There are keys ways to limit taxes upon your death by using life insurance death benefits. Estates can limit taxes (and in some cases avoid taxation) in one key way—transferring the ownership of life insurance policies—usually to an irrevocable life insurance trust (ILIT).

Is a life settlement tax-Free?

Is A Viatical Settlement Taxable? Most of the time, viatical settlements are not taxable. Settlement proceeds for terminally ill insureds are considered an advance of the life insurance benefit. Life insurance benefits are tax-free, and so it follows that the viatical settlement wouldn't be taxed, either.

Do you pay taxes on life insurance settlements?

Answer: Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them. However, any interest you receive is taxable and you should report it as interest received.

Do you have to pay taxes on money received as a beneficiary?

Beneficiaries generally don't have to pay income tax on money or other property they inherit, with the common exception of money withdrawn from an inherited retirement account (IRA or 401(k) plan). The good news for people who inherit money or other property is that they usually don't have to pay income tax on it.

When should you cash out a whole life insurance policy?

While it isn't always advisable to cash out your life insurance policy, many advisors recommend waiting at least 10 to 15 years for your cash value to grow. It may be wise to reach out to your insurance agent or a retirement specialist before cashing in a whole life insurance policy.

Can the IRS take life insurance money?

If the insured failed to name a beneficiary or named a minor as beneficiary, the IRS can seize the life insurance proceeds to pay the insured's tax debts. The same is true for other creditors. The IRS can also seize life insurance proceeds if the named beneficiary is no longer living.

How much can you inherit from your parents without paying taxes?

What Is the Federal Inheritance Tax Rate? There is no federal inheritance tax—that is, a tax on the sum of assets an individual receives from a deceased person. However, a federal estate tax applies to estates larger than $11.7 million for 2021 and $12.06 million for 2022.

How do the rich avoid Inheritance Tax?

Take out a Life Insurance Policy. If you cannot avoid a potential tax bill by giving assets away, you can insure against the tax. Taking out Life Insurance is one of the simplest way of avoiding Inheritance Tax.

Do I have to pay taxes on a $10 000 inheritance?

For example, if you only inherited $10,000, you may be exempt and not have to pay a tax. Additionally, if you are married to the person who passed away, you will not have to pay an inheritance tax. However, if these exceptions do not apply, you will have to pay an inheritance tax.

Is a lump sum death benefit taxable?

A lump-sum death payment is not taxable for Federal income tax purposes.

Is life insurance considered inheritance?

Life insurance is not considered to be taxable income in the way that an inheritance can be taxed. While there are ways to avoid inheritance tax (such as through a trust), these taxes can be considerable if your estate is large. By using life insurance instead, the death benefit can go entirely to your family members.

Do I have to pay taxes on life insurance surrender?

You can generally expect to get a surrender charge within the first 10 or 20 years of owning the policy, and over the course of time the surrender charge phases out. You won't be taxed on the entire surrender value, though. You'll be taxed on the amount you received minus the policy basis.

How to avoid paying taxes?

If you want to avoid paying taxes, start a business. A business is one of the best ways to shield your income from more taxes. You can either incorporate as an LLC, S-Corp, or simply be a Sole Proprietor (no incorporating necessary, just be a consultant and file a schedule C).

What to do when facing a large unfavorable judgement?

If your company is facing a large unfavorable judgement, it’s important to try and hollow out as much as you can from the company before the verdict. Diversify, diversify, diversify.

