The official settlement website, www.equifaxbreachsettlement.com, has been posted and is accepting claims. To confirm you're eligible to file a claim, enter your last name and the last six digits of your Social Security number on the site or call the Settlement Administrator at 1-833-759-2982.

Full Answer

Does Equifax owe me money?

JACKSON, Miss. (WLBT) - It’s been two years since the Equifax data breach and now they may owe you money. Depending on how involved you got after initial word of the Equifax breach, financial advisor Nancy Anderson says you could qualify for even more than the $125 dollar minimum, even without receipts.

When will Equifax pay settlement?

Settlement benefits for eligible time spent and out-of-pocket losses are likely to begin issuing in fall 2022. The Equifax Data Breach Settlement website will provide updates. If you still have your claim number, you can enter it on the website and check the status of your claim.

How to dispute items with Equifax?

- Enter your identifying information on the page that reads “Step 1: Authentication”, then hit “Continue”.

- Answer the four questions about your credit file to verify your identity.

- Select the red box that reads “Dispute item” that appears beneath the item in question.

- Upload any supporting documentation to substantiate your claim, then hit “Continue”.

What you should know about the Equifax breach settlement?

The Federal Trade Commission (FTC) has issued a consumer alert regarding the Equifax Data Breach. In September 2017, Equifax announced a data breach, which affected the personal information of 147 million people. Under a recent settlement filed, Equifax agreed to spend up to $425 million to help people affected by the data breach.

See more

How do I claim my Equifax settlement?

For more details and to check your claim status, visit EquifaxBreachSettlement.com . If you were affected by the Equifax data breach, you can still claim financial reimbursement for costs you incurred, or time you spent dealing with fraud or identity theft, after January 22, 2022. Claims are due by January 22, 2024.

How much is Equifax paying out?

Equifax will pay up to $425 million in restitution to those directly impacted by the massive data breach of the credit bureau in 2017. A federal court gave final approval to the class-action lawsuit settlement in mid-January.

Who qualifies for the Equifax settlement?

You are a Settlement Class Member if you are among the approximately 147 million U.S. consumers identified by Equifax whose personal information was impacted by the Equifax Data Breach.

What happened to my Equifax settlement?

Equifax denied any wrongdoing and no judgment or finding of wrongdoing was made. If you are a Class Member, the deadline to file Initial Claims Period claim(s) for free credit monitoring or up to $125 cash payment and other cash reimbursement passed on January 22, 2020. The Settlement is now effective.

How much will each person get from Equifax settlement?

Under the settlement terms, Equifax agreed to set up a fund to provide free credit monitoring and identity theft protection to consumers, as well as provide cash payments to people affected by the breach—up to $20,000 per person.

How much can you sue Equifax for?

Other plaintiffs who wish to remain anonymous have won against Equifax after the data breach in September 2017. Depending on the court you file your case in, you could win up to 25,000$.

How do I check my Equifax claim?

You can also log into your myEquifax account and view your status by clicking the “check status of a dispute” button. If you are checking your status by mail or phone, please make sure you have the confirmation number that was provided to you when you submitted your dispute.

How do I know if I was part of Equifax breach?

Equifax has created a website where you can find out if you have been affected by the breach. The website will ask you for the last six digits of your social security number and your last name, and then will tell you if you have been affected. You can also call 1-833-759-2982.

How long does a data breach claim take?

In reality, how long a data breach claim takes simply comes down to the circumstances of the case. Some cases could be resolved in a few months, whereas others may end up being pursued for several years.

Can I go to Equifax in person?

Equifax Phone number: While Equifax's official customer service phone number is 1-800-846-5279, I found the easiest path to reach a real human is to call this number: 1-866-640-2273. How to reach a real person: Press 4, then press 1.

Are Experian and Equifax the same?

Equifax: An Overview. Experian and Equifax are the two largest credit bureaus in the U.S. Both companies collect and research credit information of individuals and rate the overall ability to pay back a debt. Credit bureaus like Experian and Equifax provide the information they gather to creditors for a fee.

What happened to Equifax after the data breach?

In the wake of Equifax's 2017 data breach, which compromised the personal information of roughly 147 million consumers — including names, birthdates and Social Security numbers — the company ended up as the target of multiple lawsuits and reached a settlement in 2019 with the FTC, the Consumer Financial Protection ...

How much do banks pay for credit reports?

Since the banks buy the reports in bulk, they pay as little as a few dollars per report. While people can get their credit reports once a year for free, Equifax charges $15.95 for the report plus a credit score, while Experian charges $19.95 for a report and score.

