- Understand how much you owe. The first step is to assess your credit card debt. ...

- Explore your options. Before you pick up the phone, understand what settlement options are available and how much you can afford to pay.

- Understand the risks. All these negotiation options come with downsides, and it’s important for you to be aware of them. ...

- Call your credit card company. “Consumers can use a settlement company [to negotiate], or they can do it on their own,” says Linda Jacob, a financial counselor with ...

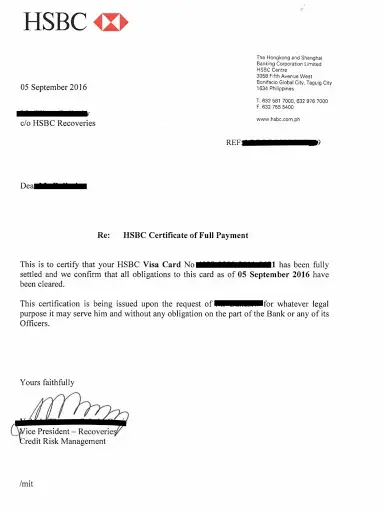

- Get everything in writing. Once you’ve found someone at the credit card company who is willing to negotiate, make sure you get the terms of the deal in ...

Full Answer

How to negotiate credit card debt settlement by yourself?

How to negotiate credit card debt settlement yourself step-by-step Step 1: Define your goals. All debt settlement negotiations start with an offer – either a collector reaches out to you or you reach out to a creditor. It’s important when trying to negotiate a settlement that you have realistic goals.

How do you settle credit card debt yourself?

What to Do to Settle Credit Card Debt

- Mobilize’em Up! This is the first step in settling credit card debt yourself. ...

- Determine Your Fiscal Health! Whatever negotiations you are thinking of, you need to analyze and determine your financial position!

- Negotiating Techniques. You can now move on to negotiate the debt. ...

- Settle It Once and For All! ...

- Document the Deal! ...

What is the credit card settlement process?

- Drop in credit score (up to 100 points)

- You need enough cash on hand for a settlement payment

- Only available for unsecured debt

- You pay tax on the forgiven portion of debt

- Risk of lawsuit

- Creditors might not settle

- Settlement stays on credit history for 7 years

- Calls and notices from collections increase (during process)

Do it yourself debt settlement?

With do-it-yourself debt settlement, you negotiate directly with your creditors in an effort to settle your debt for less than you originally owed. The strategy works best for debts that are already delinquent. Creditors, seeing missed payments stacking up, may be open to a settlement because partial payment is better than no payment at all.

How do I request a credit card settlement?

This is to inform you that I am undergoing a financial issue due to which I am unable to clear the debts of my credit card payments. My credit card no is: CXCXCXCXCX. I am negotiating a settlement with all the creditors on this regard.

What percentage will credit card companies settle for?

Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor. In either case, your first lump-sum offer should be well below the 40% to 50% range to provide some room for negotiation.

Can you get a settlement figure on a credit card?

You can negotiate a settlement for credit card debt, but doing so could negatively impact your credit for 7 years. If your credit card debt has become unmanageable, you are wise to seek help and explore your options, such as requesting a lower interest rate.

How do I write a letter to settle a credit card?

Dear Sir/Madam, I'm writing this letter in regards to the amount of debt on the account number stated above. As a result of financial hardship, I am unable to pay back the amount in full. [Here, take the time to explain your hardship so the creditor has a better picture of what's going on].

Is it better to settle a debt or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

What percentage should I offer a full and final settlement?

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

What is a reasonable settlement offer for debt?

Offer a specific dollar amount that is roughly 30% of your outstanding account balance. The lender will probably counter with a higher percentage or dollar amount. If anything above 50% is suggested, consider trying to settle with a different creditor or simply put the money in savings to help pay future monthly bills.

How much do creditors usually settle for?

Typical debt settlement offers range from 10% to 50% of what you owe. The longer you allow debt to go unpaid, the greater your risk of being sued. Creditors are under no obligation to reduce your debt, even if you are working with a reputable debt settlement company.

