How to calculate a personal injury settlement?

Top considerations in calculating this include:

- The severity of your injuries

- How much (and what type of) medical treatment you’ve undergone thus far

- What your estimated recovery time is

- If you have suffered any permanent or long-lasting effects

- What kind of an impact it has had on your daily life

How to calculate settlement discounts?

The steps to issue a settlement discount would look like this:

- Invoice the customer

- Record the payment

- Raise a credit note for the amount of the settlement discount

- Allocate the proper credit to the issued invoice

How to calculate VAT on settlement discounts?

calculate the VAT in the normal way, i.e. net x VAT rate. Option 1. Issue a credit note – If the customer pays the lower amount (ie. takes advantage of the prompt payment discount offered), issue a credit note for the amount of the discount (plus VAT). Option 2.

How much are typical car accident settlement amounts?

Your typical automobile accident settlement may be around $21,000. It will most likely be between $14,000 and $28,000. In general, more serious or persistent injuries result in a greater settlement. You will also be compensated extra if the other motorist was determined to be under the influence.

How do you find the settlement price?

Daily Settlement Price The closing price for Commodities futures contract shall be calculated on the basis of the last half an hour weighted average price of such contract or such other price as may be decided by the relevant authority from time to time.

How is final settlement price calculated?

Settlement prices are typically based on price averages within a specific time period. These prices may be calculated based on activity across an entire trading day—using the opening and closing prices as part of the calculation—or on activity that takes place during a specific window of time within a trading day.

What is a settlement price?

Settlement prices are essentially the fair market value of a commodity or financial derivative as determined by buyers and sellers in a market at a particular point in time known as the settlement period.

How are futures settlement prices calculated?

For most Equity Index futures, daily settlement price for the front month is calculated using a volume weighted average price (VWAP) based on the last 30 seconds of the trading day.

What is the daily settlement price?

Daily settlement price for futures contracts is the closing price of such contracts on the trading day.

What is settlement price NSE?

a. Index - Closing price of the relevant underlying index in the Capital Market segment of NSE, on the last trading day of the options contract.

What is settlement value accounting?

What Is an Account Settlement? An account settlement generally refers to the payment of an outstanding balance that brings the account balance to zero. It can also refer to the completion of an offset process between two or more parties in an agreement, whether a positive balance remains in any of the accounts.

What is a settlement index?

Index Settlement ValuesIndexSettlement ValueCommunication Services Select Sector Index (SISC)281.32Energy Select Sector Index (SISE)764.94Industrials Select Sector Index (SISIN)859.14Financial Select Sector Index (SISM)379.7920 more rows

What does cash settlement mean?

What Is a Cash Settlement? A cash settlement is a settlement method used in certain futures and options contracts where, upon expiration or exercise, the seller of the financial instrument does not deliver the actual (physical) underlying asset but instead transfers the associated cash position.

What is FnF in salary?

What is full and final settlement? Whether an employee resigns from the job or is let go by the management, they are paid all the dues for their service till the last working day as FnF or full and final settlement. This includes any additional earnings or deductions as well.

How is final settlement calculated in UAE?

Employees are entitled with full gratuity pay based on 30 days salary for every year of work. Multiply daily wage by 21 or 30 (depending on duration of service in the company) = 333.30 x 21 = 6,999.30. So 21-days salary is AED 6,999.30 will be received for every year of service.

What is the rule for full and final settlement?

The new wage code says a company must pay the full and final settlement of wages within two days of an employee's last working day following their resignation, dismissal or removal from employment and services.

What do you get in full and final settlement?

When an employee decides to end his/her services, the employer must follow the FnF procedure to settle the employee's compensation as per policies. Full and Final settlement includes various activities like documentation, deductions, arrears, receivables, pending salary, earnings and exit interviews.

How are settlement prices calculated?

Settlement prices are typically based on price averages within a specific time period. These prices may be calculated based on activity across an entire trading day—using the opening and closing prices as part of the calculation—or on activity that takes place during a specific window of time within a trading day.

