When you get the opportunity to purchase a car, it helps to know how much of a car loan early settlement can be achieved. To calculate this amount, add up the fair market value of the car to the total amount borrowed. Then divide that number by the length of your loan and multiply that by 1%.

Full Answer

How do I calculate my car finance settlement amount?

Different lenders have their own car finance settlement calculator which you can use to find out their repayment fees. Like all things car finance, you can only calculate your car finance agreement’s early settlement amount by considering your own personal circumstances.

What is the loan early repayment calculator?

Based on the figures entered into the Loan early Repayment Calculator: The Early Repayment Loan Calculators is helpful for managing all kinds of loan repayments be it a personal loan, a car loan or a home loan.

How many months have I made before I settle my loan?

For example, if you select “12 months since loan received” under “Early settlement”, the calculator assumes that you will have made 12 monthly repayments before settling your loan.

What is the formula for early redemption of a car loan?

When doing an early redemption on a car loan, the amount to pay is: Initial loan amount + total interest - instalments already paid - 80 percent of unpaid interest Now, the formula for Rule of 78

How do I calculate my car payoff amount?

Calculate the monthly payment using the monthly payment formula. Multiply the monthly payment by the number of months the loan is for, to get the total repayment amount. Deduct the principal amount from your total repayment amount to get the total interest.

Can I settle my car loan early?

Can I settle my car loan or personal loan whenever I want? Yes, you can! Even for lock-in periods! The only thing you need to remember when settling your loan during the lock-in period is that you'll need to pay the fee (the early settlement fee) stated in your loan agreement.

How is pre closure of a car loan calculated?

For e.g.: if the loan tenure is 5 years i.e. 60 months, but you choose to pre pay the entire balance loan amount after 3 years itself i.e. 36 months, then the 36th month will be considered your foreclosure month.

Can you pay off a 72 month car loan early?

Some lenders charge a penalty for paying off a car loan early. The lender makes money from the interest you pay on your loan each month. Repaying a loan early usually means you won't pay any more interest, but there could be an early prepayment fee.

HOW IS car settlement figure calculated?

To calculate your settlement figure, the lender will add up your remaining monthly instalments between now and the end of your agreement and take away any future interest that you won't need to pay. Finally, any arrears will be added. You'll receive your settlement figure in writing to confirm.

Is it smart to pay off car loan early?

Paying off a car loan early can save you money — provided there aren't added fees and you don't have other debt. Even a few extra payments can go a long way to reducing your costs. Keep your financial situation, monthly goals and the cost of the debt in mind and do your research to determine the best strategy for you.

How can I clear my car loan faster?

5 Ways to pay off your car loan early and be debt-free!Analyse your car loan details. The first step towards effective repayment of your car loan is to break down your loan details. ... Put up an additional principal amount. ... Cut down on secondary expenses. ... Leverage your increments. ... Clear some loans earlier than others.

Is closing a car loan good idea?

You may like to avoid the lengthy repayment tenure by paying off the loan early. However, if the penalty amount is way more than the interest charges, it is not a good idea to proceed with the pre-closure.

How can I get out of a loan early?

What to do:Visit bank with the complete set of documents (as mentioned above).You may be required to fill a form or write a letter requesting pre-closure of the Personal Loan account.Pay the pre-closure amount.Sign the required documents, if any.Take acknowledgement of the balance amount you have paid.More items...

How do I pay off a 5 year car loan in 3 years?

How to Pay Off Your Car Loan EarlyPAY HALF YOUR MONTHLY PAYMENT EVERY TWO WEEKS. ... ROUND UP. ... MAKE ONE LARGE EXTRA PAYMENT PER YEAR. ... MAKE AT LEAST ONE LARGE PAYMENT OVER THE TERM OF THE LOAN. ... NEVER SKIP PAYMENTS. ... REFINANCE YOUR LOAN. ... DON'T FORGET TO CHECK YOUR RATE.

Does paying off a car loan early hurt credit?

In the short-term, paying off your car loan early will impact your credit score — usually by dropping it a few points. Over the long-term, it depends on quite a few factors, including your credit mix and payment history.

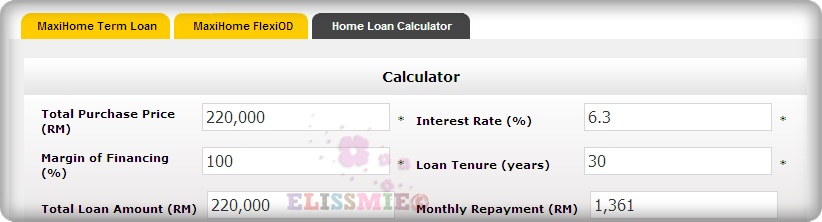

How long does it take to pay off a $30000 car?

