The Claim Settlement Ratio of an insurer is calculated using the formula given below: Claim Settlement Ratio = (Total no. of claims approved/Total no. of claims received) x 100 This result is represented in the form of a percentage.

What is paid claims loss ratio?

The loss ratio formula is insurance claims paid plus adjustment expenses divided by total earned premiums. For example, if a company pays $80 in claims for every $160 in collected premiums, the loss ratio would be 50%.

How is the claim settlement ratio of Acko insurance?

It is a tool to measure the efficiency of an insurance company. The Claim Settlement Ratio of Acko General Insurance for the Financial year 2019-20 is 74.09%, which shows that the insurance company is good at handling claims of the insured individual(s).

What is a claim ratio?

The Claims Ratio KPI measures the number of claims in a period and divides that by the earned premium for the same period. It's important to note that insurance is the business of managing risks and, to do that well, the insurer needs a thorough understanding of the incurred claims ratio.

What does claim settled mean?

When you say " Settled- This is just another way of saying that the insurance accepted the claim." Do you mean that the claim is 'left out of consideration' or do you mean that it is ACCEPTED for processing? 0 Comment actions Chris Christley May 28, 2019 15:21 You would view it as an accepted claim by the insurance.

How do I calculate my claim amount?

The actual amount of claim is determined by the formula: Claim = Loss Suffered x Insured Value/Total Cost. The object of such an Average Clause is to limit the liability of the Insurance Company.

What is a good claim settlement ratio?

The CSR higher than 80% is a good claim settlement ratio. If a company of more than 90% CSR is offering a great value product, it is more than welcome. Also look at the average claim settlement time taken but the company. This is a great indicator of the process efficiency of the company.

What is insurance settlement ratio?

The claim settlement ratio is a metric used to gauge the percentage of life insurance claims an insurer has settled during a financial year against the number of claims it has received including pending claims from the previous year.

What is final claim ratio?

Definition of 'claims ratio' The claims ratio is the percentage of claims costs incurred in relation to the premiums earned. There are two main reasons why this business is profitable: the premiums are not cheap, and the claims ratio is low. The claims ratio is equal to the claims rate divided by the risk premium rate.

Which term plan is best?

10 Best Term Insurance Plans in India 2022S.No.PlanClaim settlement Ratio(2020-2021)1.HDFC Life Click 2 Protect Life98.01%2.ICICI Pru iProtect Smart97.90%3.Max Life Smart Secure Plus Plan99.35%4.Tata AIA Life Insurance Sampoorna Raksha Supreme98.02%6 more rows

How do you increase claim settlement ratio?

Three things should help reduce this gap to a great extent: enforcing pre-existing ailment exclusion at the time of buying the policy and not at the time of making a claim, ensuring that the customers understand the exclusions and giving out sharper data on claims settlement ratios of insurers to the public.

Which insurance company has best claim settlement ratio?

Top General Insurance Companies with Best Claim Settlement RateReliance General Insurance Co. ... SBI General Insurance Company Ltd. ... Shriram General Insurance Co. ... Tata AIG General Insurance Company Ltd. ... United India Insurance Company Ltd. ... Universal Sompo General Insurance Company Ltd.More items...

How is claims loss ratio calculated?

Loss Ratio Formula = Losses Incurred in Claims + Adjustment Expenses / Premiums Earned for Period. For example, if an insurer collects $120,000 in premiums and pays $60,000 in claims and adjustment expenses. The loss ratio for the insurer will be calculated as $60,000/$120,000 = 50%.

How claims are settled by insurance company?

Claim settlement in general insurance can make the policyholder stay with the insurer. It is a process where the policyholder claims financial support from the insurer. Claim Settlement in general insurance is offered only after the due process gets completed.

Which company has the best claim settlement ratio?

The highest claim settlement ratio is of the public insurance company LIC at 98.31%.

Which is the No 1 life insurance company in India?

Life Insurance Corporation of IndiaBest Life Insurance Companies in India 2022S.NoCompanyClaim Settlement Ratio 2020-20211Life Insurance Corporation of India98.62%2HDFC Life Insurance98.01%3SBI Life Insurance93.09%4ICICI Prudential97.93%8 more rows

Which insurance company is best for claim settlement?

Top General Insurance Companies with Best Claim Settlement RateReliance General Insurance Co. ... SBI General Insurance Company Ltd. ... Shriram General Insurance Co. ... Tata AIG General Insurance Company Ltd. ... United India Insurance Company Ltd. ... Universal Sompo General Insurance Company Ltd.More items...

