There is a way to calculate how much of your loan will be paid off by early settlement. You can find that number by dividing the total cost of the vehicle with the number of monthly payments you will make while driving it. Evaluating Your Interest In Early Car Loan Settlement

Full Answer

How to calculate a settlement amount?

Settlement Calculator

- Confirm With a Lawyer. There are many factors that go into determining a settlement amount for a personal injury case, and this calculation is just the start.

- Damages and The Multiplier. ...

- More Information. ...

- Adjust Your Settlement Target for Your Own Fault. ...

How do you calculate the monthly payment on a loan?

Monthly Interest Rate Calculation Example

- Convert the annual rate from a percent to a decimal by dividing by 100: 10/100 = 0.10

- Now divide that number by 12 to get the monthly interest rate in decimal form: 0.10/12 = 0.0083

- To calculate the monthly interest on $2,000, multiply that number by the total amount: 0.0083 x $2,000 = $16.60 per month

How do you calculate the mortgage on a house?

- Comparing the monthly payment for several different home loans

- Figuring how much you pay in interest monthly, and over the life of the loan

- Tallying how much you actually pay off over the life of the loan, versus the principal borrowed, to see how much you actually paid extra

How do you calculate interest on an outstanding balance?

You can use the same interest rate calculation concept with other time periods:

- For a daily interest rate, divide the annual rate by 360 (or 365, depending on your bank).

- For a quarterly rate, divide the annual rate by four.

- For a weekly rate, divide the annual rate by 52.

See 6 key topics from this page & related content

How is a loan settlement figure calculated?

To calculate your settlement figure, the lender will add up your remaining monthly instalments between now and the end of your agreement and take away any future interest that you won't need to pay. Finally, any arrears will be added. You'll receive your settlement figure in writing to confirm.

How do I figure out my loan payoff amount?

You can calculate a mortgage payoff amount using a formula Work out the daily interest rate by multiplying the loan balance by the interest rate, then multiplying that by 365. This figure, multiplied by the days until payoff, plus the loan balance, gives you your mortgage payoff amount.

How is early settlement calculated?

An early settlement figure is the amount still owed, plus interest and charges if you want to pay off your car finance early. Our settlement figure calculator does not include any additional penalty charges that may be incurred.

What is the percentage of loan settlement?

Typical debt settlement offers range from 10% to 50% of what you owe. The longer you allow debt to go unpaid, the greater your risk of being sued. Creditors are under no obligation to reduce your debt, even if you are working with a reputable debt settlement company.

Why is loan payoff higher than balance?

Your payoff amount is different from your current balance. Your current balance might not reflect how much you actually have to pay to completely satisfy the loan. Your payoff amount also includes the payment of any interest you owe through the day you intend to pay off your loan.

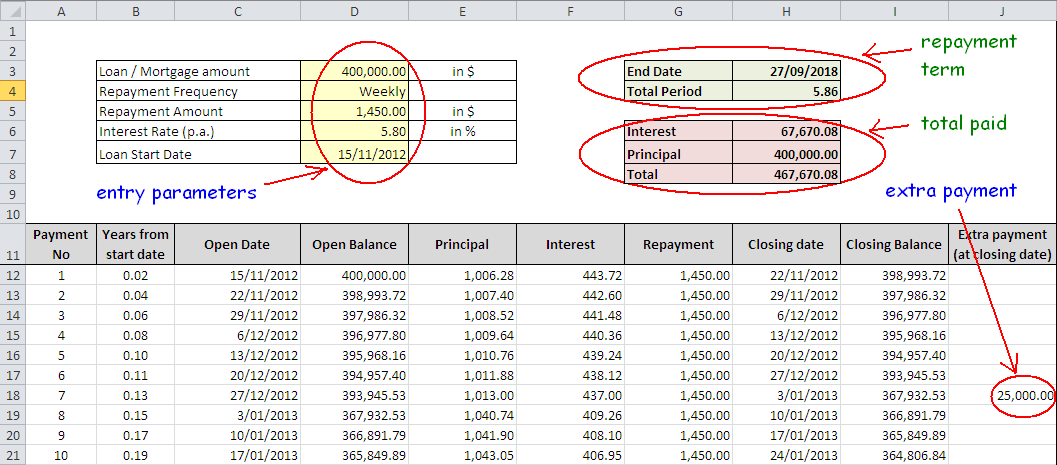

How do I calculate a loan payoff in Excel?

