The steps are as follows:

- Step 1: Calculate current policy cost of receivables (receivables x Overdraft Interest rate)

- Step 2: Calculate NEW policy cost of NEW receivables (New receivables x overdraft interest rate)

- Step 3: Calculate cost of early settlement discount and add to the new policy cost.

How do you calculate a settlement discount?

You calculate a settlement discount based on the increase in purchases from the customer. You could invoice a customer for making a purchase of X amount, but offer an additional 5% discount if the customer pays that amount within 7 days. These can also get referred to as discount days.

How do you calculate early discount on an invoice?

Calculating the Early Discount Amount as a Vendor Calculate the total amount due on the invoice to your customers. Decide what percent discount you will give your customer for early payment. Multiply the percent discount by the total owed on the invoice. Subtract the discount amount from the total amount owed.

What is an example of early payment discount?

Example of How an Early Payment Discount Works Say you are a buyer and receive a $1,000 Net 30 invoice. If you pay the invoice within 10 days of receiving it, you may be able to deduct 2%, or $20, from the payment. On the invoice, these terms would be noted as 2/10 – net 30.

What is an invoice settlement discount?

Settlement discounts are generally offered to credit customers as a means of encouraging them to pay their invoices quickly. It is up to us to decide what the payment terms will be e.g. we could offer a customer a 3% settlement discount if they pay within 14 days, or perhaps a 5% discount if they pay within 7 days, and so on.

How is early pay discount calculated?

For example, if the APR is 12% and you want to be paid in 30 days, a 1% discount would suffice. It is calculated as such: 12% APR / 360 days = . 03 x 30 days = 1% discount....Sliding Scale DiscountsControl when you get paid.Adjusted rate based on actual days.Extended time window for early payment.

How is settlement discount calculated?

Total amount payable by the customer: The total amount payable by the customer is therefore the invoice total (discounted total) discount minus the credit note (discounted total) i.e.

How do you calculate early discount in Excel?

02 / 20 days = x percent / 365 days. Then solve for x. .02 x 365 = 20x. Therefore the comparable annual interest rate is . 365 or 36.5 percent.

What is early settlement discount?

An early payment discount – also known as a prompt payment discount or early settlement discount – is a discount that buyers can receive in exchange for paying invoices early. It's typically calculated as a percentage of the value of the goods and services purchased.

How do you calculate a discount on an invoice?

2:144:11Calculating Cash Discounts and Net Amount Due - YouTubeYouTubeStart of suggested clipEnd of suggested clipStep 1 calculate the amount of the cash discount by multiplying the cash discount rate by the netMoreStep 1 calculate the amount of the cash discount by multiplying the cash discount rate by the net price of the merchandise cash discount equals net price times cash discount.

Is settlement discount an expense?

Settlement discount is the same as a cash discount and is a discount granted for paying off a debt early. Settlement discount granted is an expense (the opposite of this is settlement discount received , which is an income for your business).

What is the formula of discount rate?

What is Discount Rate? The formula to calculate the discount rate is: Discount % = (Discount/List Price) × 100.

What is the formula to calculate discount in Excel?

Say you want to reduce a particular amount by 25%, like when you're trying to apply a discount. Here, the formula will be: =Price*1-Discount %.

What is the formula for discount rate in Excel?

So, discounting is basically just the inverse of compounding: $P=$F*(1+i)-n. The discount formula can be written as P=F*(P/F,i%,n), where (P/F,i%,n) is the symbol used to define the discount factor. To convert the future value to the equivalent present value, you simply multiple the future value by the discount factor.

Should I offer an early payment discount?

An early payment discount or cash discount is offered as a means to get your customers to pay their bills a bit earlier. If you don't have a lot of late-paying customers, offering a cash discount may not be necessary, but if you do, offering a cash discount may be a good solution.

Why a supplier may offer an early payment discount?

The primary advantage of early payment discounts is that suppliers can get paid sooner, which accelerates cash flow. It also reduces the risk of nonpayment or late payment.

What is a reasonable discount for cash payment?

A cash discount is usually around 1 or 2% of the invoice total, although some businesses may offer up to a 5% discount.

What is settlement discount received?

What Is a Settlement Discount? A settlement discount can often get referred to as cash discounts or prompt payment discounts. They're offered to customers when they purchase something from you to help complete the business transaction. Settlement discounts are often used in business-to-customer (B2C) transactions.

What is the difference between trade discount and settlement discount?

Trade Discount vs Settlement Discount Trade discounts are allowed to encourage customers to purchase products in larger quantities. Settlement discounts are allowed to ensure that customers settle debts within a short period of time.

Is settlement discount granted deducted from purchases?

NB: The settlement discount received is deducted from the purchases figure and forfeited settlement discount received added to the purchases figure.

What Is a Settlement Discount?

A settlement discount can often get referred to as cash discounts or prompt payment discounts. They’re offered to customers when they purchase something from you to help complete the business transaction. Settlement discounts are often used in business-to-customer (B2C) transactions.