When is the settlement price determined?

The settlement price will be determined on the settlement date of a particular contract.

What Is the Settlement Price?

The settlement price, typically used in the mutual fund and derivatives markets, is the price used for determining a position's daily profit or loss as well as the related margin requirements for the position.

What happens if you own a call option with a strike price of $100?

If you own a call option with a strike price of $100 and the settlement price of the underlying asset at its expiration is $120, then the owner of the call is able to purchase shares for $100, which could then be sold for a $20 profit since it is ITM. If, however, the settlement price was $90, then the options would expire worthless since they are OTM.

What is the difference between closing and opening price?

The opening price reflects the price for a particular security at the beginning of the trading day within a particular exchange while the closing price refers to the price of a particular security at the end of that same trading day. In cases where securities are traded on multiple markets, a closing price may differ from the next day’s opening price due to off-hours activity occurring while the first market is closed.

Is the settlement price the same as the opening price?

While the opening and closing prices are generally handled the same way from one exchange to the next, there is no standard on how settlement prices must be determined in different exchanges, causing variances across the global markets.

What Are All of the Factors for Calculating a Life Settlement Value?

Some life settlement calculators will give you an estimate solely based on the information collected from eligibility related questions. However, the value of a life settlement is tied to several other factors as well. To help you determine what your life insurance is worth, you should be aware of all the factors that affect life settlement valuation. Here is the comprehensive list of factors used in the life settlement valuation process.

How do life settlement investors pay?

Life settlement investors pay all future premiums until the policy matures upon the death of the person who is insured, they consider that expense when evaluating a policy’s worth.. They multiply the annual premium amount by the insured person’s estimated life expectancy in years.

How old do you have to be to get a life insurance settlement?

In most cases, you must be 70 years old to qualify for a life settlement. Viatical settlements may be an option for younger policyholders if they have a chronic or terminal illness.

How much does a life insurance policy have to be to be eligible for settlement?

Most life settlement companies will not buy out a life insurance policy unless it has a face value of $50,000 or more.

How Much Is Your Life Insurance Policy Worth?

You’ve heard about the possibility of selling a life insurance policy you don’t need or can’t afford, and you’re thinking you could use the cash to pay medical or long-term care bills, or to invest in a more comfortable retirement. This transaction is known as a life settlement, or sometimes referred to as a life insurance buyout. But before you take the step of contacting a life settlement company, you’d like to get some idea of how much your life insurance policy is worth – and whether you’re even eligible to sell it. You may have seen online life settlement calculators that can quickly provide an estimate of your life insurance payout, but you should be aware of the limitations many of these have.

What is final settlement price?

The final settlement price is the official daily settlement published by CM E Clearing and is used in pay/collects and margin calculations. The final settlement price is disseminated after the start of the next trading day on CME Globex, Monday through Thursday, between 5:30 p.m. and 9:30 p.m. CT. The f inal settlement price for Friday (trade date) is disseminated on Sunday, between 12:00 p.m. and 4:00 p.m. CT.

What is settlement at trading tick?

The Settlement at Trading Tick is the instrument’s settlement price rounded to the product’s CME Globex trading tick. Some CME Group products’ trading tick is less granular than their clearing tick (e.g., clearing ticks at a penny, but trading ticks at a nickel).

What is intraday settlement?

An intraday settlement is any price that is disseminated before the official end of day settlement calculation. Intraday settlements can be a price that is used to calculate variation margin during the intraday clearing cycle; subsequent price discovery may lead to a different value when the end of day clearing cycle is run and pay/collects are performed. An intraday settlement may also represent a snapshot valuation of the settlement price used in equity end of month fair value settlement procedures.

What is settlement in CME?

Settlement is an official CME Group price established for the instrument at a given point in the trading day. CME Group staff determines the daily settlements for all contracts with volume or open interest.

Is settlement price theoretical or actual?