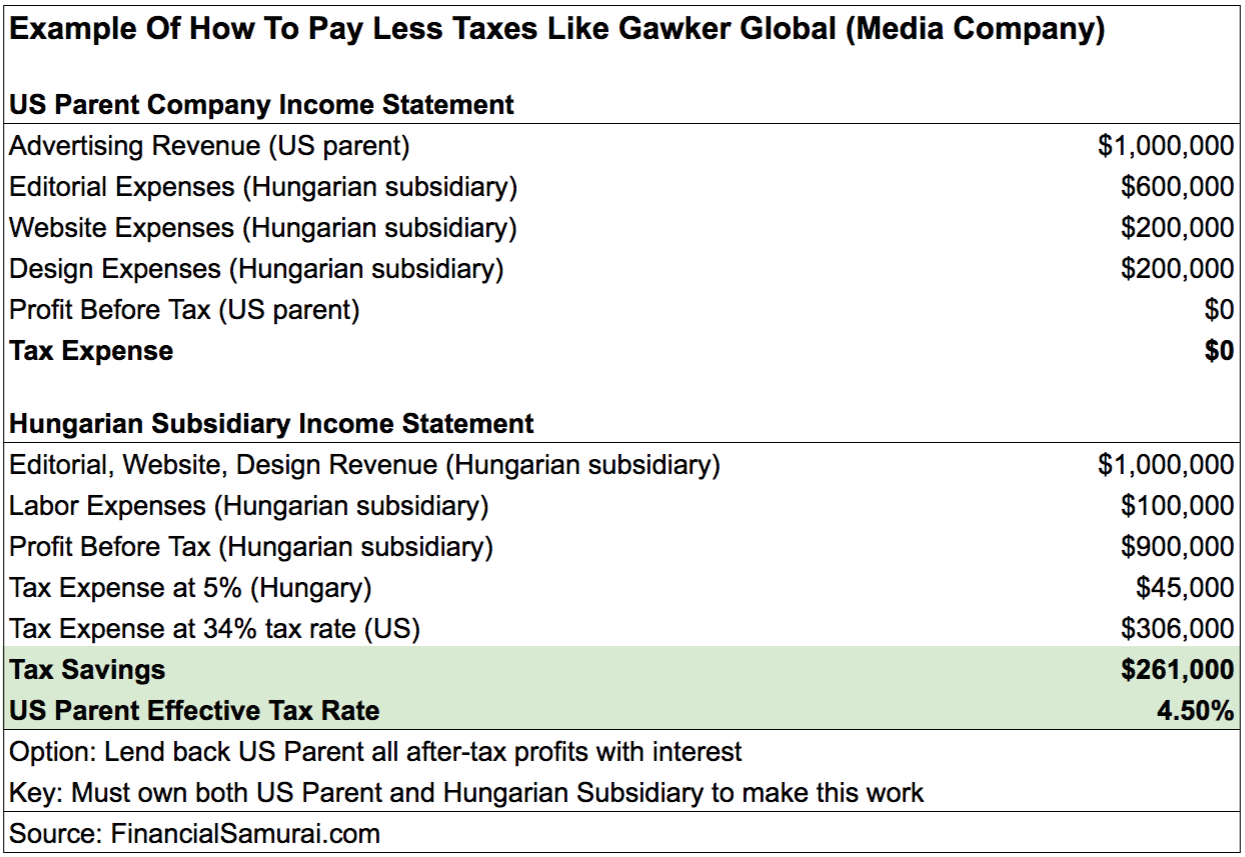

Did Gawker Media reduce its tax bill?

Now, in a fascinating exposé, Jeff John Robert from Fortune magazine highlights how Gawker Media was able to “legally” reduce its IRS tax bill by ~80%. Here’s what Gawker Global did.

What does the Tax Cuts and Jobs Act mean for life insurance?

When it comes to life settlement taxation, the Tax Cuts and Jobs Act reduces the amount of capital gains tax that life settlement recipients need to pay. This is good news if you are considering your selling your life insurance policy.

What is the tax basis of surrendering a policy?

For people surrendering their policies, the tax basis was their cumulative investment in the contract. This is generally the premiums paid less any withdrawals and dividends.

What does the IRS rule about selling insurance policies?

For people selling their policies, the IRS ruled that this basis needed to be further reduced by the cumulative cost of insurance. This meant that people selling their policies had to track down their cumulative cost of insurance – a number many insurance companies don’t even have on file.

Is a premium paid on a tax basis free?

Proceeds received up to the tax basis (total premiums paid) are free of income tax.

Is Mason Finance a tax free company?

The amount paid into the policy (the tax basis) is tax- free. Proceeds greater than the tax basis, but less than the cash surrender value, are taxed at ordinary income rates. Any remaining amount is subject to capital gains tax. Mason Finance does not provide tax, legal, or accounting advice.

Can you sell a life insurance policy for more than the cash surrender value?

Are you thinking about a life settlement transaction? Many people are surprised to learn that they can sell their life insurance policy for more than the policy’s cash surrender value. Selling your life insurance policy is a great way to get cash that can improve quality of life later during retirement.

Does Mason Finance provide tax advice?

Mason Finance does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice.

How Does Life Settlement Taxation Work?

TCJA retains the three-tier tax structure as defined in the Revenue Ruling 2009-13. To recap:

When did the life insurance settlement market start?

It came into its own under fairly morbid circumstances. At the height of the AIDS epidemic in the 1980s , younger, terminally ill life insurance policyholders needed cash to cover their healthcare expenses. That population drove the supply that created a market for viatical settlements, which are life insurance policy sales by terminally ill policyholders. Once the market for viatical settlements started to grow, it paved the way for the elderly to sell their life insurance policies, even without a terminal diagnosis.

What is the cost basis of term life insurance?

In this case, the cost basis equals the total premiums paid less charges for the cost of insurance. If the insured has no data on the cost of insurance, this is assumed to be the same as the policy’s premium. The difference between the sale proceeds and the cost of insurance is taxed entirely as a capital gain.