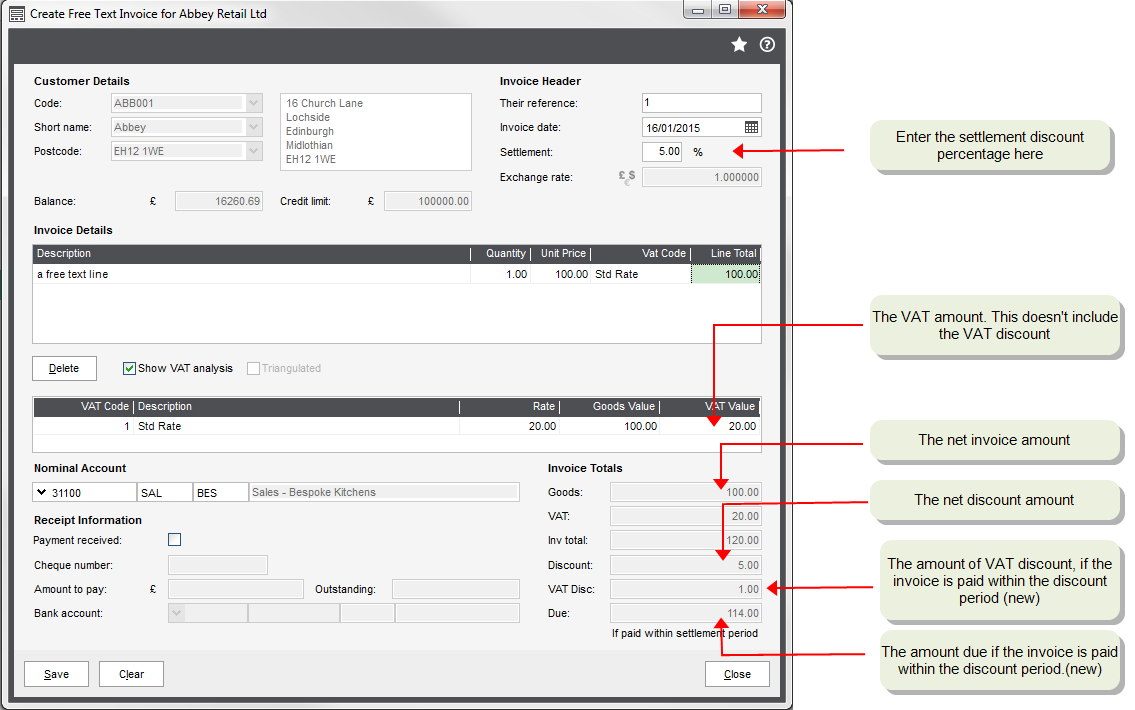

How to Calculate a Settlement Discount

The first thing to keep in mind when calculating a settlement discount is the original invoice terms. You would issue an invoice for the amount in full and then issue a credit note for the discount. Make sure that you clearly display the terms and the discount percentage on the invoice.

Key Takeaways

Offering discounts to your customers can have a ton of different benefits. Not only can you increase sales, but you can increase customer loyalty. And, with a settlement discount, it can also help in other areas.

When is a settlement discount recorded?

Settlement discounts are accounted for when the customer pays us. We will know at this point, whether or not the customer took advantage of the settlement discount. When posting the cash book (see cash book blog here ), the settlement discount should be recorded as a DEBIT entry in the Discounts Allowed Account and a CREDIT entry in the Sales Ledger Control Account (SLCA)

Where to record settlement discount?

Something that is regularly forgotten is to remember to record the settlement discount in the customer’s Sales Ledger account. This should be recorded (along with the receipt) to the CREDIT side of the Sales Ledger Account.

What is a common error that can arise when students are given an invoice extract and are asked what the settlement discount amount?

A common error that can arise is when students are given an invoice extract and are asked what the settlement discount amount will be . Mistakenly, some students will calculate the settlement discount from the invoice total amount rather than calculating it based on the invoice net amount, so watch out for this one!

When is VAT calculated on invoice?

VAT on an invoice is ALWAYS calculated after ALL discounts have been taken, even if the customer subsequently doesn’t take advantage of a settlement discount.

Do you record settlement discounts in sales day book?

Settlement discounts are NEVER recorded in the Sales Day Book where we record all the sales invoices sent to our credit customers. When the invoices are entered in the Sales Day Book, we don’t know at this stage whether or not the customer will in fact take advantage of a settlement discount. So, simply record the Net, VAT and Total amounts as shown on the invoice.

What does early settlement mean?

Early settlement will mean receivables will get smaller and so the cost less

Why is cash received early?

If cash is received earlier, it will improve the supplier’s liquidity position, because it reduces the length of its cash operating cycle. This will be particularly important if a seller is suffering from cashflow problems. If the cash from customers is received early, the cost of financing receivables is reduced.

What happens to receivables when cash is received early?

If the cash from customers is received early, the cost of financing receivables is reduced.

When customers are deciding which payments to make to suppliers and which ones to delay, they are likely to pay?

When customers are deciding which payments to make to suppliers and which ones to delay, they are likely to pay those suppliers offering a discount for early payment first.

Does increasing credit terms increase sales?

Occasionally you may be told that a new policy of INCREASING the credit term will also increase sales (as a larger credit term will attract more customers)

Is a discount an incentive?

