How to cancel a debt settlement contract.

- Continue to handle the debt on your own.

- Contact the creditors for help.

- Settle the debt either on your own or with the assistance of a third party.

- Work with a nonprofit credit counseling agency through a debt management plan. My nonprofit company, the National Foundation for Credit Counseling, ...

- Seek legal protection through bankruptcy.

- Continue to handle the debt on your own.

- Contact the creditors for help.

- Settle the debt either on your own or with the assistance of a third party.

- Work with a nonprofit credit counseling agency through a debt management plan. ...

- Seek legal protection through bankruptcy.

How do I cancel a debt settlement agreement with my bank?

If so, contact your bank right away and let them know you are canceling the agreement. If you are worried that the drafts might continue, you could also close your account and open a new one that the debt settlement firm could not access. In some instances, failure to pay may void your agreement, which would actually be to your benefit.

Will a debt settlement company affect my credit score?

Many clients come to use seeking to file bankruptcy whom have entered into a contract with a debt settlement company. Many times, people believe that signing up with a debt settlement company can help them get out of debt and have little impact on their credit score.

What do you need to know about debt settlement?

The price of the debt settlement. That you have the right to cancel the debt settlement contract at anytime without any penalties. That any of the funds that are placed in escrow account are your funds that you are entitled to unless they were earned by the debt settlement company.

Can I sue a debt settlement company for taking my money?

In that case we recommend closing out your bank account completely to prevent any debt settlement company from taking it. If the debt settlement company refuses to return the money that is legally yours, you can sue the company.

Can I cancel my debt settlement program?

Debt settlement services are sometimes advertised as “debt settlement”, “debt management”, “debt arrangement”, “debt reduction”, or “debt consolidation”. The rules for cancelling contracts with these companies are the same: You can cancel the contract at any time within 10 days after you receive a copy of it.

What happens if you cancel a debt management plan?

When you cancel, the provider will tell your creditors, so they might start charging you interest and late payment fees again, as well as expecting you to resume higher payments. You'll also have to deal with your creditors yourself again. Think about how you're going to cope with this.

How do I get out of my contract with Freedom Debt Relief?

You may terminate this Agreement (and your FDR program) or withdraw a debt from your FDR program at any time, without any termination fee. You may terminate this Agreement by providing us with written notice of termination (which may be electronic).

Can a settled account be removed from credit report?

Yes, you can remove a settled account from your credit report. A settled account means you paid your outstanding balance in full or less than the amount owed. Otherwise, a settled account will appear on your credit report for up to 7.5 years from the date it was fully paid or closed.

What is a debt cancellation agreement fee?

Debt Cancellation is not insurance, it is an amendment to the retail installment contract where the customer pays the dealership or finance company a fee and in exchange, the dealership or finance company waives the customer's debt minus a small deductible, (depending on state law), when the vehicle is total loss or ...

How do I write a letter to cancel a debt review?

I am therefore writing to inform you that I no longer require your services and wish to cancel my plan with immediate effect. Please provide a full breakdown of my account with you since it began, outlining all payments I have made, all creditor distributions and to whom they have been made.

Can I get a mortgage after debt settlement?

Most lenders won't want to work with you immediately after a debt settlement. Settlements indicate difficulty with managing financial obligations, and lenders want as little risk as possible. However, you can save enough money and buy a new home in a few years with the right planning.

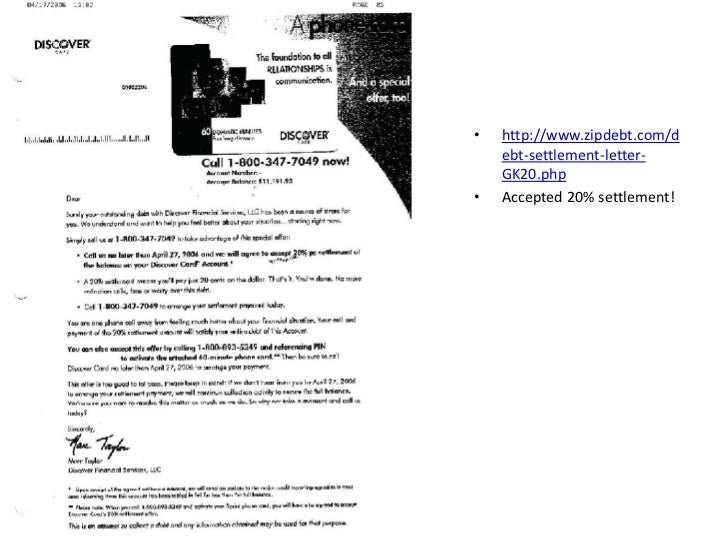

What percentage will creditors settle for?