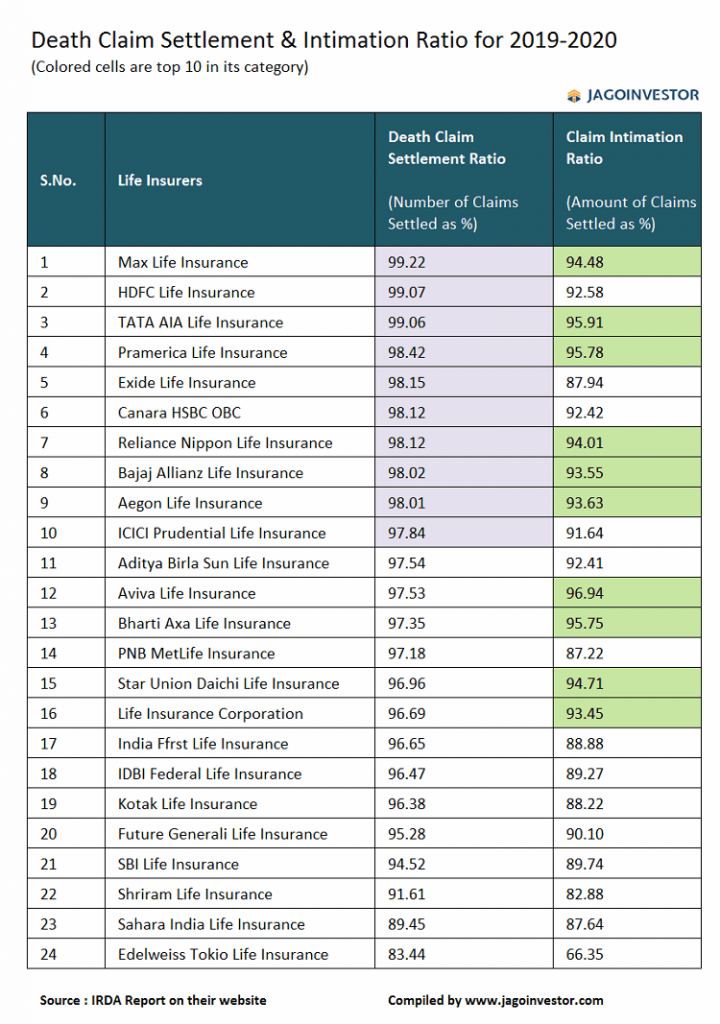

Which term insurance has highest claim settlement ratio?

The top term insurance companies on the basis of claim settlement ratio for the year 2019-20 are Max Life Insurance with 99.22%, HDFC Life Insurance with 99.07%, and Tata AIA Life Insurance with 99.06%.

How to Calculate Claim Settlement Ratio of Health Insurance Companies?

If you have seen your family members getting hospitalized, you also must have seen the hospital bills and how it must have been a bit challenging for the family to pay them.

How NFTs and Museums Can Collaborate

Museums took massive financial hits over the course of the last several years, while NFTs started their rise as the best new thing to invest in. A stark example of non-fungible tokens that proved a point that these two are a match made in heaven was, beyond any doubt, the historic Beeple sale.

8 Unique Ideas for Planning a Girls Weekend

If you want to organize a one-of-a-kind weekend outing, then you must have a plan. You want to organize an outing that will leave memorable moments for months or even years to come. This includes choosing a perfect venue and activities to engage in.

Best NFT Games on the Market in 2022

It's no secret that the cryptocurrency and gaming industries are booming. In this article, we'll take a look at some of the best NFT games on the market in 2022.

What Are the Best Shares Trading Platforms for Beginners?

Getting started as a new investor in the trading market can be overwhelming. The significant risk involved and the complicated financial terms used in trading platforms may be hard to understand. So, it is essential to choose a user-friendly platform that will help you start on the right foot.

What is claim settlement ratio?

The claim settlement ratio reflects the ability of the company to deal with the claim settlement process of a policyholder and therefore, when conducting your research you must look for the past five years claim settlement ratio of the company you plan to buy your health insurance cover from. The company you are considering to buy a health insurance plan from, must be consistent in its performance to provide claims to the customers on time with no hassles.

How Is The Claim Settlement Ratio of A Health Insurance Firm Calculated?

The claim settlement ratio of a health insurance company is calculated annually considering the total claims received, total claims paid, and outstanding claims at the start of the year in a financial tenure. Following formula is used by the companies to calculate their claim settlement ratio for a financial year:

What is the purpose of a claim settlement?

