a settlement offer from an insurance company?

When you accept a settlement offer from an insurance company, the settlement agreement is a final resolution of your claim. After you sign the agreement, you cannot demand more money for your claim.

What to do if you are not happy with the insurance company's settlement offer?

If you are not happy with the insurance provider’s settlement offer, you can make a counteroffer and negotiate a settlement. It is best to make a counteroffer for more money than you are willing to accept to settle the claim. Using a higher figure allows you to negotiate if the insurance company rejects your counteroffer.

Why do insurance companies pay the lowest amount?

Insurance companies want to pay the lowest amount possible to resolve your car accident claim. The company is in business to make money. Paying claims hurts the company’s profit margin

Do insurance companies release all claims?

The insurance company may not explain that you are releasing all claims and all parties when you sign a car accident settlement agreement. The language of the release could be difficult to understand and buried within a lengthy document.

Can you get a quick settlement for a car accident?

The insurance company may offer you a quick settlement for your car accident claim. In some cases, the company may issue an offer before you complete medical treatment for injuries. Beware of a settlement offer issued before each accident victim completes treatment for their injuries.

Do I Need to Hire a Personal Injury Lawyer for a Car Accident Claim?

It depends on the facts of the case. Some car accident cases do not require the assistance of an attorney. If you sustained minor injuries, understand the value of your damages and the insurance company agrees to pay you the amount you desire, you might not need an attorney’s assistance.

What happens when you file a claim after a car accident?

Key Takeaways. When you file a claim after a car accident, the other person's insurance company will always offer you a lower amount than you think you are owed. They may try to argue that the accident was partially or entirely your fault, or that you haven’t provided enough evidence—but don't let it get to you.

What happens after an accident?

You know that after an accident, it's important to collect the other driver’s insurance information. Then, you file a personal injury and property damage claim with the other party’s insurance. The other driver's insurance company will contact you and offer a settlement amount. Sometimes, it can be hard to know if the settlement amount is fair.

What to do if you don't agree with your insurance company?

If you and the insurance company don't reach an agreement, you might need to file a lawsuit, but hopefully, it doesn't come to that. Always keep in mind that this process requires patience and self-confidence. Filing and settling an auto accident claim is a hassle.

Why do insurance companies try to fight their way out of paying you?

This is because insurance companies are trying to make money, and they don't want to pay more than they think is enough.

Is it personal to settle a car accident claim?

Negotiating can be a frustrating process, but it's the only way to settle a car accident claim.

Can you take your insurance company personally?

They will always offer you a lower amount than you think you are owed. This is a normal part of the process, and you shouldn't take it personally. At this point, you can either accept the insurance company’s offer or continue to negotiate. If you can't reach an agreement, you might need to file a lawsuit; hopefully, it won't come to that.

Is it worth fighting for your auto accident settlement?

Seeing it through to a successful settlement can be time-consuming. But at the end of the day, it's worth the time to fight for the money you're owed.

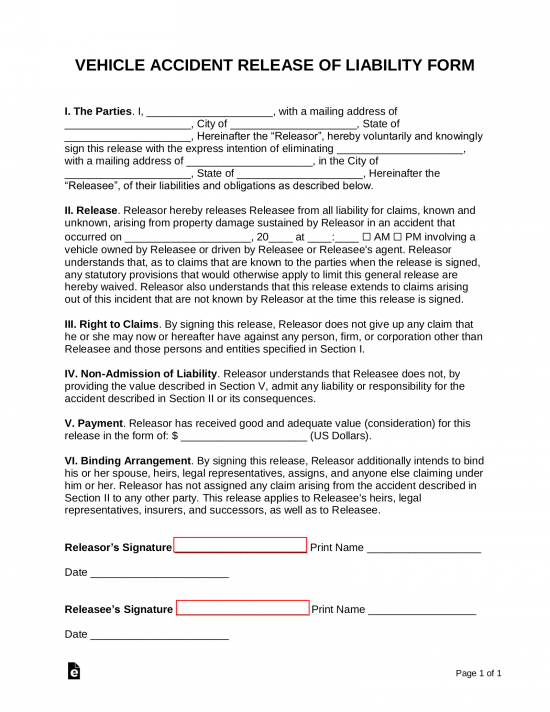

What is the purpose of a car accident settlement form?

