If an ex-spouse violates a clause in the settlement agreement, the other spouse must write a letter to the court with details regarding the violation. The offender will likely comply at that point to avoid a court action. However, the letter is often just the first step. Sometimes an attorney does need to be hired to force the ex-spouse’s hand.

Full Answer

What is a settlement agreement in a lawsuit?

The typical settlement agreement, involving the exchange of a payment (or promise to make future payments) for a full and immediate release, invites the plaintiff's worst- case scenario--losing both its bargained for payment and its right to assert the full amount of its claim.

When to seek to agree a settlement agreement with an employer?

Sometimes, an employer may prefer to seek to agree the ending of employment under a settlement agreement, to avoid the risks of claims, which may include disability discrimination and unfair dismissal. These are important issues to consider: Sick Pay Entitlement – has this been exhausted? Holidays – how many days have accrued in the last 15 months?

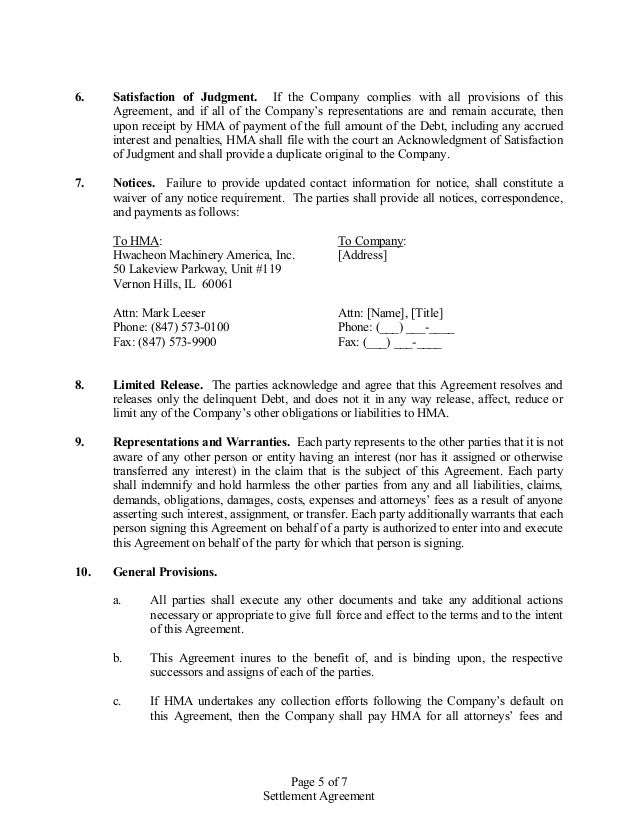

Can a settlement agreement resolve a claim that is otherwise non-chargeable?

Nevertheless, a carefully crafted settlement agreement can maximize the plaintiff's chances of being able to assert the full amount of its claim in the event of the defendant's bankruptcy. A settlement may resolve a claim that would otherwise be nondischargeable under @ 523 (a).

How to negotiate a good settlement agreement?

Pitching the offer at a level that makes sense for both sides is the art of a good settlement agreement negotiation. The words from the three bears children’s story may offer some assistance: This porridge is too hot!” she exclaimed. So, she tasted the porridge from the second bowl. So, she tasted the last bowl of porridge.

How do you invalidate a settlement agreement?

You can overturn a settlement agreement by demonstrating that the settlement is defective. A settlement agreement may be invalid if it's made under fraud or duress. A mutual mistake or a misrepresentation by the other party can also be grounds to overturn a settlement agreement.

Can you change your mind after agreeing to a settlement?

If you and the opposing party in a suit reach a settlement agreement in good faith, there is likely very little you can do to get out of the deal. However, if either party (or even your attorney) somehow induced you to agree to the settlement through fraud or misrepresentation, you may be able to void the agreement.

Are settlement agreements always confidential?

In many cases, including a confidentiality clause is a necessity in a settlement agreement. When these clauses are included, the parties, as well as their attorneys, are not allowed to disclose how the agreement was reached.

Can you force a settlement?

You cannot be forced to make a settlement offer against your will. Protections against coercion extend so far that judges may not even require a party to make an opening offer at a mediation or settlement conference. Dawson v. United States, 68 F.

What happens if I refuse a settlement agreement?

What happens if I refuse to sign a settlement agreement? Refusing to sign may result in the termination of your employment and you will not receive your employer's contribution (if there is one) to your legal fees.

Are verbal settlements binding?

Is a Verbal Agreement Binding? It might be, depending on the details of the agreement. Generally, a verbal agreement could be enforced if there was an offer, acceptance of the offer and consideration, which refers to the value exchanged between both parties.

Can settlement negotiations be used as evidence?

The Senate amendment provides that evidence of conduct or statements made in compromise negotiations is not admissible. The Senate amendment also provides that the rule does not require the exclusion of any evidence otherwise discoverable merely because it is presented in the course of compromise negotiations.

What is a non disclosure settlement?

A nondisclosure agreement states that the person or persons signing it will not reveal any of the information encompassed in the agreement. If the person violates this instruction, he or she may be required to pay substantial damages or even forfeit an amount that he or she received in a settlement of the claim.