What is the difference between the cash surrender value of $50,000 and the cost basis of $42,000?

The difference between the cash surrender value of $50,000 and the cost basis of $42,000 — $8,000 — is taxed as ordinary income. At her effective tax rate of 18%, that equals $1,440. The remaining gain of $8,000 is taxed as a capital gain. Assuming a capital gains tax rate of 15%, that’s another $1,200 in tax.

Is the cost basis of life insurance taxable?

Prior to August 26, 2009, the IRS assumed that the cost basis on life settlements equaled the cumulative amount of premiums paid by the insurer. Under that definition, any sale proceeds up to the seller’s total investment in premiums were tax-free. Sale proceeds in excess of premiums paid were taxable in two tiers. The difference between the cash surrender value and the cost basis was taxed as ordinary income. Any remaining proceeds over that amount were taxed as capital gains.

Is selling a life insurance policy taxable?

There is one more takeaway. Selling your policy will create a higher taxable gain than surrendering it. Even so, your net cash proceeds after fees and commissions will still be higher with a life settlement. In Mrs. Jones’ cash, she nets $55,360 after taxes on her settlement, assuming she pays no state income tax. If she surrenders that policy, her take-home proceeds are $48,560 — about 12% less than she’d get from a life settlement.

Can you deduct capital gains from your state tax return?

Some of these states allow you to deduct a portion of your capital gains from your state’s return — which effectively lowers the rate you pay. Others define a lower rate that’s specific to capital gains.

Who must contact the Life Insurance carrier for a 1099-SB?

If a 1099-SB is not received in the same timeframe, then the Policy Owner (Seller) must contact the Life Insurance Carrier directly and ask that the Life Insurance Carrier’s accounting department complete and resend the form directly to the Policy Owner (Seller).

What is the IRS 6050Y?

The Tax Cuts and Jobs Act of 2017 created the framework and additional tax reporting requirements for all reportable policy sales covered under section 6050Y. In late 2019, the IRS finalized the reporting forms and processes for those involved in these transactions. The 1099-LS and the 1099-SB were created and adopted for use in order to address the requirements needed for the calculation of all taxable or non-taxable transactions for both policy sellers AND the IRS.

Who issues 1099-LS?

Welcome Funds, Inc. (WFI) is the broker representing the Policy Owner (Seller) on these type of transactions. WFI does not issue 1099’s. The issuance and delivery of the 1099-LS is the responsibility of the Provider/Fund/Escrow Agent (buyer side) and the 1099-SB is the responsibility of the Life Insurance Carrier that Issued or is currently administering the Policy. If a 1099-LS was not received by the 2nd week of February of each year after the sale, then WFI can request a copy of such form from the buyer’s side. If a 1099-SB is not received in the same timeframe, then the Policy Owner (Seller) must contact the Life Insurance Carrier directly and ask that the Life Insurance Carrier’s accounting department complete and resend the form directly to the Policy Owner (Seller). WFI and the buyer’s side are unable to obtain the copy of the 1099-SB.

Is there a cash surrender value for a life insurance settlement?

The settlement amount is less than the cost basis and there is no cash surrender value. In Revenue Ruling 2020-05, it states in the, “Holdings” section number 2 that the policy owner (“A”) recognizes a long-term capital loss of $25,000 upon the sale of the life insurance settlement contract.

Should a life insurance settlement be considered before selling?

The tax implications of a life insurance settlement should be considered prior to the sale of the life insurance policy. We strongly recommend that a policy owner seek professional tax advice prior to accepting any life settlement offers. The taxation for a life settlement transaction was simplified with the implementation of the TCJA.

Is 100% of life insurance settlement capital gain?

Based on the IRS Guidelines, if a term life insurance policy is sold, then 100% of the life settlement proceeds should be treated as a capital gain.

How to avoid paying taxes on a lawsuit settlement?

Get a tax accountant or a tax attorney to help you avoid paying taxes on lawsuit settlement. In case you have incurred medical expenses, you must know about itemized deductions. Remember, medical expenses without itemized deductions are nontaxable. You must consider all the above-mentioned points before any case is filed.

When were settlements tax free?

Before 1996, all types of settlements concerning physical or mental/emotional problems caused by someone, were tax-free.

What happens if you sue an employer for wages?

If for some reason, you have to sue an employer for wages because you had been laid off for a long time without pay, the IRS will tax the settlement for wages as it would tax normal wages.

What happens if you can't afford to pay an attorney?