The purpose of the form is to make sure that the person who signs it will not sue the other party involved after the fact. Therefore, the goal of this form is to settle a dispute which arises from a small accident, out of court.

What happens if you get injured in a car crash?

If the victim claims that they were injured in the crash, they will often ask for compensation to cover their medical bills, vehicle damage, and any missed time from employment due to their injury. In the cases of back or neck pain, this can keep an individual away from their job for a long period of time which can often lead to termination of one’s employment.

How Does a Car Accident Release Form Work?

After a car accident, especially if one (1) of the drivers sustained an injury, the other driver and their insurance company may be liable to for vehicle and personal damages. This release allows for an agreement to be made between the accident victim and the other individual and their insurance company.

What happens if you sign a car accident waiver?

Once the car accident waiver has been signed the victim will have no recourse or be able to come back at a later time and demand more money. Even if their conditions worsen over time.

Why do insurance companies run a background check?

On their insurer’s side, they will most likely run a background check to make sure the victim has never been involved with any insurance fraud (a common issue with car accidents is falsely claiming one is injured to receive payment) and conduct their own due diligence before coming to a settlement amount.

What is a settlement agreement in Washington?

A car accident waiver and release of liability, also referred to as a “ settlement agreement “, is a legally binding document that, when signed, guarantees that a settlement will be finalized outside of the legal system. When in a car accident involving two cars, there is the option to settle ...

Who handles car accident claims?

In most cases, the insurance company will handle the dispute. Although, as the person who was involved in the car accident they will most likely be in constant communication giving updates to the case. On their insurer’s side, they will most likely run a background check to make sure the victim has never been involved with any insurance fraud (a common issue with car accidents is falsely claiming one is injured to receive payment) and conduct their own due diligence before coming to a settlement amount.

What to do before settlement on car accident?

Before you engage in settlement negotiations with an insurance provider, speak to an attorney to discover the true value of your car accident claim. Your lawsuit may be worth far more than the insurance provider’s initial settlement offer.

How to get maximum settlement from auto insurance?

The best way to obtain a maximum settlement from an auto insurance company after a wreck is to let a personal injury attorney take care of negotiations for you. Hiring an attorney with experience going up against insurance carriers can strengthen your case and make sure no one takes advantage of you.#N#If you were in a car accidents, contact the experienced San Diego accident attorneys at Estey & Bomberger, LLP about your case. They can help you get the maximum settlement for your damages and injuries. Call for a free consultation! (619) 295-0035

What is the goal of an insurance claims adjuster?

An insurance claims adjuster’s goal will be to convince a victim to settle for as little as possible. It is your duty as a crash victim to protect yourself and to fight for fair recovery using a few negotiation tips.

Why do insurance companies deny claims?

Insurance companies will search for every possible reason to deny your claim or to minimize your recovery. Missed deadlines, incomplete paperwork, and inconsistencies with your story are red flags that will enable an insurance company to offer you less or deny your claim completely. Increase the odds of getting a max settlement by following your insurance company’s rules for filing. Find out your deadlines and report your crash as soon as possible.

How to get maximum settlement after car accident in San Diego?

Obtaining a maximum settlement from an insurance company after a car accident in San Diego requires negotiating the system to one’s best interests. As a victim, this can be difficult, as insurance companies often try to take advantage of claimants. An insurance claims adjuster’s goal will be to convince a victim to settle for as little as possible.

What to do immediately after a car crash?