With a loan amount of $30,000, an interest rate of 8%, and a loan repayment period of 60-months, your monthly payment is around $700. Before you purchase your new vehicle, remember to budget for car maintenance, gas, and car insurance.

Can I pay off my car loan early to avoid interest?

When you think about how much you'll owe in interest by the end of your loan term, you might think: “Wait… can I pay off my car loan early to avoid future interest?” The answer is yes. In fact, paying off your car loan before the end of the loan term is a great way to reduce your interest payments!

Does paying off a car loan early hurt credit?

In the short-term, paying off your car loan early will impact your credit score — usually by dropping it a few points. Over the long-term, it depends on quite a few factors, including your credit mix and payment history.

Can I negotiate my car loan payoff?

Depending on your lender, you may be able to negotiate a payoff amount for your car loan. In addition to the lender's policies, other factors that can impact your ability to negotiate include whether you're current on your loan payments, how much cash you have to offer and the condition of your vehicle.

Will my credit score go up if I pay off my car?

Once you pay off a car loan, you may actually see a small drop in your credit score. However, it's normally temporary if your credit history is in decent shape – it bounces back eventually. The reason your credit score takes a temporary hit in points is that you ended an active credit account.

What does it mean to pay a debt with a full settlement?

A full and final settlement means that you pay your creditor a reduced sum to pay your debt. When you have paid your creditor with the agreed-upon sum,you will have paid your settled your debt fully.

Can you settle a mortgage loan during lock in period?

Yes , you can! Even for lock-in periods! The only thing you need to remember when settling your loan during the lock-in period is that you’ll need to pay the fee (the early settlement fee) stated in your loan agreement.

What is SGCarMart Connect?

In the event that you do buy a car from a direct seller or simply want to keep your financing options open, sgCarMart Connect - Singapore's first one-stop auto transaction service - can help you apply for a loan and motor insurance from at least five financial institutions. In addition, Connect will help the seller settle his or her outstanding loan, apply for an insurance refund and draft legal documentation for both parties - all for free. sgCarMart Connect can be contacted at 6744 3540.

What percentage of interest is rebated on car loan?

Because the banks need to cover their administrative costs and commission already paid out, car owners who early redeem their loans are further penalised with a charge of 20 percent of the unpaid interest; the bank will only rebate the borrower 80 percent of the unpaid interest instead of the full sum.

What is the difference between 40 and 60?

Here, 40 represents the number of months remaining of the bank loan that is unpaid, and 60 is the original number of months of the bank loan. The amount of $3,360.66 is the unpaid interest on the 40 months from early termination of the loan.

When selling a car, do you have to pay off the loan?

Therefore, when an owner sells his car, he will need to fully pay off the loan before the ownership transfer. Car buyers usually finance their purchase with a loan of five years or longer, but because most of them will sell their cars before that, early redemption of car loan is commonplace.

Is renewing the COE of your car a fatal error?

Renewing the COE of your car might be a fatal error! Here's why

Do banks charge early settlement penalties?

Banks usually further charge an Early Settlement Penalty, but in our below example, we will ignore this portion.

Why use the Early Loan Repayment Calculator?

The early loan repayment calculator will help you to calculate the monthly interest repayments and compare how alterations to the loan payments can reduce the overall cost of the loan. With this calculator, you can also compare the loan repayments over different periods of time and opt for the most affordable option. The early repayment loan calculator provides interest repayment options over a variety of time periods starting from 1 year to 10 years. You can also compare them to monthly repayment periods of your choice.

What is interest on a loan?

Interest is the extra amount of money paid for using the lender's money. Your lender could be a bank or any non banking financial institution, a private lender or a friend, ...

What are the two parts of a loan repayment?

The first that reduces the balance in order to pay off the loan and the other part covers the interest on the loan. There are certain factors or rather certain key terms that affect the amount of interest to be paid off, let's learn about them first.

How to lower the payment on a loan?

Refinance the loan: This is a very easy way to lower the payment, pay the loan back in a much less time and save interest. Many local financial institutions offer very low interest rates. You can take advantage of these low interest rates to refinance the loans.

Why pay off a loan early?

The moral of the story is that paying off a loan or any kind of debt early is always a great way of saving the amount of money paid in interest as well as decreasing the overall loan term. This extra money can be used to meet other imminent or long-term needs.

How often should I make biweekly payments?