Is Equifax credit legit?

Trusted: Equifax is one of the major credit bureaus and has a highly regarded reputation.

How much is it to get your credit report?

By law, a credit reporting company can charge no more than $13.50 for a credit report. You are also eligible for reports from specialty consumer reporting companies.

How much is a credit check?

If you do have to pay for it, a one-time request for your FICO score will cost you about $20.

When is the deadline to file a claim against Equifax?

The deadline to file a claim for Out-of-Pocket Losses or Time Spent that occurred through January 22, 2020 has passed.

When is the deadline for Equifax?

If you are a class member, the deadline to file Initial Claims Period claim (s) for free credit monitoring or up to $125 cash payment and other cash reimbursement passed on January 22, 2020.

What happens if you are impacted by Equifax?

If you were impacted by the Equifax data breach, you may seek reimbursement for valid Out of Pocket losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period if you have not received reimbursement for the claimed loss through other means.

When is the deadline for credit monitoring in 2024?

January 22, 20 24 (For future losses and time) File a claim for Credit Monitoring Services or Alternative Reimbursement Compensation. The deadline to submit a claim to receive the Free Credit Monitoring Services offered under the Settlement, or Alternative Reimbursement Compensation has passed.

When is the extended claim period for credit monitoring?

You may seek reimbursement for valid Out-of-Pocket Losses or Time Spent (excluding losses of money and time associated with freezing or unfreezing credit reports or purchasing credit monitoring or identity theft protection) incurred during the Extended Claims Period (between January 23, 2020 and January 22, 2024) if you have not received reimbursement for the claimed loss through other means.

Is the Equifax settlement final?

By order of the Court, the Settlement cannot become final until the appeals of the remaining objectors are resolved. In September of 2017, Equifax announced it experienced a data breach, which impacted the personal information of approximately 147 million people.

When is the extended claim period for out of pocket loss?

To be eligible, your claim for Out-of-Pocket Losses or Time Spent must occur between January 23, 2020 and January 22, 20 24(the “Extended Claims Period”).

How much can you get if your Equifax account was compromised?

If your information was compromised during the massive 2017 Equifax data breach, you could be entitled to up to $20,000.

When is the deadline to file a claim for a federal settlement?

The deadline to submit a claim is January 22, 2020.

What does the claim cover?

There are four types of relief you can claim from Equifax under the terms of the settlement:

What happens if you don’t file a claim?

Under the terms of the settlement, there are services that you are entitled to — even if you don’t file an official claim, the FTC says.

How long can you claim free credit monitoring?

Submitting a claim can be “overwhelming,” so take it slow, Lacey says. At the very least, you should claim the free credit monitoring for up to 10 years. “There should be no reason whatsoever not to file, especially the basic claim — the credit monitoring — or if you have credit monitoring, the claim for $125,” says Jack Gillis, executive director of the Consumer Federation of America. This is probably what most consumers will file for, Gillis adds.

How much can you claim for a credit breach?

Monetary loss: Consumers will be able to claim up to $20,000 for any losses or fraud that were the results of the breach or any out-of-pocket expenses they may have incurred, such as paying to freeze and unfreeze their credit reports. You’ll need to attach supporting documents, such as receipts, to show how much money you spent.

How to think through compensation?

When thinking through your potential compensation, cast a wide net, says Allen St. John, a technology and privacy expert with Consumer Reports. “They’re never going to give you more than you ask for, ” he tells CNBC Make It. Make sure you include not only the time you spent at the bank, but also your travel time getting to your local branch. “Your time and your money are valuable,” St. John says, so make sure you are properly reimbursed.

What happened to the Social Security numbers in 2017?

In 2017, the personal information of over 145 million Americans was exposed by one of the largest data breaches in recent times. The breach occurred at Equifax, one of the three credit reporting bureaus entrusted with some of the most sensitive personal data, including Social Security Numbers. If you are one of the individuals impacted by the breach (hint: you probably were), you can now file a claim as part of a settlement that Equifax is finalizing to resolve claims.

Can you file a claim if your personal information was compromised by the breach?

You are eligible to file a claim if your personal information was compromised by the data breach. There is a dedicated page - https://www.equifaxbreachsettlement.com/ - with important information about the proposed settlement.

How long does it take to get a free credit report from Equifax?

You can get six free credit reports from Equifax in a 12-month period, for seven years beginning January 2020. These are in addition to the free reports you’re already entitled to under the law.

When did Equifax breach?

In September 2017 , Equifax announced a breach that exposed the personal data of approximately 147 million people. If your data was impacted, under a legal settlement, you may claim free services and payments.