Request medical care immediately following a crash, whether or not you feel injured. If you have injuries, prompt medical care will show an insurance company that you were in pain, and that you did all you could to seek treatment and minimize damages. It will present you as a prudent and responsible victim.

Do you say yes to a settlement offer?

Do Not Say Yes to the First Settlement Offer. Insurance claims adjusters often use language such as last or final offer to pressure a victim into accepting a settlement. Do not let these words scare you. With help from an attorney, you may be able to negotiate a settlement higher based on the severity of the collision.

What is a good settlement for a car accident?

A good car accident settlement will compensate you for all your current and future expenses and damages, including: Replacement services for household tasks you perform (like cooking, cleaning, yard work, shopping, child care) Insurance companies want to close your case as quickly and cheaply as possible.

What is the compensation you accept in a settlement agreement?

The compensation you accept in a settlement agreement is all that you will receive. Therefore, it is imperative that you know whether and how your injuries will affect your future employability, mobility, health and enjoyment of life.

Why is speedy settlement bad?

One of the biggest problems with speedy settlements is that some car accident injuries take time to show up or be properly diagnosed. Our bodies are complex systems and the full impact of injuries may not be apparent for weeks, months, or longer. For example, traumatic injuries like a shoulder dislocation or a broken bone can lead to post-traumatic arthritis. Head and spine injuries are also likely to have long-lasting negative effects and take time to develop.

What happens if a driver is found to be 80% responsible for an accident?

So, if a driver is found 80% responsible for the accident, he must pay for 80% of the damages the accident caused . For cases that go to trial, the jury hears all the evidence and then allocates percentage of fault. If a driver runs into your car while texting, you would say that driver caused the accident.

What to do after a car accident?

After the trauma of being in a car accident, it’s natural to want life to return to normal as quickly as possible. You want to regain your health, get your car fixed, and get back to work. So a quick car accident settlement with the insurance company can sound very inviting. Resolving your claim and getting cash quickly can take a big item ...

What happens if an insurance company offers a second offer?

If the insurance company’s second, third or even sixth offer does not feel fair, you still don’t need to accept it. It is an offer, not a demand. If you are not presented with a just offer, you can take the case to trial.

What is the goal of insurance companies?

An insurance company’s goal is to maximize their profits, not look out for your best interests. Their first settlement offer to car crash victims is based on what they think you will accept. It is not based on what you are entitled to receive.

What to ask for when filing a claim for auto insurance?

As you submit documentation for your claim, you will ask the auto insurance company for the amount of money that you feel is fair based on the property damage or personal injury suffered in the car accident.

What to do if you are in a car accident that is not your fault?

When you are in a car accident that is not your fault, you may need to file a personal injury or property damage claim. The car insurance company may offer you a settlement, but its initial offer may be lower than the amount you feel you are entitled to receive. Continue reading for tips on getting a fair deal when settling your claim.

Why is my insurance offer so low?

The first offer may be very low because the insurance adjuster is hoping you will not negotiate. Don’t rush to accept an offer that feels too low. Request explanations. Ask the insurance adjuster to identify reasons why you were given a lower offer than you had asked for in your initial claim.

Why do you need a lawyer for car insurance?

These are some reasons why you might want to consider hiring a lawyer, including: The insurance adjuster is putting pressure on you to settle quickly. You don’t think the car insurance company is offering you a fair settlement.

What happens if you can't prove your injuries were accident related?

For example, if you can’t prove your injuries were accident-related with documentation, your insurer might argue that they cannot be reimbursed. Negotiating a settlement is often necessary to receive a fair settlement if the insurance company’s first offer is low.

Do auto insurance companies offer low settlements?

Auto insurance companies typically offer low settlements on claims. Their goal is to save money by paying out the minimum that you will accept. They may make the following arguments: You were at fault (fully or partially), so they cannot compensate you to the extent you feel you deserve.

Can a statute of limitations come before a fair settlement?

Your case is dragging on and your state’s statute of limitations may come before you reach a fair settlement.