Does debt settlement hurt your credit?

While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative. Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account.

Is settlement good for credit?

Loan settlements impact on the CIBIL score When a loan is termed settled, it is viewed as a negative credit behaviour and the borrower's credit score drops by 75-100 points. The CIBIL holds this record for over 7 years.

How do you write a letter asking for a full and final settlement?

Dear Sir, I had resigned from my position of (Designation) in the company on (Date). Before the last date of service and notice period, I had completed all the handing over formalities duly. I was told that I would get a full and final settlement amount of ___________ towards the pending salary and other dues.

How do I write a demand settlement letter?

Here are ten strategies for writing a settlement demand letter:Stay Focused. ... Do Not Threaten. ... Make Your Case Stand Out. ... Understand Policy Limits Before Writing. ... Support Your Claim. ... Include All of Your Damages. ... Do Not Make a Specific Demand. ... Do Not Offer a Recorded Statement.More items...

How much less will debt collectors settle for?

Offer a Lump-Sum Settlement Some want 75%–80% of what you owe. Others will take 50%, while others might settle for one-third or less. Proposing a lump-sum settlement is generally the best option—and the one most collectors will readily agree to—if you can afford it.

How much should I offer to settle a collection?

Start by offering cents on every dollar you owe, say around 20 to 25 cents, then 50 cents on every dollar, then 75. The debt collector may still demand to collect the full amount that you owe, but in some cases they may also be willing to take a slightly lower amount that you propose.

What percentage will Portfolio Recovery settle?

Since Portfolio Recovery likely purchased your debt for less than 8% of its original values, they would still profit if you settled to a pay a percentage of the cost. Most debt collection agencies are will settle for 1%–60% of the original debt amount.

Will settling a charge off raise credit score?

Paying a closed or charged off account will not typically result in immediate improvement to your credit scores, but can help improve your scores over time.

How to settle credit card debt?

Decide what you can offer to pay. Before trying to settle your credit card debt, you need to decide what you can afford. Review all of your outstanding debts, and compare these to your regular income and any other funds you have available.

What to do if you owe more on credit card?

If you owe more on a credit card than you can afford to pay, you may wish to negotiate a settlement with the card company. In a settlement you agree to pay some lesser amount, and the company agrees to accept that amount. You both avoid the trouble and expense of going to court, and you can protect your credit rating at the same time.

How to send a letter to a credit card company?

Address the letter to the proper office. Find out which office of the credit card company handles settlement offers. You can usually discover this by looking up the company online or calling the customer-service number on the back of the card itself. When you reach someone at the company, say that you would like to make an offer to settle your debt, and ask what address you should use for sending a letter.

What does "in full settlement" mean?

An offer of this type could say something like, “I am able to make an immediate payment of $4,000 in full settlement of my outstanding credit card debt.” Be sure to use the phrase “in full settlement,” so it is clear that you mean this as a full and final payment and not as part of a payment plan.

Why do we need a credit report?

Many people focus on their credit score, but your credit report is much more than just a score. It will provide a list of all outstanding debts that you owe, open accounts that you have, and ongoing collection efforts against you.

What happens if you pay less than the amount due?

If you pay anything less than the full amount due, your credit score is likely to drop. However, you can try to minimize the damage by modifying the way the company reports the settlement. Ask them to report your account as "paid.". This is best for you.

How to explain why you need to settle your debt?

Explain your predicament. Avoid getting emotional about the problems in your life, but you should explain your reason for needing to settle your debt. It will help your case if you can refer to a particular cause, such as an accident, divorce, or something else that is not likely to repeat. If you've simply overspent, the company will be less inclined to settle, because they have no assurance that your spending habits will change in the future.

What is a settlement on a credit card?

A settlement is when a credit card company forgives a portion of the amount you owe in exchange for you repaying the remaining amount. The remaining amount can be repaid in a single payment or over a series of payments.