Can you request reimbursement for Equifax?

You can request reimbursement if you spent money, for example: For certain Equifax products before the breach. To freeze or unfreeze your credit. For credit monitoring services. Dealing with fraud or identity theft after the breach.

How much did Equifax pay for the 2017 breach?

Equifax has promised a payout of up to $20,000 for customers affected by the massive breach that took place in 2017, which exposed information including 147 million people’s social security numbers.

How much was Equifax fined?

Also last year, it emerged that Equifax would be fined $700 million, with $425 million of that money earmarked for people affected by the 2017 breach. This week, an Equifax restitution fund for customers totalling $380.5 million was confirmed.

Why did the FTC try to encourage credit monitoring?

In August, the Federal Trade Commission (FTC) tried to encourage customers to apply for credit monitoring instead of the payout, because it was concerned Equifax wouldn’t be able to afford to pay all the affected customers who were applying for compensation . MORE FOR YOU.

How long does Equifax credit monitoring last?

You can use the Equifax data breach settlement website to apply for up to 10 years of free credit monitoring. If that doesn’t sound too good, you can apply for $125 instead, but it should be noted that many people will end up with free credit monitoring, unless they can prove they already have this service in place.

Why did Equifax breach?

And it didn’t even need to happen: The breach took place because the firm failed to patch a server. Equifax’s overall security was terrible and did not take into account the fact it was guarding very sensitive information.

When will the FTC pay you for a breach?

Once you have applied for the breach, you may get paid quite quickly. The FTC says some payouts may take place from January 23 2020–a day after the deadline to apply.

Is Equifax in tatters?

At a time when customers suffer significantly from the fallout after data breaches, Equifax’s reputation is in tatters. This payout will certainly help, as will the $1 billion measures to improve its security, but it may take some time to regain people’s trust.

How much did Equifax pay for the data breach?

As part of its $700 million settlement with the commission, Equifax set aside more than $500 million to compensate the millions of victims of the data breach.

How long do you have to keep your maiden name on your credit report?

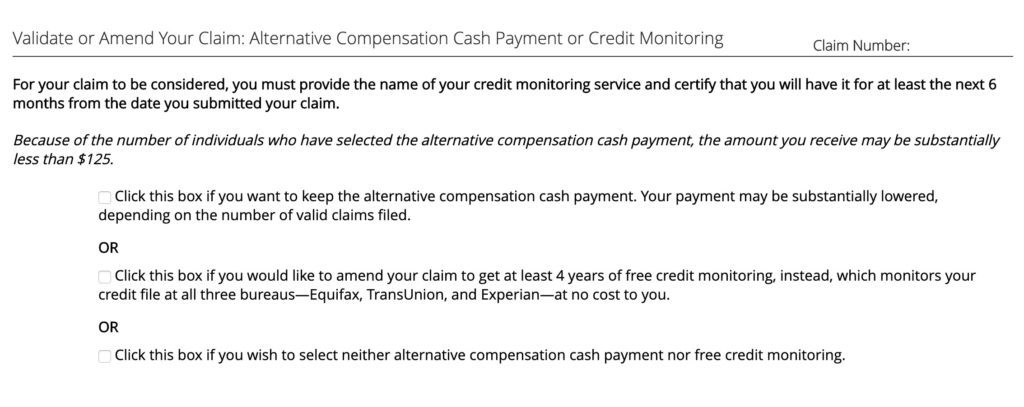

To get the cash, you must certify that you have credit monitoring and will keep it for six months.

How much money can you claim for identity theft?

If you were the victim of identity theft and it cost you a significant amount of money, it makes sense to gather the receipts and other supporting documents required for a claim that approaches the $20,000 individual limit.

How to find out if your Social Security number was exposed?

Step 1: Use this link to access the claim process . Then scroll down to "Find Out if Your Information Was Impacted" and click on that link. After entering your last name and the last six digits of your Social Security number, you'll instantly get an answer about whether your data was exposed and you're eligible to make a claim.

Can you report credit monitoring expenses?

In a Monday press conference, the FTC announced that consumers would be able to report some credit monitoring expenses and the time they spent resolving issues raised by the breach without having to submit receipts or other records.

Is Equifax doing credit monitoring?

For consumers skeptical about accepting the credit monitoring, Lacey explains, "it’s not Equifax doing the work; it’s their competitors doing it on their behalf."

Do retailers earn affiliate commissions?

When you shop through retailer links on our site, we may earn affiliate commissions. 100% of the fees we collect are used to support our nonprofit mission. Learn more.