If you cannot afford to pay an attorney upfront at the start of a case, you may ask him to work for contingency fees. This means if the case is won, then a percentage of the settlement will be granted to the attorney. However, depending on the origin of the claim in some cases, the IRS might charge tax on the whole amount of the settlement. This means if you have won $50,000 in settlement and have agreed to give your attorney 50% of the settlement, you will have $25,000 left. In this case, the IRS will charge tax on $50,000, and will not take into account the contingent fee amount deducted.

Why is it important to know the nature of a lawsuit?

This is important because many individuals who have legally won a lawsuit suddenly find themselves accountable for paying taxes.

How to reach an out-of-court settlement?

If you want to reach an out-of-court settlement, seek professional help from an attorney, mediator or counselor. Following this course will lead you to an amicable settlement, without involving the IRS, thereby helping you to avoid taxes on lawsuit settlement

Do you have to pay taxes on medical expenses?

As far as medical expenses are concerned, you will have to pay taxes, if the amount is reimbursed to you after itemized deductions for the current year.

What is the tax rule for settlements?

Tax Implications of Settlements and Judgments. The general rule of taxability for amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61 that states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion ...

What is the exception to gross income?

For damages, the two most common exceptions are amounts paid for certain discrimination claims and amounts paid on account of physical injury.

What is employment related lawsuit?

Employment-related lawsuits may arise from wrongful discharge or failure to honor contract obligations. Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

What is an interview with a taxpayer?

Interview the taxpayer to determine whether the taxpayer provided any type of settlement payment to any of their employees (past or present).

Is emotional distress excludable from gross income?

96-65 - Under current Section 104 (a) (2) of the Code, back pay and damages for emotional distress received to satisfy a claim for disparate treatment employment discrimination under Title VII of the 1964 Civil Rights Act are not excludable from gross income . Under former Section 104 (a) (2), back pay received to satisfy such a claim was not excludable from gross income, but damages received for emotional distress are excludable. Rev. Rul. 72-342, 84-92, and 93-88 obsoleted. Notice 95-45 superseded. Rev. Proc. 96-3 modified.

Is a settlement agreement taxable?

In some cases, a tax provision in the settlement agreement characterizing the payment can result in their exclusion from taxable income. The IRS is reluctant to override the intent of the parties. If the settlement agreement is silent as to whether the damages are taxable, the IRS will look to the intent of the payor to characterize the payments and determine the Form 1099 reporting requirements.

Is mental distress a gross income?

As a result of the amendment in 1996, mental and emotional distress arising from non-physical injuries are only excludible from gross income under IRC Section104 (a) (2) only if received on account of physical injury or physical sickness. Punitive damages are not excludable from gross income, with one exception.

How to deduct legal fees?

Here are the pertinent rules: 1 Deduct legal fees in the current year if your lawyer represents you in an everyday business matter, such as collecting a bill, giving you general legal advice relating to the business or handling a contract dispute. 2 If the legal work secures a benefit that extends beyond the current year, the fee is deducted gradually. For example, if the fee for negotiating and preparing a three-year lease is $900, you can write off $300 a year for three years. If legal fees are incurred for buying a piece of depreciable real estate, the fees are included in the depreciable basis and written off over the years. Generally, you can write off immediately or amortize over 180 months the fees to set up a new corporation or other legal entity. 3 If the related property is not depreciable —for example, your home or raw land—the fee is included in the tax basis of the asset and reduces your gain (or increases your loss) when the property is eventually sold.

How long can you write off legal fees?

Generally, you can write off immediately or amortize over 180 months the fees to set up a new corporation or other legal entity.

What is the maximum amount of miscellaneous deductions?

However, miscellaneous deductions are limited to the amount that exceeds 2% of your AGI. Plus, miscellaneous deductions are scheduled to phase out for high-income taxpayers after 2010. Also, deductions for attorneys’ fees aren’t included in the alternative minimum tax (AMT) calculation.

How long can you write off a $300 lease?

For example, if the fee for negotiating and preparing a three-year lease is $900, you can write off $300 a year for three years.

What to do if you are embroiled in a legal dispute?

If you’re embroiled in a contentious legal dispute, taxes may be the last thing on your mind. But errors in the way you draft a settlement agreement could mean thousands of dollars going into Uncle Sam’s pocket—instead of yours. Strategy: Try to minimize the income tax consequences of a settlement. And do it before you sign the agreement.

Can an award be lump sum?

Here’s a key point in the negotiations: The award to the prevailing party should not be described as a single lump sum. If you take the award as an all-inclusive amount, you won’t be able to avoid taxes on significant portions of it.

Is a fee included in the tax basis of a property?

If the related property is not depreciable —for example, your home or raw land—the fee is included in the tax basis of the asset and reduces your gain (or increases your loss) when the property is eventually sold.