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

Is it better to negotiate credit card debt?

Debt settlement is the right choice for some people, but keep in mind that it will lower your credit score and make it harder to borrow money in the future. Even if you do qualify for future credit, your interest rates will be much higher than they would be if you had an excellent credit score.

How do I raise my credit score after debt settlement?

10 Steps to Rebuild Credit After Debt SettlementCheck Your Credit Report Regularly.Dispute Errors on Your Credit Report.Make On-Time and Full Payments on Your Bills.Get a Secured Credit Card.Sign Up for a Credit-Building Program.Keep a Low Credit Utilization Ratio.Diversify Your Credit.Maintain Old Accounts Open.More items...•

How long does it take to remove settled accounts from credit report?

seven yearsA settled account remains on your credit report for seven years from its original delinquency date. If you settled the debt five years ago, there's almost certainly some time remaining before the seven-year period is reached.

How do I remove a settled account?

Review Your Debt Settlement OptionsDispute Any Inconsistencies to a Credit Bureau.Send a Goodwill Letter to the Lender.Wait for the Settled Account to Drop Off.

What are the disadvantages of a debt management plan?

Disadvantages of a debt management plan include: your debts must be repaid in full – they will not be written off. creditors don't have to enter into a debt management plan and may still contact you asking for immediate repayment. mortgages and other 'secured' debts are not covered by a debt management plan.

How long does a debt management plan stay on your credit file?

six yearsHow long does a DMP stay on a credit file? Details of court action, defaults, partial payments and missed payments are recorded for six years. They are removed six years from the date it happened, even if the debt hasn't been fully repaid. When your DMP ends you can improve your credit score by using credit sensibly.

How do I clear a debt management plan?

Is it Possible to Clear a Debt Management Plan Early?Increase Your Monthly Payments. ... Increase Your Income. ... Make a One-Off Payment to Your Debt Management Plan. ... Repay Debts in Full. ... Make a Payment Into Your Debt Management Plan. ... Make a Full and Final Settlement Offer. ... A Word of Warning… Avoid Making Small One-Off Payments.

How long does a debt management plan last?

between five to 10 yearsHow long your DMP lasts will depend on how much debt you have, and how much you can afford to pay off each month. But it's not unusual for DMPs to last between five to 10 years. If your DMP involves you making repayments less than the amount originally agreed with lenders, then it will affect your credit score.

Can I Cancel My Contract With A Debt Settlement Company?

More and more frequently, we are finding that some debtors with whom we meet, have already hired a debt settlement company to attempt to resolve their debt issues, prior to coming in to meet with us. The debt settlement companies advertise that they can settle with credit card companies for a fraction of the debt by negotiating a lump-sum payment or “settlement” for less than the balance. They advise debtors to stop making payments to all the creditors with which they wish to settle with (which puts them into delinquent status) and instead pay an agreed upon sum into an escrow account every month in order to build up the necessary funds to pay the settlements. These plans typically take 36 to 48 months and during that time, creditors will keep charging late fees and interest. The balances of the accounts included in a debt settlement plan can double or even triple before they are settled. Creditors may put these accounts into collection and debtors can face collection lawsuits. Most debt settlement plan do not make it to completion and leave debtors in worse shape financially than before they entered the plan.

How does TSR work?

The TSR bans deceptive telemarketing acts or practices that related to debt settlement services. Specifically, the TSR requires that a debt settlement company must disclose, in a clear and conspicuous manner, the following: 1 The debtor owns the funds held in their escrow account and they may withdraw from the debt relief service at any time without penalty. The debtor must receive all funds in the account, other than those funds actually earned by the debt settlement company. 2 the length of time that will be required for the service to make a bona fide settlement offer to each creditor (usually 36 to 48 months as mentioned above); 3 the amount of money or the percentage of each outstanding debt that the debtor must accumulate before they will make a settlement offer to each creditor; 4 the use of the debt settlement company (1) will likely adversely affect the debtor’s creditworthiness, (2) may result in being subject to collections or being sued by creditors or debt collectors, and (3) may increase the amount of money the debtor owes due to the accrual of fees and interest;

How long does it take for a debt settlement to be settled?