It is possible that offering a discount may provide an incentive to new customers, because the cost of the goods from a supplier offering a discount may now be less than those of a supplier not offering a discount, provided that the potentially new customer pays within the specified time limit.

How to calculate early payment discount?

The early payment discount is calculated by taking the discount percentage ― such as 1% ― and multiplying it by the invoice amount. For example, a 1% discount on a $1,000 invoice equals $10. If the invoice is paid within the discount terms ― such as 10 days ― the customer would pay $990 ― $1,000 less $10.

Why do vendors get early payment discounts?

As a vendor, you will get paid sooner and can reduce the risk of nonpayment, which could result in hiring a collection agency. From the customer’s perspective, you will be able to build a good credit history with your vendor suppliers, which could result in an increase in your credit limit.

How long does it take to get a 1% discount on an invoice?

This means the customer receives a 1% invoice discount if the payment is submitted within 10 days. If the customer does not pay within 10 days, then the invoice is due in 30 days with no discount. This type of prompt payment discount can be used to incentivize those customers who never seem to pay their invoices on time.

How much is an invoice settled for in 10 days?

In other words, if you pay in 10 days or less, the invoice can be settled for $980 instead of $1,000. If you pay after 10 days, you must pay the full $1,000. The screenshot below shows how payment terms are generally shown on an invoice: Sample invoice created in QuickBooks with early payment discount terms. ×.

Why should early payment be in writing?

The terms of an early payment discount should be in writing to prevent any problems. Having the terms in writing prevents timing-related issues. Usually, the customer and the vendor have different views as to when the clock starts ticking for receiving payment. The customer will start the clock when their accounts payable department receives the invoice while the vendor will start counting on the date of the invoice. Clearing up this issue ahead of time will avoid problems later on.

How to offer a discount to a vendor?

The discount a vendor offers will vary based on a number of factors: 1 What is standard in the industry: Find out what kind of payment terms other businesses in your industry are offering. You want to make sure that the payment terms you offer are not too far off from the industry standard. 2 What early payment discounts are offered by the competition: Check out what kind of payment terms your competitors are offering. To stay competitive, you should offer similar payment terms. 3 What your client’s payment history is: If a customer consistently pays on time, there is no need to offer early payment discount terms. However, you could decide to reward customers that pay on time with a customer appreciation discount periodically.

What are the benefits of paying bills early?

The benefits of early payment discounts for customers are: Save money: The discounts add up over time to save you a significant amount of money, particularly if several of your suppliers offer the discounts. Build business credit: By paying your bills early, you can increase your business credit score.

How do you Calculate my Early Settlement Figure?

If you want to settle your agreement early, you can request an Early Settlement Figure, which we calculate in line with the rules set out within the Consumer Credit (Early Settlement) Regulations 2004.

What happens if you settle an agreement early?

If you settle an agreement early you’ll normally always pay us less than the total remaining outstanding balance at that point. However, the level of discount you get by settling early does reduce the further along into your agreement you are. This is because the interest is spread over the whole contract term, and you pay more interest at the start of your agreement.

What is settlement discount?

A settlement discount is where a business offers another business a discount when an invoice is paid early. This is usually a percentage discount if an invoice is paid within a specified number of days, for example, a 5% discount for invoices paid within 15 days. Settlement discounts can be recorded for both sales and purchase transactions - ...

When an invoice is paid immediately, is the settlement discount automatically taken?

When an invoice is paid immediately, the settlement discount is automatically taken. The VAT is discounted on the invoice and no subsequent VAT adjustment is necessary.

How to make sure that the correct discounts are always entered?

To help make sure that the correct discounts are always entered, you can store the discount settings on your customer and supplier accounts. Each time an order or invoice is entered, the discount details are automatically entered on the transaction.

How to notify customers of VAT discount?

Businesses must: Notify their customers of the VAT discount available and the amounts the customer is due to pay. This can be done in one of two ways: Issue an invoice detailing the full net and VAT payable. If the invoice is paid within the discount period, issue a VAT only credit note to account for the VAT discount.

When an invoice contains settlement discount is paid within the discount period, is the VAT charged?

When an invoice that contains settlement discount is paid within the discount period, the VAT is only charged on the discounted invoice amount. VAT must be calculated and shown on the invoice at the full rate. If the customer pays within the settlement discount period, the VAT is discounted and a VAT adjustment must be processed. Businesses must:

When can you record a discount?

When the payment is received from a customer , you can record the discount amount. This is then posted to the Discounts Allowed nominal account. When the payment is paid to a supplier, you can record the discount amount. This then posted to the Discounts taken nominal account.

Do you need to issue a credit note if you pay an invoice early?

If the invoice is paid within the discount period, there is no need to issue an additional credit note.

What to do if the annual discount rate is larger than the current value of funds rate?

If the effective annual discount rate is larger than the current value of funds rate, accept the discount and pay early. If the effective annual discount rate is smaller than the current value of funds rate, reject the discount and pay as close to the payment due date as possible. In the first three boxes, put in the numbers for your situation.

What is the rate in the box?

The rate in the box is the current rate.