How to save money on credit card debt?

Working directly with your credit card company: Managing your own settlement can save you money by avoiding debt settlement fees associated with other services and ensures that you're involved and aware of every step in the process. The CFPB also provides recommendations for negotiating a debt on your own . “Consider all of your options, including working with a nonprofit credit counselor, and negotiating directly with the creditor or debt collector yourself.” - Consumer Financial Protection Bureau

Does a settlement affect your credit report?

The settlement may be reported to the credit bureaus. While it isn’t possible to say exactly how a settlement will affect your credit report, your settlement and payment information likely will be reported to the major credit bureaus as “settled in full for less than the full balance.”. This can stay on your report after you’ve paid ...

Is it risky to settle debt?

The CFPB emphasizes that dealing with debt settlement companies can be risky. They note that debt settlement companies “often charge expensive fees” and that “most debt settlement companies will ask you to stop paying your debts in order to get creditors to negotiate...a settlement.”

Do credit card settlements have to be complicated?

Credit card settlements can seem complicated, but they don’t have to be. By understanding your options, you can make an informed decision about how to manage your settlement.

Can a debt settlement company help you?

Debt Settlement Resources: You might have heard advertisements for debt settlement companies claiming to negotiate a settlement with credit card companies on your behalf. While these companies can help you with your debt settlement, there may be other associated costs.

How to settle credit card debt before calling creditors?

Have the facts in place before you call. Before you call the creditors you owe, it’s important to get a copy of your credit report or have a current letter in hand from your creditor verifying the amount of money that you owe. Proper settlement of credit card debt can more easily occur if you have your facts straight.

What to do if you are behind on credit card payments?

Have you fallen behind on your credit card payments? Do you have old credit card debts that haven’t been serviced for a while? Then you may be able to create a settlement plan with your creditors to help you to avoid bankruptcy and put a plan in place that is both affordable for you and ensures repayment to those you owe.

Why is it important to ask for a specific reporting status to the credit bureau?

After you’ve settled on a specific dollar amount for the debt to be considered paid in full, it’s important to also ask for a specific reporting status to the credit bureau. Ask the creditor if they will report your agreement as “Paid as agreed upon” instead of “Settled” because the former is more favorable on your report than the latter.

What to do if customer service representative can't help you?

If the customer service representative can’t or won’t help you, calmly ask if there is a supervisor or crisis specialist that you can talk to. Professionalism is important in creditor negotiations, so no matter how frustrated you might become during the call, it’s vital to remain cool and calm during negotiations.

How to explain a sob story to creditors?

For this reason, it’s important to make them aware of the situation in a calm and honest manner. Be clear and concise as you explain your predicament. Explain calmly that because of your financial situation you can’t afford to pay them the full amount due and ask them who you can talk with to figure out a plan that will benefit both them and you.

What to do if you haven't paid your debt?

If you haven’t paid anything on your debt in a while, you may want to check and see if the collection amount is past the statute of limitations. It’s important to do this before you call any creditors so that you do not accidentally reactivate the account and start the statute of limitations timeline over again.

What to do before calling creditors?

When you call your creditors, tell them exactly how much you can afford to pay them and ask them how you can negotiate with them to get to that amount.

What is a credit card settlement?

Credit card debt settlement is an agreement between an indebted consumer and a creditor that entails the consumer submitting a lump-sum payment for the majority of what they owe in return for the company that owns the debt forgiving part of the outstanding balance as well as certain fees and finance charges.

How long do you have to be behind on credit card payments to settle?

you’re experiencing serious financial hardship). In other words, you have to be around 180 days behind on your credit card payments to even qualify for consideration.

When is Debt Settlement a Good Idea?

People often wonder why they should even bother with a debt settlement given that they’ll already be in default and the damage to their credit standing will already be done. However, debt settlement can be a wise decision for two reasons: 1) It eliminates the threat of a lawsuit, which might force you to pay your full balance; and 2) Paying what you owe is simply the honest thing to do.