Is a settlement privileged?

Settlement privilege protects the confidentiality of communications and information exchanged for the purpose of settling a dispute. Accordingly, discussions in the context of mediation are protected by settlement privilege.

What is a reasonable settlement agreement?

By Ben Power 8 April 2022. A settlement agreement is a contract between two parties, usually (but not always) an employer and an employee, which settles the employee's claims against their employer.

How do you negotiate settlement?

Identify, gather and produce the most important information early. Settlement negotiations are most effective at the proverbial sweet spot, when each side has the information it believes it needs to make a judgment about settlement but before discovery expenses allow the sunk costs mentality to take hold.

Is out of court settlement legal?

In case of civil suits, out of court settlement can be brought at any stage of the suit. The only requirement to formalise the settlement is a compromise Agreement in Civil Cases. The complexities arises in criminal cases. But the same is settled by the new guidelines issued by the Supreme Court.

Can you change your mind after signing a legal document?

The General Rule: Contracts Are Effective When Signed Unless a contract contains a specific rescission clause that grants the right for a party to cancel the contract within a certain amount of time, a party cannot back out of a contract once they have agreed and signed it.

How long do I have to change my mind after signing a contract?

In general, once a contract is signed it is effective. In most situations, you do not have a time period where you have a right to rescind a contract. There are a few exceptions to this general rule. The Federal Trade Commission (“FTC”) has a 3 day, or 72 hour, cooling off period rule.

Can I change my mind after signing?

If you've signed a contract to accept an offer of employment and subsequently change your mind you should provide notice as per the contract of employment.

Can I cancel a signed agreement?

The only instance where there will be an automatic right to cancel a contract is if there is a cancellation clause or a suspensive condition in the contract. A contract containing a suspensive condition will terminate automatically unless the suspensive condition is fulfilled or waived.

What happens if I don’t accept a settlement agreement?

If the employee rejects the offer often the underlying risk is that the employee’s employment may be terminated following the completion of the relevant process.

How to protect a settlement agreement conversation?

If the conversation is protected it can’t be used. If an employer has made an offer and it’s not protected, that could be used as leverage in negotiations by an employee or to support an unfair dismissal claim.

What is a settlement agreement?

A settlement agreement is a legally binding document between and employee and employer, which settles claims the employee may have arising from the employment or termination of employment. The employee must be advised by a qualified independent adviser, usually a solicitor, before signing the agreement.

What does Without Prejudice mean?

If a letter or discussion is Without Prejudice it means it cannot be used or referred to in any legal proceedings like an employment tribunal claim. The opposite of a without prejudice communication is an ‘open’ communication which is capable of being used or ‘admitted’ in legal proceedings.

How do I respond to a low offer?

If the offer isn’t anywhere near the ballpark you’d accept, you may decide to reject it and make it clear you see no point making a counter offer as your miles apart . That’s a bold strong move but risks killing off the negotiations and pushing you towards a dispute and tribunal claim.

Why do employers need to sign a second agreement after termination?

This is commonly called a reaffirmation certificate or agreement because the employee is asked to reaffirm the waiver of claims.

When are settlement agreements offered?

Settlement agreements are typically offered when an employee is leaving their job. Group Scenarios – such as large-scale redundancy or dismissal processes when an employer is offering an enhanced termination (voluntary redundancy) payment.

What is the goal of a settlement agreement?

The goal of a settlement agreement is not only to end an existing claim or lawsuit, but also to limit future exposure for the defendant. For this reason, some settlement provisions target not just plaintiff’s future conduct, but also that of her counsel. Settlement terms common in many settlement agreements between a claimant ...

What is the purpose of a common clause in a settlement agreement?

Intended to prevent future exposure, a common clause in settlement agreements provides that a plaintiff’s lawyer agree to “not represent any other person who is contemplating filing the same or similar claims against defendant as those asserted in the lawsuit.”. Ohio holds that this provision poses a two-part problem.

Can an attorney settle a case on behalf of her client?

This means that when an attorney settles a case on behalf of her client, there can be no agreement that restricts that attorney’s future practice. This rule applies even if the restrictive language is not explicit but, in effect, works to restrict the attorney’s legal practice.

What happens if a plaintiff accepts a settlement?

The plaintiff accepts the agreed payment from the defendant and in turn immediately gives the defendant a full release of all claims and dismisses its lawsuit with prejudice. If the settlement payment is later recovered as a preference, the plaintiff may be hard pressed to revive its original claim.

How to minimize risk of default in structured settlements?

The key consideration in minimizing the risk of payment defaults in structured settlements is to consider the negotiation of payment terms a credit decision. If the defendant is not financially solid, the settling plaintiff should not just accept an unsecured obligation to pay, but rather should take the best payment protection possible to prevent the loss of its settlement expectancy in the defendant's bankruptcy.

What is the risk of a bankruptcy settlement?