These plans typically take 36 to 48 months and during that time, creditors will keep charging late fees and interest. The balances of the accounts included in a debt settlement plan can double or even triple before they are settled. Creditors may put these accounts into collection and debtors can face collection lawsuits.

What happens if a debt settlement company does not return money?

If for some reason, the debt settlement company does not return the money that is being held in escrow, the debtor’s rights to sue to recover those funds and may be limited by an arbitration clause in the debt settlement contract. When the Supreme Court ruled in AT&T Mobility v.

How to get a fresh start in financial life?

Typically, when facing financial difficulty, the best way to obtain a true financial fresh start is to file for bankruptcy. The results that a debtor receives from their bankruptcy filing is generally more favorable than the consequences of debt settlement.

What case did the Supreme Court rule that the Federal Arbitration Act did not allow states to nullify arbitration clauses?

When the Supreme Court ruled in AT&T Mobility v. Concepcion 563 U.S. 333 (2011) that the Federal Arbitration Act did not allow state courts to nullify arbitration clauses in consumer cases even if those courts considered them “unconscionable,” they severely limited consumers ability to get their day in Court.

Does a debt settlement company have to disclose their escrow account?

Specifically, the TSR requires that a debt settlement company must disclose, in a clear and conspicuous manner, the following: The debtor owns the funds held in their escrow account and they may withdraw from the debt relief service at any time without penalty.

How long does it take for a credit card to negotiate a delinquent account?

However, they fail to tell consumers that as their accounts continue to go into delinquent status, the impacts on their credit score can be severe. Debt negotiation can take anywhere from 36 to 48 months. This is almost three years of accounts being in delinquent status.

What do debt settlement companies have to tell you?

Some of the requirements that debt settlement companies must tell you are: The price of the debt settlement. That you have the right to cancel the debt settlement contract at anytime without any penalties.

What to do if a debt settlement company refuses to return money?

If the debt settlement company refuses to return the money that is legally yours, you can sue the company. Also, we recommend filing a complaint against the company with the New York Attorney General’s office or the New Jersey Attorney General’s office.

What to do if you are falling behind on your bills?

Debt Lawyer. If you are falling behind on your bills, it is best to speak with a bankruptcy lawyer who can help you determine which route is best for your financial situation. Keep in mind, that filing bankruptcy is usually the better option when you are in debt.

What is the FTC?

The FTC (Federal Trade Commission ), the organization that protects consumers, has issued rules to regulate debt settlment companies. They have enacted rules to ban deceptive telemarkeing acts by debt settlement companies. There is a list of things that debt settlement companies are required by law to tell you before you sign up. Some of the requirements that debt settlement companies must tell you are:

Can you keep up with debt settlement?

During this time interest, fees and penalties continue to accrue. Most consumers can’t keep up with these payments and thus, never make it to the end of any debt settlement plan. More importantly, debt settlement companies fail to inform consumers about the risks of being delinquent on their credit cards.

When will bankruptcy be filed in 2020?

March 30, 2020. Many clients come to use seeking to file bankruptcy whom have entered into a contract with a debt settlement company. Many times, people believe that signing up with a debt settlement company can help them get out of debt and have little impact on their credit score.

Kurt Duane Elkins

In california most of the "settlement" firms are not living up to the terms of the contracts. It is a very tough business with a lot of new firms, they tend to over promise and under deliver based on the cases I have seen. You should ask for a refund, if they are honest they will refund your money, If you...

Dorothy G Bunce

The contract you have with the debt settlement company should have specified exactly how you can cancel & what portion of your money you can receive as a refund. Typically, your payment is broken into 2 categories - service fees, which include...

Scott Richard Kaufman

My experience is that mostly, these companies are shams that prey on people already in dire need of financial help. I'm guessing you are now figuring this out. Years ago there was one or two firms doing this work and they were quite honorable.

Kathryn Ursula Tokarska

It's simple to cancel. Give them notice IN WRITING and request accounting and a refund. Over the past 3 years, I've seen a bunch of these settlement contracts and been digusted by the terms. People who prey on the desperate and vulnerable are the worst, in my book.