Why do you need a debt settlement company?

Advantages: A debt settlement company is likely to know which creditors are more inclined to settle and for how much. A debt settlement program will provide you with the discipline to save money every month that you can use as leverage when negotiating.

How long does a default stay on your credit report?

It’s also important to note that since you are likely to have defaulted on your account prior to reaching a debt settlement agreement, information about the default will remain on your major credit reports for seven years from the date that you became 180 days late. Your credit score will suffer during that timeframe.

What are the two types of debt settlement?

With that said, there are two basic types of debt settlement: 1) do it yourself debt settlement; and 2) service-assisted debt settlement. You can also attempt to settle the following types of debt:

What is debt settlement?

Debt settlement is an amended payment agreement that entails submitting a one-time payment for part of what you owe in return for the creditor/debt collector forgiving the rest. Your account must be in default (or close to it) in order for you to qualify for debt settlement.

What to do if your credit card company is having trouble making your minimum payment?

If your financial circumstances have changed, inform your credit card company that you’re having trouble making your minimum payment and explain why. Be factual. Explain your hardship, but realize the call representative may have fielded a lot of calls. Don’t take offense if they don’t initially understand or sound empathetic.

What is the best way to get credit advice?

If you decide to seek professional advice, look for an approved credit counselor. Most of these services are free and federally regulated. An accredited financial counselor or financial fitness coach can provide unbiased information to help you make a decision that best meets your needs.

Why Should You Negotiate Your Credit Card Debt?

If you carry a high credit card balance or have missed payments, you may have heard from a debt settlement company. Often these organizations promise to resolve your debt for pennies on the dollar. It can sound like a relief to have someone else do the work for you. But the Federal Trade Commission cautions that you may not get the results you want.

What is debt settlement?

This is an agreement to settle a debt owed to a creditor for a single payment, or lump-sum. In most cases this is the approach a debt settlement company will take. For instance, if you owed $12,000, you might settle upon a total payment of $8,000. You can also ask to negotiate a new principal amount owed on your credit card, but in this case fees and interest rates will still apply. Remember creditors are under no obligation to accept less than you owe, but it never hurts to ask.

How to manage credit card debt?

If you’re behind on your payments or have lost your income, speaking with your credit card provider is an important first step in managing your debt. By staying in communication with your creditor you can avoid additional fees and potentially protect your credit score. Knowing your options for renegotiating your credit debt and working with your creditor to develop a plan can set you on the path to bringing your credit card debt under control.

What happens if you fail to comply with a credit card workout agreement?

Once the agreement term expires or if you fail to comply with the agreement, your credit card’s regular terms including interest and fees may take effect. If a penalty APR was assessed on your card prior to the agreement, you may revert to the penalty APR. Make sure to get any agreement in writing. Once you enter into a workout agreement, you are responsible for complying with the new terms. Your creditor does not need to provide you with notice if your interest rate increases if you are out of compliance.

Can you be in default if you are not charged off your credit card?

Debt settlement companies may advise you to stop making your minimum credit card payments which can result in late fees, a higher penalty APR and ultimately more debt to negotiate. Failure to communicate with your card provider and failure to stay current with payments may result in default. If you are in default, your account could be moved to collections. Even if your debt isn’t charged off, missed payments can adversely impact your credit score.

Debt Settlement Companies

- Decide what you can offer to pay. Before trying to settle your credit card debt, you need to decide what you can afford. Review all of your outstanding debts, and compare these to your regular income and any other funds you have available. Using your credit report can help you make this decision. Many people focus on their credit score, but your credit report is much m…

- Make a reasonable offer. If your offer is too small, the company is not likely to accept it, but i…

Researching Debt Settlement Companies

Other Debt Relief Options

- Debt settlement programs typically are offered by for-profit companies, and involve the company negotiating with your creditors to allow you to pay a “settlement” to resolve your debt. The settlement is another word for a lump sum that's less than the full amount you owe. To make that lump sum payment, the program asks that you set aside a specific...