The whole purpose of having a health insurance policy is to provide monetary support to the customers at the time of medical emergency. Therefore, claim settlement plays a crucial role, as when not settled on time or with efficiency the insurance policy has no point to serve to its policyholder. A claim settlement ratio determines the ability of the health insurance company to settle claims of the customers on time with not much effort. A claim settlement ratio is the ratio of claims paid or settled by the company out of the total claim requests received to the company in a financial year. The company with the highest claim settlement ratio is the one with the best claim settling record in a financial year.

What is the Significance of a Claim Settlement Ratio?

When purchasing life insurance, you must consider several factors before determining which provider is best for you. It would help if you learned about the insurance company's numerous policies and coverage options. You must understand how their clients rate their offerings and customer relationship management. However, many people overlook the importance of checking the claim settlement ratio, which is a significant mistake. The IRDA claim settlement ratio is essential for two reasons :

What is the IRDA settlement ratio?

The IRDA Claim Settlement Ratio is exclusively determined for Death Claims. Claim Settlement Ratio does not include Maturity Claims. It encompasses all Life Insurance Company products, whether they are Term Plans, Endowment Plans, or ULIPs. According to annual report of IRDAI, The claim settlement ratio for FY 2019- 20 for private insurers increased to 97.18, up from 96.64 percent the previous year. The settlement ratio in the industry fell to 96.76 percent in 2020, down from 97.64 percent in 2018-19.

Why is it important to check the settlement percentage?

It's critical to check the claim settlement percentage to safeguard your family's financial security. The last thing any family wants to deal with after losing a loved one is an insurance claim denial. As a policyholder, it is your responsibility to ensure that your family does not have to go through that ordeal.

What does 85% mean in insurance?

A claim settlement ratio of over 85% is a good sign, indicating that the insurer is reliable. To find out how persistent policyholders have been renewing their policies, look at an insurer's persistence ratio. It demonstrates the policyholder's confidence in the long-term insurance goods and services available.

How is settlement amount calculated?

Settlement amounts are typically calculated by considering various economic damages such as medical expenses, lost wages, and out of pocket expenses from the injury. However non-economic factors should also play a significant role. Non-economic factors might include pain and suffering and loss of quality of life.

How much is contingency fee for personal injury?

It is standard practice for a contingency fee to be one third if the claim is settled and forty percent if the claim is not settled and goes to trial.

What are the factors that limit or minimize a recovery?

Pain and suffering damages are where potential factors could limit or minimize your recovery. Things such as the seriousness of your injuries, treatment bills, recovery time, and physical or emotional distress form the accident can enhance or minimize your settlement.

What do insurance companies use to evaluate injuries?

Many insurance companies use computer programs to evaluate specific injuries, or treatment codes, average settlements and jury verdicts. These programs usually project a range of settlements which adjusters use as a base for their offer.

How is Claims Settlement Ratio Calculated?

The formula to calculate the claim settlement ratio for health insurance is:

Why is a claim settlement ratio important?

Claim settlement ratio for health insurance is important in indicating the insurer’s ability to solve claims efficiently and reliably as well as their risk management skills. The higher the Claim Settlement Ratio for health insurance, the better it is for the insured customer. It further guarantees that the experience of filing the claim will be efficient, transparent and convenient. If there are any unforeseen circumstances by which one needs quick disbursement of funds, the same is assured.

What is a Health Insurance Claim Settlement Ratio?

Health insurance claim settlement ratio is the proportional difference between the insurance claims that are raised and those that are paid by the insurer within a defined time period. This is an important aspect to consider while buying health insurance plans to have claims settled efficiently and in a timely manner.

What to do if your claim is incorrect?

1. If the details required for the claim are incorrect - one must double-check the information that has been filled in all the forms in order to avoid such errors.

What is loss ratio formula?

What is the Loss Ratio Formula? In the insurance industry, the term “loss ratio” refers to the financial ratio that indicates the number of claims and benefits paid during the given period as a percentage of the amount of premium earned in the same period. In other words, loss ratio indicates the losses incurred by the insurers, brokers, ...

What is the single number loss ratio?

The single number – loss ratio, can be used to determine the performance of an insurance company: the lower value of lass ratio means better profitability and hence better performance. As such, all the successful companies operating in the industry keep a close look at the loss ratio of each account.

Why is loss ratio important?

The concept of loss ratio is very important for the insurance industry as it is used to assess the impact of the claims on the profitability of all the players involved in the insurance industry , such as insurers, brokers and underwriting agents.

What happens if an insurance company continues to incur higher claims pay out as compared to premiums earned?

Otherwise, if an insurance company continues to incur higher claims pay-out as compared to premiums earned, then it will be in losses and will soon run into financial distress, such as default on future claims. Therefore, it is important that the insurance companies maintain a healthy loss ratio to stay in the race.