0:351:52Calculating Loan Payoff in Excel | Knowledgecity.com - YouTubeYouTubeStart of suggested clipEnd of suggested clipSo negative monthly payment amount that's L 9. And now the next piece of information we need to knowMoreSo negative monthly payment amount that's L 9. And now the next piece of information we need to know is the present value or the loan amount. And that's going to be L 4.

What is a settlement amount?

More Definitions of Settlement Amount Settlement Amount means the amount in US$ equal to the sum of Losses, Gains, and Costs, which the Non-Defaulting Party incurs as a result of the termination of this Agreement.

What is the penalty for paying off a loan early?

While most personal loan lenders don't charge you to pay off your loan early, some may charge a prepayment penalty if you pay off your loan ahead of schedule. Prepayment penalties typically start out at around 2% of the outstanding balance if you repay your loan during the first year after applying and qualifying.

Is paying a loan off early good?

In most cases, paying off a loan early can save money, but check first to make sure prepayment penalties, precomputed interest or tax issues don't neutralize this advantage. Paying off credit cards and high-interest personal loans should come first. This will save money and will almost always improve your credit score.

Can I get NOC after loan settlement?

synopsis. A No Objection Certificate (NOC) is a legal document issued by a housing finance company or bank to a customer declaring that he/she has no outstanding dues towards the lender. Sometimes referred to as a “No Dues Certificate”, an NOC can be obtained from the lender once the loan has been paid off completely.

Can I get loan after settlement?

The bank or lender takes a look at the borrower's CIBIL score before offering him a loan and if the past record shows any settlement or non-payment, his loan is likely to get rejected.

How can I settle my personal loan fast?

5 Ways To Pay Off A Loan EarlyMake bi-weekly payments. Instead of making monthly payments toward your loan, submit half-payments every two weeks. ... Round up your monthly payments. ... Make one extra payment each year. ... Refinance. ... Boost your income and put all extra money toward the loan.

Is the principal balance the same as the payoff?

The current principal balance is the amount still owed on the original amount financed without any interest or finance charges that are due. A payoff quote is the total amount owed to pay off the loan including any and all interest and/or finance charges.

What is the payoff amount on a car loan?

“A car loan payoff amount is the total amount of money necessary to pay the entirety of your car loan, including interest plus principal. However, this amount isn't just what's on your last statement, as the amount can change due to the accrual of interest.

How long will it take to pay off $7000?

In order to pay off $7,000 in credit card debt within 36 months, you need to pay $254 per month, assuming an APR of 18%. While you would incur $2,127 in interest charges during that time, you could avoid much of this extra cost and pay off your debt faster by using a 0% APR balance transfer credit card.

What is a 10 day payoff amount?

What is a 10-day payoff? A 10-day payoff refers to the time it takes for your new lender to pay off your old loans during a refinance. This happens with any loan you refinance, whether that's a home loan, auto loan, personal loan, or student loan with Earnest.

How much of the balance is a payment on a 401(k)?

Payments will be assumed to be made at either 3% of the total outstanding balance or £5, whichever is the higher.

How to arrange credit card product details?

Click the arrows to arrange the product details by the name of the lender. Click the arrows to arrange the product details by the purchase rate (APR) of the credit card. Click the arrows to arrange the product details by the balance transfer rate ( APR) of the credit card .

What does a tick mean on a mortgage?

Tick to remove mortgages that have Early Repayment Charges. Early Repayment Charges are applied by the lender if you repay the mortgage, or remortgage to a different lender within a certain period of time or date set by the lender. Typically a percentage of the outstanding balance at the point of repayment.

What is total cost?

Total costs consist of the full monthly payment amount over the comparison period, plus the upfront fees.

Is annual deposit charge taken into account when calculating costs?

No initial, annual or per deposit charges are taken into consideration when calculating costs.

Do you take charges into account when calculating costs?

No charges are taken into consideration when calculating costs.

Is my current balance shown on my loan?

Your current balance will be shown - this may be different to a balance you quote from your loan provider as they may have fees or other charges they apply when giving a settlement figure.

What does it mean to pay a debt with a full settlement?