The settlement price can be actual or theoretical.

How to negotiate a settlement for a car accident?

The first step in negotiating a settlement for a car accident or personal injury claim is calculating a reasonable amount of money you would accept to give up your legal claim. Most insurance companies and injury attorneys rely on one formula or another to get a starting point for settlement talks. This is true for a bodily injury claim in ...

How to put a dollar value on medical losses?

To get a dollar figure that might represent the value of the general damages, an insurance adjuster will add up all the "special" medical damages (remember those are your quantifiable losses) and multiply that total by a number between 1.5 and 5 (that's the multiplier).

What happens when you add a multiplier to a special damages claim?

But once the multiplier is used to arrive at a general damages figure, adding that number to the special damages total will give the insurance adjuster (and you) a ballpark idea of the value of your claim, or at least a starting point for settlement negotiations.

What are the two types of damages in a personal injury claim?

After you enter your numbers and click "Calculate," the two dollar figures you see above the "Your Total Settlement Estimate" field represent the two main types of damages that arise in the majority of injury cases: economic losses (called "special" damages) and non-economic losses (called "general" damages). In any injury-related insurance claim, or even a personal injury lawsuit filed in civil court, the losses suffered by the person who has been injured can be placed into one of these two categories.

What is special damages?

Special damages are those losses that are easy to quantify. They include the costs of medical treatment, any lost income due to time missed at work, property damage caused by the accident, and other out-of-pocket losses.

Can you win a lawsuit if you are found to be at fault?

The following states have a very harsh rule on shared fault. You cannot win any damages if you are found to be even 1% at fault. If the evidence shows that your own carelessness contributed to your injuries, you cannot win an award in a lawsuit, so your estimated settlement value is nearly zero.

What is the closing price of equities?

The price of equities when the exchange opens is referred to as the opening price. The price of equities when the exchange closes is referred to as the closing price, which is the last trade price or the last price the market traded at when it closed.

What is closing price?

The closing price is used to calculate the settlement price.

How are margin requirements calculated in derivatives?

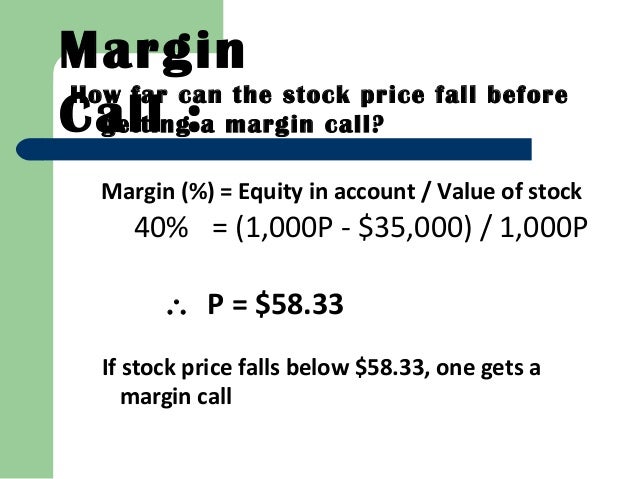

The average is calculated by using both the opening and closing prices for each trading day. Margin requirements are based on the settlement price, not the closing price. Each derivatives exchange has a set of procedures used to calculate the settlement price.

How many points are in a bid side quote?

The same concept as the cash market convention applies. The bid-side quote represents 134 full points plus 1/32 of a point. The converted price into decimal would be 134-010 = 134.03125, and so forth for the offer-side price. In futures you might see 134-012 for 1-1/4 (1/32), 134-015 for 1-1/2 (1/32), or 134-017 for 1-3/4 (1/32).

Do cash bonds trade in decimal?

Cash bonds and futures based on U.S. Treasury securities do not trade in decimal format but in full percentage points, plus fractions of a 1/32 of par value. For example, if you were to see a quote on a broker/dealer screen showing U.S. Treasury prices you might encounter something like this: