To be precise, four pieces of information are needed to calculate a structured settlement payment: the year the payments started; how often the payments are made; the amount of each payment; the year the payments will end; To use an example, suppose a individual lost the ability to work in 2013, and won a lawsuit with a total settlement of $2,000,000.

Full Answer

How to sell structured settlements?

How to Sell a Structured Settlement

- Evaluate Your Needs. Step 1: Decide how much money you need and how much of your structured settlement you want to sell. ...

- Get Quotes. Step 2: Contact the company that will make the purchase — known as a factoring company — for a quote.

- Assess Your Options. ...

- Select the Company. ...

- Request an Advance. ...

- Appear Before a Judge. ...

- Get Your Money. ...

Are structured settlement annuities taxable?

While many ty pes of cases are resolved using structured settlements, there are instances where structured settlement annuity payments could be taxable. The fact is that structured settlement annuities have absolutely nothing to do with the taxation of structured settlement annuity payments. A structured settlement is merely the vessel on which the damages travel to the payee.

What is a structured settlement annuity?

- The plaintiff receives the guarantee of future income

- Structured settlement payments do not count as income for tax purposes, even when the structured settlement earns interest over time.

- A structured settlement annuity contract often yields more than a lump-sum payout would because of the interest the annuity may earn over time.

What is a structured settlement loan?

- Structured settlements are a stream of tax-free payments issued to an injured victim. ...

- Structured settlement payments are guaranteed by the insurance company that issued the annuity. ...

- There are more pros than cons for choosing to receive a structured settlement over a lump sum. ...

How is settlement amount calculated?

The settlement amount is calculated by adding back the accrued interest on the clean price and then multiplying by the face value.

What is a structured settlement amount?

A structured settlement is a regular stream of tax-free payments granted to the plaintiff in a civil lawsuit. Structured settlements are meant to provide long-term financial security to the injured party. If the amount of money is small enough, the wronged party may have the option to receive a lump sum settlement.

How is a structured settlement paid out?

A structured settlement can be paid out as a single lump sum or through a series of payments. Structured settlement contracts specify start and end dates, payment frequency, distribution amounts and death benefits.

What percentage do structured settlement companies take?

“Some structured settlement companies charge 25 percent to 50 percent of the payment amount to be received,” said Sullivan. “That means getting the rest of $500,000 remaining in an annuity might result in a loss of $125,000 to $250,000.”

Should I take a lump sum or structured settlement?

You should take a lump sum settlement for all small settlements and most medium-sized settlements (less than $150,000 or so). But if you are settling a larger case, there are two good reasons for doing a structured settlement. First, the structure guarantees that you won't spend the money too fast.

Are structured settlements tax free?

Income tax exemption: Structured settlement payments—including growth—are 100% income tax-free. While lump sum cash settlements are income tax-free for physical injury cases, if the money is placed in a traditional investment, then any growth is subject to income taxes.

What is a disadvantage of a structured settlement?

A major drawback of a structured settlement is that it may jeopardize the beneficiary's eligibility for public benefits, which may be particularly problematic when the person's medical needs are covered by Medicaid rather than private health insurance.

Are structured settlement worth it?

Structured settlements can save you on taxes versus a lump sum, and for many people work as a form of income or annuity every year. Structured settlements can work in many instances. But they may be less than advantageous in others.

Can you cash out a structured settlement?

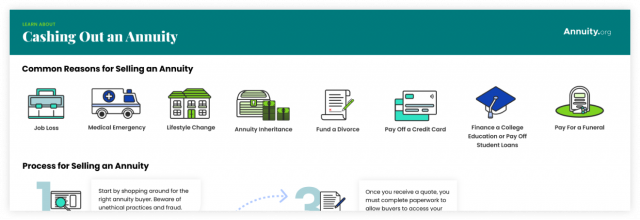

If you have a structured settlement in which you receive your personal injury lawsuit award or settlement over time, you might be able to "cash-out" the settlement. To do this, you sell some or all of your future payments in exchange for getting cash now.

What is an example of a structured settlement?

Examples of cases that may result in structured settlements include personal injury, workers' compensation, medical malpractice and wrongful death.

Is selling a structured settlement a good idea?

In a word, the benefit of selling your structured settlement is liquidity. While structured settlements offer financial security over many years, sometimes people run into situations that demand a large sum of cash immediately.

How much does it cost to sell a structured settlement?

Most companies charge between 9 and 18%, but it could be higher. You can sell part of your annuity more than once, but your take-home money will be reduced every time because each transaction comes with a set of fixed expenses you'll have to pay.

What is an example of a structured settlement?

Examples of cases that may result in structured settlements include personal injury, workers' compensation, medical malpractice and wrongful death.

Are structured settlement worth it?

Structured settlements can save you on taxes versus a lump sum, and for many people work as a form of income or annuity every year. Structured settlements can work in many instances. But they may be less than advantageous in others.

What is a disadvantage of a structured settlement?

A major drawback of a structured settlement is that it may jeopardize the beneficiary's eligibility for public benefits, which may be particularly problematic when the person's medical needs are covered by Medicaid rather than private health insurance.

Is structured settlement considered income?

Structured settlement annuities are not taxable — they're completely tax-exempt. It's a common question that we are asked by personal injury attorneys, and in certain situations, the tax-exempt nature of structured settlement annuities results in significant tax savings to the client.

What Factors Impact the Value of My Structured Settlement?

Because of inflation, a dollar today is worth more than a dollar in the future. Therefore, time, or more specifically, the time value of money , also influences the value of your settlement.

What factors determine the value of a settlement?

Other factors that determine the cash value of your settlement include: Dollar amount of your payments. Number of payments remaining. Interest rates.

What is the percentage of settlement purchasers?

The percentage the settlement purchaser takes is called the discount rate, and it is determined using a formula that calculates the difference between the present value of your payments and the future value of your payments, along with other factors specific to your transaction.

Why are structured settlements important?

Federal and state lawmakers encourage the use of structured settlements as protection for people who have been physically injured by another party . Structured settlements prevent the misspending of money intended to provide income for an extended time, which, in turn, prevents injury victims from relying on public assistance for their basic needs.

What does a purchasing company subtract?

Purchasing companies subtract — or discount — a percentage from your lump-sum payout to account for inflation and the decreased purchasing power of the future payments, as well as the risk they assume when they buy your payments. For example, the purchasing company assumes the risk of the insurance company failing.

What to do if you are not sure about settlement?

If you’re not sure, now is the time to bring in a professional. A qualified financial planner can help you assess the benefits and drawbacks of each option as it relates to your unique financial situation. You may also want to enlist a financial expert or an attorney in reviewing your structured settlement contract.

How long does it take to get a sale approved by a judge?

If the judge approves the sale, the transaction will be completed within three to five business days.

What is partial settlement sale?

Partial Structured Settlement Sale: This variation involves you selling part of your structured settlement. If you receive monthly structured settlement payments, you can exercise this alternative to sell just part of each monthly structured settlement payment. If you receive future lump sum structured settlement payments, you can sell just part of a lump sum structured settlement.

What is delayed settlement?

Delayed Structured Settlement Sale: This variation involves you selling some portion of the payments due in the future for lump sum but keeping your current structured settlement payments. It is often the best structured settlement offer from those relying on the income from their structured settlement to pay for day to day expenses.

Can you use a structured settlement calculator?

When you utilize a structured settlement calculator, there is certain information you should have handy. Our experts can input this information regarding your structured and provide you with immediate quotes. We are happy to do this for you WITHOUT TAKING ANY OF YOUR PERSONAL INFORMATION.

Calculator Instructions

Select the item you would like to find. Fill in the other values. Answer will appear.

Example 1

Find the number of payments to sell to get the lump sum amount you need.

Example 2

Find the amount of payment to sell to get the lump sum amount you need.

How Do Structured Settlements Work?

Legal settlements can be paid out in a one-time lump sum or through a structured settlement where periodic payments are made through a financial product known as an annuity. The key differences between these settlement options are in the areas of long-term financial security and taxes.

Why is structured settlement more than lump sum?

A structured settlement often yields, in total, more than a lump-sum payout would because of the interest your annuity may earn over time.

What happens when a plaintiff receives a lump sum settlement?

When a plaintiff receives a settlement through a one-time lump sum, they might spend it too quickly, robbing them of the long-term financial security that future payments could provide. Moreover, any interest and dividends earned if the lump-sum were to be invested would be subject to taxes.

How are legal settlements paid?

Legal settlements can be paid out in a one-time lump sum or through a structured settlement where periodic payments are made through a financial product known as an annuity. The key differences between these settlement options are in the areas of long-term financial security and taxes. When a plaintiff receives a settlement through ...

What are the pros and cons of structured settlement?

Structured Settlement Pros and Cons 1 Payments are tax-free. 2 In the event of the recipient’s death, the beneficiary can continue to receive tax-free payments. 3 Payments can be scheduled for almost any length of time and can begin immediately or be deferred for as many years as requested. They can include future lump-sum payouts or benefit increases. 4 Spreading out payments over time can reduce the temptation to make large, extravagant purchases and guarantees future income. This is especially helpful if the recipient has a medical condition that will require long-term care. 5 Unlike stocks, bonds and mutual funds, structured settlements do not fluctuate with market changes. Payments are guaranteed by the insurance company that issued the annuity. 6 A structured settlement often yields, in total, more than a lump-sum payout would because of the interest your annuity may earn over time.

What is the role of a judge in an annuity sale?

The role of the judge is to decide if the sale is in the best interest of the annuity owner. Other rules may apply depending on the details of your annuity contract and the laws of the state where you live. The Structured Settlement Protection Act of 2002 provides federal guidelines on such transactions.

What was the purpose of the National Structured Settlements Trade Association?

By 1985, the National Structured Settlements Trade Association formed to preserve and promote structured settlements to injury claimants through education and advocacy.

What to do if you have a structured settlement?

Always remember that your structured settlement was designed to protect your financial well-being and that of your dependents. If you have any reservations about selling your payments, you should speak to a qualified, trustworthy financial advisor — or an attorney who specializes in structured settlements — before you make a decision.

What is your net worth?

Knowing your net worth is crucial to your personal financial planning. Your net worth is the total value of your assets after deducting any liabilities you have. If you assume any asset you own is worth more or less than it actually is, you have an inaccurate picture of your financial health.