Making Bi-weekly payments: You can submit half the payments to the lender every two weeks rather than making the regular monthly payment. Three things will happen due to this practice. There will be less accumulation of interest because the payments get applied more often. You will also make extra payments. Practising making bi-weekly payments could reduce several months.

What happens if you pay monthly on a mortgage?

You will reduce the total amount of interest paid on the loan, reducing from to which is a saving of in interest payments.

How to save money and stop getting in financial trouble?

Borrow Little, Repay Quickly: Pay back the loan as quickly as possible. This will save you money and will stop you from getting in any financial trouble. Borrow only what you need, nothing more, and repay it as soon as you can.

What happens if you take out a loan and aren't able to repay it?

If you take out a loan and aren't able to repay it, then your credit ratings will be terrible and you will have a difficult financial future.

Can you get a smaller interest rate on a loan?

You may be getting a smaller interest rate although you could be paying just as much if the time in which the loan is repaid is high. It might be tempting to go for the loan interest rate, but make sure it balances out. Borrow Little, Repay Quickly: Pay back the loan as quickly as possible.

Is it bad to take out a pay day loan?

Pay Day Loans: Taking out a pay day loan is dangerous for your financial profile. A pay day lender has no concern for you as a person, they only care about your money. Regardless of your financial situation, never as much as consider these people.

Is a personal loan better than a car loan?

Choose Between a Personal Loan or a Car Loan: While a personal loans usually offer a far better interest than car loans, take the time to do your research. With consideration of second hand dealerships APR rates, it's very uncommon for you to find a car loan lender who has better rates than a personal loan. However if you are looking to buy a new car, you really should take your time and look at a variety of different loans till you find exactly what you're looking for.

What is the assumption of a monthly repayment calculator?

The calculator assumes that monthly repayments are made in arrears and that identical monthly repayments are made.

Why is it important to settle early?

Important: You have the legal right to repay a debt in full at any time. An early settlement can save you money because lenders are not legally allowed to charge you interest based on the loan term. Interest must be based on the amount owed.

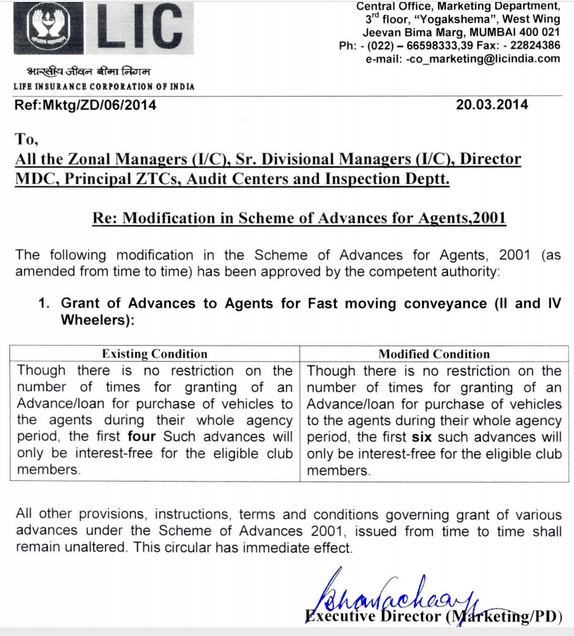

What is an ibra in banking?

As for Islamic banking, Ibra’ denotes the granting of the rebate by Islamic banks at their discretion to customers who settle their debt obligations arising from sale-based contracts earlier than the agreed settlement period.

How long is a bank notice period?

Notice period: Three months prior written notice to the Bank, or payment of three (3) months’ interest on the amount redeemed in lieu of notice.

How long is the notice period for a loan restructure?

Notice Period: One month. Loan restructure: Not allowed once the loan is approved and disbursed. The extra payment will be treated as an advance payment to reduce your installment in the following month. You will not be able to redraw the extra payment made.

How many personal loans are there in Malaysia?

However, recognizing that not many know the terms or the benefits you can reap, here are 16 personal loans in Malaysia and their terms for an early settlement to help you find the loan for your needs.

What is the rule of 78?

For Rule of 78, the calculation of the proportion of principal and interest payable for the entire loan, assumes that the interest forms a larger percentage of the monthly installments during the early stage of the loan. The borrower shall repay all monthly installments payable over the unexpired period subject to the rebate.

Why settle a personal loan early?

Another good reason for you to settle your personal loan early is to allow your money to grow to its fullest potential. When you have an outstanding personal loan, you will always have to pay interest rates as a cost to the bank for the loan.

Is rebate based on Ibra?

Rebate: Applicable based on the concept of Ibra’. (Please refer to the formula and example as shown above.)