Perhaps the most critical risk in settlements is the risk that the settling plaintiff will end up with neither the settlement payment it bargained for nor the ability to assert the full amount of its original claim in the defendant's bankruptcy. Without some attention to this risk, this is the likely result of most simple settlement agreements involving payment of a compromised amount. The plaintiff accepts the agreed payment from the defendant and in turn immediately gives the defendant a full release of all claims and dismisses its lawsuit with prejudice. If the settlement payment is later recovered as a preference, the plaintiff may be hard pressed to revive its original claim. The plaintiff then may be left with only an unsecured claim for the amount of the preference (i.e.,the settlement amount), to be paid cents on the dollar, rather than having the ability to receive pro rata payment for the full amount of the original claim. The plaintiff should address this risk in negotiating the terms of settlement and do whatever it can to preserve its right to assert the full amount of its claim.

What is a preference in a settlement?

A settlement involving payment inherently involves the risk that the payment received by the plaintiff will be voidable as a preference if the defendant files bankruptcy within 90 days after the payment. 11 U.S.C. @ 547 (b). While an argument can be made that the dismissal of litigated claims is "new value"and thereby excepted from preference risk under @ 547 (c) (1), this reasoning is suspect at best and a settling plaintiff must recognize the preference risk just as any creditor receiving payment on a pre-existing debt must. While the release of claims is certainly of value to a defendant, the defendant's settlement payment is a payment on account of the plaintiff's claims, which arose out of some past transaction or event--therefore, a classic preference. See In re VasuFabrics Inc., 39 B.R. 513 (Bankr. S.D.N.Y 1984) (settlement payment is for antecedent debt even if made before signing settlement agreement). While preference exposure cannot be eliminated, the settling plaintiff can take steps to both minimize the risk of preference exposure and reduce its ultimate impact.

How to address nondischargeability in a settlement agreement?

The most straightforward way to address this risk is for the settlement agreement to explicitly state the grounds for the debt being paid, so that the debtor will be hard pressed to dispute those grounds. Rather than reciting that the debt is nondischargeable, the actual grounds for nondischargeability should be stated, consistent with the language of the applicable statutory exception to discharge. This kind of confessed nondischargeability generally will be honored. But see In re Huang, 275 F.3d 1173 (9th Cir. 2001) (agreement of nondischargeability alone not enforceable).

How to reduce preference exposure?

Another approach to reducing preference exposure is to build up the "new value" aspects of the settlement. If there is an ongoing business relationship between the plaintiff and defendant, future business accommodations might be worked into the settlement structure to provide some element of identifiable value, thereby raising the possibility of a new value defense to a preference challenge. The parties also can express the terms of settlement as much as possible as involving new value. Whether this kind of "window dressing" can insulate the settlement payment is doubtful, but anything the plaintiff can do to inject a basis for arguing new value cannot hurt.

What is structured settlement?

"Structured" settlements, involving more than just a single payment, often allow the parties to reach a resolution that otherwise would not be possible . The simplest of structures is payment over time, where the defendant agrees to pay the negotiated settlement amount in installments. The defendants likely to negotiate hardest for extended payment terms, however, also are those whose financial condition puts them at the greatest risk of bankruptcy. Obviously, if the settling defendant files bankruptcy before completing its payments, the other party may not realize the full economic value of the settlement. Taking security interests in collateral of sufficient value to cover deferred payments is the settling plaintiff's best option. Although the security interest itself may be subject to challenge as a preference, as discussed later, once the preference period passes the collateral will provide protection for the creditor's future payments even in the event of bankruptcy.

How to reach an out-of-court settlement?

If you want to reach an out-of-court settlement, seek professional help from an attorney, mediator or counselor. Following this course will lead you to an amicable settlement, without involving the IRS, thereby helping you to avoid taxes on lawsuit settlement

How to avoid paying taxes on a lawsuit settlement?

Get a tax accountant or a tax attorney to help you avoid paying taxes on lawsuit settlement. In case you have incurred medical expenses, you must know about itemized deductions. Remember, medical expenses without itemized deductions are nontaxable. You must consider all the above-mentioned points before any case is filed.

What happens if you sue an employer for wages?

If for some reason, you have to sue an employer for wages because you had been laid off for a long time without pay, the IRS will tax the settlement for wages as it would tax normal wages.

What happens if you can't afford to pay an attorney?

If you cannot afford to pay an attorney upfront at the start of a case, you may ask him to work for contingency fees. This means if the case is won, then a percentage of the settlement will be granted to the attorney. However, depending on the origin of the claim in some cases, the IRS might charge tax on the whole amount of the settlement. This means if you have won $50,000 in settlement and have agreed to give your attorney 50% of the settlement, you will have $25,000 left. In this case, the IRS will charge tax on $50,000, and will not take into account the contingent fee amount deducted.

Why is it important to know the nature of a lawsuit?

This is important because many individuals who have legally won a lawsuit suddenly find themselves accountable for paying taxes.

Is a lawsuit settlement taxable?

There are two types of lawsuit settlements: taxable and nontaxable. The rules for taxation vary from state to state. All taxations depend on the origin of a claim (to summon to law, to shout out, claim, cry out). On the basis of the following situations, the Internal Revenue Service (IRS) has the right to tax anyone.

When were settlements tax free?

Before 1996, all types of settlements concerning physical or mental/emotional problems caused by someone, were tax-free.