A full and final settlement means that you pay your creditor a reduced sum to pay your debt. When you have paid your creditor with the agreed-upon sum,you will have paid your settled your debt fully.

Can you settle a mortgage loan during lock in period?

Yes , you can! Even for lock-in periods! The only thing you need to remember when settling your loan during the lock-in period is that you’ll need to pay the fee (the early settlement fee) stated in your loan agreement.

How to Calculate using the Loan Repayment Calculator?

One needs to follow the below steps to calculate the monthly installment amounts.

What is loan repayment calculator?

Loan Repayment Calculator can be used to calculate the repayment amount in the form of installment and what shall be the periodical installment amount in case the person borrows a loan from a financial institution.

How to calculate monthly installments?

One needs to follow the below steps to calculate the monthly installment amounts. First of all, determine the loan amount which is borrowed. Banks usually provide more loans to those who have a good credit score and less amount to those who have a lower credit score. First, we shall enter the principal amount.

How much is a 10 year installment on a loan of $200,000?

Therefore, the installment amount for the firm for 10 years on the loan amount of $200,000 shall be $8,306.30

How long is the $200,000 loan?

Banks have agreed on them to provide funds for $200,000 at an 11% rate of interest, and it shall be repaid on a quarterly basis. The loan has been taken for 10 years. Based on the given information, you are required to calculate what shall be the installment amount for the quarterly repayments.

What does N mean in a loan?

N is the number of period or frequency wherein the loan amount is to be paid

What is the assumption of a monthly repayment calculator?

The calculator assumes that monthly repayments are made in arrears and that identical monthly repayments are made.

Why is it important to settle early?

Important: You have the legal right to repay a debt in full at any time. An early settlement can save you money because lenders are not legally allowed to charge you interest based on the loan term. Interest must be based on the amount owed.

Will the credit card settlement calculator come to help if you continue using the credit cards?

It is often advised not to use the credit cards unless you solve you repay the negotiated payable amount of settlement. For the time being, you can use cash for all your purchases to keep your spending at a check.

Can you use a settlement calculator to pay off debt?

By using a settlement loan calculator, when you come to know about how much you need to pay to get rid of your outstanding debts, you can include it in your budget. You can manage finances accordingly and plan your financial moves as well. But, while opting for settlement, you also need to take into account that you’d have to pay a tax on the forgiven debt amount.

Can you use credit cards to pay a settlement?

It is often advised not to use the credit cards unless you solve you repay the negotiated payable amount of settlement. For the time being, you can use cash for all your purchases to keep your spending at a check.

How to Improve Your Credit Score?

A low credit score always exposes a lender to a high risk of default. Therefore, banks or lenders are often unwilling to offer credits to individuals who have a low credit score and who have defaulted on loan payments in the past.

How to avoid multiple credit cards?

Avoid taking multiple credit cards or loans unless you really need to. Pay off your monthly EMIs on time. Keep monitoring your CIBIL Score at regular intervals to keep a track of your financial performance. When you opt for loan settlement, don’t apply for a new loan immediately.

What is personal loan settlement?

Personal loan settlement process, also known as personal loan defaulter settlement refers to an agreement between a lender and a borrower wherein the loan is ‘settled’ by repaying only a part of the loan. The lender may forgive a part of the debt in order to help the borrower repay the loan at least partially.

What happens if you settle a personal loan?

When you opt for a personal loan defaulter settlement, it negates the original credit agreement between you and your lender. Also, when your lender reports the same to credit rating agencies as ‘ settled’ instead of ‘paid as agreed’ or ‘paid in full’- it will have a negative impact on your credit score, and discourage other lenders ...

What is loan closure?

Loan closure is a term that refers to the closing of an existing loan account after the borrower repays the loan fully on time. This will have a positive impact on one’s credit score.

How does a loan settlement affect your credit score?

Loan settlement process can negatively affect your credit history and reduce your credit score drastically thereby limiting your chances of receiving credit in the future. When you opt for a loan settlement, even if it is for a genuine reason, the amount paid will be lesser than the original amount which reduces your creditworthiness.

What to do if you can't repay a loan?

In case you are unable to repay your loan due to unavoidable circumstances, then one of the options available is loan settlement. However, this is not a recommended option due to various reasons, one of which includes the adverse impact on your credit score.