Why cancel a debt management plan before you're finished?

The problem with canceling a debt management plan before you’re finished is that it creates (or recreates) the problems that got you in trouble. You still have credit card debt; you still need debt relief, and you likely will lose the concessions from creditors that gave you a chance to be debt-free.

What happens if you stop paying your debt management plan?

Here are a few things that happen when you stop paying your debt management plan: Interests rates on credit cards jump back to previous levels. Late fees that were waived may be reinstated. Credit card payments are no longer consolidated into one payment. You must make individual payments to each account.

Why cancel debt management?

There are valid reasons consumers may want to cancel their debt management plans. Maybe you’ve been promoted and can afford to repay your debts in full, or maybe you can’t afford the DMP fee. Whatever your reason for canceling, you should think long and hard about what you plan to do next.

What is debt management plan?

A debt management plan is built around those concessions. Creditors offer reduced interest rates and sometimes waive late fees and over-the-limit fees on your credit cards so that you have lower monthly payments. Those concessions go away as soon as you drop out. In other words, the interest rate on your debt returns to its previous level, ...

What happens if you stop making monthly payments to your debt management plan?

If you stop making monthly payments to your debt management plan, you will be removed from the program and your rates will shoot back up to their previous levels. Some plans will drop you after missing a single payment, while others may be generous enough to allow up to three missed payments. Since the purpose of a debt management plan is to eliminate a consumer’s debt – and teach the consumer the benefits of on-time payments – it will only work if you’re making consistent monthly payments.

How many missed payments can you have with a debt management plan?

Some plans will drop you after missing a single payment, while others may be generous enough to allow up to three missed payments. Since the purpose of a debt management plan is to eliminate a consumer’s debt – and teach the consumer the benefits of on-time payments – it will only work if you’re making consistent monthly payments.

What to do if you decide to part ways with your debt management plan?

If you decide to part ways with your debt management plan, you still need a plan to deal with your debt. You need to figure out how you will be managing your money , and you need to figure this out before you pull the trigger on canceling your debt management plan.

Can a Settlement Agreement be Cancelled?

It is possible to back out of a settlement agreement if both parties consent and it has not been incorporated into a court order. However, the issue arises if the other party does not agree. Usually, courts are reluctant to allow a party to back out of a settlement agreement if it is made in good faith with the parties involvement. The settlement agreement can be voided if it was formed through fraud or misrepresentation.

Do I Need a Lawyer for Assistance with a Settlement Agreement?

The process of drafting a settlement agreement can be time consuming and draining. It is recommended to seek out an attorney that can closely examine the nuisances in your local jurisdictions to determine the best possible outcome for the legal dispute. A settlement agreement needs to be carefully crafted to balance the risks and provide a workable platform for both parties to abide by.

How to obtain damages from a breach of settlement agreement?

The process to obtain breach of settlement agreement damages can vary depending on the different states. A separate lawsuit may need to be filed in order to obtain the damages from the breach of the settlement agreement. Typically, the settlement agreement will stipulate the course of action, penalties or fees that need to be paid if either party fails to follow its legal obligations under the agreement.

Why do you need to file a separate lawsuit?

A separate lawsuit may need to be filed in order to obtain the damages from the breach of the settlement agreement. Typically, the settlement agreement will stipulate the course of action, penalties or fees that need to be paid if either party fails to follow its legal obligations under the agreement.

What is a breach of a settlement agreement?

A breach is when either party refuses to adhere to the agreed terms and conditions outlined in the settlement contract. In brief, a party that breaches a settlement agreement will risk being forced to complete the agreement and paying the legal costs of the party seeking to enforce the agreement. The process to obtain breach ...

How to enforce a settlement agreement in California?

In general, enforceability of settlement agreements vary among the different jurisdictions. One of the most common ways to enforce them in court is to file a motion. For example, according to the California law entering into a settlement agreement requires that the agreement must be either in writing, signed by all the parties outside the court or may take the form of an oral agreement made in the presence of the court.

What is the role of a judge hearing a motion?

The role of the judge hearing the motion is to examine the evidence and hear oral testimony. Additionally, the judge may also consider the factual disputes regarding the settlement. If the judge finds that the settlement is sound in its terms, it may then enter a judgment pursuant to those terms. Furthermore, for the settlement agreement ...